CRONOS GROUP

A catalyst-rich net-net with a path to becoming a dominant player in an emerging industry

Disclaimer: Nothing on this blog is intended as financial or investing advice. Please do your own due diligence.

This is a catalyst-rich opportunity to purchase a company that I believe is well-positioned to eventually become a blue-chip player in a young and emerging, but ultimately inevitable industry…at a net-net price.

What gives?

Well, this is the cannabis industry…an industry where so much capital has been incinerated, so many high-hopes dashed, that the capacity for investors to rationally assess risk/reward has been fundamentally compromised. Couple that rock-bottom sentiment against a backdrop of vast uncertainty with respect to how the competitive and regulatory landscape ultimately shakes out, and there can be no margin of safety wide enough for many investors to get interested. As all students of investing know, risk and uncertainty are not the same. And yet, those concepts are never more conflated than when sentiment utterly collapses (which, ironically, is often when situations are the most ‘de-risked’). “Be greedy when others are fearful…”, like all Buffett adages, has biblical adherence in the abstract, but when the time comes, it is always easier to take comfort in the herd.

So, I will say up front: this is a hated company, within a hated industry, facing a situation riddled with uncertainty. But — I find it incredibly difficult to envision a world in which that uncertainty unfolds in a manner that puts our capital at risk. Why?

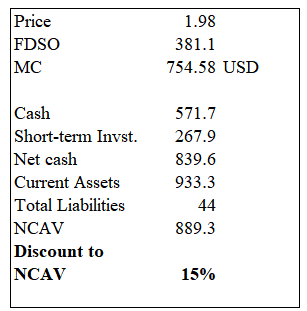

For one, as noted, this is a net-net, with the market currently implying a negative ~$100mm value for the business ($840mm net cash and $885mm NCAV vs $750mm market cap). Second, the company has an abundance of hidden assets, adding further downside protection to its armory of cash. Third, the company has very real competitive advantages beyond its enviable balance sheet, including: a favorable home jurisdiction that has provided a first-mover advantage; strong brand power; strategic international partnerships; and a multinational blue-chip backer providing access to cheap financing well below the industry's punitive cost of capital. And fourth, the murky regulatory environment that has provided cumbersome headwinds for cannabis producers is finally poised to become more favorable in the near-term — a question not of if, but of when.

The company I am writing about today is Cronos Group, a Canadian based, global cannabis company focused on research, technology, and product development. It trades on both the TSX and NASDAQ under the symbol CRON. This is not a darling. Here’s the chart in case you think I am exaggerating:

My thesis on CRON is in a way both a bottom-up and top-down investment. That is, this a true value stock which has no business trading below liquidation value. At the same time, I think there are very good reasons to start getting bullish on the cannabis sector more broadly, and I think a CRON long is a really prudent way to play the incoming inflection. I see true asymmetry here: a robust margin of safety with a bunch of free call options that could turn this into a multi-bagger over time.

There are really two questions that need to be addressed here: Why is now the time for cannabis? And why is Cronos an attractive way to play it? These questions are inextricably linked and I will attempt to answer them in what follows.

The Canadian Cannabis industry

I think perhaps the best place to begin is to look at Cronos within the context of the Canadian cannabis industry, which is its home base and where it presently does the majority of its business.

The Canadian experience is unique because, in October 2018, it became the first G7 and G20 country to legalize cannabis. In many respects, legalization has been a huge victory for the country. Accordingly to a report by Deloitte, between legalization in late 2018 through to 2021, the cannabis industry contributed CAD$43.5B to Canada’s GDP and created more than 150,000 jobs. Both the federal and provincial governments have benefitted tremendously from tax revenues, with the same report finding that, through to 2021, the industry created CAD$15.1B of taxes for the feds and CAD$3B for Ontario alone (the country’s largest province). Legalization has also drastically reduced strain on the criminal justice system. And many of the concerns with respect to health risks have failed to materialize. In short, legalization appears to have been a net-benefit for both society and the state thus far.

These benefits, however, have failed to accrue to industry participants and investors. As of late 2022, law firm Miller Thomson estimates that Canadians have lost more than CAD$131B investing in publicly traded and licensed cannabis producers. Take a look at the charts and you’ll notice that CRON is among friends in being down 90% from the highs. What has been responsible for such utter capital destruction?

