Disclaimer: Nothing on this blog is intended as financial or investing advice. Please do your own due diligence

During Q1 24, BQE reported a 114% increase in recurring revenue YoY. Ordinarily, doubling the most important KPI would be met with enthusiasm by the market. But shares are down somewhat since the report due to what I believe is increasing skepticism that the company will be able to sustain meaningful growth moving forward. And with the stock trading at something like 20x NTM earnings, you do need to believe in the growth story here to pencil out sufficient returns, particularly to justify the substantial illiquidity.

My impression is that this skepticism emanates from three concerns: 1) Technical Services revenues dropping materially, suggesting a decline in demand looking ahead; 2) no new operations projects announced, indicating that management’s projection of 2-4 new projects annually may not hold up; and 3) general concerns that the company lacks the scale and/or expertise to capture any further share of the sizeable TAM.

While I hear these concerns, I think they are all largely misplaced. I’ve commented elsewhere on why that is (see here) but I’ll briefly reiterate and expand on a few of my pushbacks:

Yes, Technical Services did drop materially, but this part of the business is going to be inherently lumpy given: a) the pricing of these services depends on what stage in development a given project is at; b) Technical Services work can run for many years before a project transitions to the operating phase (as we will see below); and c) the reality is that many mining projects simply never make it off the ground and proceed to operations. Management does a good job explaining this in the earnings PR and, in any event, they guided to the remainder of the year catching up to 2023. In my view, focusing on the number of projects receiving Technical Services (which the company lists in its MD&A) is likely a more insightful look through to future growth than looking at the revenue those projects presently generate.

While I am not worried about meeting the projection of 2-4 new operating projects annually, investors need to understand that this doesn’t mean the cadence is going to be predictable in the short-term - e.g. we might get 1 this year, 4 next year, etc. Over a longer period of time, however, this is how it should track.

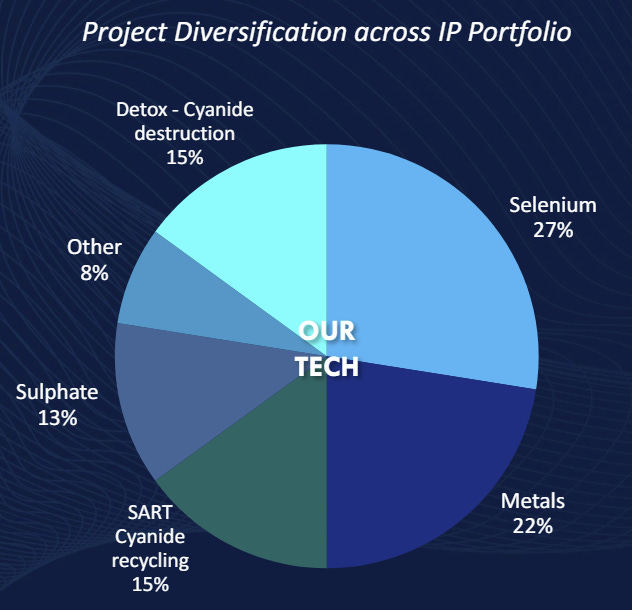

As I elucidated in my update, the unit economics per operating project are vastly improved due to the premium selenium water treatment gets. The company’s stated project average of $1.6m per year (which in my opinion is sufficient on its own to underwrite huge upside here) is likely too low given the current contribution from the US selenium plants. As we see from the company’s investor deck, selenium treatment is now the largest piece of the business at 27% of the mix, and I expect this to increase over time:

Finally, on scale limitations, which I hear frequently expressed as a bear case: we need to remember how small the numbers we are currently working with are — at an $5m EBITDA run-rate, all we need is a couple new projects with selenium economics to essentially double this figure, which would put the stock at around 7x EBITDA (which is too cheap given the asset-light operating model, stickiness, TAM size, etc.). Moreover, the company is presently more than adequately equipped to assume several more operations projects without any material investment. Remember, the principal input is labor and we can see that is currently in surplus given the huge SG&A increase in Q1 that resulted from diverting excess labor to sales and marketing given the temporary technical services slowdown.

