Mispriced Distress: A Deeply Discounted Equity with Two Engines to Drive Re-Rating

A liquidity crunch forcing the monetization of Class A real estate to deleverage, coupled with an incoming inflection at the operating business, provides fuel for a potential multibagger

Disclaimer: Nothing on this blog is intended as financial or investing advice. Please do your own due diligence.

I have been working on this one here and there for a couple weeks, but with some very positive news coming out this week that has gone under-noticed by the market, I’ve put somewhat of a rush job on it, as I think this name is due to wake up. This might, therefore, be a slightly less comprehensive than my usual deep-dives (probably for the best) but I think this is easily one of the most asymmetric bets I currently know of in the market and it has all the ingredients for a meaningful multibagger.

With that said, this is a small microcap (~$45m market cap) with a lot of debt and the widest bid/ask of any stock I’ve written about with the exception of BQE. Please DYODD (as always) x2.

***

I’ve previously written about some unloved stocks, some hated ones, and some downright ugly ones, but I’ve surely never pitched one quite as disgusting, at least not as optically disgusting, as this one.

The disgust is understandable:

A dual-class share structure entrenching control in nepo babies who have a history of caring little for minority shareholders;

A partially subscale operating business that has been decimated by an endless series of successive headwinds;

Some head scratching capital allocation decisions that have served as an accelerant for those headwinds;

An extremely levered balance sheet, with a debt-to-book value ratio of more than 40:1 (excl. leases), net debt/EBITDA of >16x, and negative TTM FCF.

That strained balance sheet is now officially creating a liquidity crunch, with ~$70m of debt maturing this year against $10m of cash, and $12m LQA EBITDA drowning in $20m of annual interest expense.

And, in light of it all, a stock that has now generated negative returns if you bought and held at any point over the last 40 years.

Recognizing all of this, I have proceeded to do the only sensible thing.

Buy.

Have I gone mad? Time will tell.

But I’ve left out a very important piece to this story — and that is: the company owns a large collection of high-quality, non-core real estate assets, the fair market value of which, crucially, well exceeds the value of the company’s total financial debt.

In short, I believe this story hinges on a crucial distinction that equity investors often neglect to make: that of illiquidity (i.e. the inability to service liabilities due to a shortage in cash or near-cash assets) versus insolvency (i.e. whereby an entity’s liabilities exceed the fair value of its assets). In the case of an insolvent company, the equity holders are doomed when liquidity dries up — the company files and there is no surplus left after the creditors take their due. But in the case of a solvent company with a liquidity shortfall, there is by definition some surplus residual value left for the equity. In such cases, the health of one’s equity stake ultimately depends on the price paid for it. Buy at a large enough discount to that surplus, and the liquidity issues may in fact be the friend of the equity holders.

This insight was the key to Bill Ackman’s famous near 100-bagger on General Growth Properties, as the following slides from his presentation of that thesis reveal:

To be clear: I think the odds that the company I am about to dive into is forced to enter restructuring proceedings, at least in the forseeable future, are near zero, especially in light of some recent developments I will detail below. My motivation in raising this point on solvent debtor situations is simply to help frame the downside and give some context into why I would even consider owning a balance sheet that looks the way this one does.

The lesson also helps elucidate an integral piece to the thesis. Remember I said that for solvent companies, “liquidity issues may in fact be the friend of the equity holders.” Why? Because a liquidity shortfall coerces the monetization of illiquid assets and thus forces a realization of their value for shareholders. Either management affects the liquidation of assets to satisfy the firm’s liabilities, or a bankruptcy court will do it for them.

For this company, in my view, the liquidity crunch is a blessing. For the better of a decade, minority shareholders have called on management to monetize the company’s tremendously undervalued real estate holdings — to no avail. Now, facing an enormous maturity wall in 2025, management has no choice but to liquidate some of these assets. That process is well underway and picking up steam. Indeed, the company just announced a non-core, non-productive asset sale at a price good for ~1/2 of the market cap and with expected proceeds sufficient to meaningfully derisk the maturity wall.

This, apparently, has gone unnoticed.

Ironically, having finally got their wish, shareholders are nowhere to be found. This has left the equity trading at a fraction of its fair value right as much of that value is set to be realized.

At today’s share price of ~$1.45, the company has a market capitalization of ~$42m and an enterprise value of ~$240m. The real estate holdings alone, on conservative assumptions, are likely worth more than the entire EV, giving you the operating business for free. What’s more is that operating business, which prior to COVID generated upwards of $40m in EBITDA, is hitting an inflection point and could very well reach similar profitability levels over the next couple years.

While this entity deserves to trade at a material discount to fair value given the controlling family dynamic, I believe the recovery of the operating business coupled with material deleveraging from asset sales could nevertheless result in upside of 300% or more over the next couple years, with limited downside risk given the already extremely impaired equity and solvent debtor dynamics discussed above.

The company is Reading International (RDI, RDIB).

Disclosure: I am long RDI at an average price of $1.35/share.

Background

Origin Story

Reading International has a storied history. Its origins date back to the 19th century as the Philadelphia and Reading Rail Road (many of you will recognize the name from the Monopoly board game) which focused on the mining and hauling of anthracite coal. Apparently, it was the largest company in the world at some point in the 1870s.

Fast forward a century to 1971, and the company filed for bankruptcy. The railroad assets were sold off and the entity was left with a collection of real estate holdings. From there, an enterprising lawyer from Los Angeles, James Cotter Sr., eventually took control of the entity and made it his holding company. Cotter used the entity’s assets to finance the development of movie theatres across the US, Australia, and New Zealand. Cinemas remain the company’s core operating business today.

