With BQE Water reporting what the market obviously thinks are disappointing Q1 numbers (as you’ll see, I disagree), I thought I’d share my thoughts on that print, as well as a quick note on this blog’s most recent idea, Enzo Biochem.

BQE Water

If your analysis of Q1’s numbers begins and ends with a cursory review of the financials, there’s a good chance you’ll be disappointed. While recurring revenue from Operational Services increased by ~115% YoY, that number is down sequentially nearly 40%. Moreover, Technical Services revenue fell off a cliff, with a 61% decrease YoY. All the while, SG&A is up a lot YoY. The result: a net loss of 0.38/share vs. net loss of 0.27/share. EBITDA, which I have argued is a better measure for profitability at this stage, was also both negative and lower YoY.

Pretty ugly right? Superficially, yes - but if you look beneath the hood, I’d argue these results are not only fine, but actually quite strong. Why?

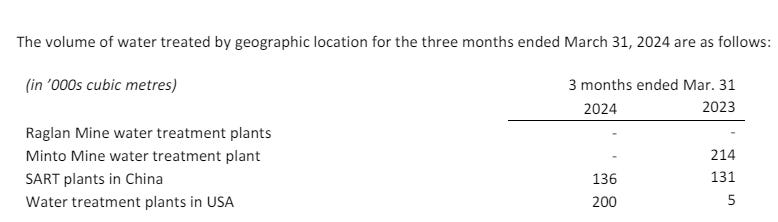

The first thing we need to remember is that BQE’s operating projects in Canada tend to go offline in the winter due to weather, which creates some seasonal weakness. But this seasonality is clearly improving as more US based projects are brought online. Notably, the new selenium plants brought online in H2 last year treated 133K cubic meters of water in Q1, which alone is more than 1/3 of the total volume treated last year during Q1. That alone is a positive obviously, but there is a more important piece here if you dig deeper. First, note that recurring revenue was up 115% despite the Minto Mine in Yukon, which was the largest volume contributor in Q1 2023, being shut this year due to winterization:

Obviously, had the Minto Mine contributed as it did last year, recurring revenue would be up even more than 115%. But, more importantly, you’ll note that the total volume of water treated actually declined slightly YoY (336 vs. 350), and yet revenue doubled. Essentially, the new selenium project in the US replaced the lost volumes from Minto, but those volumes are worth 2x more. This is a big tell for the premium BQE is able to receive for treating selenium and what continued focused on this opportunity might mean for earnings power going forward. Remember, the company suggests that the average operations project will do ~$1.6m in revenue annually: with the company doing $1.8m in recurring revenue this quarter, and the new plants clearly being the major contributor to that, we can see this selenium project is fetching far more than the guided average. (You may recall that I discussed the likely premium this project would receive in the initial write up and referred to it as a ‘company-maker’ project, though I have since been advised this is in fact not a company-maker project - that should be a clue as to how outsized such projects will likely be, and I’ll reiterate again that we are very likely to see some company maker projects in the not too distant future).

All considered, the recurring revenue story, which is the story, is tracking very nicely, and we should see substantially higher revenues in the quarters ahead when the Canadian operations come back online and new projects are incrementally stacked on top.

Okay, now for the part that likely has everyone worried - Technical Services. As noted, revenue from this segment, which is non-recurring, collapsed this quarter both YoY and sequentially. The worry - “didn't you say this segment is a quasi-backlog for operational services, and doesn’t this decline suggest that growth in recurring revenue is likewise going drop looking ahead?”

I would encourage you to review management’s commentary regarding this slow down in the press release. In short, this is a lumpy earnings stream and the revenue from each project depends on what stage that project is in, with the early stages being worth substantially less. Moreover, as I have stated previously, most of these projects will not transition to the operations phase, so there is bound to be a lot of turnover and unpredictability from this segment. But in my view, there are three reasons to take comfort here:

Management “currently expects our technical services revenue to catch up to 2023 levels over the remainder of the year.” I’ve spoken to this management team and they do not strike me as the type to set expectations they can’t meet (I think the broader history here speaks to that as well). So I will take them at their word on this.

Perhaps more importantly, the disclosures list the Technical Services projects currently underway. You’ll note both that this list is almost entirely different than the one provided in Q4 (giving credibility to the claim that revenues are down due to how early stage these projects are) and that, notwithstanding, the list of projects is just as long despite the turnover (which indicates to me just how many opportunities there are for BQE to pursue).

Finally, over time, the inherent lumpiness of Technical Services will be increasingly mitigated as Operational Services grow to bigger share of the pie.

The last reason for concern is the large increase in SG&A. The reason for this is quite straightforward and a natural byproduct of having a fair bit of operating leverage in your business. Being extremely capital light, BQE’s major expense is labor, which is principally a fixed cost; that labor is generally expensed as “operating expenses before depreciation”, which is essentially BQE’s gross margin; with a slowdown in Technical Services, there was a surplus of labor, which was accordingly allocated to and expensed as “Sales and Development”. There is nothing to sweat here in my opinion and I think we will be quite happy seeing this operating leverage work the other direction as the business picks up heading into subsequent quarters.

Just a couple other points before I move on:

Cash balance grew sequentially by 4% due to a working capital benefit. One concern I have heard from a lot of people is with respect to the ever growing account receivables line — seeing that decline from $4.3m to $3.26m should help assuage some concerns on this front.

There was fairly substantial improvement from the China JVs. Though not core to the broader thesis, I was expecting some upside due to increased copper prices. Interestingly, however, most of the upside was apparently from increased volumes, not pricing. The company noted that this indicates that the substantial decline in 2023 was likely more attributable to climate, rather than depletion as initially believed — implying, of course, that this segment may continue being a material contributor for longer than expected.

Shares are down substantially as I write this, which as you can probably gather from the above I think is silly. I added some at $56.

Enzo Biochem

One of the big pieces to the thesis here is that management is incentivized to sell the business. Well, those incentives got even stronger last week with an amendment to CEO Kara Cannon’s compensation package. Firstly, she was granted 200K options with a strike price of $2/share, nearly double Enzo’s share price at the time. What is more, is that her bonus in the event of a change of control has been amended from 0.75% of Transaction Value, to 1% of Transaction Value "in excess of $50m". Taken together, the incentives are not merely to get some value for shareholders, but to effect a transaction that results in at least 100% upside from the present levels. This suggest to me that insiders at least see a plausible path to getting value close to, or even in excess of, my $2.40/share bull case.

Shares are up ~18% since the write-up, which is in line with what I had pinned as the bear case. As such, I still consider the present price to offer a very attractive R/R.

Hey Jake - I agree it’s a good sign that selenium revenues are a higher quality stream. What’s your take on Minto in the report they say winterization is typical but if you look at 2023 the Yukon government had them operate during this period. I’m not saying management is lying about operations resuming but is there a reason for the discrepancy in seasonality between 23 and 24?

SPWH price moves have been wild recently