JBG Smith

A local monopoly exposed to strong growth tailwinds and helmed by prudent capital allocators...available at a 40% discount to NAV.

Disclaimer: Nothing on this blog is intended as financial or investing advice. Please do your own due diligence.

“Land monopoly is not only monopoly, but it is by far the greatest of monopolies; it is a perpetual monopoly, and it is the mother of all other forms of monopoly.” - Winston Churchill

“Buy on the fringe and wait. Buy land near a growing city! Buy real estate when other people want to sell. Hold what you buy!” -John Jacob Astor

In my most recent piece “Where I’m Looking for Value Today”, I spent some time discussing the opportunity, as I see it, in certain publicly traded real estate names. One of the names discussed was JBG Smith (JBGS), which is the company I am recommending today.

While shares have run about 10% since I first discussed the name (currently ~$15.50/share), I believe JBGS offers that ever elusive combination of deep value and high quality that we are on a perpetual hunt for as value investors. Ultimately, this is an opportunity to purchase what is a effectively a local monopoly run by elite operators with numerous tailwinds behind it. And it’s available at a very large discount to NAV.

This is a buy-and-hold fundamental long with the potential to generate significant long-term compounded returns through a combination of growth, distributions, and a closing of the discount.

The thesis can be broken down as follows:

Uniquely robust supply and demand fundamentals.

Supply Side:

There is a structural shortage of housing in the northeast of the United States and that is likely to remain the case for years to come.

75% of JBGS’ assets are in the National Landing area of Northern Virginia. JBGS essentially has monopoly control over the supply of real estate in the area, helping insult it from the inherent cyclicality brought on by overbuilding.

Demand Side:

With inflation running hot, the money printers in perpetual motion, and many being priced out of home ownership, the macro backdrop provides strong support for growing rental demand.

JBGS is able to influence demand for its National Landing assets through its ‘Placemaking’ strategy, whereby it takes a holistic approach to developing entire communities, rather than assets in isolation. As part of this strategy, JBGS helped secure National Landing as Amazon’s new headquarters, an invaluable outcome that is in the early innings of setting into motion a flywheel of value creation in the area.

The assets are available at a large discount to NAV.

At $15.50/share, the entire enterprise trades at a ~7.5% cap rate. While that doesn’t immediately scream cheap, a deeper analysis illustrates that NAV is conservatively closer to $25/share. We can quibble over what discount, if any, ought to apply here (I’d say none!), but a 40% discount for this collection of quality assets, which again, are mostly located in a rapidly growing area over which JBGS has a development monopoly, is way too cheap.

Leverage, though facially concerning, is manageable, and the company has ample liquidity to service its debt whilst continuing to return capital to shareholders.

The company screens quite levered at ~9.5x net debt/EBITDA (that figure is likely a fair bit higher over the NTM). But the leverage poses little risk upon a closer look.

In addition to ~$230m of cash, there are a number of unencumbered assets in the portfolio, including 7 multifamily properties which offer substantial borrowing capacity, as well as $750m of undrawn revolver. Together, that provides some $1.3B of liquidity vs. ~$2.6B of debt, of which only ~$800m comes due over the next three years.

Moreover, much of this debt is non-recourse mortgage debt. JBGS is explicitly taking advantage of this structure and foreclosing on its toxic office assets where necessary.

Strong history of capital allocation

Management have done an impressive job steering the ship in the face of extremely challenging office headwinds. Since inception in 2017, the company has disposed of 55 assets, mostly office, and recycled ~70% of the proceeds into multifamily acquisitions and development. As a result, the portfolio composition has gone from nearly 80% office in 2017 to majority multifamily today. As a result of this asset recycling, NOI in the coming years should return to pre-COVID highs despite the company now operating with some 40% less commercial square footage than possessed at inception.

There is an aggressive and prudent capital return policy in place. After issuing $473m of stock in 2019 at a price of $40/share, management have since repurchased ~$1B worth, or 33% of shares outstanding, at a weighted average ~$20/share, well-below my estimate of current NAV, and the company continues to aggressively buyback stock today, with ~$500m remaining on its authorization. There is also a $0.175/share quarterly dividend, good for a ~4.5% yield at today’s price. Coupled with the present buyback run-rate, the cumulative yield is ~17%.

