BQE Water

A high-quality, rapidly growing recurring revenue services business, with an unnoticed growth catalyst and a clear path to becoming the go-to player for an unmet need

Disclaimer: Nothing on this blog is intended as financial or investing advice. Please do your own due diligence.

A couple weeks back, as some of you know, I had the opportunity of pitching an idea during a Twitter Spaces (the event included some very good investors and ideas, and I would encourage anyone who hasn’t yet listened to do so). Following the event, I summarized the pitch on this thread. With some added attention on a criminally underfollowed company, shares traded up from $43 to as high as $55 in the following days. However, given several rough sessions in the broader market, shares have come in a bit since, and now sit at just shy of $50. Regardless, I think shares are nowhere near close to fair value (in fact I added at the $55 ATH) and therefore I wanted to share a full write-up here.

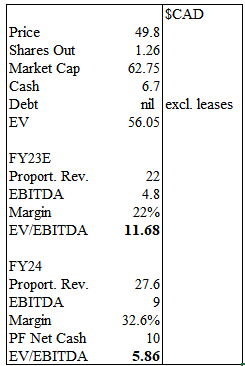

The company is BQE Water, a Canadian microcap with a current market capitalization of ~CAD$62mm (All $ below are CAD unless otherwise specified). Shares currently trade for $49.80 and are listed on the TSX Venture as BQE and OTC as BTQNF. Please note up front, this is quite an illiquid security (that has been improving with discovery) with a very tight float (~1.26m shares out, with more than half of that held by insiders and large shareholders), so please use extra caution, etc, etc.

There is a great deal to like about this idea. In fact, though the businesses could not be more different, I think this set-up rhymes in many ways with that of Cipher Pharmaceuticals’ back when it was in the $5/share range (I’ll admit I may actually prefer what we have on offer here). How so? In addition to being an illiquid Canadian microcap, I’d point to the following:

1) High Quality: a very asset-light, cash-generative operating model that does not need incremental invested capital to grow; and a number of strong, but underestimated, competitive advantages;

2) Opportunity: a “Good-co/Bad-co” dynamic contributing to the mispricing— a declining legacy businesses that is masking the growth and superior economics of another segment;

3) Growth Catalyst: the company is growing recurring revenues at a high-rate and that growth is set to continue for years to come. However, the company has a novel technology and several “company-maker projects” in the pipeline that are being missed by the market, and that are likely to multiply its earnings power;

4) Clean Balance Sheet and Capital Structure: ~$6.7m of cash, de minimis debt, and a simple equity stack with commons and some very minimal employee options and RSUs;

5) Strong Management: high insider ownership and an aligned management team that think like shareholders and have a strong track record of capital allocation; and

6) Valuation: the company is cheap on current numbers, but the discount is mouthwatering if we look out to the future.

Company Overview

[One note before we proceed: the company earns some of its income from certain Joint Ventures in China, which are accounted for using the equity method; however, because these JVs have historically been the biggest part of the business, the company provides a metric called “Proportional Revenue”, which is the sum of GAAP revenue plus the implied share of BQE’s revenue from the JVs. I’ll be using this term frequently below as it helps illustrate the financial transformation at work.]

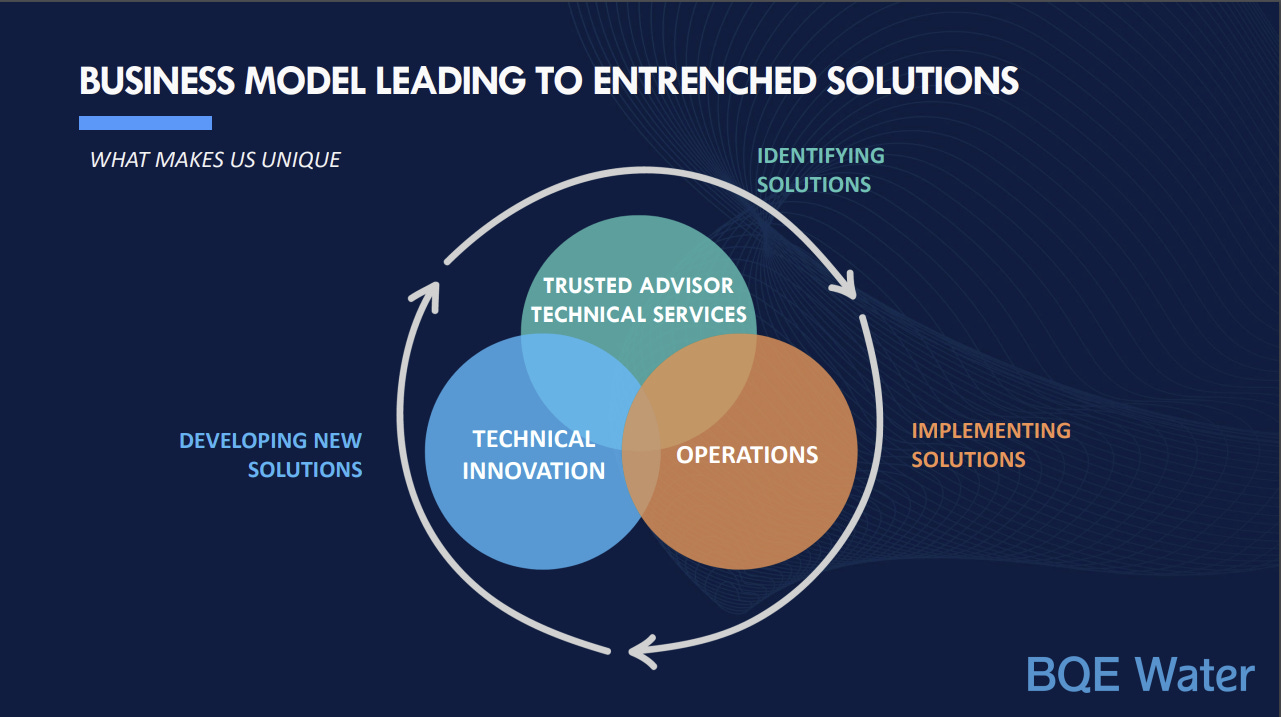

BQE Water provides water management and treatment services to its partners, which are generally companies within the mining and metallurgical industries. Here is how the company describes its business:

