Cipher Pharmaceuticals (CPH.TO)

A quality, asset-light, cash flow generative core business at a 25% fcf yield w/a near-term catalyst that could multiply earnings

Disclaimer: Nothing on this blog is intended as financial or investing advice. Please do your own due diligence.

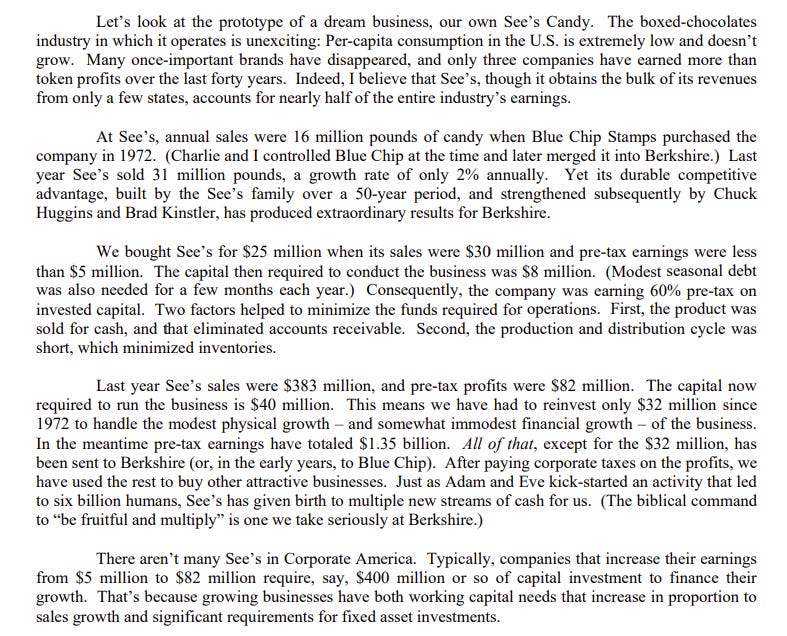

In his 2007 letter to shareholders, Warren Buffett breaks out businesses into three categories of quality: 1) The Great — businesses that earn high returns on capital with limited reinvestment needs; 2) The Good — businesses that earn fair returns on capital but require continuous incremental capital investment; and 3) The Gruesome — low return on capital businesses that require continuous incremental capital investment.

Buffett actually identifies a fourth category of business superior to the rest — viz. a business that can continually reinvest its earnings at high rates of return. However, as he recognizes, such a business exists only in the short-run — the law of diminishing returns posits that a company’s returns on incremental capital will decrease over time as the business grows. Berkshire itself, which perhaps has been able to reinvest its earnings at high rates of return longer than any company in history, has seen those returns diminish with each passing decade.

Therefore, over the long-run, the best businesses (The Great) are those that do not need much, if any, incremental capital to finance their operations. Here is how Buffett describes it:

Readers will be familiar with these archetypal asset-light, high ROIC businesses as the some of the greatest compounders ever: e.g. the credit card companies, the ratings agencies, the stock exchanges. Year after year, these companies churn out cash flows with little to no incremental investment in tangible capital. Buffett owns several companies that fit this model, including Moodys and Amex, but his favorite example is See’s Candies:

Because an asset-light company like See’s does not need to reinvest its earnings to fund operations (nor does it have ability to do so), it is able to distribute all of its cash earnings to its owners without impacting its future operations. Therefore, the common stocks of these companies are in effect like perpetual bonds, paying out ‘coupons’ (dividends or buybacks) year after year. Those coupons may grow over time, but that growth will not be the product of retained earnings, but rather factors like increased pricing or sales volumes. We can accordingly estimate expected returns from these securities in the same way we would for a perpetual bond — simply, free cash flow yield + growth. (E.g. if you pay $20 million for a company that makes $1 million in annual fcf (5% yield) and is able to grow at 5% without retaining any earnings, your annual returns will be 10%).