Company Overview

JBG Smith went public in 2017 as the spin-off of Vornado’s assets in and around the Washington D.C. area. JBGS has ~88m basic common shares outstanding (as of late June) but its assets are held by an operating partnership in which it owns ~87% and in which the remaining 13% of units are convertible for stock. Fully diluted shares outstanding, after accounting for LTIP Units, are therefore ~102m as of end of June.

At a current share price of $15.50, the market capitalization is ~$1.6B. Net debt is presently $2.36B. Total enterprise value is accordingly $3.96B.

The company currently has 41 operating assets comprised of 15 multifamily properties totaling 6318 units, 24 commercial properties totaling 7.5m SF (~7.2m SF at JBGS share - some are held in JVs), and two ground leases. In addition, the company has two highly attractive under construction multifamily assets — 1900 Crystal Drive and 2000/2001 South Bell — totaling 1583 units (bringing the pro forma multifamily segment to 7901 units) as well as 17 assets in the development pipeline totaling an additional 7715 multifamily units and 1.6SF of commercial space.

National Landing

While the company has assets located in D.C. and Maryland, ~75% of its properties are located in the National Landing area of Northern Virginia, which is located just across the river from D.C.. National Landing comprises parts of Crystal City, Pentagon City and Potomac Yard.

Historically, National Landing had been “long disparaged as a soulless wasteland of office blocks and parking garages.” JBGS, in conjunction with state and local governments and economic development communities, has been in the process of changing that image and its lack of appeal for the better part of the decade through a strategy it refers to as “Placemaking”. Similar to the master planned community development strategy employed by, e.g. Howard Hughes, Placemaking is a holistic approach to development in which the developer attempts to buildout entire communities and neighborhoods through a strategic mix of multifamily and commercial properties, the signing of anchor tenants to spur demand, and a thoughtful curation of public spaces and amenities.

Though it has taken time, JBGS’ efforts in building out National Landing have been a huge success if you ask me (though, as we will see, this success has not been reflected in the share price due to broader macro and office headwinds).

Today, National Landing is home to more than 24K people, 14m SF of office, 5500 hotel rooms, and 450 restaurants.

The Amazon HQ2 Deal

In November 2018, Amazon announced that National Landing secured the bid to serve as the location of the company’s second headquarters, “HQ2”. The securing of Amazon as an anchor tenant is a potential game changer for the area and JBGS.

As of year-end 2023, Amazon leased ~927k SF across five JBGS buildings. While 444K SF of those leases expire in 2024 and are not expected to be renewed, the far more important item is that JBGS serves as the developer, property manager, and leasing agent for Phase 1 of Amazon’s new headquarters - Metropolitan Park - a two building 2.1m SF project which was completed by JBGS in 2023. The campus has the capacity to house 14000 Amazon employees.

Beyond Metropolitan Park, there is a planned second campus, Phase 2, the construction of which was paused by Amazon following the large round of tech layoffs in 2022 (more below).

Readers should note that these HQ2 buildings are not owned by JBGS, but are rather developed in partnership with Amazon in an effort to lure residents and other businesses to National Landing — thus increasing demand for JBGS’ retained commercial and residential assets, and the community at large.

Before moving on, I think it is insightful to note how National Landing managed to win this competitive bid for Amazon.

(Source)

While there were obviously economic incentives for Amazon, including a potential $750m from the State, the company was clearly motivated by a variety of non-economic factors, including National Landing’s proximity to bright young talent.

Virginia Tech’s Innovation Campus

One element that enticed Amazon to come to National Land was a commitment from Virginia Tech to build out a tech focused graduate campus known as the Innovation Campus. Indeed, the decisions were so intertwined that VT signed a memorandum of understanding with the city regarding the campus the same day that Amazon announced HQ2. The campus, expected to be completed by 2030, will include three buildings totaling 600K SF at a cost of more than $1 billion. The campus will host just shy of 1000 grad students with a computer science and engineering focus.

The Placemaking Flywheel

The securing of HQ2 has led to a chain reaction of events that illustrate why development models like this can be so attractive. Let’s break the mechanics down:

Amazon is secured as an anchor tenant. Due to how the deal is structured, Amazon is financially incentivized to hire up to 38K six-figure employees to work at HQ2. Amazon also stands to benefit from increases in local taxes;

Amazon’s presence has in turn incentivized Virginia Tech to build out a large tech campus that can serve as a talent pipeline for Amazon;

All of that local STEM talent attracts further corporate presence. As the slide above shows, both Boeing and Northrop Grumman have provided financial assistance to build out the VT campus. Additionally, Boeing, as well as Raytheon, recently followed Amazon and moved their headquarters to National Landing. Have a look at all of the large businesses that have leased spaced in National Landing in the last 24 months:

One of those tenants is Federated Wireless, which has turned National Landing into the first place in the US with a large-scale 5G enabled downtown, thus incentivizing more businesses to relocate to the area.