I know what you’re probably thinking: “a Canadian microcap traded on the Venture Exchange that operates in the mining industry and provides a highly-technical service well outside my circle of competence — hard pass!” But I urge you to stay with me: the business is actually very simple and easy to understand, and is not exposed to the usual vicissitudes of the mining industry. Indeed, what I hope to show is that this is one of the highest quality businesses, with one of the highest visibility earnings streams, that I have ever come across in the microcap space. Allow me to explain…

Somewhere in the neighborhood of 90% of metallurgical and mining processes require the use of water to extract the sought-after resources. Inevitably, this water ends up being contaminated with various minerals or metals, which in-turn poses a substantial threat to the environment and drinking water. As one can imagine, stringent regulations have increasingly been adopted worldwide obligating resources companies to address this contamination risk (see e.g. here and here) (attention on this topic has been magnified due to some recent disasters, including the Mount Polley tailings breach, which I recommend getting up to speed on if you’re interested in the idea).

This is where BQE comes in: it works with its partners throughout the life cycle of a mine to develop and implement the appropriate solutions to ensure that water contamination is addressed and that regulations are complied with.

To better understand how the business works, it is helpful to first understand the lifecycle of a mine as being divided into three stages. First, there is the development and permitting stage, which generally runs between 5-10 years. Many mining projects never make it beyond this first stage due to a lack of viability. Those that do, however, proceed to the second stage, operations, which can generally run from 10-20 years depending on the nature of the mine. Finally, there is the closure phase, which can run anywhere from 5 years into perpetuity depending on the demands of regulatory compliance.

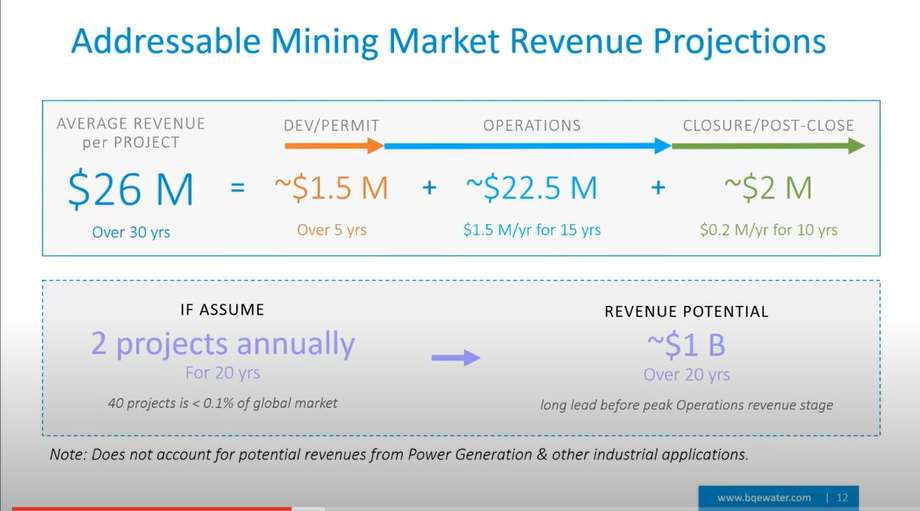

As noted, BQE is involved at every stage of the mine, meaning the average project for BQE should run for 30 years (assuming the project reaches the operating phase).

BQE segments its business between Technical Services (which concerns its involvement during the development and permitting phase of a mine) and Operational Services (which captures the operating and closure phases). BQE projects making, on average, $28m of revenue over the lifetime of a 30-year project, broken down as follows:

Technical Services Segments

So why does BQE get involved before a mine begins operating? Well, first of all, articulating and developing a solution for water treatment is often a regulatory precondition to having a mine permitted and approved for the operating phase. Relatedly, each mining project requires it own ad hoc solution for water treatment, depending on a host of factors, such as the resource being mined, geography, size, etc. Because there is no one-size-fits-all solution and yet a solution is nevertheless required, BQE is brought in by its partners during this phase, who rely on BQE’s expertise to advise on the best path forward. The arrived at solution may involve using some of BQE’s patented technologies, it may involve employing more conventional methods, or in some cases, it may require BQE to develop a entirely novel solution. For these Technical Services, BQE charges what are essentially consulting fees.

This segment is of crucial importance for two reasons. First, during consultation, BQE may decide that the project at hand will require a novel approach, thereby serving as an impetus for BQE to innovate new solutions, which may then be used for additional operating projects down the road. These innovations can lead to the development or furthering of competitive advantages, e.g., through the creation of new IP.

Second, and more significantly, for the mines that do move on to the operating phase (of course, many mines will not), BQE will continue on to operate the water treatment infrastructure, which is the high-quality recurring revenue portion of the business I will discuss next. In a sense then, Technical Services acts as somewhat of a backlog for the recurring revenue segment — as Technical services revenues grow, so too should recurring revenues. And Technical Services revenue has really been growing, achieving a respectable ~24% CAGR over the last 5 years, which has accelerated in the back half of that period to ~40% CAGR since 2021. Technical Services currently represents ~65% of Proportional Revenues. The average economics per project are ~$2m over 5 years, or $400k/annual per each Technical Services project. For FY23, the company should generate between $8-$9m of revenue from this segment. While not quite as impressive as Operational Services, gross margins from this segment are still a robust 35-45%.