The trouble with companies fitting this model is that everyone understands their virtues, and so their stocks tend to trade for sky-high multiples, pushing the yield part of the equation down. For example, OTCM, which operates the over-the-counter-market infrastructure, is one of the most asset-light businesses you will ever find. But it currently trades for around 23x EV/FCF or a 4.3% yield. With the 10-year yielding around 4.1%, this means any excess returns need to come from growth. And OTCM’s growth has essentially grinded to a halt - EPS is basically flat since 2021, as is FCF after adjusting for working capital. Here is where the virtues of the asset-light model become an impediment — because OTCM’s business model requires no tangible capital, the company has limited levers to pull to stimulate growth.

Cipher Pharmaceuticals

With that out of the way, the business I am writing about today is a sleepy Canadian microcap (market cap CAD $138mm) called Cipher Pharmaceuticals. I have owned Cipher for around a year and have averaged up along the way.

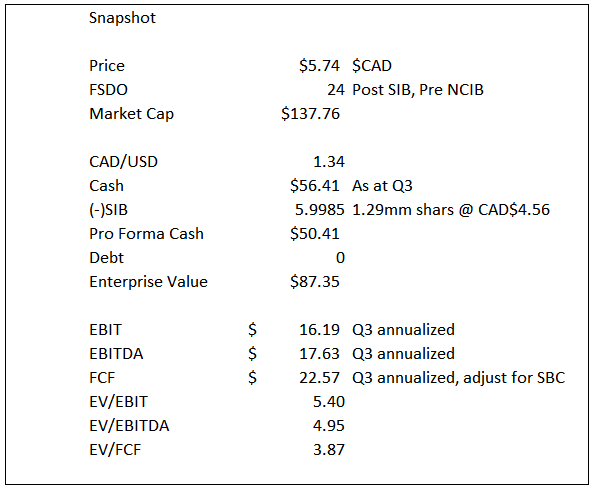

Cipher falls squarely into Buffett’s “The Great” category - it is an asset-light, high ROIC, competitively advantaged business operating in a stable industry. However, what makes Cipher so interesting is that, despite these characteristics, the company is being valued like it belongs in Buffett’s lowest tier — “The Gruesome”. Indeed, Cipher currently trades at around a 25% free cash flow yield. Given the company has effectively no reinvestment needs, we can therefore expect at least a 25% annual return even underwriting no growth, provided the present cash flows are sustainable.

But here’s the thing - Cipher is growing. Last quarter (Q3), after years of little, to negative growth, the company reported a 27% sequential increase in revenue, while adj. EBITDA grew by 37%. While there is no chance the core business continues sustainably growing at this rate, even a few percentage points worth of growth to add to the mid 20s FCF yield gets you close to a sustainable 30% annual return.

But that’s just the growth in the core business. It turns out that Cipher also holds the exclusive Canadian licensing rights to two drugs presently in Phase 3 trials that have a high probability of being game changers for the company. One of the drugs, MOB-015 for the treatment of nail fungus, whose trials are being funded by the Swedish company Moberg Pharma (MOB.ST), has already received approval in much of Europe. This indicates a high probability that the Phase 3 North American trial, which is expected to be completed by Jan. 2025, will be successful. As I describe below, the company projects that, if MOB-015 is approved, operating income will grow at a 38% CAGR through to 2027, resulting in more than a triple from TTM numbers. If so, the company is currently only valued at 1.85x 2027 EBIT (before giving any credit to the company’s other Phase 3 candidate, CF-101 for plaque psoriasis, which is another high probability shot on goal with approval expected by early 2026). It goes without saying that any company with the high probability of growing its earnings at this clip should be trading for well more than 4x EV/FCF (In fact, as I make clear below, I think the core business itself should be worth well more than 4x FCF.) Couple that expected growth in earnings with a 25% free cash flow yield, and we are looking at a multi-bagger.