State and local government agencies have invested nearly $6B into National Landing, with further investment sure to come:

All of this, of course, creates demand for JBGS’ office, retail and multifamily assets, as increasing numbers of people choose to spend time or live in National Landing. This increases the value of both JBGS’ existing assets as well as the value of its large development pipeline.

As further inhabitants are attracted to National Landing due to its employment opportunities and other attractions, further businesses are incented to relocate…thus creating a virtuous cycle of value creation.

JBGS’ Placemaking efforts in National Landing have been a success, as evidenced by items 1-5 above. However, unfortunately for preexisting shareholders, those efforts have not yet translated materially to items 5-6 (i.e. value creation), largely due to setbacks brought on by COVID-19 and the economic challenges that came with it.

For one, office assets, which have historically been the majority of JBGS’ portfolio, have been under tremendous strain given work from home dynamics — this has harmed NOI generation which, along with the rapid rise in cap rates, has hammered JBGS’s NAV.

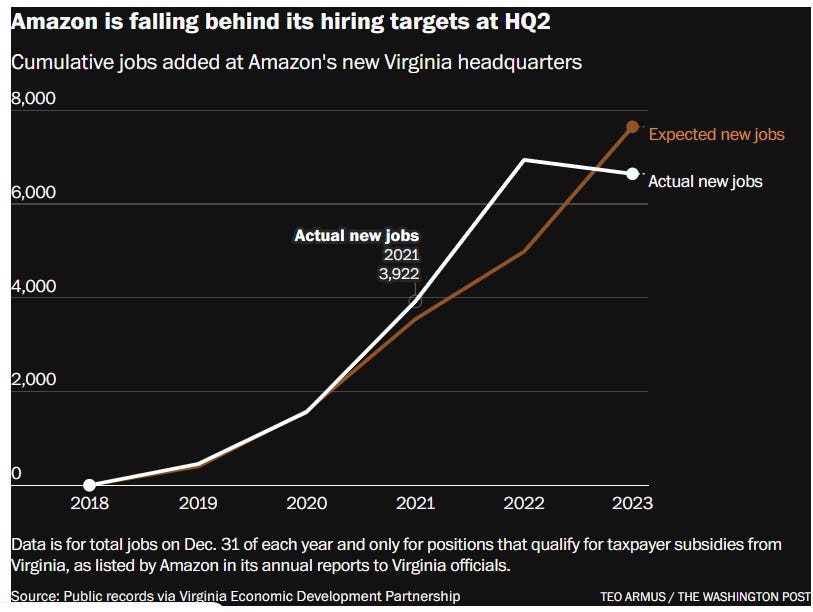

Second, and relatedly, the waive of tech layoffs following years of bloated spending has led Amazon to layoff more than 27,000 employees since 2022. This has been a huge blow to the expectations surrounding HQ2. Indeed, Metropolitan Park, which has capacity for ~14,000 employees, currently employees about half of that number, and in fact, the campus actually saw its employee count decline over the course of 2023. After being well ahead of schedule through to 2021, Amazon is now falling behind on its hiring targets.

Further, as noted above, given the ongoing struggles to even fill capacity at Metropolitan Park, Amazon has paused the development of Phase 2 altogether.

These setbacks have obviously been frustrating for shareholders. And the stock has reflected this frustration, with shares down ~60% over the last 5 years (excl. dividends).

However, I believe investors’ disappointment with the past is causing them to overlook a ton of positive developments and an inflection that is nearer than consensus expects.

For one, there is good reason to believe the Amazon setbacks are largely temporary. Recall, as noted above, Amazon was attracted to National Landing due to a unique agreement that was far more holistic than simply a large paycheck. Indeed, Amazon’s counterparties prudently structured the agreement such that Amazon’s financial rewards are essentially entirely contingent on certain milestones being met. These include e.g.:

15% of any increases in local hotel taxes;

$23m in tax subsidies from Arlington country subject to increases in transient occupancy taxes;

Promises from the county to fund a ten-year infrastructure development plan subject to increases in county tax revenue; and

Most significantly, an agreement from the State, to pay Amazon up to $550 million for creating 25,000 six-figure jobs by 2030, or as much as $750 million if they hit 37,850 jobs by 2038. The incentives are also structured to ensure Amazon keeps those qualifying jobs for 5 years.