Operational Services - the Recurring Revenue Segment

Now for the real value proposition.

For the mines that do go into development, BQE implements the water treatment solutions, which is segmented as Operational Services. The company aims to add at least two new operating projects annually.

This segment is essentially a toll booth. BQE charges either base monthly fees or tolls based on the volume of water treated. And significantly, they do so throughout the life of the mine as well as potentially for years after it closes. As a result of how long-duration these contracts are, this is one of the stickiest, high-quality revenue streams I have ever come across. Moreover, this an extremely asset-light operating model because BQE’s partners bear the capex burden associated with building out the water treatment systems! On a per project basis, the company projects averaging $24m of sales over 15 years of operations ($1.6m/annually) and a further $2m during the closure phase (these economics ignore the potentially much larger so-called “company maker” projects, which I will address below). Margins here are ~45-55%.

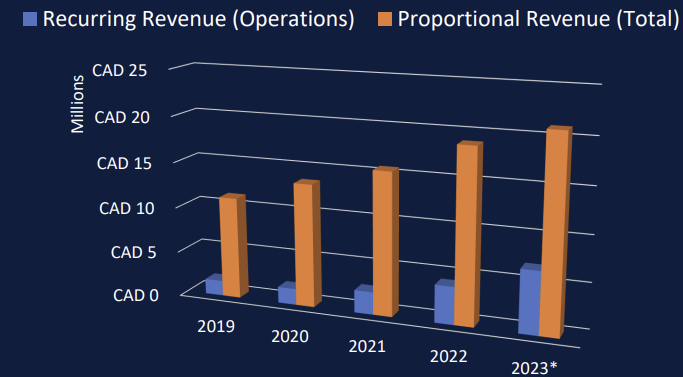

The book of recurring revenue is growing at a rapid rate, up nearly 4x since 2019, and achieving more than a 60% CAGR since 2021. Importantly, it is becoming an increasingly large part of the Proportional Revenue mix, from ~13% in 2020 up to 40% in the company’s most recent reported quarter, Q3 23. This trend is bound to continue as revenue from new projects stacks on top of preexisting ones that will not roll off for decades. I expect recurring revenue to account for well-over 50% of Proportional Revenue within the next year or so.

The significance of this composition shift is reflected through the company’s evolved margin profile, with EBITDA margins going from low to mid teens pre-COVID, up to 34% in Q3 2023. (Note, Q2 and Q3 are seasonally far stronger because some of the operations close during the winter, so you cannot extrapolate this across the entire year, though margins for the full year should still come in at an impressive ~25% of Proportional Revenue.) Margin expansion will continue as recurring revenue becomes a greater share of the revenue mix mix, and I expect the company should be able to sustain well over 30% EBITDA margins in 2025 and beyond. Indeed, the margin profile is much better once we adjust for the impact of the China JVs (more on this below).

I must also stress just how early innings this recurring revenue opportunity is. As of Q3, the company only had 6 recurring revenue projects on the books (technically, there are 8, but two are the China JVs, for which the primary revenue source is the sale of metals, and which therefore have different, less desirable economics):

And the runway for this opportunity is enormous. In 2021, BQE claimed that if it was able to secure 40 projects over the next 20 years, that would only comprise 0.1% of the global market:

(Note this slide, which is from 2021, projects $26m per project, whereas the slide above from the 2023 deck assumes $28m — an indication of yet another growth driver here viz. pricing power).

For FY2023, the company should do around ~$8m recurring revenue (excl. the JVs). And recall: the company projects adding two new projects annually, with the average project contributing $1.6 in sales per year. So we have $3.2m increments, or 40% of the current base, to add annually, before accounting for any large company-maker projects.

In short, given the size of the TAM and small base we are starting with, BQE has a very long runway to sustain the presently rapid growth rates.

The China JVs and The Sales of Recovered Metals

Now for the final piece of the business: the company is involved in certain Joint Ventures in China in which it uses its technology to extract metals (mostly copper), and then gets paid a share of the proceeds for selling the recovered metals. Historically, income generated from these JVs has been the largest contributor to BQE’s business. Indeed, going back as recently as 2021, the implied revenue from theses JV's comprised over 50% of Proportional Revenues (and was more than 3x Operational Services revenue). However, proceeds from these JVs have been in decline, with implied revenue trending down from over $8m in 2021 to what should be closer to $5m for FY23. This decline has had the impact of masking just how much BQE’s core business is growing. Indeed, while Proportional Revenue has grown at a respectable 17% CAGR over the last five years, revenues from Technical Services and Operational Services have grown at a whopping 30% CAGR.

Moreover, because the JV business is levered to the price of copper, I suspect the former dominance of this segment has caused some investors to write-off BQE as a cyclical commodities company. This, of course, is becoming less and less true as the JVs continue to decline in importance.

Having said that, there is a fair bit of upside to be had from this book of business if the price of copper continues to trend in the right direction. Indeed, the price of copper is up some 60 cents from BQE’s last reported quarter (end Sept. 30). If sustained, this should result in at least an additional ~$1.5m in income from the JVs over the course of the year, which is a huge increase from the <$1m the company will earn over FY23 (and substantial relative to the company-wide $3m EBIT). Over the long-term, though I am far from a commodities expert, I think there are pretty convincing reasons to be bullish on the price of copper. Ultimately, while my thesis here in no way turns on the contribution of these JVs (if these declined to zero, my interest in this investment would be unchanged), I think it’s more likely than not we get some pretty decent upside from these contracts over the next couple years.

The Thesis

BQE’s business is very high-quality

We are all well-acquainted with the virtues of a recurring revenue business model. But there a lot of features of BQE’s operating model and the nature of the service it provides that I believe make this a uniquely high-quality business.