I am a big fan of cinema businesses right now for reasons I will flush out below. One attribute that I love is that they often operate with negative working capital. That reliable access to ‘float’, coupled with the strategic value of having cinemas as anchor tenants, facilitated the ability for Cotter Sr. to pursue meaningful real estate development and acquisition activities. In turn, those real estate activities, and consequent depreciation expenses, would generate meaningful tax savings for the cinema business. While most of the company’s real estate developments and acquisitions involved cinemas and broader entertainment complexes, Cotter ocassionally made investments in real estate with no bearing to the cinema business.

What exists as Reading International today is really amalgamation of various companies. Though Cotter Sr. only owned 30% of the economic interest in these combined entities, he was able to entrench his control through a dual-class share structure. Today, there are ~21m RDI shares — these are the Class A shares, which have no vote. Then there are ~1.7m Class B voting shares, which are also publicly traded as RDIB, although volume is very thin (these trade at an enormous premium and I personally see no reason to own them over RDI).

Cotter Sr. placed his shares in a living trust for the benefit of his grandchildren.

Though Cotter Sr. was obviously an impressive entrepreneur, RDI had always been run for the benefit of the family, and the stock consistently traded at a material discount to fair value as a result.

Cotter Sr. Dies

In 2014, Cotter Sr. passed away and a succession-like battle for the company ensued between his three children, James Jr., Ellen and Margaret, due to some complications around the trust. This old VIC pitch does a good job detailing it, as does this piece, and I will defer you to those sources for background if interested.

Around Senior’s death, James Jr. became CEO of the company. This excited the market as the impression was that Jr. would be more shareholder friendly and perhaps open to relinquishing the family’s control for the right price. Billionaire Mark Cuban filed an activist stake, purchasing ~14% of the voting shares and 5.5% of the non-voting. However, the sisters had the board terminate James Jr. as CEO and Ellen appointed herself to replace him.

In 2016, Patton Vision, a cinema company, along with a consortium of investors made various bids for the company up to $18.50/share ($440m). Then in 2019, Patton Vision bid again at a near $600m EV. The Cotter sisters declined each proposal and in doing so noted that they would refuse to even entertain any offers for the company moving forward (“our Board has no plans to consider further Patton Vision’s “Proposal.””). This was obviously a monumental disservice to shareholders, given RDI shares have since declined to below $1.50.

I raise this saga for two reasons. Firstly, to provide a sense of just how much value there was, at least before COVID, in this company, particularly with control in the right hands (again, I’d note the voting shares, which have the same economic interest as the A shares, trade for nearly a 500% premium). And second, as a glimpse into the questionable character of the people running this company.

Today’s Challenges

Since the sisters took control, the business has been plagued by myriad issues, some certainly self-inflicted, others attributable to broader industry and macro dynamics.

With respect to the latter, the cinema industry has been hit by a successive streak of challenges.

First came Netflix and the rise of streaming, which put pressure on box office numbers. Then came COVID, which forced the closure of cinemas entirely for long stretches of time, effectively pushing revenues to zero. Given meaningful ongoing lease expenses/operating leverage, this obviously resulted in an existential threat to many industry participants. Finally, with theatres reopened and beginning to rebound after COVID restrictions, the 2023 Writer’s Strike served yet another blow to box offices.

As I will discuss below, the cinema industry has proven to be extremely resilient and, in many ways, has emerged as a better industry than it was prior to COVID due to less competition (yes, this is another story of consolidation), an improved offering (better screens, recliners, improved concession offering/alcohol sales) and impressive pricing power, making it a low-key inflation benefactor. Shares of the larger theatre chains have responded accordingly, with e.g. MCS and CNK up ~3x off their COVID lows.

However, RDI is somewhat idiosyncratic and has been uniquely impacted by these challenges. On the positive, the NOI from RDI’s real estate holdings, as well as asset sales, helped the company generate some cash during the theatre closures, which in turn helped the company not only survive, but also to fund sizeable growth capex to make the cinema improvements necessary to remain competitive in this new world.

However, this was more than offset by the negatives. For one, much of RDI’s real estate generates no NOI and thus actually exacerbated the cash crunch, a problem further augmented by mortgage obligations attached to some of those assets.

Second, RDI’s US cinema business is subscale and has large art-house exposure, which has complicated its efforts to rebound and compete with larger chains.

The slow rebound has had a detrimental impact on company-wide financials. In 2018, EBITDA (including the real estate segment) was $46.6m. In 2023, EBITDA was merely $7.6m, and that was with an unprecedented Q3 at the box office due to Oppenheimer and Barbie.

EBITDA last quarter, Q3 24, was $2.9m, suggesting less than $12m annualized. While that is a marked improvement from the depths of COVID, it hasn’t been enough to offset RDI’s ballooning interest expense, which is currently running at $20m annually. Moreover, despite some asset sales, those have clearly not been sufficient to get the debt obligations down to manageable levels.

The consequence of all this is a debt table that looks like this:

(*Cinemas 1, 2, 3 Term Loan was extended to Oct. 1 2025; 44 Union Sq has an option to extend to 2026)).

There you have it: $214m of debt, with $71m maturing in 2025, and an even larger slug the following year. Focusing on just this year, we have:

$12m USD Westpac corporate loan in New Zealand due on Jan. 1 (yes, that date has already passed - more below);

$13.9m USD NAB Bridge loan in Australia due on March 31;

$7.7m Minetta and Orpheum secured loan due June 1;

$16m BoA Credit Facility due Aug. 18; and

$21m Cinemas 1, 2, 3 Term Loan due Oct. 1;

Meanwhile, you’ve got 1) only ~$11m of cash (as of Sept. 30) ; 2) negative working capital of $81m (yes, this attribute cuts both ways) and 3) An EBITDA run-rate that needs to nearly double just to service the interest expense

Are we cooked? Let’s find out.