To date, Amazon has received virtually none of this contingent consideration due to the challenges it has faced in filling out Metropolitan Park. Now, while this consideration is admittedly peanuts to Amazon, given Phase 1 is already built-out, there are clearly incentives for Amazon to do its part. For what it’s worth, Amazon has mandated that employees return to the office at least three days per week; the company has expressed willingness to fire employees that fail to adhere to this policy, though it’s unclear to what extent it has actually followed through on this threat (if anyone has insight into this I’d love to hear from you).

Moreover, though clearly now a distant catalyst (if it ever does materialize), Amazon’s communication around Phase 2 suggests that the project is merely on pause, and not terminated.

But the positives go well beyond incremental demand that might come from HQ2. There are at least two additional considerations, independent of anything Amazon related, which are materially increasing the value proposition here: 1) robust supply and demand fundamentals in the region; and 2) prudent capital allocation that has created a lot of dormant value that is bound to be realized in due time.

Robust Supply/Demand Fundamentals

“Location, Location, Location”

Real estate markets are, of course, local. And JBGS’ assets are entirely located within markets with strong supply and demand fundamentals that are likely to continue for years to come.

Broader Northeast Dynamics

In my previous post, I raised some bullish points in support of real estate in the northeast of the United States, particularly as it relates to residential. I’ll reiterate and expand on some of those points here (credit to Twitter user rev_cap for sharing some of these helpful graphics that I borrow from below).

On the demand side, note the following:

national wealth, on a per capita basis, is highly concentrated in the northeast (median household wealth in D.C. is more than 50% higher than the median US household).

nominal net worth has rocketed to all time highs, which obviously increases demand for housing. This likely continues given our irresponsible inflationary monetary/fiscal policies.

the combination of high home prices and interests rates have made new home ownership prohibitive and uneconomic for even relatively high wage earners, thus increasing demand for rentals. This problem is pronounced for younger generations, who have disproportionately low rates of homeownership, but are concentrated in northeastern cities.

Couple this with the supply side:

The inventory of homes for sale in the northeast is lower than anywhere else in the country.

This phenomenon is driven in part by long-duration, low fixed-rate mortgages that homeowners are unwilling to part with.

The supply of rentals is also constrained given lower homeowner vacancy rates.

New builds are extremely depressed in the northeast, as the combination of cost inflation and high financing costs have made it near impossible for developments to pencil, particularly given the small margin of error at market cap rates. There is thus a structural shortage, unlikely to be resolved anytime soon.

Nationally, the three month moving average for multifamily housing starts is the lowest it has been since 2013, and the numbers in the northeast have plunged across the board, with housing starts down 44% YoY.

JBGS’ specific submarkets have ~5% of exiting inventory under construction.

Altogether, this combination of factors has been a huge boon for rent growth in the northeast; indeed, we have seen YoY growth rates of mid to high single digits in many parts of the region. Apartment List data suggests that the D.C. metro area experienced the second highest median rent increase in the country YoY.

Factoring in leverage, such growth presents enormous upside to property owners. And given continued inflationary trends and a lagging supply response, the trend appears poised to continue looking ahead.

The dynamics with respect to the office market are not nearly as strong. However, the dynamics within National Landing, though still challenged, are far better relatively speaking.

National Landing Dynamics

Demand Side

The dynamics outlined above are particularly acute in and around National Landing. Since 2019, home prices in Arlington Virginia have risen at an annual rate of ~7%. And we can see this trend spilling over to JBGS’ financials, with same store multifamily NOI growth increasing more than 11% YoY and occupancy rates ticking up over 94%.

But wait a minute — didn’t I just spend several paragraphs explaining that JBGS’ Placemaking efforts have largely not been rewarded yet? That’s right — JBGS’ multifamily assets are nevertheless still boasting mid 90s occupancy rates and high rental growth despite the impact of HQ2 and its second order effects remaining largely negligible today. In other words, the robust demand JBGS’ multifamily assets are seeing is largely attributable to broader trends in the region.