Well, part of the explanation is simple boom-and-bust dynamics. Upon legalization, there was enormous demand for cannabis products and the initial supply was insufficient. Capital rushed-in to meet the demand and, as is generally the case with capital cycles (especially concerning largely commoditized products) the supply response was vastly overdone. This, coupled with ongoing material supply from the illicit market, led to a collapse in prices. For example, the average retail price of 1 gram of dried cannabis flower fell from $11.78 at the start of 2019 to $7.94 as of June 2023, with some products selling for as low as $3.5/gram. Yet at the same time, SKUs exploded with more and more products entering the market:

This boom-bust dynamic is far from unique. However, the situation has been exacerbated by the burdensome regulatory challenges faced by Canadian cannabis companies, none more impactful than the excise tax, which charges producers the higher of $1/g or 10% per gram on sales. This levy was set based on an expectation that cannabis would sell for ~$10/g. However, the tax does not adjust for market prices, and as a result has eviscerated the already razor-thin margins of producers, with some paying up to 30% of their top-lines in excise taxes given presently depressed cannabis prices (I recommend reading the linked source for further perspective). And the excise tax is not the only regulatory burden impacting the industry: participants are also constrained by onerous packaging, advertising, and distribution regulations, as well as a 2.3% regulatory fee owned to Health Canada (which, curiously, is not owed on tobacco and alcohol sales) and further fees to provincial wholesalers.

With that said, I believe the conditions responsible for these difficulties are clearly beginning to reverse.

First, as with all boom-bust cycles, the bottoming out is leading to a natural consolidation and rationalization of the industry: “the attrition, turnover, and consolidation is relentless”. In 2022, 40% of all filings under the Companies’ Creditors Arrangement Act (one of the Canadian bankruptcy codes) involved cannabis companies, with an additional 12% of all filings in 2023. And the CCAA is available only for companies with debts exceeding CAD$5mm; many others have likely filed under the Bankruptcy and Insolvency Act. Notably, many of these bankruptcies appear directly linked to the excise tax. In addition to bankruptcies, there has been an abundance of further attrition through closures, downsizings, mergers, and license revocations: see e.g. here.

Significantly, we can see the impacts of rationalization occurring by looking at Health Canada’s licensing data. Licensed indoor growing area, for example, has fallen from a high a 2.2mm square meters in May 2020 down to 1.37mm as per the most recent data from September 2023. That is a whopping decline of nearly 40% in only 3.5 years. Outdoor growing area has also come in from the highs.

And the consequences of this rationalization are beginning to show. According to StratCann, per CCX data (a B2B cannabis exchange), wholesale cannabis pricing has been trending up MoM for much of 2023, with the average wholesale price for dried cannabis up to $1.10/gram in October from below $1/gram as recently as May:

CCX expects that pricing will continue to improve for sellers, pointing to numerous production facilities coming offline in 2023, consistent domestic demand, and growing demand from international markets.

Beyond the cyclical reversal, pressure is mounting for a reform to the draconian excise tax regime; “opposition to the excise tax seems to be a rare unifying factor in an otherwise wildly complex and varied industry.” As noted, the excise tax can capture up to 30% of a producer’s top-line given the way it is structured. However, the taxes are also borne by consumers, with as much as 30% of the retail price of cannabis attributable to taxes.

There are growing indications that the excise tax is set to change. The House of Commons Standing Committee on Finance has recommended that the excise tax be changed to a 10% ad valorem rate. This change would eliminate the absurdity of the tax consuming a larger part of the pie as market prices decline and would obviously alleviate a lot of the present pressure on producers. We will know whether the Legislature chooses to adopt this proposal when the annual budget is released in April. Based on how much money governments are bringing in from this tax, it appears that there is not much optimism for this proposal to be adopted. However, at some point, the government is going to need to compromise; otherwise, they may well end up losing out on these extraordinary revenues anyways by killing the industry: “If the government does nothing, at the end of the day, one of the most progressive and liberal policies of the Canadian government [i.e., federal cannabis legalization] will probably fail, because we won't be able to get a sustainable cannabis industry in Canada.” Therefore, an amendment to the excise tax is, in my view, an inevitably at some point down the road.

Somewhat perversely, the longer it takes the government to make these changes, the better for Cronos. While the onerous tax serves as an existential threat to many producers, Cronos is built to easily withstand this hit to its margins. In effect, the government is killing the competition for us the longer they take to act.