I want to stress that we do not need these drugs candidates to be approved to do well here. This is by no means a speculative biotech bet. The core of the thesis is simply that we are buying a competitively advantaged, asset-light, cash generative business that earns high returns on capital, yet is being valued like it has no terminal value. Further, due to the low multiple and large net cash position, the core business offers large margin of safety. The pipeline is simply a free call option that could (and I think is likely to) provide huge upside; essentially, you get the upside of a speculative biotech without having to make a binary bet.

The Core Business

Cipher Pharmaceuticals is based in Oakville, Canada. It was spun out of CML Healthcare in 2003 by its founder John Mull.

Cipher’s core business involves the sale of various pharmaceutical products in Canada (“Products Segment”) and the licensing of products to companies in the US, through which it earns royalties (“Licensing Segment”). Unlike many pharma companies, Cipher operates an asset light model with a focus on cash generation. The company incurs de minimis R&D expense (USD $110 thousand as of the nine months ended Sept. 30). (Note the company reports it financials in USD despite its stock price being in CAD. This creates some confusion when analyzing the company, and likely causes some investors to miss how cheap this really is. Moving forward I will be using USD numbers unless otherwise specified.) Rather than taking on development risk, the company “builds its business through product acquisitions and in-licensing arrangements” - i.e. they purchase the North American rights to drugs being developed by other companies, thereby eliminating R&D spend and freeing up cash for M&A and capital returns.

The company’s key product is CIP-Isotretinoin, which is used for the treatment of severe nodular acne, as well as other forms of acne. The product is sold under the name Epuris in Canada and Absorica in the United States. (Note, despite being marketed under different names, these are the exact same product).

The Product Segment

Epuris comprises the vast majority of revenues from the Product Segment (~86%). Due to some of the challenges faced by Absorica, which I will discuss below, I believe investors have missed how much of a gem Epuris is. First, Epuris is the #1 prescribed oral isotretinoin in Canada with a 46% market share, and that market share has been steadily growing each year since its commercialization in 2013; Epuris sales increased from $2.6mm in 2013 to ~$10mm run rate today. Further, the market itself is large and growing. According to the Canadian Dermatology Association, acne affects nearly 20% of the Canadian population, primarily adolescents and females. And the Canadian acne therapeutics market is projected to grow at a 6.7% CAGR through to 2030.

In addition to robust and growing demand, dermatologists prefer Epuris to its competitors, mainly Accutane and Clarus, because it has better absorption and it does not need to be consumed with food. This latter fact is significant given the most common user - i.e. adolescent girls. Further, Epuris’ market dominance likely has staying power. This is because the economics simply are not there to incentivize new entrants. IQVIA estimates the oral isotretinoin market in Canada to be around CAD$39.1 million. After accounting for the costs of getting product of approval from Health Canada, which could run in the tens of millions, there is simply no incentive to enter the market (remember, Epuris is the lead product and only does $10mm of revenue). Additionally, Canadian drug prices are cheap (Epuris appears to run between $1-8 per day without insurance) and most people pay nothing due to insurance. Therefore, even if the economics were present for a new competitor to enter, it would be difficult to incentivize doctors and patients to switch brands absent clear advantages.

On this point, while there are medical treatments being onboarded which purport to be superior methods of remedying acne (e.g. Cutera’s AviClear), none of those have been able to achieve meaningful market penetration yet. So for now, demand for Epuris remains stable and acyclical (this is really as recession proof of a product as there is) and its economics are protected by fairly robust competitive advantages.

In addition to Epuris, the Product Segment includes numerous other products in the dermatology space and hospital acute care, as well as Durela, which is an opioid analgesic. Quietly, the Product Segment has grown sales around a 16% CAGR from 2018 through 2022, though grow has stalled out this year.

Licensing Segment

This growth in the Product Segment has been masked by declining revenues in the Licensing Segment.