Those are just some brief remarks in response to some bearish comments I have come across recently. But that’s not the point of this piece. Rather, the point of this (short) piece is to provide some insight into the so-called “company-maker projects.” While I have alluded to these a few times now as being a potential catalyst for an inflection in earnings, the company has been very mum in its public disclosures on this topic. In fact, other than some passing remarks in interviews, I believe the only explicit mention management has made regarding these projects are in buried in the back of the investor presentation:

These slides do not give us much in the way of what to expect at a project level other than that these are huge projects (>$100m in capex), but there are two important pieces of information here that I think investors are sleeping on. First, the language implies the existence of more than one company-maker project in the pipeline; and second, the company has already been generating Technical Services revenue from these projects for at least over the last year.

While I caution again that not all Technical Services projects progress to the operations stage, it’s promising that there are multiple shots on goal here and that these have been generating revenue for at least a year, indicating these are likely in advanced stages of developments. Nevertheless, you might say, given the low rate of conversion of Technical Services into Operations, and the dearth of any particulars, isn’t it reasonable for the market to not be pricing in any of this alleged upside?

Well, if that were all we could ascertain about these projects I’d likely agree; as it turns out, however, there’s actually some very valuable information to be gained on this topic from a little investigative work.

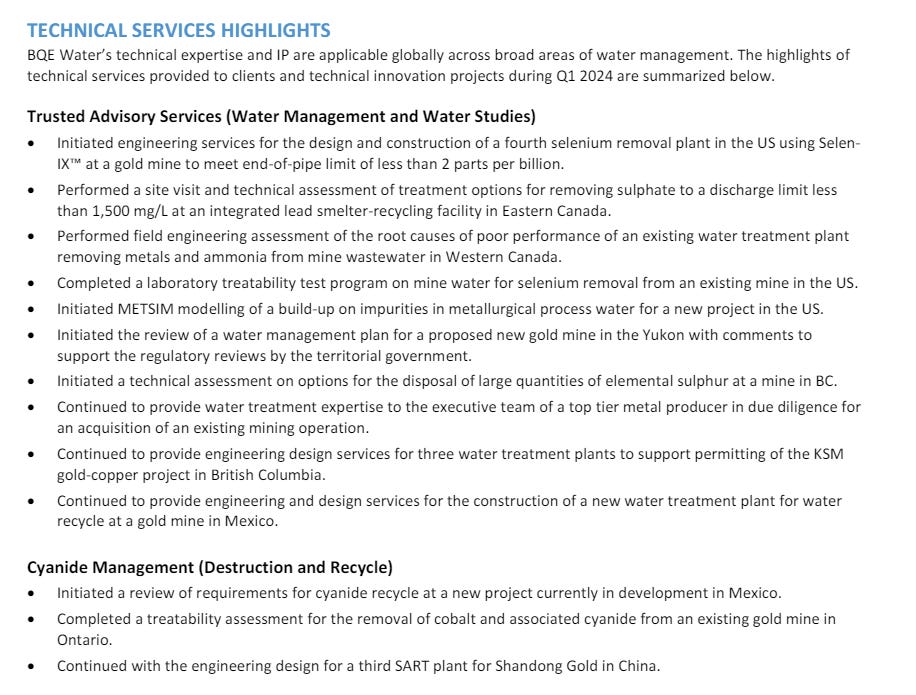

Anyone who has read BQE’s MD&A will be aware that the company helpfully provides a bullet list of ongoing Technical Services projects. Here is the list from the last quarter reported, Q1 2024:

What’s immediately interesting is the company does not disclose the specific name of any project with the exception of one — the KSM gold-copper project in British Columbia. Worth double-clicking on, perhaps?