This is evidenced by the figure below, which shows that National Landing home prices initially surged after the HQ2 announcement, but have largely grown in line with the rest of the D.C. region since the onset of the pandemic.

Given National Landing’s population is presently ~24K, even a small bit of progress towards Amazon’s goal of 38K employees will surely supercharge this already strong regional demand. Of course, we need to also keep in mind the other demand drivers, like VT and the abundance of tech and defense companies setting up in the area.

But even as it stands, this robust demands seems highly likely to continue as we look ahead. Indeed, as of Q1, JBGS’ National Landing multifamily was 95% occupied and its two under-construction developments are being leased up at $4/SF vs. average class A rents in the portfolio being ~$3.36/SF.

As it relates to the office portfolio, the fundamentals are obviously not as strong, but they are both improving and superior to many parts of the country. JBGS’ National Landing assets have been experiencing 87% peak day occupancy, well in excess of places like New York (65%) and San Francisco (52%). One reason is likely due to the presently strong environment in the defense sector, which, along with tech, constitutes the majority of the tenants in the area. Of course, being situated beside the Pentagon surely helps:

Moreover, JBGS’ largest commercial tenant is the US government (~30%), which is a very sticky tenant given proximity to D.C., as well the sensitivity of confidential information often requiring in office attendance.

The Supply Side

"Rather than focus on numerical indexes in investment decisions, the investor should focus on unique characteristics that protect the investment from competition. Thus bar to access is a critical element in the evaluation." - Sam Zell

Strong demand is fine and well, but it can often be short-lived as it spurs on a supply response from developers looking to capture the high returns on offer.

And it is here that I think the thesis for JBGS is most compelling: JBGS effectively has a monopoly over real estate development within National Landing, insulating it from the ordinary, value destructive supply responses that make real estate inherently cyclical. JBGS controls not only 28% and 56% of the multifamily and office inventory respectively, but, significantly, it controls 83% of all the developable land.

This control means that JBGS is insulated from overdone supply side responses and can likewise adjust the supply of real estate to ensure equilibrium.

We can presently see the benefit of this dynamic as it relates to office, as JBGS has been able to increasingly place underperforming office assets out of service to help create a healthier market.

Valuation

The stock does not look particularly attractive from this snapshot. A 7.5% cap with a ton of office exposure, including some toxic assets, with the 10-year above 4%, doesn’t exactly scream cheap. Moreover, you’ve got >9x Net Debt/EBTIDA and your interest expense is nearly 50% of EBITDA (and your cost of debt is going to increase once legacy loans get refinanced). The dividend barely yields more than the 10-year and it’s not exactly on a low AFFO multiple.

While this kind of back of envelope valuation is instructive to get situated, ending the analysis here - which I’m sure plenty of investors do — results in missing the huge discount that manifests once one pulls back the layers.

I’ll caution that none of what follows is intended to be precise. I don’t believe precise targets are in anyway helpful or realistic for a company like this - “better to be approximately right than precisely wrong”. But I think the angle I explore below should help to suggest that the intrinsic value of this company is well in excess of $15.50/share and, in fact, closer to $25.

JBGS owns 15 stabilized multifamily assets, which will contribute ~$130m of NOI on Q1 annualized. These assets are comprised of ~80% Class A properties with an average life of 7 years. Of the total 6318 units, 2856 are located in National Landing, with the remainder in the D.C. area. Applying a 5.5% cap rate to the multifamily assets values the portfolio at $2.36B (130/0.055).

Additionally, we need to account for the two under-construction assets in National Landing - 1900 Crystal Drive and 2000/2001 South Bell — which total 1583 units and are in the process of being leased up. Early leasing activity has been promising (1900 Chrystal was ~22% leased as of the end of April). The company expects to incur an additional $134m to finish the properties. These properties are expected to contribute a further $44m of NOI once stabilized.

Altogether, after factoring in some conservative NOI inflation (i.e. two years at 4%) , pro forma the two under construction properties, the multifamily segment should be able to do ~$185m of NOI in a two years. At 5.5% cap, that’s worth $3.36B (vs. today’s EV of $3.9B).

Debt at the multifamily level, including the construction loans, is $1.36B, which implies an equity value of ~$2B (3.36-1.36) for the multifamily assets (vs. current market cap of $1.5B).