The company’s key product here is its CIP-Isotretinoin offering in the US, which is marketed as Absorica. Absorica, which is licensed to Sun Pharmaceuticals, was formerly the company’s crown jewel, as Cipher earned ~100% margin royalties off of the product. However, in and around 2017, Sun ceased marketing Absorica due to the product’s incoming patent expiry in 2021. Unlike the dynamics at play in Canada that insulate Epuris from competition notwithstanding no patent protection, the expiry of the patent in the US led to the market being flooded with generic competitors. This is because 1) the US market is obviously far larger than the Canadian one (~USD$2.3B vs. CAD$39.1M) and 2) the cost of drugs is much higher in the US (Absorica can cost over $1000 for a month’s supply without insurance). As a result, the economics justified new entrants. Presently, there numerous generic versions of isotretinoin available in America, in addition to at least five brand name offerings. These generics can be much cheaper.

The Absorica patent cliff was disastrous for Cipher, with the share price peaking at $17 in 2014 and steadily dropping as the cliff approached, settling below $1 in 2020. The market reaction made sense given that Absorica represented well over 50% of the company’s revenues as recently as 2018. Given the sales decline in the company’s key offering, the company was perceived as a melting ice cube. Cipher’s revenue declined from a peak of $40m in 2017 to $22m in 2019.

However, declining Absorica sales created a huge opportunity for an astute investor. Hidden by Absorica’s rapid decline was the robust growth of Epuris. As Epuris grew and became a larger share of total revenue (Epuris now comprises ~50% of the total revenue, vs. ~25% for Absorica) the ice cube stopped melting. Indeed, the company’s revenue has largely flatlined since 2020, stabilizing at around $20 million.

Moreover, much to everyone’s surprise, Absorica sales have reversed course and started growing again. Last quarter (Q3), Absorica revenues were $2.6m, a 117% increase YoY. The increase is attributable to the fact that the company’s generic version of Absorica (Absorica AG) appears to be gaining market share.

The reason for this gain in market share is due to an amendment to the licensing agreement with Sun which has incentivized Sun improve market and pricing for the product.

As I will elucidate more below, we do not need any sustained growth in Absorica for this investment to do well, but it is obviously welcome and substantially increases the upside here, given that revenues from this segment have effectively 100% gross margins.

While Absorica is the key offering in the Licensing Segment (~72% of sales), the company licenses several other products, including Lipofen and its generic, which is a stable, mature product for the treatment of high cholesterol.

Further, in May 2023, the company entered into a licensing agreement for Epuris in Mexico. Royalty revenue for this product to-date has been small (~$100K), but could provide further upside down the road.

Altogether, the Licensing Segment has accounted for ~42% of revenue YTD.

Financials

As you can see, Cipher has both an attractive capital structure (zero debt, with a large cash balance) and trades for less than 4x FCF on annualized Q3 numbers, which is generally the company’s weakest quarter. I think this low multiple is incredibly undeserved given the stable, cash generative nature of the core businesses and Epuris’ market dominance. I think Cipher’s core business is conservatively worth 7-8x FCF, or between $9-$10/share, after accounting for cash and before giving credit to the ongoing buybacks.

A closer look at the company’s financials drives home the unique combination of quality and value Cipher offers.

Beginning with the balance sheet, it is immediately obvious how asset-light the business model is. As of Q3, the company had $90.5mm in Total Assets; nearly half of that ($42mm) is cash, another $20.8mm is deferred tax assets (which themselves are very valuable), and $17.5mm is goodwill and intangibles. After backing this out, you are left with very little in the way of tangible assets: ~$7mm in average receivables, ~$2.5mm of average inventory, and $412k (yes, thousand) of PP&E. The company has no financial debt and nominal lease obligations. After adjusting for average NIBCL’s, net tangible invested capital (which I use as the denominator for ROIC) is around $4m.

TTM EBIT is ~$10m. This means that the company is generating 250% pre-tax returns on net tangible capital invested. Essentially, ROIC here is infinite. Because of the company’s light operating model, whereby it simply purchases the rights to assets from other companies to sell in Canada and earns royalty income in other countries, Cipher effectively needs no incremental capital to run its business. In case you think I am exaggerating, have a look at the cash flow statement.