The KSM Project

For those of you not familiar, the Kerr-Sulphurets-Mitchell (KSM) project is the world’s largest undeveloped gold project by resources, with proven and probable reserves of 47.3m oz of gold, as well as 7.3b lbs of copper and 160m oz of silver. The project is 100% owned by Seabridge Gold (SEA.TO), who have been in the process of developing the project since 2001 and have spent ~$1B to-date. Sounds like we might have our hit?

Well, fortunately for us, in Canada companies developing mineral assets are required to file a highly detailed instrument called National Instrument 43-101, disclosing virtually everything material about the project. Seabridge’s NI 43-101 is dated August 8, 2022 and can be found here. I highly encourage any BQE shareholders to review this document, as this may be our own pot of gold ;) . You certainly do not need to read the entire 540 pages — CTRL-F for “BQE” “BIOTEQ” (BQE’s former name and name of various subsidiaries) and “selenium”, and that should do the trick.

What you will immediately discover running this exercise is that BQE has been engaged by Seabridge since 2015 to develop a selenium water treatment plant for KSM using its Selen-IX technology (see pg. 18-19) (remember, this is the technology that we have seen the premium unit economics attached to). Encouragingly, the disclosure reinforces what we’ve been told — viz. that this is a highly effective technology —noting that, during a pilot test nearly 10 years ago, Selen-IX demonstrated a reduction in selenium concentration from 120 and 320 parts-per-billion (ppb), to less than 1 ppb:

So one of the largest gold projects in existence has BQE lined up to handle its selenium water treatment. That’s obviously great news, but there’s more: the N1 43-101 gives us a fairly clear line of sight into what the economics might look like for BQE.

Firstly, Seabridge estimates incurring c. USD$134m of capital costs for selenium treatment (as a slight aside, I’d just flag that while that is a huge investment in the absolute, it is a tiny fraction of +$3.2B of total capital costs Seabridge anticipates incurring, giving further credence to BQE’s sticky and advantaged position of providing mission critical, but relatively small cost services to its partners). The company-maker project slide projects 10% of such capex going to BQE, which would imply ~CAD$18m assuming this slide applies to the KSM project, which I understand would be billed as Technical Services revenue. Given that BQE has already been engaged with the KSM project for nearly 10 years, surely a decent amount of this has already been billed. Having said that, given that we are still in the “engineering design” phase of the project, I’d guess there’s still a fair bit of Technical Services revenue to be earned (e.g. for actual construction) before this project transitions to the operating phase.

While that’s obviously a big number for BQE (and some insight into how valuable and long duration some Technical Services projects can be) this number is nothing once we look at Seabridge’s estimated annual costs to operate the selenium treatment plant. And herein lies the kicker: at pg. 21-10, Seabridge estimates the annual operating cost for selenium water treatment to be USD$19.6m for the life of the mine:

The disclosure provides some further color on how much of this might go to BQE: indeed, pg. 21-16 notes that the operating cost is $0.27/t milled of which $0.11/t milled is for reagent consumption and maintenance, which is the “major cost for selenium water treatment”. I don’t think it’s possible to pin this down any further given the disclosure, but based on all this I am comfortable underwriting 1/3 of the overall $19.6m annual operating cost being paid to BQE.

After converting to CAD, that’s ~$9m of annual recurring revenue for BQE from the KSM project alone, which is approximately equivalent to the entirety of recurring revenue that BQE will earn in 2024! And that is almost surely conservative for two reasons: first, given Seabridge’s estimate of USD$1.24/cubic meter of water, 1/3 of that would amount to CAD$0.56, which is well below the unit economics at legacy projects like Raglan, which uses a lower spec technology (see my original write up for more). Further, there’s been material cost inflation since 2022 (BQE’s own investor deck has indicated an increase in average project value since then) and there will likely be a great deal more by the time KSM actually gets off the ground, if ever.

Which brings me to the final two considerations here: timing and feasibility.

On timing, while this is obviously a very transformative project for BQE if it does come online, investors need to understand that recurring revenue (i.e. the transition to the operations phase) from this project is still years away. In addition to KSM still not yet being online itself, the NI 43-101 indicates that the selenium water treatment plant will be operating by Year 5, which likely puts the commencement of these cash flows closer to end of the decade, if not the early 2030s.