Firstly, the operating model is extremely asset-light and scalable. As noted, BQE’s partners bear the capex associated with building out the water treatment facilities. Moreover, there is no inventory in the business. BQE’s ability to grow is therefore not constrained by its balance sheet; rather, the only limit on its ability to scale is the skilled labor needed to man the water treatment facilities and to provide the technical services — and this is a long way out from becoming an issue given how early in the growth story we still are.

One thing you may note from viewing the balance sheet is how quickly accounts receivables have grown over time, largely tracking the growth of recurring revenue. While this can serve as a drag on growth in certain enterprises, it is not concerning here because, again, the company does not need capital to grow; these receivables simply reflect a lag in when recurring revenue is billed vs. when it gets paid (given BQE’s partners are mainly blue-chip resource companies, there is no material concern about credit risk). Beyond receivables, the only remaining tangible balance sheet items are leases (reflecting office space in Vancouver, Chile, and China).

And of course, because the company needs no capital grow, essentially all cash flow generated is available for distribution. And BQE is about start generating a lot of cash. As I hit on below, management have been patient in letting cash build, but having now hit what is a significant excess cash balance, they have started returning capital through share repurchases.

The business quality is underscored by robust competitive advantages

Not only is this an ideal operating model, but I believe BQE possesses numerous competitive advantages that will ensure durability over the long-run:

The services are mandated by regulation. The reality moving forward for resource companies is that a water treatment solution is likely to be a regulatory precondition, and an ever increasing burden, for getting a project approved.

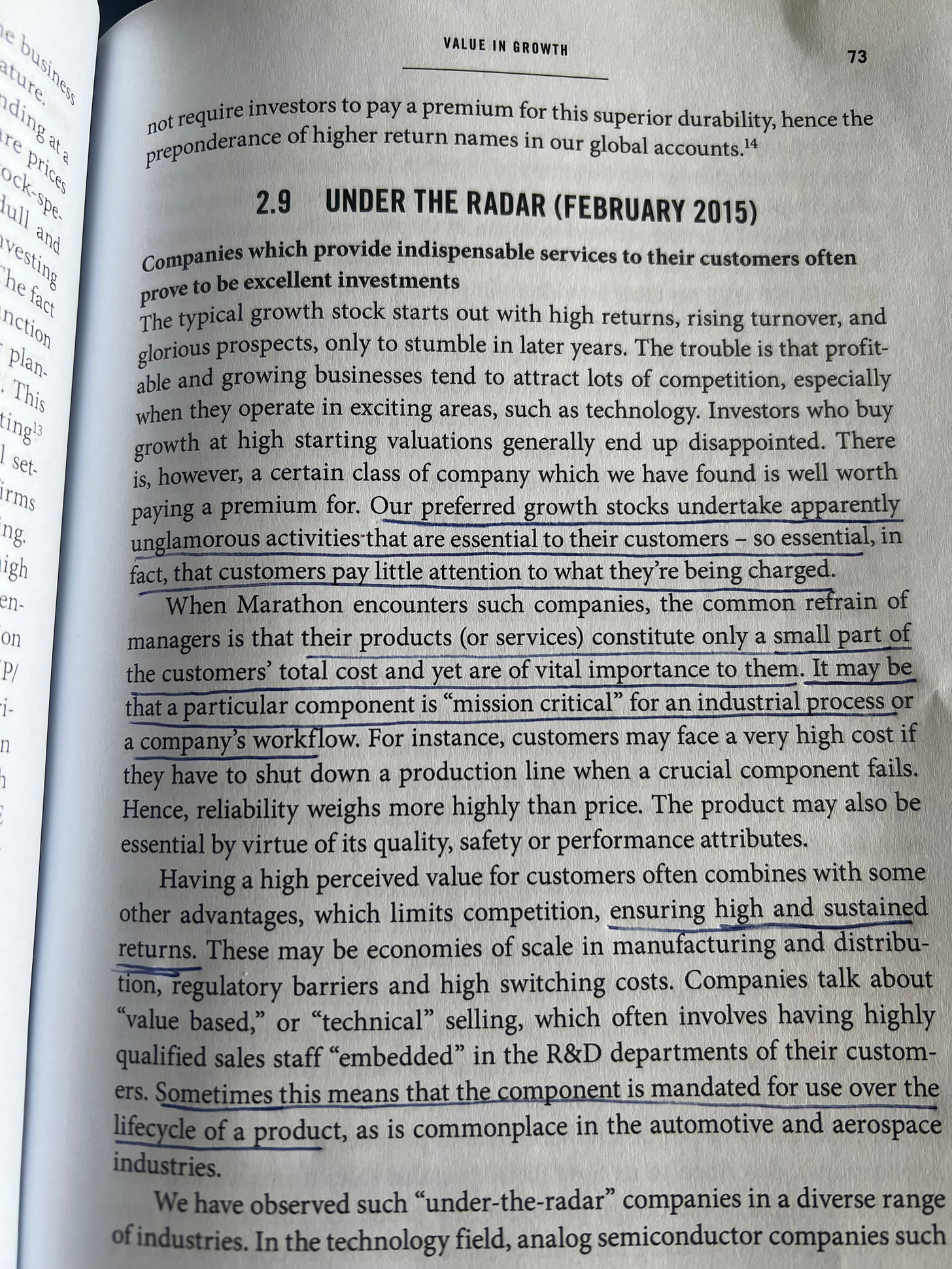

The services are a small, but essential part of overall capex spend for miners. While this may not seem like a significant feature, studying some of the great compounders teaches us that this is very common formula possessed by companies that have been able to generate sustainably high returns over the long-term. Why is this? Perhaps foremost, because the service is of relatively low cost yet of high importance, it is simply not worth it for the customers to incur the costs and bear the risks of bringing the service in-house. In BQE’s case, this means there is little risk of its partners handling water treatment internally. Moreover, this dynamic of ‘small but mission critical’ tends to lend itself towards other competitive advantages and features that lead to sustainably high returns, such as pricing power and sticky customer relationships, both of which BQE possesses. There is a great formulation of this dynamic in the book Capital Returns, which I’ll share here (apologies for the quality as I only have a hard copy) — note the parallels:

Speaking of sticky customer relationships: because BQE’s projects last for year, it develops durable, sticky relationships with its partners that should lead to new work down the road, as its partners bring new projects online.