The Real Estate Holdings

What I am going to do here is go through each of RDI’s material real estate holdings, provide a valuation estimate, and breakdown what role, if any, they might play in shoring up the balance sheet.

New Zealand and Australia

Courtney Central — Wellington, New Zealand.

This is an incredible 3.7 acre (161K sqft of freehold land), five parcel assemblage, with zoning for a 43m high development, in downtown Wellington, which is consistently rated one of the best cities in the world. RDI historically operated the Courtenay Central movie theatre on one of the lots, but it has been shut for 6 years due to seismic issues, and residents have longed complained that the abandon building is a blight on the city.

Significantly, this month, RDI announced that it has entered into an agreement to sell this asset for NZ$38m, which converts to ~$21.5m USD at today’s exchange rate. While well below my estimate of fair value, this is nevertheless a huge win which appears to have gone unnoticed by the market. In addition to the price tag being ~1/2 the market cap, it also represents a ~$5m book value gain (doubling RDI’s current book value), and the proceeds will be well more than enough to entirely wipe out the $12m Westpac facility, with what should be close to $8m left over. Given no remaining debt in New Zealand, RDI should be able to upstream the residual to the parent, where it can then be applied to paydown some of the punitive BoA facility due in August. To be conservative, let’s assume only $4m is left for debt paydown, with the rest being applied to fund operations. In that case, here are the remaining maturities for the year:

$12m USD Westpac corporate loan in New Zealand due on Jan. 1 (yes, that date has already passed - more below);$13.9m USD NAB Bridge loan in Australia due on March 31;

$7.7m Minetta and Orpheum secured loan due June 1;

$

16m$12m BoA Credit Facility due Aug. 18; and$21m Cinemas 1, 2, 3 Term Loan due Oct. 1;

The result: RDI pays down nearly 10% of its total debt, monetizes nearly half of its current market cap by realizing value for an asset the market gives zero credit for, and reduces its annual interest expense by ~$1.4m ($12m at 7.95% for Westpac and $4m at 11% for BoA) (~half of last Q’s trough EBITDA). Capitalized at 7x, that interest savings alone is worth ~$10m or +25% to the equity. Moreover, having shored up liquidity, this may enable refinancing BoA at a lower cost.

An important final piece here is that this property was generating zero NOI. Therefore, the sale should improve the company’s PnL.

The stock, still trading near all-time lows, has not meaningfully responded to this sale despite it being a huge de-risking event.

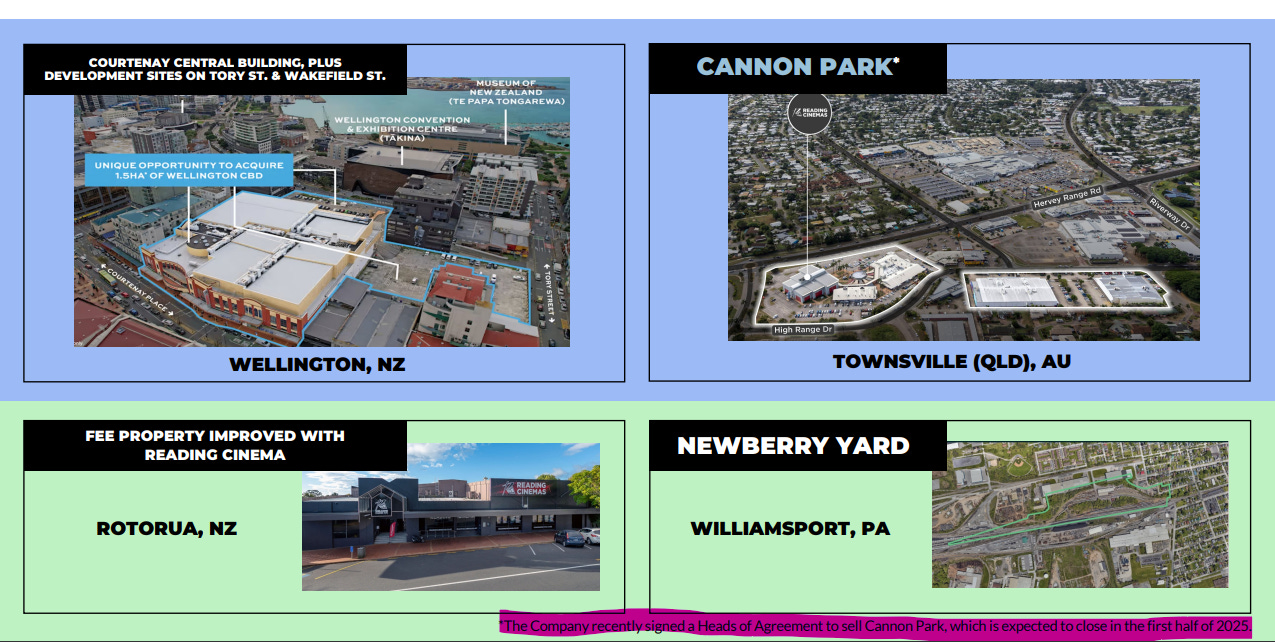

Cannon Park - Townsville, Queensland, Australia

Cannon Park is another very attractive entertainment complex comprised of 9.4 acres, with gross leasable area of 126K SF. The property is 96% leased to a mix of tenants, and includes an RDI owned cinema

The asset’s book value is $19.5m.

