An Old School Leveraged Buyout

Plus: industry consolidation, spin-offs, an inventive use of leverage, and multibagger upside.

Disclaimer: Nothing on this blog is intended as financial or investing advice. Please do your own due diligence.

Back in June, I wrote a piece entitled “Where I’m Looking for Value Today” in which I gave some credence to Einhorn’s frustration that it is no longer a sufficient strategy to merely identify undervalued stocks and expect incremental buyers to follow behind and drive price discovery. Buying cheap stocks with strong fundamentals often isn’t enough right now — at least not if you are concerned with generating high IRRs. For that reason, absent unique qualitative characteristics (such as, e.g., “Outsider” type managers, dominant moats, irreplaceable assets etc.), I generally insist on an identifiable catalyst as a pre-condition to investing.

But in this market, especially as it concerns smaller caps, even correctly identifying a catalyst that materializes hardly seems to be a sufficient assurance that you’ll get your price. Indeed, there have been numerous times this year where one of my positions has seen a clear value-creating catalyst materialize, only for the stock price to briefly respond (if at all), before giving it all back (Organigram’s acquisition of Motif this month is case-in-point, with the stock essentially flat despite the clearly enormous value created by the deal; the fairly muted reaction to Northern Ocean’s backlog multiplying since I wrote it up is another example; and don’t get me started on Calumet). The problem is that many things we identify as catalsyts still rely on the market to properly price their occurence in — and in an environment where things like Palantir trade at 400x EPS, expecting a rational re-rating is a fool’s errand. This state of affairs will of course change — in the long run, fundamentals do matter. But I’m not holding my breath.

So what do we do?

One proposal: look for catalysts that completely eliminate any dependence on the market “giving” you your value. In its surest form, those are situations involving an exit and/or a large return of capital.

With today’s idea, an exit and capital return is the raison d'être of the company. This, coupled with a clear and asymmetric pathway to multi-bagger upside, makes this perhaps my favorite event-driven idea in the market at-present.

***

Zegona Communications (ZEG.L) is a London-listed special purpose vehicle that is currently running the old leveraged buyout (LBO) playbook on a single European telecom — Vodafone Spain (moving forward I will refer to this entity simply as “Vodafone”, to be distinguished from its former parent company, which I refer to as “Vodafone Group”).

I think Zegona’s LBO of Vodafone is particularly interesting for the following reasons:

Credible Management and Repeated Success. Zegona’s founders are seasoned telecom executives who have already delivered shareholders attractive returns through two previous exits in the Spanish telecom space. They have also installed a proven all-star, who was instrumental in their most recent exit, to be the new CEO of Vodafone. Given how much of the value creation in an LBO hinges on execution, having a team that has done this not once, but twice, in the same country and sector, is immensely comforting.

A Unique, Attractive, and Misunderstood Capital Structure. Like all LBO’s, Zegona relied on a lot of leverage to finance its acquisition. Indeed, merely ~6% of the €5B acquisition price was funded with equity, with the remainder financed by debt, including €900m of “vendor take-back” financing structured in an obscure and inventive way that adds a lot of potential torque to the set-up. In effect, from an accounting perspective, it appears that this vendor financing was satisfied through the issuance of €900m worth of common stock; these “Preference Shares” today represent ~69% of total commons outstanding. However, these shares are effectively redeemable at par (€900m) plus accrued interest, and thus in reality are akin to a debt-instrument/preferred interest (assuming they can be redeemed). Thus, Zegona can essentially “repurchase” 69% of its current £2.4B ‘accounting’ market cap (i.e. £1.67B), for only ~£750m (€900m). A deleveraging on steroids, which I will illustrate below.

Accretive Asset Sales Provide a Path to Deleveraging. This deleveraging sounds great, but how do we get there? Fiber network monetization. Zegona, running an increasingly common playbook in the telecom space, has already taken concrete steps towards “spinning-off” its fiber network by contributing its assets into joint-ventures with Spain’s two largest telecos. Eventually (hopefully soon), Zegona aims to sell down its stake in these “Netcos” to infrastructure investors, which, given the high multiples these assets fetch, will be very accretive and should generate sufficient proceeds to fund meaningful deleveraging, including Preference Share redemption.