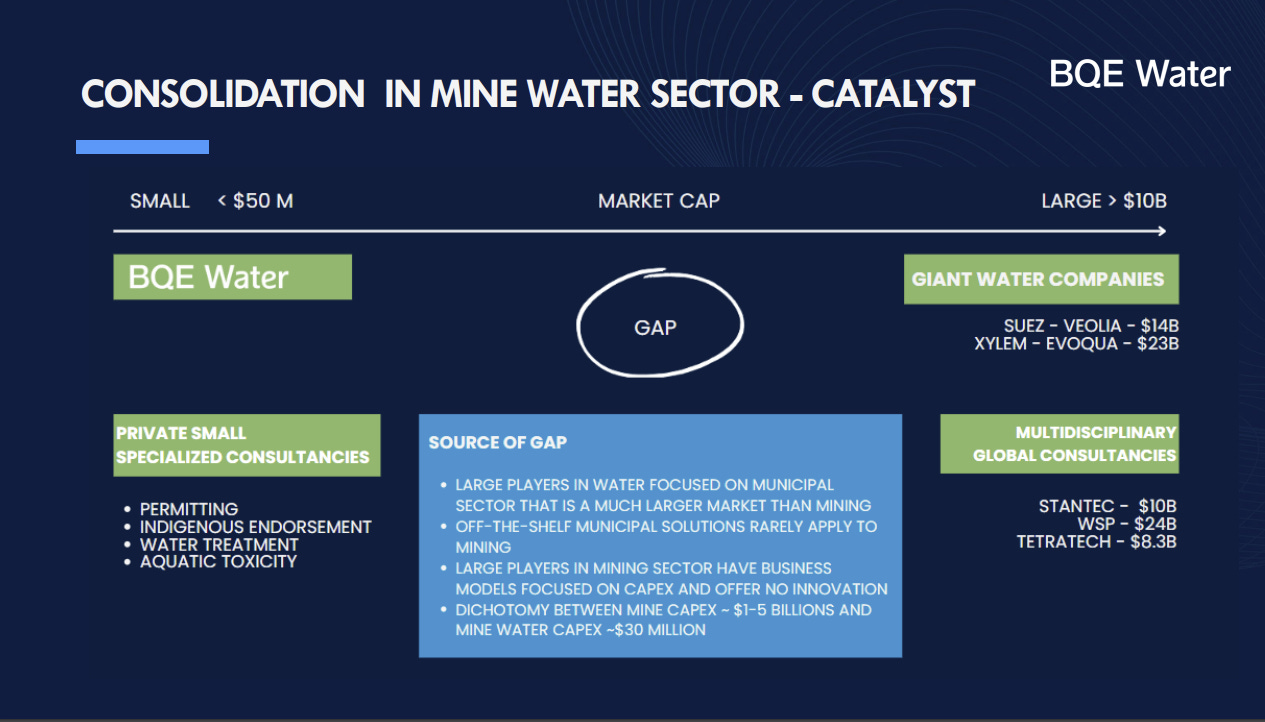

There is a lack of competition in the space. Lack of competition is itself, of course, not a competitive advantage, but I raise this to indicate BQE operates in a huge white-space, as larger water treatment companies tend to focus on municipal services. The evidence: 60% of BQE’s projects are sole-sourced (meaning there are no other bidders).

Finally, BQE has very important patented technologies. BQE holds patented technologies in metals, sulphate and selenium water treatment. While these are all important, the significance of company’s selenium technology, Selen-IX, needs to be emphasized. As I will discuss below, this novel technology provides BQE with a potential monopoly (or at least, a shot of establishing a dominant position) in addressing selenium removal from mine water, which is an enormous opportunity that could easily turn BQE into a multi-bagger several times over.

The company is rapidly growing

As noted above, BQE has been experiencing tremendous growth, with Proportional Revenue growing at a 17% CAGR over the last 5 years, with GAAP revenue (i.e. excl. the China JVs) growing even faster with a 30% CAGR. This growth rate has accelerated since 2021:

Growth in profitability has been even more impressive, with G&A as a % GAAP revenue declining materially from ~20% in 2021 to what should be closer to 15% for FY 23. The trend is even more impressive if we zoom out:

The net result, of course, is that margins have exploded, from the mid-teens to low 20s, meaning that profit growth has well eclipsed the impressive top-line number.

What makes this growth story so attractive, however, is that this is clearly just the beginning. In fact, this is one of the rare high growth stories where there is a high-level of visibility, and thus certainty, into sales trajectory. Let’s briefly walk through the math.

The company projects adding between 2-4 new operating projects per year. Let’s use two to be conservative. As I noted above, the average project should do ~$1.6m of revenue annually. Further, because of how long-duration yet young these projects are, there shouldn’t be any material attrition for years to come, meaning we can essentially stack $3.2m of incremental revenue each year onto the top-line as a base case. Given FY23 recurring revenue should come in ~$7.5m, these are very meaningful increments and will be for the remainder of the decade. The recurring revenue segment has ~50% margins. Moreover, the company notes that further G&A increases moving forward will be minimal, meaning two new operational services projects per year should tack on ~$1.6m in annual EBITDA — again, enormous growth given the company’s entire FY23 EBITDA is going to be ~$4.5m. In fact, assuming no growth in Technical Services (which is ridiculous — the growth rate in this segment should be sustainable or even increase moving forward) and no growth from the China JVs (remember, there’s likely to be surprise growth here given the price of copper), then the company’s EBITDA will more than double by FY26 simply from tacking on two new average operating projects per year.