The first thing to notice is the working capital adjustment. While the company does need to reinvest some earnings into replenishing inventory, that spend is a tiny fraction of over all cash earnings. What is really eye-popping here though, is that the cash used in investing activities section is completely blank, reflecting the total absence of capex to sustain the business. Furthermore, because the company has no debt and has sizeable tax loss carryforwards, this means that EBITDA is approximately equal to free cash flow.

A pessimist might be thinking that Cipher is hiding its reinvestment on the income statement, expensing it as R&D and SG&A rather than capitalizing it. But that’s not the case, as evidenced by the company’s robust ~50% EBIT margins. YTD (first 9 months 2023) R&D spend has only been $100k, in line with 2022. Moreover, SG&A has been 4.4m, with ~$1.8m of that as salaries and SBC. About $1.5 million of SG&A is for professional fees, some of this relating to a contract sales force to promote Epuris in Canada. While this might fairly be characterized as a growth investment, this is at most a single digit % of total revenue.

High margin, low capital intensity businesses like Cipher are capable of generating piles of cash. And as a result of the market’s refusal to put a reasonable multiple on this business, Cipher is able to generate sizeable chunks of its value in cash every year.

Cipher’s present management team has done a great job of allocating this cash. The company’s focus is to purchase the rights to promising but overlooked drugs, and therefore they like to maintain a sizeable cash balance for opportunistic M&A. However, the company has recently commenced sizeable share repurchase programs, which are obviously highly accretive at this low multiple. In September, the company announced a Substantial Issuer Bid (“SIB”) (essentially a tender offer) to repurchase CAD$6mm worth of stock. The SIB was completed within a month, with the company purchasing 1.29mm shares or 5.1% of shares outstanding for at was then a large premium of $4.65/share.

Following the SIB, the company has continued repurchasing shares, announcing a Normal Course Issuer Bid in November for up to 10% of shares outstanding. Given the high levels of cash generative and limited opportunities to deploy that cash, I expect the company will continue aggressively buying back shares provided its valuation remains this silly.

The Pipeline

As noted, I think the core business + cash is conservatively worth around $9-$10/share, offering up to 75% upside from the current price. But this is before giving any credit to the company’s pipeline, which I believe has a high probability of success and, if so, easily makes Cipher a multi-bagger.

MOB-015

MOB-015 is a drug being developed by Swedish company Moberg Pharma (MOB.ST) for the treatment of Onychomycosis (i.e. nail fungus). Cipher owns the Canadian rights to this product. I want to highlight two things here, first being the likelihood of success. While all bets on drug development have an element of speculation, the prospect for MOB-015 panning out is about as high probability as it gets. For one, the product has already been recommended for approval in 13 European countries, having demonstrated 76% mycological cure vs. 42% in comparators. The product is currently in Phase 3 trials in North America, with results expected by Jan. 2025. The drug already underwent Phase 3 trials, in which it successfully met all endpoints but resulted in unwanted coloration of the nail. Therefore, Moberg is running the trial again with a lower dose. Given the fact the drug has already been approved in Europe, and given the coloration issues should be easy to remedy, I think the likelihood of approval here is very high. And I am clearly not alone in thinking this. MOB-015 is Moberg’s only advanced asset: and Moberg’s stock has been on a tear, up to 19SEK/share from low single digits in mid 2023.

The second thing I want to highlight it just how big the opportunity is. Cipher estimates the Onychomycosis market in Canada to be worth CAD$82mm. The market is expected to grow at around an 8% CAGR through to 2030. Currently, Bausch’s Jublia is the primary treatment, with about 90% of the market share.

Importantly, doctors and patients hate Jublia. Patient reviews on Drugs.com show an average rating of 5.6/10, with 43% of the 227 reviews reporting a negative experience. Dermatologists likewise would prefer to not to prescribe Jublia, but have no alternatives available. This sentiment is borne out in the data, as the North American Phase 3 trials showed as 84% mycological cure rate in MOB-015 vs. 54% for Jublia.