Significantly, the sale of this asset also appears to be imminent. And like Wellington, this has gone largely unnoticed, in part due to a lack of signaling from the company. Indeed, buried in a footnote of RDI’s AGM presentation deck from a few weeks back, the company notes that a Heads of Agreement (essentially an LOI) has been signed, with closing expected in H1 this year:

This property generates ~$2m USD in annual NOI, which would imply its worth $33m at a 6-cap. However, RDI intends to enter into a sale-leaseback of its cinema on the property. This suggests RDI achieves a lower price tag, but also gets the continued benefit of the cinema’s cash flow after lease payments, benefiting liquidity.

Let’s assume $20m in a sale, which is effectively book value. The first $14m of proceeds would go to wiping out the NAB Bridge loan due in March. Due to repatriation rules, I believe RDI would not be able to upstream the remaining $6m to the parent giving the remaining $70m of Australian debt from the NAB corporate loan, so I assume the remainder goes to paying that down (not shown below as it matures in 2026):

$12m USD Westpac corporate loan in New Zealand due on Jan. 1 (yes, that date has already passed - more below);$13.9m USD NAB Bridge loan in Australia due on March 31;$7.7m Minetta and Orpheum secured loan due June 1;

$

16m$12m BoA Credit Facility due Aug. 18; and$21m Cinemas 1, 2, 3 Term Loan due Oct. 1;

The result: another 10% of total debt paid down, ~$1.2m in annual interest savings, and perhaps an equivalent loss in NOI contribution. On net, this sale’s impact on earnings power is essentially neutral, but it gets rid of another daunting maturity and further delevers the enterprise.

It is worth pausing here to consider the combined impact of RDI’s near-term sales of Wellington and Cannon Park alone. With just two assets, they will be able to pay down the equivalent of the current market cap in high-cost debt, generate interest savings equivalent to last quarter’s trough EBITDA, and ultimately extinguish ~20% of total net debt.

Moreover, these two sales have the effect of eliminating around 50% of this year’s maturities.

Newmarket Village, Brisbane, Australia

Newmarket is the most valuable of the Australian assets, and another entertainment complex. It is comprised of 203K SF of land, with 144K rentable SF, which currently includes a Reading cinema and 48 third party tenants. It also includes a three-floor, 22K SF office building (fully leased). Collectively, the complex is 99% leased.

Depreciated book value is $40m! Fair market value is likely in excess of book, meaning this asset alone is worth more than the entire market cap and likely 1/4 of the EV. Last year, the Australian real estate assets generated $5.3m of NOI. Given Cannon Park generates ~$2m and Newmarket is larger with a higher lease rate, I’ll assume this asset contributes close to $3m in NOI. At a 6-cap, that’s worth $50m.

While not for sale, this property carries zero debt and provides great optionality for further deleveraging down the road or to provide collateral for any outstanding principal on the NAB Corporate facility if necessary/or the Bridge in the event Cannon Park is not sold in time. And, to reiterate this point again, this is a very attractive unencumbered asset worth more than the market cap!

Belmont Common, Perth, Australia

The final material Australian based real estate asset is Belmont Common, which is worth less than the other assets, though it is still meaningful. It is comprised of 103K SF of land, 60K SF leaseable area, and is 100% leased. There are 6 third party tenants and the complex is anchored by a 10-screen Reading cinema.

Depreciated book value is $5m, but it has been on the books for at least 25 years and is surely worth more. As with the other assets covered thus far, it has no debt on it. Let’s value it at $6m conservatively, which is what you get by applying a 6 cap to the remainder of Aus based NOI. I’d guess fair value is probably even higher than this.

***

Before moving onto the US real estate assets, tallying up the total value of these four assets down-under conservatively sums to ~$95m US, or nearly half the EV. Again, there is no debt attached to any of these assets.

Moreover, I’d further note that RDI also owns an additional cinema in Australia, plus a 33% JV in another, as well as two cinemas in NZ, including Rotorua, which is currently held for sale and has a book value of $1.5m.

United States Real Estate Holdings

Minetta and Orpheum Theatres, NYC

I’ll start with the smallest New York assets.

The Minetta Theatre is a 9K SF, 399 seat off-Broadway theatre located in Greenwich Village, Manhattan, and is currently licensed out to Audible (an Amazon subsidiary) for productions through to March 2026. Book value is $2.2m, but I’d think it’s worth at least $800 per SF given the location, which is good for $7m. In reality, I believe this asset could be worth a lot more for its development potential, given the pristine location in downtown Manhattan.

The Orpheum Theatre is a 5K SF, 347 seat theatre in East Village, Manhattan. RDI is currently exploring licensing for a new show. Book value is ~$1.34m. Although likely worth materially less than Minetta, I’d think fair market value surely exceeds $3m, which is $600 per SF.

Altogether, that’s conservatively another $10m of value in these assets. As a sanity check, given the bank was willing to extend $8m of debt against these assets this summer, I’d suspect my numbers are likely on the low end.

I am admittedly not sure what the path forward is for these assets. The current lender provided an extension to give RDI more time to pursue refinancing. Given the size of the principal and low NOI generation, I’d expect RDI will either need to contribute more capital to keep these assets, sell them (again, I think they’d fetch a pretty penny for redevelopment), or give the keys back. That said, given the at-issue debt is secured on these properties, which are not meaningful contributors to earnings power or asset value, I am not troubled by this maturity, and view this is as another item we can cross off.