It is worth pausing here to note a couple things. First, given the non-multifamily debt is ~$1.23B, there’s theoretically enough equity value in the multifamily portfolio to cover the entire debt balance and still be left with ~$700m in equity. We’re ignoring a ton of frictional costs and obviously this isn’t a liquidation play, but its certainly helpful for framing downside.

The second thing to note is that the multifamily portfolio, despite JBGS’ scary looking net debt number, actually appears to be overcapitalized — debt/asset value is ~40%, which is extremely conservative for these assets. Indeed, 7 out of the current 15 multifamily assets are entirely unencumbered - i.e. don’t have any mortgage debt attached to them. I’ll discuss liquidity more below, but the unutilized borrowing capacity from these assets is a substantial consideration that surely gets missed by superficial screens.

JBGS has repurchased some 3m shares during the second quarter, implying what is now a fully diluted count of ~102m. That means the multifamily equity alone is worth ~$19.6/share.

Again, this is obviously a fiction because it fails to account for any other debt obligations. But here is where the non-recourse/asset level debt structuring I discussed in my last post comes into play. Of the remaining $1.23B of debt on the balance sheet, ~$540m of that relates to mortgages on office properties which are mostly non-recourse to the company - i.e. that debt is effectively subordinate to any equity held in assets that it is not secured against. The remainder of the debt — ~$717m — is attributable to Term Loans that do rank above the equity and therefore must be subtracted from NAV.

On a per share basis, the Term Loans are a ~$7.03/share hit to NAV.

Therefore, after subtracting all debt to which it is subordinate, the per share equity value of the pro forma multifamily portfolio is ~$12.58/share, leaving ~$3 of the current share price unaccounted for. (Note that the debt stack on the multifamily portfolio is going to change a good bit by the time we get to 2026, but not in a way that should materially impact NAV calculation).

What else do we get?

Well despite it’s troubles, the office portfolio is worth a hell of a lot more than $3/share. JBGS is the currently in the process of giving the keys back on what it euphemistically deems its “highly levered” office assets (i.e. assets where the loan exceeds the property value and will thus be foreclosed). There is ~$420m of mortgage debt on these assets which we can largely exclude from our SOTPs math. That leaves $120m of mortgage debt against the remaining office assets, which are currently doing ~$95m of NOI (i.e. excluding the toxic assets and certain unencumbered ones the company intends to place out of service). JBGS projects office NOI increasing to $140m over time as lease rates increase with declining supply, but let’s be conservative and call it $110m. At a likewise conservative 11% cap rate (these assets have occupancy rates in the mid-80s, unique demand drivers (e.g. defense and gov tenants) increasing leasing activity, and an owner that controls the local supply), the pro forma office assets are worth $1B, good for ~$880m of implied equity value after subtracting debt, or a further $8.26/share of NAV.

But there’s more. We also get JBGS’ enormous development pipeline, which is comprised of 9.2m SF of development density at JBGS’ share (consisting of 1.52m SF of office, 253K SF of retail, and 7,715 units of multifamily).

Obviously, this could and likely will be worth a lot overtime, but it’s impossible to really get closer than simply using historical cost, which JBGS puts at $380.3m. On a per share basis, that’s good for another $3.73/share.

Then we have ~$227m of cash, which I will not give any credit for given the ongoing capex needs for the under construction assets and the ~$40m of buybacks during Q2.

Putting it altogether…

Ignoring some minor pieces, like the asset management business and some NOI attributable to ground leases, these parts add up to just shy of $25/share.

Again, there’s a lack of precision here and it doesn’t entirely reflect reality — this is not a liquidation play, there are capex and SG&A needs, potential deemed capital gains upon foreclosures, refinancing will change the capital stack, etc. — but the point is to illustrate that shares presently trade at a ~40% discount what I think is a conservative NAV estimate and that we are essentially paying for the multifamily assets and development pipeline at cost, and getting the office portfolio for free.

And remember — land is forever: therefore, absent destructive capital allocation, this NAV figure is nearly certain grow over the long-run, which will contribute to shareholder returns on top of any upside from the discount closing.

Leverage, Liquidity, and Cash Flow

I don’t think its a great use of time trying to model out cash flows for a company like this which has a number of moving pieces, engages in constant asset recycling, and has non-recurring items all over the financials. What I do think we need to consider is whether the company has sufficient liquidity to meet its debt maturities while funding operations and ongoing capex needs, and whether, after doing so, it will still be able to return capital to shareholders.