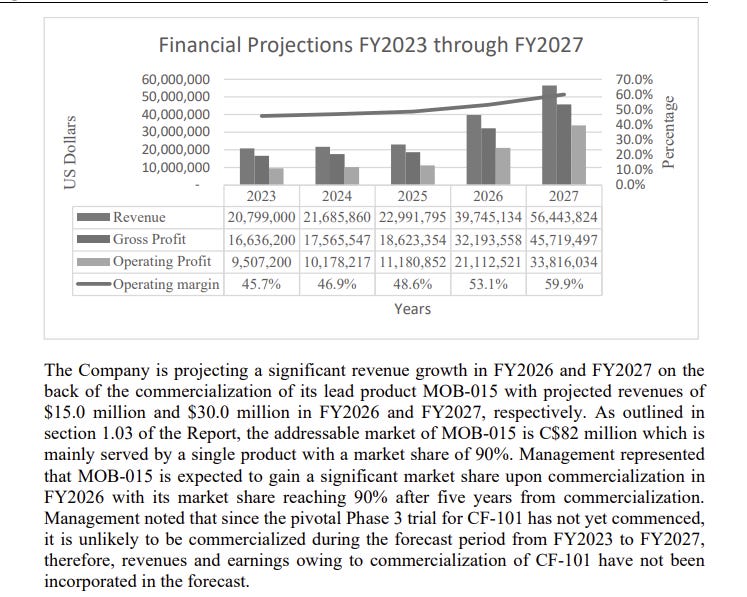

So MOB-015 has the potential to capture a sizeable amount of a large and growing TAM. Approval will result in enormous economic benefits to Cipher. In addition to $14mm of milestone payments for certain regulatory and sales thresholds being reached, the company is also entitled to royalty payments on net sales. Rather than modeling this out myself, let’s look at the third party valuation report buried in the company’s SIB prospectus from September.

This is absolutely jaw-dropping. As you can see, the company expects MOB-015 to eventually capture 90% of the market within five years of commercialization. But in the nearer-term, the company expects MOB-015 to contribute USD$30mm of revenue by FY 2027, leading to company level operating profit of $33.8mm, or more than triple today’s number. To put this into perspective, Cipher’s present EV is only US$60mm, meaning Cipher is trading at less than 2x 2027 EBIT at today’s prices, which is a decent proxy for FCF given de minimis capex requirements! If the current TTM multiple of 5x EBIT were to stay flat (it wouldn’t, given the transformation from a no growth to high growth business), this would result in an EV of $165mm. Assuming a flat cash balance ($42) (and ignoring the impact of buybacks), this results in a market cap of CAD$278mm or $11/share. Obviously, that severely understates the upside as it fails to account for the material cash build and buybacks that will occur in the interim. Moreover, 5x EBIT is way too low of a multiple for a stock projected to grow the top line at a 28% CAGR and EBIT at a 37% CAGR with operating margins expanding towards 60%. Such a company should be deserving of at least a mid-teens multiple. I won’t lay out all the math for you, but suffice to say if the projections above are anywhere near correct, we are looking at what is easily a +$20 stock in just a few years (e.g. at 12x FY27 EBIT and a 25% reduction in the share count, you are looking at $21/share, or more than 4x return, before giving credit to any cash on left on the balance sheet).

Obviously, these projections should be taken with a grain of salt. But given the size of the nail fungus market and the clear superiority of MOB-015, I don’t find these estimates outlandish at all. I’d also add that I do not find this management team at all promotional or prone to hyperbole.

CF-101

Cipher’s second Phase 3 candidate is CF-101, which it acquired the Canadian rights to from Can-Fite BioPharma (CANF). CF-101 is intended for the treatment of plaque psoriasis, which is estimated to be a CAD$600mm market, of which $45mm is moderate to severe plaque psoriasis. The drug is currently in a pivotal Phase 3 study with results expected by 2026. Here is what the company has to say about the drug in its MD&A:

I won’t elaborate further on this candidate, given we are still a few years out from commercialization. However, given its success in trials so far, this another high probability shot on goal that the market is presently giving Cipher no credit for.