Cheap Going-In Valuation. Vodafone Group was overleveraged and thus willing to part with its non-core Spanish segment for cheap. Zegona paid somewhere between 3.9x EBITDAaL (according to Zegona) or 5.3x (according to Vodafone Group), depending how you calculate it. Regardless, even using 5x, this valuation is apparently the lowest paid for a scaled Spanish teleco during the decade. Of course, given all the leverage involved (magnified by the Preference Shares), even a couple turns of re-rating results in a lot of upside. Although in purchasing ZEG today at £3.14/share we are creating our interest at a higher mark (shares were placed at £1.50/share for the acquisition), we are still paying a low implied multiple, particularly if we properly treat the Preference Shares as debt.

A Clear Strategy and Path to Improved Profitability. Zegona has a proven strategy for creating value and the historically mismanaged Vodafone offers some low hanging fruit. Zegona has already slashed the workforce by ~28%, which should result in ~€70m of annual savings down the road. Along with further operational improvements, and a potential renegotiation of its tower leases, the company expects to be able to drive €320m of cost savings, which capitalized at 5x is worth ~€1.6B.

Multi-bagger Upside. From the combination of deleveraging, Netco monetization, and improved opco profitability, shares could return 300% or more over the next few years.

NB: This is an optically complicated thesis given the quirky capital structure and some other unique facets, including a private equity style promote. This complexity is exacerbated by relatively dense and dated disclosures (the operative source of information for this thesis is the long and “legalese” deal Prospectus) and because I am streching well outside my geographical circle of competence. As such, although I have done my best to ensure accuracy (as always), it is possible that I may be imprecise in some of what follows. That said, given the clearly tremendous upside potential, total precision shouldn’t matter here.

Before getting into it, I’d also give a shoutout to Cocoa Beans Podcast who has a great write-up on this idea from last month and who has helped me overcome some of the geographic and language barriers that I have encountered in diligencing the company.

Some Brief History

Zegona was founded in 2015 by former Virgin Media executives Eamonn O’Hare and Robert Samuelson, who both played central roles in transforming and later selling that company to Liberty Global for $25B. Zegona was formed with the intention of running a Buy-Fix-Flip/LBO strategy targeting European TMT companies.

Zegona acquired Spanish cable company Telecable in August 2015 for €640m, which was then sold to Euskaltel for €701m in May 2017. The sale resulted in Zegona owning 15% of Euskaltel, and it later increased its stake to 21%, becoming the largest shareholder and taking control of two board seats.

Zegona implemented substantial changes at Euskaltel, including brining in Jose Miguel Garcia as CEO (now our CEO at Vodafone), partnering with Virgin, and driving €40m of annual cost savings (20% of cash flow) from 2018 through H1 2020.

In 2021, Euskaltel was sold to major Spanish player MásMóvil for €3.5B. In total, Zegona generated an 87% return on invested capital through these transactions. Following the exit, Zegona returned the capital through a tender, and management began searching for the next target.

That brings us to the Vodafone acquisition.

The Acquisition Financing and Cap Table

In October 2023, Zegona entered into an agreement to buy Vodafone for €5B. The deal, structured as a reverse takeover, closed on May 31, 2024 and was financed with ~€3.8B in debt, €900m in vendor take-back financing (the Preference Shares), and €300m in equity from the issuance of ~175m shares at £1.50/share. (NB: EUR/GBP has declined from ~0.87 to 0.83 since the acquisition.)

The Preference Shares, as noted at the outset, are a very interesting feature.

Essentially, as part of the deal consideration, an entity — EJLSHM Funding (referred to as Newco) — subscribed for 523.2m ZEG common shares at £1.50/share. This €900m investment was in turn funded by Newco’s issuance of an equivalent value of Preference Shares to Vodafone Group.

The Preference Shares entitle Vodafone Group to dividends from Newco that accrue at 5% per annum for the first three years, and escalate thereafter, up to 15% by year 6. Newco’s sole purpose is to pay the accrued dividends on, and to redeem, the Preference Shares. These distributions from Newco will in turn be funded by Zegona’s payment of dividends on its commons.