$12m USD Westpac corporate loan in New Zealand due on Jan. 1 (yes, that date has already passed - more below);$13.9m USD NAB Bridge loan in Australia due on March 31;$7.7m Minetta and Orpheum secured loan due June 1;likely refinanceable with further equity contribution or sold??$

16m$12m BoA Credit Facility due Aug. 18; and$21m Cinemas 1, 2, 3 Term Loan due Oct. 1;

Cinemas 1, 2, 3

Cinemas 1, 2, 3 is RDI’s most interesting asset in my view. This is 7900SF of gross land/and a 24kSF building in the Upper East Side of Manhattan, on 3rd avenue between 59th and 60th street. The parcel has rights to build up 96K rentable SF above grade. For reference, this site is directly across the street from Bloomingdales and right on the subway line. Currently, the site is operated as an art house cinema, but the real value is in the development potential (note the tall residential towers erected around it).

RDI owns 75% of this asset in a joint venture, with the other 25% owned by a Cotter family entity. Book value is ~$24m, but the property is worth a lot more than that. At $600 per buildable square foot, it is worth close to $60m, or $45m at-share. The property is encumbered by a $20.7m term loan maturing in October 2025.

At the AGM, management indicated that they are looking to buy out the minority interest:

The first question that comes to mind is how? The second question is, assuming they can acquire the remaining 25%, then what? I admittedly do not know the answers to these questions. I would note, however, that Reading has been holding this property for development for years and nothing has come of it. My understanding is some of this inertia stems from the need to have the corner lot (see the taverna on the map) join in on the development so that value can be maximized; some of the trouble apparently owes to the fact the Cotter’s want to ensure a cinema stays there; and, moreover, surely much of the lack of progress owes simply to the fact that RDI has neither the capital nor expertise to develop this site. This very real limitation gives me comfort that the Cotter’s will not be able to pursue any high-risk, grand plans here, however much they may want to.

Eventually, my best guess is this gets sold to a developer, but time will tell. The key, however, is that $20m of RDI’s maturities this year are secured on this property, which is currently worth far more than the liability. Having said that, the JV parties have previously been forced to inject capital into the asset given its cash flows are insufficient to service the loan. Given RDI is out of extensions on this loan, I believe they are on a shot clock to figure out what to do with this asset. The biggest near-term risk to the thesis likely involves management trying something stupid here/diverting newly freed up liquidity towards funding development, but they are so far away from the capital and expertise required to do so that I think it’s far more likely we see this monetized or partnered. Either way, because the asset is worth more than the loan, this is another maturity we need not fret too much about. Of course, given this asset’s prime location, time is the friend of its value.

$12m USD Westpac corporate loan in New Zealand due on Jan. 1 (yes, that date has already passed - more below);$13.9m USD NAB Bridge loan in Australia due on March 31;$7.7m Minetta and Orpheum secured loan due June 1;likely refinanceable with further equity contribution or sold??$

16m$12m BoA Credit Facility due Aug. 18; and$21m Cinemas 1, 2, 3 Term Loan due Oct. 1;

That leaves just the reduced BoA balance, which should be serviceable from operating cash flows or additional asset sales, which I will turn to shortly.

44 Union Square

Another crown jewel asset in Manhattan — the old Tammany Hall building. A 73K SF, recently developed property in downtown. This is a Cotter sister passion project and a development that has been rather troublesome despite the property’s irreplaceable nature. Currently, 42% of the property is leased to Petco, while the remainder sits vacant. RDI have struggled to find takers for the rest of the space given office headwinds and a very unusual built out, but any incremental NOI from this property would be a big positive for the equity.

This asset is on the books at $97m and has a high cost (12.5%) $47m mortgage against it due July 2026. While there’s clearly a lot of equity value in this, the property makes zero sense for RDI to own and the nearly $6m in annual interest expense it is incurring (let alone the other carrying costs) is a huge burden on cash generation. If RDI is able to secure a tenant(s) to lease the vacant space, this would be a huge uplift to earnings. In addition to the incremental NOI — perhaps ~$6m at full occupancy — filling the empty space would allow RDI to refinance the loan at a much lower cost of debt, materially reducing interest expenses.

In the event they are unable to find tenants, my hope is that this asset gets sold sooner than later, as doing so would extinguish nearly $6m in interest expense while resulting in proceeds net of debt worth a huge portion of today’s market cap.

As with Cinemas 123, the value of this asset will only go up over time.

8. Reading Viaduct and Surrounding Land

RDI owns 350K SF of land and bridgeworks in Philadelphia as part of the legacy assets it inherited from the railroad. These properties include the Reading Viaduct, which is a 0.7 mile long raised rail bed, which can be thought of as a decrepit version of the High Line in New York City.

This is a very interesting asset. For years, the City has sought to purchase the Viaduct but negotiations have gone nowhere, largely due to a wide bid/ask between the parties; RDI has previously sought $50m for the property. My understanding is that RDI has been drawing this out to capture the ongoing appreciation brought on by rapid development in the area, including a $160m federal grant to advance the Chinatown Stitch, and a proposed $1.3B redevelopment plan involving a new stadium for the 76ers, with which the Viaduct would link to.

In short, the Viaduct is an essential piece of real estate for the City to control, and my guess is that RDI gets a decent price for it sometime in 2025. Note, this is carried at zero and generates no NOI, and therefore any proceeds from a sale would be accretive to both stockholder’s equity and cash flows.

The City has threatened to condemn the property but it is currently restricted from doing so due to the Surface Transportation Act, which recognizes the asset as being under federal jurisdiction and thus immune from municipal takings. The parties are currently litigating the matter, but this legal dispute gives RDI some significant leverage to get a price substantially higher than zero.