Pretty impressive, right? Notwithstanding, I think this little exercise we just went through vastly underestimates the growth ahead. Why?

For one, I am assuming the low-range of the projected of 2-4 new projects annually; ramp that to the high-end, and the numbers get crazy. Second, I’m assuming no growth in Technical Services. However, given the increasing regulatory focus on water treatment and the fact that we appear to be in the early innings of a mining capex cycle, I expect BQE’s services to be in continual demand for consulting on new projects.

But there is a third, less obvious reason. Note my emphasis above on two new average operating projects per year. Well, not all projects are created equally — and BQE has an enormous hidden growth catalyst that the market appears to be entirely missing and which could very well double EBITDA by the end of FY24.

The near-term growth catalyst(s)

And that brings me to my next point — what is the catalyst? Yes, merely growing recurring revenue as penciled above should be sufficient to re-rate the stock moving forward. However, as I mentioned, the company can accelerate its growth through “company-maker projects”.

In January, the company issued a press release noting that a Selen-IX plant in the US has just transitioned to its operating phase (brief aside: the issuance of a press release is in itself notable, as the CEO notes in this interview that the company only issues press release for the most significant of updates — I unfortunately lost the time stamp, but for anyone that likes this idea, I’d highly encourage giving the full interview a listen). This is the largest Selen-IX plant currently in operation. The company does not give it to us explicitly, but we have the information to take a stab at ascertaining how valuable this contract might be.

The company notes that the plant is expected to run year round and treat 4500 gallons of water per minute, which equates to ~17 cubic meters/minute and 8.9m cubic meters annually assuming the plant operates constantly.

Let’s cut that in half to be conservative — i.e. assume the plant only operates 50% of the time and therefore treats ~4.45m cubic meters per year.

The Raglan water treatment project for Glencore was the company’s largest recurring revenue contributor in 2022, earning $1.6m on 1.86m cubic meters, which equates to a fee of ~$0.86 per cubic meter.

Now, unlike Raglan, the new Selen-IX plant charges a base fee, rather than a fee per cubic meter. However, given it is both treating a far higher volume of water and that the Selen-IX technology is a far more complex, high-spec offering (more on this below), I think we can fairly assume that BQE will be earning far more than $1.6m from this plant annually. In fact, merely applying $0.86 per cubic meter fee to the volume of water treated (assuming the plant runs 50% of the year) gets us to nearly $4m of incremental recurring revenue on a segment that will only earn ~$7.5m in 2023.

With ~50% margins and no material incremental G&A spend necessary, I expect this project to contribute at least ~$1.5m of EBITDA in FY 24, and this number should materially ramp over time. In short, in the NTM, BQE is set to conservatively increase its recurring revenue by 50% and company wide EBITDA by ~30% from one project alone!

The selenium opportunity

We need to now briefly discuss the selenium opportunity more broadly, as the above project is nothing compared to the potential ahead for Selen-IX.

Selenium “is a naturally occurring element and is essential to human health in very small doses, but can become toxic at higher levels. It is harmful to aquatic life and other egg-laying creatures, even at low levels.” (see here). It is also a drinking water contaminant at certain concentrations. Mining processes for many resources, including coal, uranium, and certain metals, accelerate the release of selenium into water. As a result, regulatory agencies throughout North America have enacted selenium discharge limits ranging from one to ten parts per billion: e.g. here, here, and here.

Despite these regulations, however, governments have historically struggled to ensure compliance. For example, Teck’s 2018 Environmental Monitoring Report noted that selenium concentration at its Elk Valley project in British Columbia had exceeded the province’s guidelines since 1993. The consistent lack of compliance historically has caused outrage among activists and scientists and has led to increased regulatory scrutiny, particularly over the last decade. Have a look through Teck’s reports over the recent years to see just how much importance is being placed on this issue.