Here’s the kicker: 1) Newco can redeem the Preference Shares at their €900m face value (plus accured dividends); and 2) Crucially, upon redemption of the Preference Shares, the 523.2m commons held by Newco will lose their economic rights (i.e. they will be effectively cancelled).

This complexity is driven by legal, accounting and tax fictions, but at bottom, the economic reality for our purposes is that Vodafone Group holds a €900m redeemable at-par debt/preferred interest, and upon its redemption, the 523.2m commons held by Newco will be cancelled. Currently, the Newco commons comprise 69% of Zegona’s share count — thus, Zegona can effectively “repurchase” 69% of its shares for €900m (~750mGBP), even though at today’s £3.14/share your screen will show you that Zegona’s market cap is ~£2.4B (£3.14/shares*759.2), 69% of which is £1.64B.

In effect, this structure allows ZEG to repurchase 69% of its equity at a ~55% discount to today’s share price.

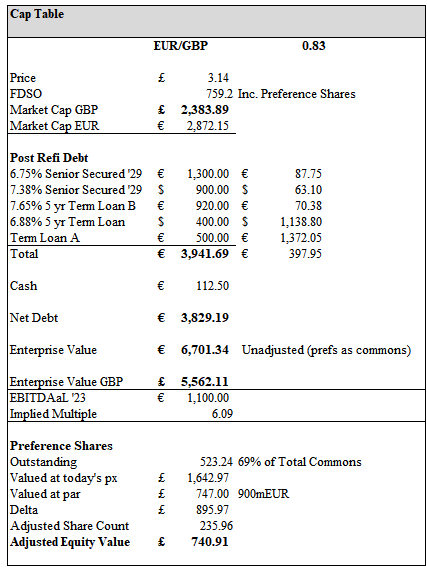

In July, Zegona refinanced its debt, and the resulting cap table now looks roughly like this:

What are the takeaways from this?

First — going in valuation. We are working with somewhat outdated information on Vodafone’s financials, but per the Prospectus, Vodafone did somewhere between €945m to €1.3B of EBITDAaL in FY 23 depending on how you calculate it. I will use €1.1B, which adds back subscriber acquisition costs and adjusts for intercompany agreements (ZEG uses ~€1.3B for its headline 3.9x acquisition multiple). Accordingly, we are creating our interest at ~6x. That seems okay, albeit not screaming cheap given the uncertainty, Vodafone’s status as the #3 player in Spain, and well, because it’s Europe.

And that is clearly one of the reasons this opportunity exists: the stock doesn’t screen as cheap…until you realize value is being obfuscated by the quirk of the Preference Shares.

Which brings me to the second takeaway. Look at the delta between the value of the Preference Shares priced as commons and their redemption value of €900m. There’s a lot of different ways to think about that, but one way is that at today’s share price you could purchase the entire equity in Zegona (adjusted equity value) for ~£740m ((759-523)*3.14), assuming the company is able to redeem the Preference Shares. So understood, this begins to look a lot cheaper.

What will it take to redeem the Preference Shares?

Zegona will need to pay Newco dividends sufficient for the latter to distribute €900m plus accrued interest to Vodafone Group. Assuming that can be achieved in the first year, then Zegona would need to pay a special dividend of at least €945m (900*1.05) to Newco. But because the Newco shares rank pari passu with the other commons, Zegona presumably needs to pay that £1.50/share distribution to all common holders to facilitate the redemption. In other words, Zegona needs to return £1.14B (£1.50*759.2 s/o) or €1.38B to shareholders to elimate the Preference Shares.

Where are they going to get £1.14B from? At exit would be the obvious answer. But there’s a good chance we won’t need to wait that long.

Netco Monetization

The telecom industry tends to suck in a lot of value investors for various reasons, perhaps the utmost being that it has characteristics that are conducive to intricate financial engineering and smart capital allocation. The best exemplar of this is, of course, John Malone and all the value he has created through the decades with TCI and the Liberty family.