Why Cronos is Positioned to become a Blue-Chip Player in Canada

That is a nice segue for the next question — assuming I am correct about these industry tailwinds, why Cronos?

Cronos has brand power.

Cronos’ Spinach brand is currently the #2 brand by market share in Canada, and it is growing (up from #3 in November). It is also #1 in both the edibles and flower categories. The lead in edibles is particularly important, as it is a less commoditized offering than flower and comes with superior gross margins. Meanwhile, Peace Naturals is the #3 vape brand, which is likewise a higher margin offering than flower.

Cronos has been growing the topline while aggressively cutting costs, and as a result, is now approximately breaking even.

Gross revenue (i.e. before excise tax) has increased from $80m in FY21 to $120m in FY23, largely due to increased domestic sales volumes as well as the initiation of sales into Germany and Australia (I will discuss the foreign component of Cronos’ business more below). Moreover, the company achieved YoY topline growth despite a 31% decline in Israel sales brought on by the Israel-Hamas war. This is notable given that Israel comprised c. 35% of post-excise tax revenues in 2022.

Whilst growing the topline, the company has still been able to materially reduce operating expenses, capturing $30mm of savings in 2023 largely due decreases in G&A and R&D. The company has guided to an additional $5-10mm in cost improvements during 2024 due to the closure of its Winnipeg facility.

On a cash basis, the situation has also vastly improved, with the company just shy of breakeven on a cash from operations basis for FY23 after adjusting for a one-off tax obligation. Moreover, the company was FCF positive in Q4 and, notably, expects to increase its net-cash balance over the course of 2024. I should note that much of the cash inflow will be attributable to the large interest earned on the cash balance (~$50mm), proceeds from the sale-leaseback of its Stayner facility (~$17mm), and interest on loans to certain JVs. That said, I think this is quite an attractive position to be in whilst facing both depressed market prices and the excise tax regime (which was responsible for a $33mm hit during 2023).

Cronos has the best balance sheet in the industry.

As noted, Cronos is a net-net. In effect, this is a microcap with a huge pile of cash attached to it.

Of course, this huge cash balance provides a margin of safety. Additionally, it is presently generating $50mm of annual income which has helped to materially slow burn during this cyclical trough. However, there are two additional benefits implied by this vast cash balance that are integral to the long-term thesis for Cronos and its competitively advantaged position. First, it demonstrates the company’s mammoth cost of capital advantage vis-a-vis its competitors. Second, it creates huge optionality for the company to seize upon the inevitable opportunities that will open up as the competitive and regulatory landscape for cannabis continues to evolve and the weak players are weeded out.

Valuable hidden assets

There is a lot of asset value here beyond the cash, including a large facility in Winnipeg that is currently listed for sale, the Stayner facility, which was just sold in a sale-leaseback for $17mm, and a list of global investments and partnerships which I will address more below.

With respect to the Canadian operations, readers should be aware of Cronos’ 50% JV interest in Cronos GrowCo, which is a production facility licensed to sell cannabis to license holders in the wholesale channels as well as to provincial cannabis authorities. GrowCo is a profitable operation, with Cronos reporting $1.5mm of net income during 2023. Moreover, Cronos holds ~$75mm of senior secured debt issued by GrowCo.

Cronos is backed by Big Tobacco titan Altria

You may be wondering how an unprofitable cannabis company came into an $840mm net cash balance? Well, in 2019, big tobacco giant Altria invested $1.8B for a 45% stake in Cronos (implying a valuation of $4B). As of year end 2023, that stake is approx. 41%, with Altria possessing certain rights to purchase more shares. Altria also has the right to nominate four of the company’s 7 board members and possesses certain approval rights over material transactions.

The importance of Altria’s involvement here cannot be understated. For one, the investment has equipped Cronos with a war-chest of cash that ensures its survival for however long it takes the regulatory and competitive landscapes to improve — while Cronos is out here earning $50mm annually on interest, others are burning cash and looking to raise punitively expensive capital just to stay afloat. This cost of capital advantage is simply invaluable.

However, there is something even bigger at stake here, which is obvious if you read behind the lines — viz. Altria, like the other Big Tobacco names, is positioning itself to become a dominant force in the cannabis industry and is using Cronos as its proxy to do so until the legal/regulatory hurdles are resolved in the United States. When that time does come, I believe Cronos will be folded into Altria as its cannabis arm.