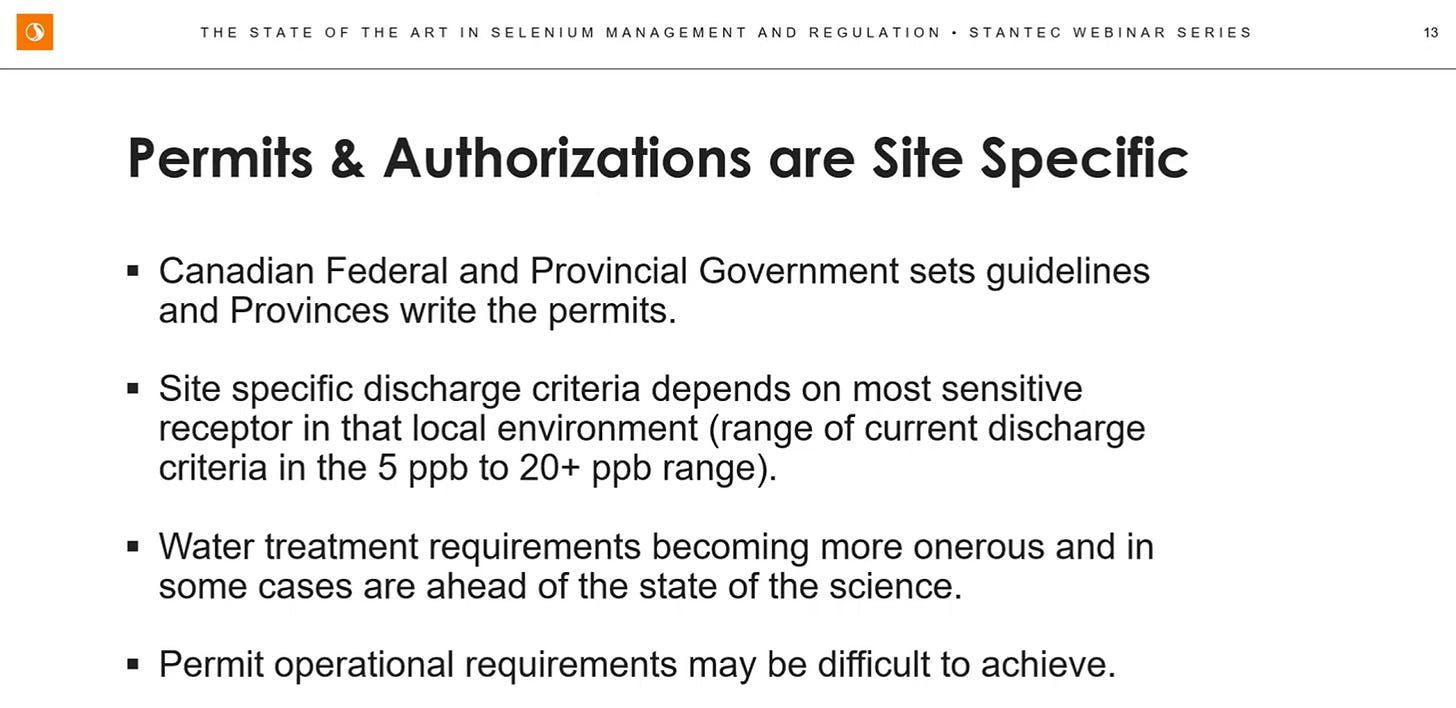

Why the lack of compliance? Well, a major reason is that the technology just hasn’t been there. Here is a slide from a 2022 Stantec webinar noting the issue [I would definitely give this a listen if you’re looking to do more due diligence on this idea]:

“Water treatment requirements becoming more onerous and in some cases are ahead of the state of the science.”

There are various approaches to dealing with Selenium discharge, each having its pros and cons (including Selen-IX). The most common approach over the last decade appears to have been the use of so-called “biological systems”. While these systems have been moderately effective, they have some very real drawbacks: — “[t]hey cannot reliably reach selenium discharge limits of even less than ten parts per billion. They require dilution, produce sludge waste with unknown long-term stability, and, by their very nature, have uncontrolled rates of processing that makes them unsuitable for operations requiring fast start up and shut down.”

Enter BQE.

In 2018, BQE was issued US Patent 9,963,360 for Selen-IX for the removal of selenium from industrial wastewater to meet the most stringent limits in North American. Selen-IX is a disruptive non-biological technology that reliably limits selenium to less than two parts per billion, does not lead to the production of toxic residue, can be shut on/off on-demand for seasonality, and reduces costs as it adjusts to fluctuations in water flow. This is not to say that Selen-IX is the perfect solution, but given these characteristics, it appears to have very real advantages vis-a-vis the alternatives (again, I would listen to the Stantec webinar for a more comprehensive, and impartial review on the space).

So how big is the opportunity? Well, management indicated in the 2021 Smallcap Discoveries interview that ~25/35 projects currently in the environmental assessment stage in Canada alone have identified selenium as a concern. That says nothing of the opportunity in the US. Obviously, given the economics of the new Selen-IX plant outlined above, even securing a handful of similar recurring revenue projects could make this a multi-bagger several times over.

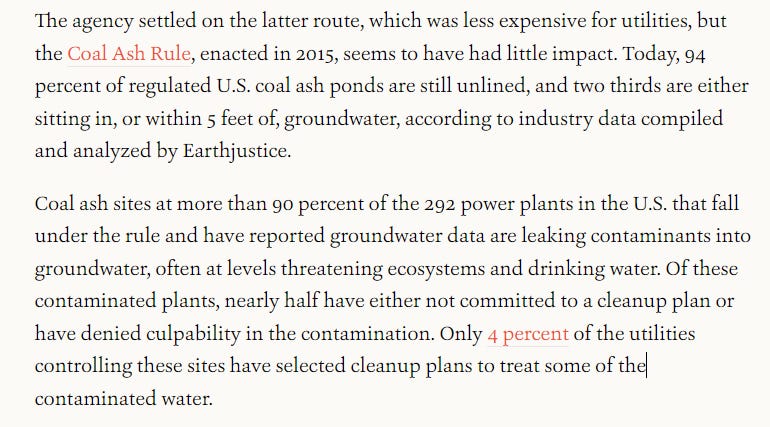

Moreover, there is further opportunity here with respect to remediation projects. In 2021, BQE completed the commissioning of a Selen-IX plant to remove selenium from a coal ash pond for WesTech Engineering in the US. According to data compiled by Earthjustice, 94% of of US coal ash ponds are unlined and ~2/3s are within dangerous proximity to groundwater.

After years of weak enforcement, it appears the EPA is beginning to crack down. Given the majority of coal ash ponds are owned by a small number of utilities companies, BQE’s early entrance into this space could lead to partnerships that generate a huge backlog of projects. [Author’s edit: one thing I should have noted is that the utility company that BQE is presently doing remediation work for with WesTech operates in 18 states; so there’s likely a huge pipeline of work just from this relationship alone. For a primer on the coal ash opportunity, see here].