Weighted average cost of debt is presently 4.84% and weighted average maturity is 3.5 years. There is ~$850m of debt maturing through the end of 2026, with ~$340m of that attached to office assets.

Note $420m of total debt relates to the “highly levered” office assets that the company has already implied it won’t be hanging onto. The company does not give us this explicitly, but given the $121m maturity this year relates to one of these assets, some simple arithmetic implies the $116m office maturity in 2025 is the only encumbered office asset the company will look to refinance. (These are three different buildings in National Landing with relatively strong leasing numbers).

All of the debt due this year belongs to a non-core D.C. office asset and the majority of the remaining maturities through to 2026 relate to multifamily assets which will not be a problem to refinance (though the principal amount and cost of debt will likely rise, particularly given the $197m of multifamily debt due in 2026 pertains to the construction loans against 1900 Chrystal Drive which will no longer have capitalized interest expense).

As of the end of Q1, JBGS had ~227m of cash. The company also has $750m of undrawn revolver capacity, in addition to the 7 unencumbered multifamily assets that could be financed for additional liquidity (the company suggests that this capacity amounts to ~$350m). Altogether, that’s ~$1.3B of potential liquidity, before accounting for cash generation and further optionality from asset sales if necessary.

Given there will be no issues refinancing the ~$500m of upcoming multifamily maturities, and the $121m and $105m of office maturities in 2024 and 2026 apparently concern non-recourse debt on foreclosure assets, it looks like JBGS really only needs to put up cash to refinance the maturity associated with the $116m 2025 maturity. Given all the excess borrowing capacity and cash on hand (I’d note there are also a few unencumbered office assets in National Landing with high occupancy that could potentially offer additional optionality), I don’t see any problems in meeting maturities relating to core assets through the end of 2026.

The term loan maturities in 2027 and 2028 present a larger burden, but will still only amount to ~$717m due across those two years, and with more than that available on the revolver alone, I don’t see that as particularly concerning either. And again, there’s always the optionality of asset divestments.

So in short, I don’t see any pressing concerns relating to maturities.

Now to the question of funding operations and growth capex.

Annualized Q1 NOI is ~$300m, but we need to adjust this substantially downwards given the office assets being placed out of service and others being imminently foreclosed. Run-rate NOI is probably closer to $232m, using the current $137m for multifamily and $95m for office pro forma the retirements. (Note, this is simply a short-term number, which should materially improve within the next year or two due to same store NOI growth, the under construction assets coming online - Chrystal in 2025 and Bell in 2026 - and office leases stabilizing as supply normalizes). I think it’s highly likely NOI returns to $300m within a couple years, with further growth ahead from there).

SG&A expense, which is improving as the company transitions to multifamily, is ~$80m after accounting for reimbursable expenses associated with third party management. EBITDA (NOI - SG&A) for 2024 therefore might be closer ~$150m, rather than the $240m implied by the current run-rate.

Interest expense is coming in ~$30m per quarter, or $120m annually. Altogether, that leaves little, if any room, for using cash flow to fund recurring capex and tenant improvements, which have been coming in at ~$40m annually, let alone the $130m the company will need to fund the rest of the under construction assets.

But I don’t think this is cause for concern at all because, as noted above, the company has sufficient borrowing capacity to bridge its capex needs through to 2026, at which point we should see a large inflection in cash generation as NOI trends back towards $300 and beyond.

The final consideration then is capital returns. JBGS has currently been returning upwards of ~$50m/quarter via share repurchases as well as ~19m via dividends. Is this nearly $300m of annual capital returns sustainable? Not without asset sales: but that’s clearly already more than priced in, otherwise the stock wouldn’t be trading at the present 17% distribution yield.

Overtime, the buybacks will surely slowdown, but the more the share count can be reduced now, the more the dividend should yield over time. Indeed, the ~3.4m shares repurchased in Q2 alone saves the company nearly $2.4m in annual dividends at the current $0.70/share annual payout. $0.70/share on the current 102m FDSO merely requires ~$72m in annual distributions. Given the surplus liquidity and the growth in cash generation ahead, I don’t think a cut to the dividend is likely, though this is the piece of the thesis I have the least confidence in. (Final note on this point is that the company filed a DRIP (dividend reinvestment program) prospectus in late June, which could help with the cash burden associated with the dividend.)