One strategy that has become commonplace to drive shareholder value, particularly in Europe, has been to break up vertically integrated telecos into two entities: one owns the network infrastructure (Netco) and the other provides services based off that infrastructure (Servco). Unsurprisingly, Malone’s Liberty Global has run this playbook several times, as have numerous others, including Zegona’s former portfolio company Euskaltel.

The principal motivation for doing this is, simply, that the parts are often worth more than whole. Why? First and foremost, because network infrastructure is essential, has high-barriers to entry/high build-out costs, and can provide toll booth/recurring revenue economics with very high-margins, Netcos can obtain sky-high valuations of 15-25x EBITDA — substantial premiums to vertically integrated telecos and Servcos. You don’t need me to explain why it’s accretive for an entity trading at 5x EBITDA to sell its assets for 15x.

Meanwhile, at the Servco/remainco level, you are in effect trading some margin erosion (since the Servco now needs to make payments to use the network infrastructure), in exchange for taking a lot of capital out of the business, thus becoming more asset/capex-light and improving ROICs.

Fortunately for us, Vodafone has an extensive fixed-line network, with its owned network supporting 10.7m premises (6.8m through HFC and 3.2 through FTTH).

Significantly, Zegona explicitly lays out its strategy in the deal Prospectus (see pp. 55-56) to monetize this network through Netco transactions:

Beyond making this an explicit strategy, the Prospectus helpfully lays out the math, concluding that Vodafone’s fixed-line network could be worth between €2-3.5B (40%-70% of the acquisition price!) depending on how the monetization is structured.

While this may seem wishful thinking at first-glance, Zegona has already taken material steps to making this a reality. And early indications suggest both that monetization is a near-term catalyst and that the above valuation may prove conservative…

On July 24, Zegona announced that Vodafone and the newly merged MasOrange (now the largest telecom entity in Spain by some metrics, and the owner of ZEG’s former portfolio company Euskaltel) entered into an agreement to create a joint fiber network company covering 11.5m households across Spain. The ownership split is based on respective % of customers within the footprint and the parties intend to bring an infrastructure investor into the joint company, with the pro forma ownership expected to be 50% MasOrange, 40% infrastructure investor, and 10% Vodafone. Note, this is a smaller (11.5m vs. 16m homes), but otherwise identical version of the envisioned deal laid out in the Prospectus that Zegona projected could create €3.5B in value for Vodafone.

Then, only a week later, Vodafone and Telefonica, Spain’s largest owner of fixed-line infrastructure, entered into a similar non-binding agreement to create a joint fiber company, covering 3.5m premises and 1.4m customers. The intention here is likewise to bring in a third-party infrastructure investor, with Vodafone/Zegona retaining a 10% interest. In November, the parties announced that this agreement is now binding and provided further details, including the present ownership composition as 63% Telefonica and 37% Vodafone. The press release provides an expectation of the Netco generating €125m of EBITDA after 3 years.

While there are several unknown variables, we have enough to work with here to get a rough sense of the value these deals could create.

Beginning with the binding Telefonica deal, using the 15x EBITDA multiple provided in the Prospectus (which is at the low end of industry multiples), this fiberco alone could be worth €1.875B, or €694m at Zegona/Vodafone’s 37% share. If Zegona sells its stake down to 10%, it would generate ~€506m in proceeds whilst retaining a stake worth ~€188m.

Based on these terms, we can try to back into what the larger MasOrange fiberco agreement might be worth. Per the 85% EBITDA margins in the Prospectus, the Telefonica fiberco revenues would be ~€147m (€125/.85). This amounts to a ~€9 access fee per customer/per month, given the 1.4m customers the agreement is said to cover (€147m/1.4m/12), slightly less than the €10 figure used in the Prospectus, but close enough.

The MasOrange announcement does not provide customer figures, but it does provide that the total network would cover ~11.5m premises. The Prospectus contemplates a larger network of 16m premises covering 7.5m customers (implying 4.6 customers for every 10 premises). Though not apples-to-apples, of course, the Telefonica fiberco press release implies a similar ratio of 3.8 customers for every 10 premises). Using a figure of 4 customers per every 10 premises implies the MasOrange fiberco would cover ~4.6m customers. Applying the same €9 access fee, we can therefore estimate this fiberco’s revenues could be ~€500m at stabilization, good for ~€420m of EBITDA at 85% margins. Assuming Vodafone contributes 30% of the customers, the fiberco is worth €6.3B, and €1.89B at Vodafone’s share. Selling Vodafone’s stake down to 10% would result in proceeds to Zegona of €1.26B while the retained interest would be worth €630m.