Now, before that totally ruins the excitement here, I’d note two things: 1) BQE will likely earn significant Technical Services revenue as we get closer to launch (recall the capex figures above — even receiving half of that CAD$18m over the next 2-4 years is material); and 2) the KSM project is estimated to have a +30/year project life, and the selenium plant is already anticipated to remain in service following the closure of the mine:

So, while we may have to be patient, the present value of the discounted cash flows if and when KSM comes online are enormous, especially considering escalations in pricing over time.

And now for the final point: will KSM ever come online? The answer is very likely ‘yes’. As noted, this project has been in the works for more than 20 years with ~$1B already being sunk into it. Moreover, this is an enormously valuable asset in a jurisdiction, British Columbia, which is the most mining friendly jurisdiction in Canada. Presently, there are two near-term outstanding items before Seabridge is able to go ahead:

In January 2024, Seabridge filed a formal application with BC regulators for a “Substantially Started designation”. This designation, if approved, would have the effect of keeping the existing approvals in place for the life of the project. In effect, my understanding is that approval here would essentially signal the province’s ultimate go ahead for the project. A response is expected sometime this year.

Seabridge is currently looking to secure a joint venture with a global mining company to finance and operate the project. With respect to timing, in its Management Circular filed April 2024, Seabridge notes that its #1 priority for 2024 is to secure this JV agreement.

Before wrapping up here, I just want to flag two other items that I thought were revealing from my digging around on KSM:

the NI 43-101 notes BQE successfully used its SART technology during tests in 2017 and 2022 to remove copper and recover cyanide from leaching residue samples - see pg. 13-52. This provides some insight into the flexibility and value of BQE’s Technical Services work, even where it doesn’t directly translate to an operations project — i.e. BQE provided early stage cyanide services, despite only selenium treatment apparently being contemplated for the operations stage;

more generally, it is worth noting just how much emphasis mining companies are required to place on water treatment during the development phase. In addition to the highly detailed NI 43-101, Seabridge’s Sustainability Report has an entire section devoted to water management and explicitly refers to BQE and the Selen-IX technology.

Final Thoughts

Based on the foregoing, we know that KSM is one of the company-maker projects in BQE’s pipeline. However, as I noted at the outset, the company’s investor deck makes it clear that KSM is not the only one. While I have a vague idea of what these might be, my sleuthing around has not nearly been as fruitful in securing the particulars of those. As a result, I am just going to leave it here for now on the company-maker piece, though I’ll provide more details as they become clear.

To summarize, I would encourage you to keep in mind all of the following when thinking about the potential growth ahead for BQE:

1) we are starting with very small numbers, meaning that each new ‘average sized’ operations project is going to have an outsized impact on earnings for the next couple years;

2) while the projection of 2-4 new operations project a year is attainable, in my opinion, the cadence of those is not going to be predictable on a quarterly or even annual basis;

3) Technical Services is always going to be lumpy given the value of the services varies across different stages, so I would focus more on the number of projects in the pipeline as a look through for future growth, rather than the revenues from that segment.

4) the unit economics of the selenium technology appears to be vastly superior, which means that the ‘average' project’s recurring revenue might exceed the current estimate of $1.6m/annually as selenium takes a bigger share of the pie (currently, it sits at ~27% of the total mix);

5) there is at least one company-maker project, KSM, which is very likely to come online at some point, and should alone be worth BQE’s entire current run-rate ARR, and should provide material Technical Services revenues while we wait; and

6) there is at least one additional company-maker project in the current pipeline and, obviously, each incremental project added that looks anything like KSM is going to be transformative.

Altogether, assuming management executes, we are looking at company that is still trading at a very low multiple of earnings as we look out a few years from now.

A nice read Jake! Cheers

Thanks for the great read. FYI, there are three potential company maker projects in the pipeline (see latest micocapclub interview on youtube). Another in NA ("good visibility", linked to existing operating mine) and one in LA.