Management

After founder John Mull’s departure from the company, subsequent management teams lost the confidence of shareholders, due to some poor acquisitions, including Innocutis for $45mm and Cardiome for CAD$24.5mm. These acquisitions were utterly value destructive.

In 2019, John Mull’s son, Craig Mull, was brought in as CEO to right the ship. In my view, he has done an excellent job allocating capital and I expect him to take a patient, but opportunistic approach to M&A.

The Mull’s collectively own a little over 40% of shares outstanding, with that number set to grow as buybacks progress. While some investors have concerns about family controlled companies, the Mull’s clearly think and act like shareholders and are clearly incentivized to create shareholder value. While Craig’s base and equity comp is higher than I would like it to be, he has much more economic interest qua shareholder. Moreover, given the impressive turnaround in the share price since he took over, it is hard to say any of his comp in undeserved.

Why the Opportunity Exists

This an obligatory section for this write-up given how much praise I have given this company in comparison to its lowly valuation. So why does this opportunity exist?

For one, this is a boring, relatively non-promotional Canadian microcap, with limited liquidity (the Mull’s have +40% of the float tied up). Despite the share price run, this remains too small and illiquid for anyone of real size.

Some people have concerns about family controlled public companies, particularly in the microcap space (though, as I just said, I am not worried about this at all);

The company screens like a melting ice cube. Given the weighting, Absorica declines have historically more than offset the growth in Epuris, which has made the company’s declining sales look far more dire than they are;

Investors are likely scarred from the terrible prior management teams, not noticing that the Mull’s have reasserted control;

Investors are not underwriting any value for the pipeline, not noticing the high probability upside offered by MOB-015 that lies only a few years out.

Risks

There is a huge margin of safety here given the low valuation, the large and growing cash balance, and no debt. Even if demand for Epuris/Absorica were to fall to 0 within 5 years, e.g. due to a superior competitor - you would still make all your money and more back from the interim cash flows. Obviously, MOB-015 and/or CAN-101 could turn out to be busts, but as I said above, the company should be worth up to 75% more than the current share price just based on the core business alone.

Other than the failure of the pipeline or precipitous declines from the isotretinoin products, the most obvious risk here is that management engages in poor M&A. While possible, the Mull’s have been incredibly patient on this front so far, and given their commitment to buybacks, I think the odds of chasing a silly acquisition are low.

Perhaps another reason why this is still cheap is due to the fact that the licensing agreement with Sun on Absorica and Absorica AG is due December 2026 and Absorica LD due December 2024. They represent about 40% of revenue.

-----------------------------------

Let's play with the worst case scenario: Total revenues remain flat up to FY26 (Assuming MOB-15 sales haven't picked up & slight delays and whatnot). They don't come to an agreement with Sun, so 30% of revenue is cut off. Epuris not picking up sales in Mexico.

We have currently at Q1 2024 (USD):

MC=154M

cash = 42M, debt=0

EV = 112M

TTM EBIT= 11M ish

TTM EV/EBIT = 10x

-----------------------------------

Assume EBIT=FCF= 2.75M / quarter.

FY26 numbers=11 quarters left.

11*2.75=30M extra cash so we have

(assuming same stock price):

MC=154M

cash=42+30=72M

EV=82M

EBIT cut by 40% so we get 0.6*11=6.6M

FY26 EV/EBIT = 82/6.6 = 12.4x

So essentially 20% more expensive (but 47% of MC is cash), assuming Epuris sales to Mexico don't increase, everything else remains stable, MOB-015 not getting any credit, etc. If they come to an agreement with Absorica, we suddenly have EV/EBIT of 7.4x just from the underlying business.

Interesting idea. I just saw that Medexuss has a topical terbinafine product expected to launch in Canada in the first half of 2025 ahead of Cipher. Do you have any thoughts on this? Why would MOB-015 beat out this competitor? Management is expecting 90% market share?