While these MasOrange JV numbers are obviously an assumption, as a sanity check, Spanish business media outlet CincoDias recently reported on the MasOrange/Vodafone fiberco and suggested a valuation between €7-10B — the low-end notably exceeding my own estimate. Moreover, my €420m EBITDA projection is lower than the sell-side’s. I’ll stick with €6.3B to be conservative.

Altogether, the value of these fibercos at Zegona’s share could be worth a combined €2.585B and assuming it retains a 10% interest in each, it could receive €1.77B of that in pre-tax/pre-transaction cost sale proceeds. Furthermore, these Netcos can carry a good amount of leverage given the economics, meaning that Zegona could receive additional proceeds through a recap of its retained 10% stake worth ~€800m - e.g. at 6x net debt/ebitda, an additional ~€300m could be freed up at Zegona’s share.

These proceeds of ~€2B will be upstreamed for deleveraging. At its simplest, the proceeds could be applied to pay down more than 50% of the outstanding principal on the senior secureds and term loans. But the more interesting, and likely outcome, would be to use the proceeds to pay the ~€1.38B special dividend needed to redeem the Preference Shares, subject to compliance with the 2:25-1 net leverage covenant in the debt instruments pro forma the distribution. I’m skeptical debt covenants will impede the payments of the special given the likely size of the netco proceeds, but if that ends up being the case, I believe Zegona could simply pay down principal and redeem the Preference Shares from the proceeds of selling Vodafone down the road.

In any event, let’s look at the upside that results from netco monetization and the payment of a special dividend, with the remainder going to debt paydown. For simplicity, I ignore additional proceeds from a potential debt financing of the retained netco stake, and thus treat the retained 10% stakes as equity. We can see how potential accretion to ZEG equity is magnified given the odd quirk of the Preference Shares:

For the Servco/remainco EBITDAaL, I take the €1.1B figure we have been using and reduce it to account for the lease payments Servco would need to make to the netcos, which I estimate at ~ €180m. I then apply the same 4.55x multiple Zegona paid in the acquisition (assuming €1.1B of EBITDAaL (€5B/1.1)) to the remainco. The outcome: ~120% upside from today’s share price including the dividend. Yes, we could probably discount the multiple to reflect that this will take some time to unfold, but on the other hand, I am giving no credit for incremental cash generation, which could be positive even after restructuring charges.

It is worth pausing here to contemplate whether it would really make sense for a third-party to pay >15x for these assets. For one, precendent transactions support this as the low-end; e.g. KKR acquired a fiber stake from Reintal for >20x in Dec 21; Credit Argicole purchased rural fiber assets from Telefonica at >25x in July 22.

Further, while those multiples may seem rich in the current macro environment, I’d note these assets could warrant a premium given the JVs have been formed with Spain’s two other largest telecoms, meaning that the owners of these Netcos will control dominant market share in near-irreplaceable physical infrastructure that serves as a large foundation for Spain’s digital world. That seems like something that might garner some interested buyers…

And it already has, with reports emerging in recent weeks that Spanish billionaire Armancio Ortega is looking to acquire the third-party piece of the Telefonica fiberco, with those same reports valuing the fiberco at €2B, or 16x EBITDA — higher than the 15x used in my underwriting above. There are an abundance of other purported bidders as well, including Allianz, PGGM, Aimco, and CPPIB, which manages the Canadian Pension Plan.

The earlier stage, and larger, MasOrange fiberco also appears to already be garnering interest. This article, for example, provides that investment banks have been enlisted to find a partner for the JV, valued between €7-10B, and are looking for a €4B investment, with the process expected to conclude in H1 2025.