Big tobacco’s interest in entering cannabis is no secret (Indeed, Altria has not exactly been quiet about this). Given Big Tobacco is on the sidelines for now, the companies have been preparing themselves by picking their respective fighters; e.g. while MO has gone with Cronos, BAT has gone with Organigram, etc.

In my view, backing from Big Tobacco not only provides a huge advantage to secure Canadian dominance, but it also paves the way for the chosen Canadian producers to capture a sizeable share of the US market once it opens up. Once that is possibly is understood, it becomes clear just how big the upside could be here.

The United States Opportunity

For those who have not followed this space, a very big catalyst may be on the horizon for the US cannabis industry. In August, the US Department of Health and Human Services (HHS) issued a recommendation to the Drug Enforcement Agency (DEA) that cannabis be rescheduled from a Schedule I to a Schedule III substance. Whether or not the DEA will accept the proposal remains to be seen. This week, the WSJ published an article claiming that certain DEA officials are disputing the scientific findings underpinning the HHS recommendation. There has been a fair bit of skepticism surrounding this reporting, which does not name its source. Regardless, a decision is likely to come in advance of the upcoming election, with Democrats hopeful for a final appeal to younger voters. Bloomberg Intelligence puts the probability of a decision in the next few months at 80%.

What does Rescheduling mean for Cronos? Well, having little present exposure to the United States, it faces far less (if any) downside than the US based Multi-State Operators (MSOs) will if Rescheduling is denied (Indeed, US cannabis stocks tanked on the day of the aforementioned WSJ report, while CRON was mostly flat). On the other hand, I think the market is vastly underestimating how large of an opportunity Rescheduling may be for the well-positioned Canadian producers to become juggernauts in the US.

Why?

The obstacles the US cannabis industry has faced make the Canadian difficulties appear a walk in the park. As a result of cannabis’ classification as a Schedule I substance, companies in the space face immense constraints including: exclusion from capital markets, a prohibition on interstate commerce, limitations on research, no IP protection, and inability to deduct ordinary business expenses (as a result of Schedule 280E of the IRC, cannabis companies can only deduct COGS, meaning they pay income tax on their gross profits, creating draconian effective tax rates). Given how cumbersome these restrictions are, investors are understandably bullish on the prospects for US MSOs if and when the restrictions are lifted.

But are MSOs really prepared to be competitive simply upon Rescheduling? I am not so sure. You see, in many ways the dynamics that have crushed the US cannabis industry are the opposite of those that have plagued it in Canada: i.e. the problem has not been one of over-investment, but of under investment. For example, investments into IP and brand development (which presumably will be a huge determinant of who ultimately wins the space) have been extremely limited in the US due to Schedule I constraints. Moreover, the very structure of MSOs implies impediments to success at a national scale, given they are built to operate within state-lines. MSOs are generally vertically integrated, touching every step of the supply chain within each state they operate in, from cultivation to distribution to retail. So MSOs are both: largely unspecialized and not optimized for nation-wide operations.

This week, Small Cap Discoveries released on interview with the CEO of Grown Rogue, a “craft” cannabis grower. It is worth listening to, as he highlights several of these issues facing MSOs. Here are some key lines:

“I don’t think [rescheduling] materially changes the way these [MSOs] function”

“[Rescheduling] is just going to further accelerate the competitive nature”

“Cultivation is really really hard…you got to show experience…you’ve got to have that pedigree of expertise”

Here is ultimately how I see situation. Larger MSOs have had their development retarded due to operating with cannabis as a Schedule I substance. Vertical integration has resulted in a lack of focus and expertise; IP restrictions and no R&D expense deductions have caused an utter absence of brand power and R&D advances; and prohibitions on interstate commerce put MSOs behind the curve in being able to scale and distribute their offerings nationally. Further, Rescheduling, as the Grown Rogue CEO aptly points out, is likely going to “accelerate competition”, which should lead to a race to the bottom, similar to what happened in Canada upon legalization — capital will flood the space as companies seek to develop a national footprint and competition will be fierce given non-existent brand power.

And herein lies the opportunity for Cronos and other established Canadian players. Unlike MSOs, Cronos is: singularly focused as a producer; possesses brand power tied to specialty higher-margin products, is well-ahead on R&D; knows how to operate at scale across different jurisdictions; and has a massive balance sheet to fend off the competition with.