Management and Shareholders

BQE is led by President and CEO David Kratochvil and Chairman Peter Gleeson. Together, they own ~6% of the company. Personally, I am very impressed by these guys and what they have done with the company. Since taking over in ~2014, they have transformed the company from a struggling, cyclical business biting off more than it could chew, to the quality, narrowly-focused enterprise it is today. During that period, Proportional Revenues have gone from ~$7m to over ~$22m today. At the same time, this growth has been achieved with G&A declining from ~40% of Proportional Revenue down to ~15% today. More importantly, all of this success has been achieved without material dilution (a rarity for growing microcaps), with the share count being essentially flat since 2018. They have certainly been rewarded for their efforts, with shares up from mid-single digits to just shy of $50 over the course of the decade.

BQE’s biggest shareholders are three private investors, who each own between 10% and 20% of the company, and collectively own ~45%. Notably, one these investors added to his position on April 11 after the big move towards $50. A small buy, but I think it’s still rather bullish for a major shareholder to be adding near all time highs.

Capital Allocation

So we have a capital light business that is about to start gushing cash flow. What’s the plan for the cash? Well, management have been opportunistically buying back stock. In first 9 months of 23, the company repurchased ~9,700 shares for ~$277K, good for an average price in the high $20s. Obviously, that’s been accretive given the stock is now around $50. Buybacks continued after the reporting period, with a further 3200 shares repurchased in October. In December, the company renewed its NCIB, authorizing the repurchase of 5% of shares outstanding.

Obviously, I would love the company to be hammering the buybacks as much as possible right now given how cheap I think the stock is. However, it is important to temper expectations here. As I noted, this is an extremely thin float with somewhere in the neighborhood of only ~650k shares given around half the shares are held by larger investors and insiders. Unfortunately, it might be difficult to meaningfully make a dent in this NCIB until liquidity increases, which is only going to occur after the stock starts its ascent higher. Moreover, while the company has a decent net cash balance, I get the sense that management wants to run with excess cash for the time being until the recurring revenue business really begins to inflect.

Regardless of how extensive buybacks will end up being in the nearer term, one thing I am very confident in is that there is going to be an abundance of cash available for distribution in the coming years. And given management’s track record of narrow focus and patience, I can’t find any specific reasons to be concerned about value destructive capital allocation via M&A or otherwise. To the extent they do elect to pursue M&A, I expect the transactions to be bolt-on and executed at accretive multiples. Absent that, I think we will be seeing buybacks to the extent manageable, or otherwise dividends in the alternative.

Valuation

Alright, so what is worth? At $49.80/share with net cash of ~$6.7m as of last report, the enterprise value is ~$56m (note, the company has some borrowings from a government agency, but it is non-interest bearing debt and tiny, so I am ignoring it). This puts the valuation at ~11.5x EBITDA on FY23 numbers. Conservatively assuming the top-line grows ~$5.5m in 2024 (~$4m from the new Selen-IX plant + an additional operating project with average economics of $1.6m), the company should be able to reach ~$9m of EBITDA in FY24. Note, I’m assuming no growth from Technical Services and the China JVs, which is punitive given what I’ve outlined above. However, even with these punitive assumptions, the stock currently trades for less than 6x NTM EBITDA, which is way too cheap for an asset-light company that should be able to sustainably grow at least 25% for several more years, and with +30% EBITDA margins.

Given the absence of capex, inventory, and interest bearing debt, EBITDA should be a fairly good proxy for FCF over the longer-term, though I’ll note again there is a conversion delay and thus a growing receivables line which results in annual FCF coming in significantly less than EBITDA for now (it is also fairly lumpy, as earnings from China are paid out during Q3). I should also note that BQE has a valuable tax loss carryforward of around ~$26m, although it is not applicable to offset income earned in certain foreign jurisdictions.

I think trying to put a precise price target on BQE is a waste of time. At <6x NTM EBITDA, the market is not remotely pricing in the growth, the runway, and the underlying quality of earnings. If you believe, as I do, that the company will be able to tack on at least two new average operating projects annually, that right there is an incremental ~$1.5m of EBITDA per year for many years to come. Add a few company-maker projects to the mix (and there are multiple in the backlog), and I can easily get to $15m of EBITDA by the end of FY26. Applying a 10x EBITDA multiple, which I think is sufficiently conservative, that gets us to ~$125/share before giving credit to any interim cash generation or capital returns. Moreover, I expect that the company will be able to continue growing at least 20% for several more years after that, meaning the stock could be worth a lot more than $125 over time, provided management executes and avoids imprudent capital allocation.

In short, my view is that there is a real shot at a multi-bagger here with a long-enough time horizon. Absent any thesis breakers, I intend this as a long-term hold.

Risks

As always, destructive capital allocation. This is particularly important to monitor here given there is no need to retain earnings. That said, management has given me no reason to worry on this front yet.

Project-level failures. There is always the chance the company blunders a project - e.g. the technology fails or the wrong solution is implemented - thereby opening themselves up to liability and reputational damage.

Competitive technologies. While I think BQE has very real competitive advantages, given the size of the opportunity, I have no doubt others are investing in innovations which may prove superior to BQE’s current tech. That said, BQE should still do very well even with some added competition considering just how wide-open the space currently is and given its own proven track record of innovation.

If anyone sees other clear risks here, please do let me know, as I am really struggling to come up with reasons to be bearish on this thesis.

Catalysts

In the near-term, Q4/FY23 earnings are due this week. I’ll provide an update shortly thereafter. Note that Q4 is a seasonally weak quarter as some of the projects shutdown during the winter - so don’t be surprised to see a picture that appears facially weaker than the one I have painted here.

Company maker projects.

Further capture of the selenium opportunity.

Given the small market cap, yet the high-quality of the business, I would not be surprised to see take-out interest.

Disclosure: I am long BQE at an average price of $44/share.

Great analysis. If the pearl is discovered, I am very confident about the future! My price target is 175 CAN$ in the next 3 years.

Hey Jake, what do big coal players in the US use for water treatment? For example AMR? I tried to look at can't find anyone specific so I'm guessing they use an in house team?