Vodafone and Why It’s a Good LBO Candidate

There are ultimately three broad reasons I think Vodafone is an attractive LBO target beyond the fiber spin-off angle. The first I’ll tackle quickly — acquisition price. Zegona, as noted, paid a multiple below industry averages, driven in-part by pressures at Vodafone Group to refocus and improve its balance sheet.

Beyond price, the other two reasons Vodafone is an attractive target are: 1) tailwinds in the Spanish telecom sector (read: consolidation!); and 2) low hanging fruit to improve profitability.

An Attractive, Consolidating Market

Readers of this blog know I am always looking for industries undergoing consolidation (e.g. here and here and here). And that dynamic has been heavily at work in the Spanish telecom industry for the last decade.

At the time the deal closed, four major operators — Telefonica, MásMóvil, Orange, and Vodafone — held a combined share of >90% of the market. This has now been reduced to a Big 3 following April’s combination of Mas and Orange, which is now apparently Spain’s largest telecom in terms of customers, boasting 41.8% of the fixed broadband market, 42.8% of the mobile market and 31.6% of the TV market in 2024.

One of the difficulties for telecom operators is that it is difficult to generate topline growth once markets reach saturation. When the vast majority of the TAM is penetrated, growth generally needs to come from market share capture or price increases. But when the offering is relatively commoditized/substitutable, as it is here, companies compete on cost in an effort to grow market share, thus driving down returns. That is to say, if you want to grow, prices will work against you, not for you.

However, as the market consolidates, these competitive dynamics wane and participants become more rational. We have seen this dynamic play out in Spain over the last decade, as the number of operators has dwindled from 14 to what is now 3 large companies controlling nearly the whole market. This dynamic has reduced churn, stabilized ARPU, and is beginning to result in pricing power:

The ability to generate topline growth through taking price, rather than competiting on market share, should be augmented by the Mas/Orange combination, which has officially made this industry an oligopoly.

Vodafone offers “low hanging fruit”

Vodafone operates both Consumer and Business segments. In Consumer, Vodafone has ~4.8m total subscribers and the share across its offerings include 19% in mobile consumer, 17% in fixed broadband, 20% in PayTV, and 26% in mobile prepaid. Vodafone operates multiple brands from premium (Vodafone Spain) and value (Lowi). In Business, Vodafone likewise has significant market share in mobile and fixed BB.

Over 90% of fixed subscribers are converged, which is beneficial as it reduces churn and increases ARPU.

Vodafone operates an extensive mobile network , with over 18k mobile sites and 99% 4G and 60% 5G coverage. It holds 26% of total market spectrum across the low, mid and high frequenices. Moreover, the network benefits from sharing agreements with the other major providers

The fixed-line network, as referenced above, covers 95% of Spanish premises: 10.7m homes are supported by its owned network, of which 6.8m are on HFC and 3.2m have full fiber-to-the-home, while 18.3m households are covered through wholesale partnerships with other major providers, including a recently renewed agreement with Telefonica and Bluevia.

Despite this relatively attractive positioning and footprint, Vodafone has historically been undermanaged as a non-core subsidiary of Vodafone Group.

For one, Vodafone’s cost structure is inefficient compared to its peers. As an example, Zegona points to Vodafone employing more than 4000 individuals as of March 2023, as opposed to 2,400 employees at MásMóvil. This high headcount, in addition to other cost inefficiencies, has resulted in margins well below that of peers. Zegona calculates Vodafone’s Business EBITDAaL and cash flow margins as 33% and 11% respectively, vs. much higher numbers for its peers, including Euskaltel, which was generating EBITDAaL and Cash Flow margins of 50% and 27% before Zegona’s exit. (NB: Business EBIDTDAaL adds back subscriber acquisition costs).

While Zegona does not believe it can achieve the same margins at Vodafone as it did at Euskaltel, it believes it can achieve half of the difference — in other words, they see a path to improving Vodafone’s Business EBIDTAaL margins by ~8.5% to ~41.5% ((50-33)*.5), which would result in annual cost savings of ~€320m.

Second, Zegona sees potential to grow, or at least stabilize, what has been a declining top line. More below.