Perhaps most significantly, Cronos already has a massive distribution network in the US by virtue of the Altria partnership. Reasonable people can argue with whether Canadian operators or MSOs are better equipped to benefit from Rescheduling. However, it is hard to envision any cannabis player being able to compete with a multinational giant like Altria in winning swaths of market share. And I have little doubt this has been precisely the longer-term motivation of Altria in backing Cronos. While Cronos appears to have not been particularly explicit about this, Organigram (one of CRON’s closest comps), which is backed similarly by British American Tobacco, has made it clear that the US is a focus.

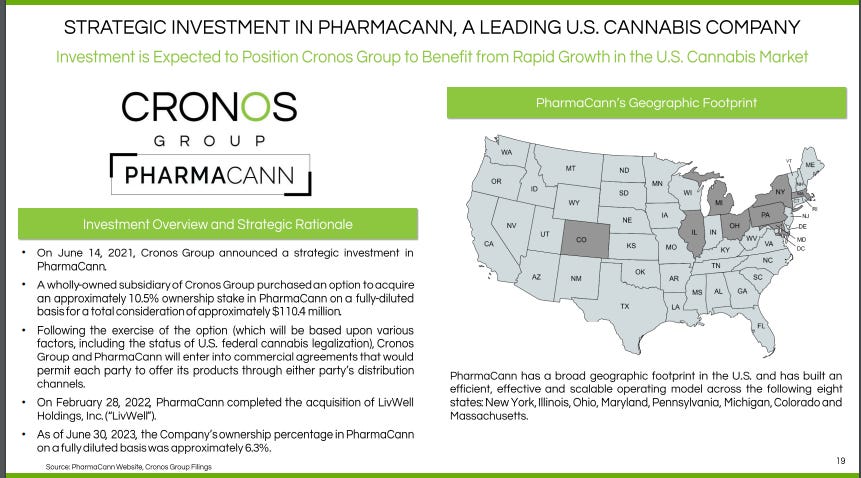

In addition to the Altria partnership, Cronos also has a 5.9% investment in PharmaCann, which is a large privately held MSOs. Cronos has an option to acquire up to 10.5% subject to certain conditions, such as federal legalization. The stake is booked at $26mm. This partnership gives Cronos yet another avenue by which to tap the US market.

The International Opportunity

The last thing I want to highlight here briefly is the international opportunities. What makes the -$100m EV even more absurd here is the amount of valuable partnerships/investments that Cronos has globally.

Germany

In Sept. 2023, Cronos entered into a partnership with Cansativa, a leading German cannabis company, to distribute the Peace Naturals brand of products. Cansativa has a large medical cannabis network of ~2000 pharmacies. In February, Germany officially legalized cannabis. The opening up of this market could represent a large opportunity for Cronos.

Australia

Cronos also owns a 10% stake in publicly traded Australian cannabis company Vitura Health, through which it distributes cannabis products. Based on Vitura’s present share price, Cronos’ stake is worth ~$5.5mm. Cronos made its first shipment to Vitura in Q4. This represents another attractive opportunity, with the Australian cannabis market expected to grow at a 30% CAGR through to 2030.

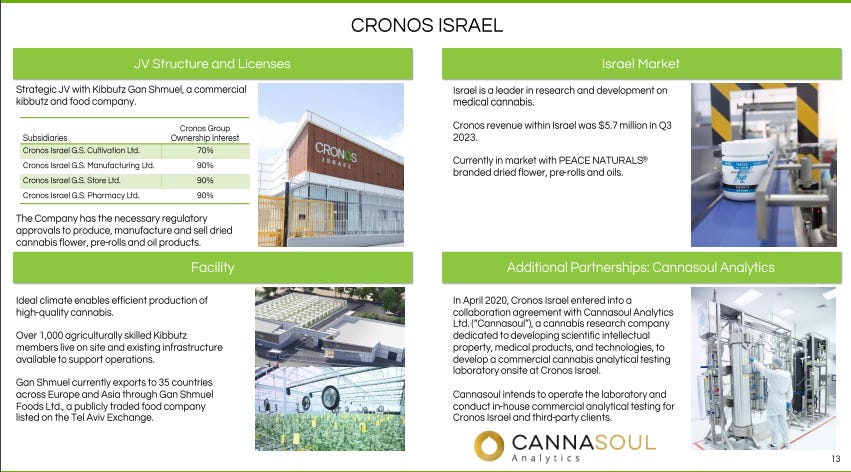

Israel

Cronos has developed a substantial footprint in Israel, with the country being responsible for ~35% of post-excise tax revenues. Despite substantial disruptions from the ongoing war, the company did $21.1mm of net revenue in for FY2023.