Something in the neighborhood of $10m seems reasonable to me.

Newberry Yard, Williamsport, Pennsylvania

Finally, RDI owns a 24-acre industrial site, which includes a 30K SF rail car building and internal rail lines. This is another legacy asset from the railroad, and it is effectively on the books for zero. Unlike the other US real estate holdings, Newberry Yard is currently held for sale. I expect this asset to be sold in the near-term and it should fetch low single digits millions. A rather small sum, but nevertheless accretive to book value, and a net positive for earnings power given this property does not generate meaningful NOI.

Putting It All Together

So let’s quickly summarize what we just went through as it relates to asset valuation and what this all means for the company’s debt stack and near-term maturities.

New Zealand

This is the easiest jurisdiction, as the Courteny Central property is RDI’s only major real estate holding in the country. Assuming the announced sale closes, the company will receive ~$20m USD before fees and transaction costs, of which $12m will be applied towards extinguishing the Westpac loan, which is the earliest of the company’s maturities and the only debt obligation in NZ. Whatever remains of the proceeds will be likely up-streamed to the parent to help service US debt.

Australia

Between the NAB Bridge loan and NAB Corporate facility, RDI has ~$84m USD of debt in Australia, with ~$14m maturing this year, and the remainder in 2026.

Above, I noted that Cannon Park is likely to be sold in the first half of this year for at least its $19.5m book value. Proceeds from that sale will accordingly extinguish the bridge loan entirely, with some surplus available to pay-down the corporate facility.

Let’s say pro forma the sale Australian debt balance is $65m, all of which matures in 2026. Reason to be concerned? I don’t think so. As I canvassed, the two remaining major Australian real estate assets, Newmarket Village and Belmont Common, are likely worth ~$56m ($45m if we simply use depreciated book), have no debt attached to them, and are both cash flowing. RDI thus has substantial collateral to give to help refinance this loan.

United States

And finally, the US. There is ~$45m of debt maturing in the US this year. However, ~$29m of that is secured against the Minetta and Orpheum theatres, and Cinemas 1, 2, 3. Though collectively not cash generative, these assets are worth substantially more than the value of debt against them.

That leaves the $16m high-cost BoA facility due in August. However, with likely surplus from the Cannon Park and Courtenay Central proceeds, as well as likely sales of the Reading Viaduct and Newberry Yard, there should be ample liquidity freed up to pay this down and refinance it. Moreover, as I am about to cover below, there is strong evidence suggesting that RDI’s operating business is going to be substantially cash flow positive in the coming quarters.

From a valuation perspective, I’d note that the value of the US real estate is likely conservatively worth ~$90m net of debt (or more than 2x our current market cap).

As a final note, I’d just flag that there are some odd and ends I did not cover here. For example, RDI has exercised an option to purchase the ground lease at the Village East cinema in the East Village. That is a $5.9m liability due sometime this year which readers should be aware of, although given ongoing asset sales and the inflection I am about to discuss, I don’t view this as a material concern. With that said, it is very important interested reader’s study the balance sheet of this company closely.

The Cinema Business

What I hope I’ve demonstrated is that the fair market value of RDI’s real estate holdings, which are slowly being liquidated, well exceeds RDI’s financial debt obligations. This surplus suggests that RDI, despite its ongoing liquidity issues, is far from insolvent. Moreover, the liquidity troubles are enabling us to create the equity in some irreplaceable Class A real estate assets at a laughably discounted valuation before those assets get monetized at far higher valuations.

But RDI is more than simply a hidden real estate liquidation. Indeed, as I will argue, I think there is enormous value in the company’s cinema business and I believe this business is hitting a very clear inflection point that the market is sleeping on.

RDI operates 57 movie theatres across the US, Australia, and New Zealand.

Movie theatres are, in general, quality businesses, in my opinion. Why?

Negative working capital: Due a combination of low inventory levels, payment lags to suppliers, and substantial gift card revenues, cinemas often operate with negative working capital, which augments free cash generation.

Resilience: Movie theatres are historically recession proof, as they are one of the cheapest forms of entertainment. Moreover, the industry has weathered numerous existential threats over the last decade and it has only emerged stronger: streaming wars, COVID, etc. I think movie-going is forever.

Right sizing and consolidation: The shuttering of cinemas during COVID, along with streaming headwinds, has forced a consolidation and downsizing of the industry. According to this article, the number of total screens in the US since 2019 has decreased by 3000, to what is now just under 40,000. Bankruptcies, mergers, and closures have led to a less competitive, more rational industry.