The Strategy

The Prospectus lays out a comprehensive four-step plan to “fix” Vodafone. As we will see, much of this plan has already been implemented despite the acquisition closing ~6 months ago.

Replace the management team.

Zegona’s first order of business has been to replace Vodafone’s historically unfocused management team, with its own team, including bringing on telecom superstar Jose Miguel Garcia as CEO. Garcia has a tremendous track record of success in the Spanish telecom space. He was the CEO of Jazztel from 2006-2015, during which he delivered 4x revenue growth and increased the company’s value more than 400% before it was sold to Orange for €3.4B. Subsequently, Zegona brought Garcia in to serve as the CEO of Euskatel, where he apparently increased EBITDA by 8% within his first 6 months.

As an aside, it is worth noting that Garcia purchased 485,500 shares of Zegona at £2.653/share in July, good for ~$1.6m worth. Always a good sign!

Improve efficiency

As noted above, Zegona believes there is a lot of room to improve cost efficiencies at Vodafone and the Prospectus identifies several areas where savings can be achieved (see pp. 54-55). While it is one thing to identify inefficiencies, and another to actually remediate them, concrete and material steps have already been taken to this end.

For instance, having noted that Vodafone’s personnel costs were 7.1% of FY23 revenue (16% higher than Euskaltel’s ratio), Zegona quickly moved to shrink Vodafone’s workforce, announcing in July that it cut a deal with unions to layoff 898 employees. This figure, although less than the 1200 jobs it initially proposed, results in a reduction in-force of ~25% of its 4000 employees (per the Prospectus) or 27.5% per the press release. In any event, at 7.1% of FY23 revenues, personnel costs were ~€277m, meaning a 25% reduction in-force should lead, ceteris paribus, to cost-savings of €70m annually after incurring ~€100m of up-front restructuring costs. That right there already gets us 20% of the way to Zegona’s goal of achieving €320m in annual cost savings.

Zegona has also taken strides to reduce fixed wholesale access costs, which were previously 5.2% of FY23 (i.e. €203m) and 18% higher than Euskaltel’s. Accordingly, in November, it was announced that Vodafone entered into a 5-year contract with Telefonica and Bluevia for fiber wholesale, replacing the previous agreement. Though details have not been disclosed, the press release provides that “the new terms will deliver significant economic benefits to Vodafone Spain alongside enhancing core operational processes and improving the customer experience”.

Additionally, reports have recently emerged that Zegona is threatening to pull out of its tower agreement with Vodafone Group owned Vantage Towers if it does not get improved pricing. The reports suggest that Zegona is seeking a €50m reduction in annual fees, otherwise it will find another towerco provider. Given Vodafone and Vantage were previously related parties, it is not surprising that Vodafone might be overpaying. Moreover, given Vodafone is the anchor tenant on most of Vantage’s towers, and that there are now more towercos than MNO’s, it is likley that Vodafone may have some leverage here. Subsequent reporting indicates that Vantage Towers is now looking to sell itself. Time will tell how this plays out, but it’s something worth keeping an eye on, as an additional €50m of savings in addition to €70m from layoffs would already get Zegona 40% of the way to its goal.

Beyond these items, Zegona has identified several other categories of costs that are a disproportionately high % of revenues compared to what they achieved at Euskaltel, including IT capex (6.7x higher), tech spend (80% higher), subscriber acquisition costs (30% higher), and bad debts (3.7x higher). Again, actually solving problems requires a lot more work than merely identifying them, but some of these categories appear to offer low hanging fruit, and given the replacement of Vodafone’s previously unfocused management team with Zegona’s experienced and financially aligned team, my bet is on these aspirations being largely attainable.

Stabilization of Revenues

Vodafone’s revenues have been in gradual decline, from €4.17B in 2021 down to €3.9B in 2023. While topline growth is difficult in this space, for reasons I addressed above, Zegona aims at the very least for stabilization. It proposes, among others, the following measures:

Discontinuance of 12-month discount periods, which coincide with contracts coming up for renewal, which has historically led to lower ARPU and higher churn;

Growing market share in the value segment by leveraging areas of differentiation, such as adding 5G and TV to the Lowi brand;

Increase focus on wholesale relationships, which are currently 4% of total revenues vs. ~20% at Orange and Telefonica.