Cronos Israel is a joint venture with Kibbutz Gan Shmuel in which Cronos Group holds a 70% interest in a cultivation company, and 90% interests in each of manufacturing, distribution and pharmacy companies. The Peace Naturals brand is one of the leading brands in Israel.

Cronos also has an investment in Cannasoul, a cannabis research company based in Israel.

Colombia

Finally, Cronos owns 50% of Natuera, which is a joint venture in Columbia to develop, cultivate, manufacture and export cannabis products in Latin America.

Management

The company is led by Mike Gorenstein, who serves as the Chairman, President and CEO. Gorenstein has an investing background as a founder of Gotham Green Partners, a cannabis focused private equity firm, as well as a legal background as a former M&A attorney at Sullivan & Cromwell. Between him and his partner at Gotham, Jeff Adler, who is also a director, Gotham Green owns around 6.5% of the company.

As noted, Altria controls 4 of the 7 board seats.

Valuation

Given all the uncertainty and moving pieces involved in this story, coming up with an intrinsic value for Cronos is a futile exercise. But ask yourself - what would you be willing to pay for a company that:

Operates in an industry with several huge catalysts on the horizon;

Is growing and nearly breakeven despite an oversaturated market and a punishing taxation system;

Owns the #2 cannabis brand in Canada that is both #1 in edibles and flower;

Holds $840mm of net-cash earning $50mm in interest annually and which offers tremendous optionality, while the majority of competitors are subject to a punitive cost of capital;

Has an exclusive relationship with a blue-chip company that owns 40% of its common stock, and which gives it enormous competitive advantages with respect to financing and distribution, as well as a clear path to US market capture;

Possesses an abundance of valuable hidden assets and partnerships that position it to compete globally;

And is run by an accomplished and align team of insiders.

My answer: I am not sure, but a hell of lot more than -$100mm. As Buffett once said about PetroChina, quoting Ben Graham — “You don’t have to know a man’s exact weight to know if he’s fat.”

It is possible to envision many futures for Cronos a decade from now. In many of those, this is a multi-bagger several times over. At the same time, I struggle to envision a future in which the value of our interest is worth less than what it is presently.

Risks

The key risk here in my view is capital allocation. We are in a fortune position to buy this at a material discount to NAV, but that discount could obviously be eliminated by some poor decisions. That said, the risk is quite low given the company is trending cash flow positive and earning huge sums of interest on the cash balance. Ultimately, for this risk to materialize, you have to believe that management fails to earn any material return on that cash over time while the operating business simultaneously flops. I consider this risk quite remote.

On the regulatory front, I highly doubt the Canadian landscape will get any worse than the status quo. Cannabis legalization has been a gold mine for federal and provincial governments and is here to stay. If anything, the domestic regulatory landscape should improve.

In the nearer term, there is definitely some opportunity cost risk here. As with most things in investing, the catalysts for this stock to re-rate could be much further out than we expect. If so, we may be sitting on dead money for a while. That is a risk I am willing to take here given the asymmetry.

Conclusion

I see a really asymmetric bet here with a potential power law outcome. As such, I intend to size this up. I also see this as a long-term hold. Gun to my head on how this ends up, I’d bet that Cronos will end up acquired by Altria to serve as its cannabis arm once the US legal arena allows it. Time will tell.

As I final note, I would caution that there are a lot of moving pieces here and I have certainly skipped over some of the less material parts of the business. I would encourage those interested in the idea to review the company’s most recent 10-k.

Disclosure: I am long shares of Cronos at an average price of $1.98

Thank you very much for this article. I think there's a great tradable opportunity for cannabis stocks in an election year - am slowly dipping my toes into the cannabis space too.

However, want to get your views on how does Cronos compare with OrganiGram?

Additionally, should Rescheduling not be successful, would this break your thesis? I suppose our money will be dead money for even longer?

Thanks for the great article.

Regarding Germany, its not as easy with the legalization as you described. In April cannabis should be legalized; but commercial sale is not (yet). It will probably take another year or so until this is really through and the government is done "testing"