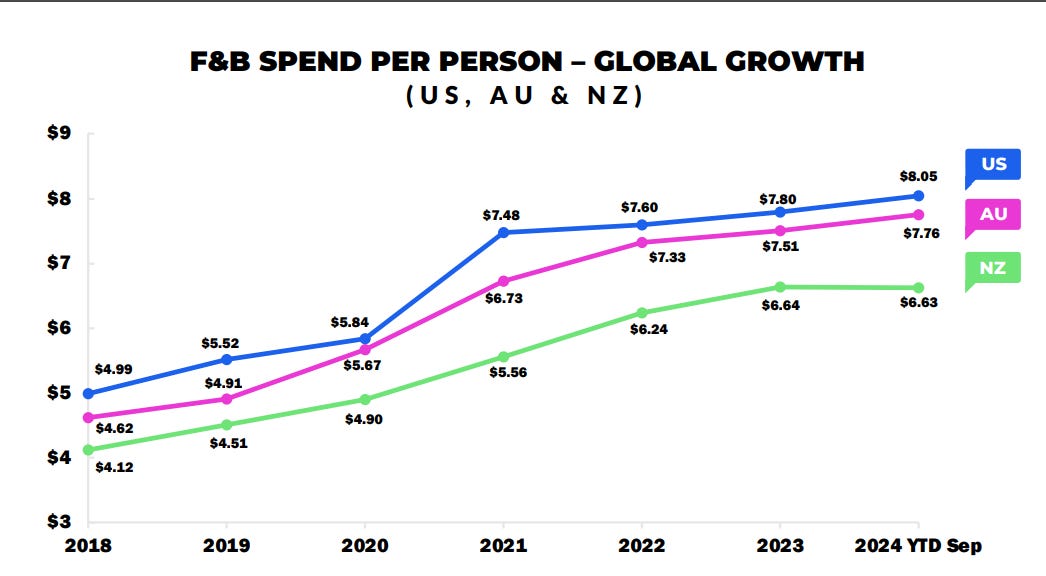

Pricing power: We can see the fruits of consolidation in the pricing power cinemas are currently exhibiting. Akin to what we have seen in industries like tobacco, declining volumes have been offset by increased prices. Through a combination of general inflation, the fact that total spend per patron remains relatively low compared to other forms of entertainment, and due to improve offerings (VIP experiences, better screens, recliners, in-theatre concession + higher priced goods like alcohol), cinemas have been able to take a lot of price in recent years. We can see this in following figures produced by Canadian cinema chain Cineplex:

Cineplex’s average box office and concession spend per these figures sums to $21.43 CAD or less than $15 USD. That is an incredibly cheap bill in the absolute and suggests that there remains a lot of runway for taking price moving forward. It is important to note that Cineplex operates in what is a near monopoly in Canada, so these numbers are likely supercharged, but this is nevertheless a phenomenon we are seeing across the industry as you’ll see below.

An Inflection Point: These large price increases are resulting in cinema businesses returning to all-time high earnings despite the feared declines in attendance. Indeed: November saw the highest-grossing Thanksgiving weekend ever, while total November and December box office numbers were the highest they have been since before COVID.

For these reasons, I am bullish on cinemas generally.

But how does this relate to RDI specifically?

First, I’d note that RDI’s US cinema business is not particularly good. This is the result of a more indie offering and because RDI has very low market share (~1%) and thus cannot compete against the AMC, Regal, Cinemark oligopoly. The result of RDI’s lack of scale means that they are at a large disadvantage as it relates to distribution rights.

However, it is an entirely different story for RDI’s cinemas in Australia and NZ, where RDI is the 4th (8% market share) and 3rd (9%) largest operator, respectively. Moreover, in those countries, every major cinema is generally provided with access to all films in distribution, substantially lowering the competitive dynamics.

Geographic revenue composition is ~50% AUS/NZ and ~50% US.

Prior to COVID, RDI’s cinema business handily generated >$30m annually in segment level operating profit (i.e. before corporate costs) and ~$45m in EBITDA. In the most recent quarter reported, Q3 2024, the cinemas generated a meager $2.3m in segment level EBIT, or ~$9m annualized. Is there a path back to pre-COVID levels? I think so.

Firstly, much of the trouble for RDI relates to its US business. Indeed, last Q the AUS and NZ segments collectively produced >$3m EBIT, while the US segment lost nearly $1m. The company is taking strides to improve US profitability, having closed four theatres over the last year, and 8 since 2019. Eliminating unprofitable locations should improve margins.

Second, RDI has invested heavily in upgrading its offering, including the addition of recliner seating, larger format screens, and improved food and beverage (including, importantly, an expanded, high margin, alcohol offering).

Third — we are starting to the fruits of this investment, particularly as it relates to concession spending. Similar to the Cineplex example shown above, RDI’s concession prices have been increasing steadily, with sales per person reaching new records last quarter in the US and AUS:

Fourth — most importantly: box office demand is booming. I noted some of the record box office numbers the industry is currently experiencing above. But this week, RDI issued a news release indicating it is similarly benefitting from this upswing. The release notes:

In Australia, RDI had its best November ever, while December was the segment’s highest box office ever for any month!;

In New Zealand, RDI had its best November and December since prior to the pandemic;

And in the US, RDI likewise had its best November and December since prior to the pandemic;

So, in short, the operating business appears to be firing across the board.

Valuation

So what does this all mean for the investment thesis.

RDI is currently trading like a distressed equity. But if you look under the surface, the story is far more attractive than ~$1.50/share suggests.

As I see it, there are two engines for a re-rating here that are both kicking into overdrive.

The first is the ongoing asset sales, which drive value in three ways: 1) deleveraging the balance sheet, which is hugely accretive given the high debt-equity ratio and consequent multiplier effect; 2) reduced interest expense, which will improve EBITDA - FCF conversion; and 3) realizing value for assets that are not getting fairly valued, if at all, within the current structure.

The second is the inflection of the operating business. Importantly, given the huge operating leverage involved in cinemas, in addition to declining interest expense and decreased capex obligations, it will not take much of an upswing in revenue for EBITDA to rapidly grow and convert to meaningful free cash flow.

I think the combination of these two engines should result in multibagger upside for the equity, even assuming a substantial and warranted discount for Cotter control.

I assume:

Net debt decreases $50m due to sales of Courtenay Central, Cannon Park, the Reading Viaduct, and Newberry Yard, which extinguish the Westpac facility, NAB Bridge loan, and BoA facility.