These again are simply ambitions and we are largely relying on management to deliver. With that said, I would note that the consolidation brought on by the Mas/Orange merger, which has effectively turned the industry into an oligopoly, should lead to reduced competition and more rational pricing, which in turn should help stabilize revenues through pricing increases, rather than incremental market share gains.

Moreover, Zegona already appears to have made substantial inroads towards accomplishing this goal, with this report noting that after Zegona took control in June, Vodafone achieved net additions of 135K broadband and mobile lines through to September, while having lost >400K in the preceding five months. The article also notes that Zegona has implemented several other changes to improve its offering, including strengthening the value brand, Lowi, by introducing 5G and streaming services. Moreover, Zegona has simplified its plans, reduced prices and made existing discounts permanent to reduce churn, but plans to begin increasing pricing 3% in 2025 — which would increase ARPU by €1.50/month.

What impact these measures ultimately have remains to be seen, but these all seem to be reasonable, low-risk moves and it is promising to see how quickly Zegona have moved to take action.

Monetize Netcos (see above).

Valuation

Above, I showed the upside simply from Netco monetization/the special dividend and the resulting deleveraging. But in that exercise I assumed no improvement in profitability and nor any multiple expansion. What might we expect at exit?

I layout two scenarios below, using €918m of EBIDTAaL as the starting point, which is the €1.1B FY23 Adj. EBITDAaL figure adjusted to account for Netco leases.

In the base case, Zegona achieves 50% of its €320m in expected cost savings (i.e. €160m), which results in €1.14B of EBITDAaL, and is able to exit at a 5x multiple. In the bull case, I assume Zegona achieves the full €320m savings, resulting in €1.3B of EBITDAaL, and exits at a 6x multiple. Note these assumed margins are lower than the guidance in Prospectus, largely due to the Netco leases. The cap structure is pro forma the “netco monetization pathway” laid out above.

As you can see, these assumptions lead me to 200% upside in the base case and 430% upside in the bull case. Including the £1.50/share special dividend from the netco proceeds, which I leave out in this table, upside is closer to 250% to 475%.

However, we need to adjust for the promote I mentioned above. Despite being a public vehicle, this is still at its core private equity, and there is a management incentive scheme that gives management 15% of all the upside from the market cap on Oct. 15 (~equivalent to today’s) subject to a 5% preferred and after adjusting for capital returns. By my very rough math, that cuts the upside down by ~£1/share in the case base case and ~£2/share in the bull case. Excluding the special dividend from the return calculation should therefore roughly neutralize the impact of the promote.

To be clear, I am not expecting a 400% return here — there is a lot that needs to go right for that to occur — but the point is that there is a roadmap to getting a mid-teens share price if this plan is executed.

I’d also note that this underwriting is potentially conservative in other respects in that it assumes zero revenue growth, zero organic cash flow generation/deleveraging, and very limited multiple expansion (in fact, the multiple is actually contracting at today’s implied valuation).

Alignment and the Management Incentive Scheme

I just want to quickly note the large insider alignment here. In addition to Garcia’s aforementioned large purchase shares, Zegona management own >7.5% of shares outstanding.

As noted, there is a "management incentive arrangement” in place (See pg. 31-33 here for details). While this scheme eats into our upside, it also provides further alignment as 1) the comp is paid in shares; 2) there is a two-year lock up period after each payment; and 3) the vesting for the ongoing period is not until October 2027. In these circumstances, I am more than happy to sacrifice some profits for added alignment. Indeed, as I noted at the top, management execution is perhaps the most important consideration in these situations.

Risks

First and foremost, failure to monetize the Netcos in line with the valuation assumptions above would impede meaningful deleveraging and complicate the path forward.

Limited visibility into Vodafone and a dearth of updated financial disclosures makes this somewhat black-boxy.

Leading-man risk both with Jose Miguel and the Zegona founders.

Regulatory interference.

Disclosure: I am long ZEG shares at an average cost of 326p.

Hello there,

Huge Respect for your work!

New here. No readers Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing poetic take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

Built to Be Left.

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e