Management and Capital Allocation

Given the quality of these assets, the underlying tailwinds, the discount to NAV, the navigable leverage, and the substantial distributions, I don’t think it’s difficult to pencil out satisfactory returns from this overtime.

But, as is always the case, in order for this to be the homerun I think it has the potential to be over the long-run, we need to believe in this as a capital allocation story. This is always exceptionally important in real estate where so much of the return comes from intelligent use of the capital stack and basis plays; but I think it’s extra important here given the enormous development pipeline which could lead to trouble if the company fails to develop it accretively.

However, given management’s track record to-date, I strongly expect prudent and value additive capital allocation.

To begin, I think the CEO, Matt Kelly, and his team are solid operators and long-term thinkers. For those interested in this idea, I would highly recommend reading Kelly’s quarterly shareholder letters for an insight into how he thinks. One big takeaway from me is the seeming prescience the team had with respect to office issues and their preemptive repositioning of the portfolio towards a larger mix of multifamily well in advance of 2020. From inception as public company, the company has aggressively divested office assets and recycled the proceeds into accretive uses like multifamily developments, having now sold 45% of initial assets and recycling 2/3s of that into multifamily developments and acquisitions.

And this hasn’t been activity for activity’s sake — this asset recycling has clearly created value (and ultimately likely the saved the company from cataclysm). The proof is in the pudding — since inception, JBGS has sold ~$2.4B worth of office assets at a blended cap rate of 5.2%! That number might worth taking with a grain of salt, but given market cap rates for office today, anything close to that number implies a huge win:

Much of those proceeds were then used to deliver multifamily developments at a stabilized yield of 6.5% (according to the company - again, grain of salt). That’s hugely accretive given where market cap rates presently sit.

And now for what is probably my favorite slide in the investor deck:

The yield spread between capital raised and deployed is obviously impressive (grain of salt again!), but my favorite display of capital allocation (which surely has some element of luck to it) is that management issued ~$500m of equity (11.5 shares) in 2019 at $42/share, effectively at all time highs…and has since repurchased more than $1B (>50m shares as of Q2) at an average price of ~$20/share (50% below the issuance)! While shares sit well-below the average purchase price, buybacks have consistently been at a discount to NAV (estimated >40%) and the company continues this practice today. Altogether, the share count has been reduced by some 35% over the last 4 years.

This year, rightfully in my opinion, management cut the dividend from $0.225/share per quarter to $0.175 to prioritize buybacks. Because many investors hold REITs for their dividends, the market was disappointed with this news: but to me, this act just further shows that management prioritizes long-term value creation over short-term performance.

Remember, JBGS’ development pipeline is massive: in addition to 1.6 SF of commercial, it includes 7715 multifamily units, which is approximately equivalent to the size of the entire current multifamily portfolio, including the under construction assets. As such, if the company is able to continue prudently allocating capital and is able to develop this pipeline accretively over time, we could be looking a multibagger many times over in the long-run.

Given everything I’ve covered in this write-up, I don’t think this blue-sky scenario is particularly remote.

Why the Opportunity Exists

This should be pretty obvious:

An unhealthy and hated office market;

Rapid increases in interest rates;

The stock screens poorly given high net debt/EBITDA and what looks like fair valuation at first glance;

Investor fatigue with a stock that has done nothing but go down since the spin-off;

Deferred benefits of the Placemaking strategy due to HQ2 stall outs and broader headwinds.

Risks

Severe recession (when is it not?)

Capital allocation (when is it not? Though admittedly it’s exceptionally important here).

Amazon abandons its commitments to National Landing (I think unlikely and we probably do fine regardless, but it’s worth considering)

Cut to the dividend. This is probably the biggest risk in the short-term — REIT investors hate dividend cuts. For long-term investors, this isn’t the end of the world at all.

Left-tail risk: nearly all the portfolio is concentrated in one geographical region, exposing it to force majeure or terrorist risk (which is a heightened risk given proximity to federal government buildings).

As always: questions, comments, feedback welcome. The company reports at the end of July and I’ll provide an update thereafter. Please note that, because this is a long-term hold, I don’t intend to provide constant updates about how I am thinking about this position, though I’ll obviously comment on significant happenings. And always with actionable ideas, I will timely update readers of any decision to sell my position.

Disclosure: I am long shares of JBGS at an average price of $14.45.

Great write up with a high level of detail.

Would you sell if price got close to $25?