Pro forma real estate holdings are worth $150m net of debt, which I then haircut by 40% for a Cotter control/holdco discount;

The cinema business is able to generate $25m in EBITDA, after corporate level G&A of ~$15m, moving forward. I capitalize this at 7x, which is a material discount to leading operators which tend to fetch ~10x.

The result: an equity value that is nearly 300% higher than today. I know this seems wild, but it’s an unsurprising product of a very low/distressed starting point, a huge leverage multiplier, operating leverage, and the monetization of assets that are currently being valued at zero. Now, I am skeptical we ever get quite there, particularly given the people managing this business, but at a ~$45m market cap, you are taking on incredibly minimal impairment risk to find out, and the upside should be material regardless.

As usual, my valuation work isn’t intended to be precise, and in any event, the discount is so wide here precision isn’t all that worthwhile. However you play with the inputs, its hard not get an equity value worth multiples more than it is today, assuming you accept the premises I’ve hashed out above.

Where do we go from here?

I have just flushed out the path I see for the equity to re-rate significantly in the near to mid-term. But the biggest pushback I get on this thesis is simply — what is stopping the Cotter’s from selling some assets, getting some breathing room, and proceeding to allocate capital into more pet projects like 44 Union Square that eventually result in us arriving in the same position we just emerged from? I wouldn’t say capital allocation isn’t a long-term risk — when is it not, really? — but there are a few things worth keeping in mind:

While some decision-making from the Cotters exacerbated the problems RDI has found itself in, a lot of this mess was beyond anyone’s control, and absent another global pandemic, RDI’s business is sturdy enough to support a higher valuation even if burdened by poor capital allocation. And it’s hard to imagine leverage levels ever returning anywhere near where we are today again (who is going to do the lending?).

Despite being poor managers, the Cotter’s are financially aligned with minority shareholders, as they are largest holders of both the voting and non-voting shares, and the current share price reflect poorly on their father’s legacy. In other words, they have incentive to make this equity work.

Relatedly, it is worth wondering how long the Cotter sisters truly want to continue running this company. Despite their refusal to entertain any offers prior to COVID, they are entering their 60s and it is unusual for heirs to want to run companies into old age. Moreover, the Cotter family trust is for the benefit of the five grandchildren of James Sr (three of which are James Jr’s children and two are Margaret’s — Ellen has no children). It would seem, particularly given three of the beneficiaries are not the children of the Cotter sisters, that the most likely path forward would be to sell the company, and distribute the proceeds to the grandchildren — which proceeds would notably be worth much more than the present share price suggests. Remember, prior to COVID the company was fielding offers for near $20/share, and though value has since been impaired, it shows you just how much these assets would fetch from a buyer that could get control.

On that note, this explains in part why the voting shares trade at such a material premium — if the Cotter’s do ever choose to sell, one could take control by simply acquiring the majority of RDIB, which would be a much smaller required outlay of capital than buying the entire company.

Ultimately, where this goes in the long run is anyone’s guess, but I would be very surprised to see the Cotter family running this company a decade from now.

Risks

A major risk here is longer-term capital allocation. Specifically, having freed up liquidity, the Cotter’s use that capital to do something like fund the development of Cinemas 1,2,3 and quickly return us to a position similar to the one we currently find ourselves. That said, in the near-term, it would take a Herculean feat of capital destruction for the equity in all these assets to get further impaired than the market is currently pricing them.

Relatedly, the company does some punitive financing to buy out the 25% JV interest at Cinemas 123.

Wellington and Cannon Park sales do not close and the company is unable to sufficiently pay down the BoA facility, which is the only 2025 maturity without sufficient asset coverage.

Broadly, the balance sheet creates more problems than I envisioned

I am wrong about the cinema business and movies are in fact dead.

i read this whole thing and what i come up with is this:

they should hire jake lamotta to run this business.

would be huge for the family too.

This is a great write-up and I appreciate the depth you go into - there is not much free content this good. However, I do have to disagree somewhat on the risk/reward picture here.

The controlling family have proven themselves not only to be purely self-interested, but to be terrible operators and capital allocators. Refusing to sell for $600m pre-covid was massively value-destructive for themselves as well as other shareholders. And I think their underperformance relative to other cinemas is probably as much to do with poor operational management as their indie offering. I think the $25m EBITDA and the 7x multiple are both pretty damn optimistic in all honesty.

Given that they sold what you describe as an incredible parcel, Courtney Central, for "well below" your estimate of fair value, I think it's also optimistic to assume the rest of the real estate could/would be sold at or near fair value - especially considering they're likely to sell (or have sold) the properties on which they can get the highest price relative to value.

I also don't see a compelling reason to believe they will continue selling assets off, other than as is necessary to keep the business out of bankruptcy. My impression is that they're using the real estate portfolio as their piggy bank.

44 Union Sq seems like a massively important piece of the puzzle here, making up almost half the value in the RE portfolio in your assessment. It seems a little strange to me that a loan of $47m against a property worth $97m would carry an interest rate as high as 12.5%, tenants or no tenants. I think it's again optimistic to assume (a) that they sell it off, seeing as they perfectly seem content not to at the moment, and (b) that it can fetch book value.

A final note - you say it's weird the market hasn't reacted positively to the property sale, but (a) the stock has rallied 24% and (b) you said it was sold for far below fair value - why should the market react positively to that? If anything, it was two negatives in one - it showed they aren't willing to go into liquidation, which would probably be a positive; and it suggests other parts of the portfolio are unlikely to get fair value either.

Sorry to be a downer. Would be interested to hear your thoughts on my thoughts.