The Investment Case for Movie Theatres -Part II: An Operator w/ Monopoly Market Share

A very likely acquisition target, with another high-margin monopoly business embedded, an interesting growth segment, and a valuable hidden asset to tie it together

Disclaimer: Nothing on this blog is intended as financial or investing advice. Please do your own due diligence.

Much of this thesis hinges on a single premise: viz. can the box office return to at least 75% of its 2019 attendance levels going forward?

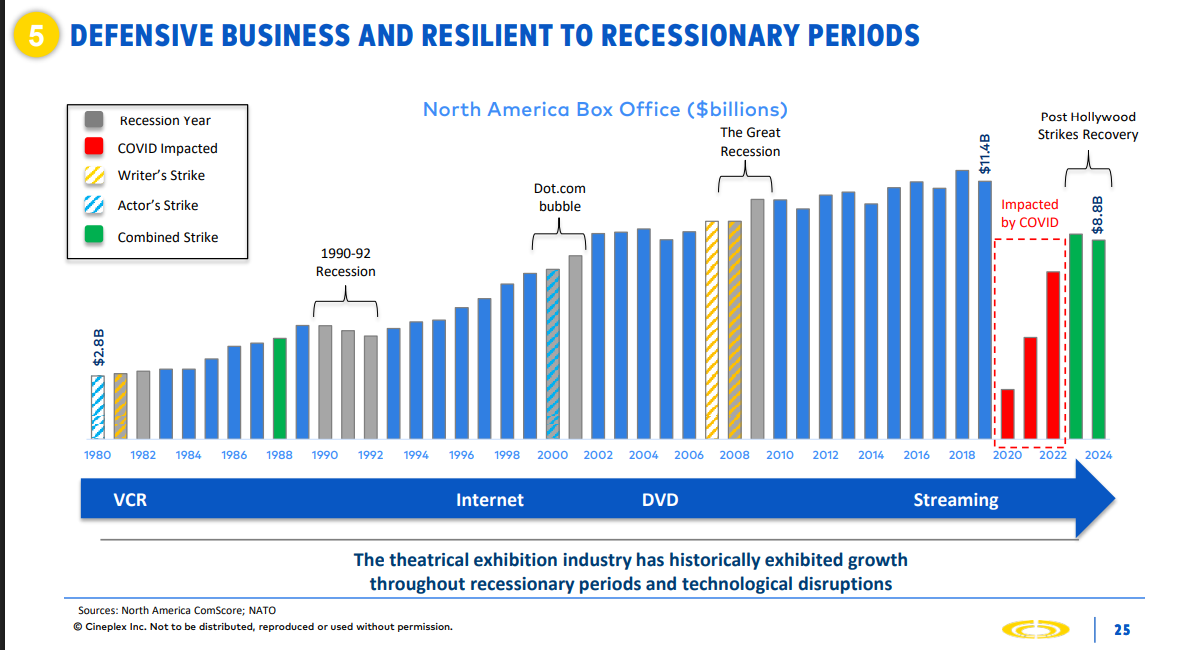

I wrote over 5000 words in Pt I laying out the historical case in support that premise — my view being that despite the 100-year prevailing narrative that movie theatres are dead, the industry has in reality been remarkably durable and ultimately follows a cyclical pattern that we find ourselves on the right side on. I therefore won’t spend much time here trying to support that premise further, but for those who remain skeptics I would encourage you to run some Google searches on recent box office numbers and expectations for the next 24 months, as well as reading this quarter’s call transcripts from CNK 0.00%↑ and NCMI 0.00%↑ (no position in either) , which should lend some further credibility to my views.

The stock I want to highlight for playing this theme is Canadian exhibitor Cineplex ($CGX.TO). At ~$10/share, Cineplex has a market cap of ~$640m, which steps up to $850m if we treat the $216m convertible debenture with a $10.29/share conversion price as equity (which I do). Cineplex also has a $575m Note due in March 2029 and $83m of cash as of the end of 2024. The enterprise value is accordingly ~$1.34B. (All $ are CAD). (NB: CGX reports tomorrow. Results will be weak, both for seasonal and content related reasons, and could lead to near-term softness in the stock price, but I suspect that’s mostly priced in as Cineplex’s box offices numbers are already disclosed. In any event, this is all about the next 24-36 months and beyond).

While Cineplex primarily derives its revenue from its movie theatre operations (~80%), it is much more than just an exhibitor: it also has a very attractive Media segment and an interesting growth segment in its Location Based Entertainment (LBE) business, each contributing ~10% of total revenue. The company presents itself as a diversified entertainment and media company, and I will touch on the various pieces as we go along.

Beyond the attractive industry themes laid out in Part I, here are the high-level reasons I like Cineplex specifically:

Market Power. Cineplex has a near-monopoly on movie theatres in Canada, with just shy of 75% of the total market. This dominant market share gives it crucial scale benefits and leverage over suppliers and landlords, which in turn drives operating efficiency, while the absence of competition also enables it to exercise even more pricing power than its US peers. As you’ll see, CGX has increased prices every year for two decades.

Macro Beneficiary. The Canadian consumer is weak right now and the country is likely in the midst of a protracted economic downturn. Canadians are thus likely to shift away from more expensive entertainment and travel and towards local and lower price point options. Despite significant prices increases, going to the movies remains one of the cheapest forms of entertainment, and I expect the Canadian box office to benefit, or to at least be resilient, in the face of a challenging macro environment. History supports this view.

“Premiumization”. Cineplex has intelligently invested in upgrading its offering over the years, with 42% of its box office revenues now coming from premium formats, which has helped drive average spend per patron to new highs quarter after quarter. There is further runway here.

A High-Margin Media Business. On-Screen advertising before the movie starts is highly valuable ad inventory because it boasts top-ranked attentions scores. Unlike US peers, which rely on National CineMedia (NCMI) to sell their inventory (and accordingly split the revenue), Cineplex owns and operates its own media business — Cineplex Media (CM). By fully capturing the economics of valuable on-screen advertising, Cineplex generally earns an extra >$1.50/per patron of high margin revenue, which upgrades its “earning’s quality” and helps support the company’s high fixed cost structure in periods of soft box office demand. CM also provides its services to third party theatres, giving it a domestic monopoly in this attractive niche. There is also a separate and attractive digital media business (Cineplex Digital Media) that I’ll discuss below.

A Growing LBE Business. Cineplex has been allocating capital to building out its LBE business, which is best thought of as a modernized Dave & Busters for millennials (arcade games, axe throwing, bowling, etc. + food and beverage). To-date, units have achieved ~20% returns on cost with 20-25% store level margins, and the segment currently contributes >$30m of EBITDAaL. This segment may be impacted by a weak consumer, depending on the extent of the downturn, but it’s a relatively small mix of the overall business and adds strategic value and another diverse revenue stream.

A Valuable Hidden Asset. Cineplex has hidden value in its Scene Loyalty Program, a joint venture with Scotiabank and Empire (a leading Canadian grocer) which has over 15 million members, or nearly 40% of Canada’s population. While this is important on its face for building consumer loyalty to drive attendance and engagement, there is also value in the robust data the program has collected over Cineplex’s nearly 20 years of operating it. As evidence of that value, Cineplex sold a 17% interest in the program for $60m in 2020 (out of distress in COVID), implying a $350m value for the program, or ~$115m for CGX’s retained share. Notably, the number of Scene members has increased by 50% in the fives years since, implying that mark is now way too low.

Attractive Valuation. If Cineplex can return to 80% of 2019’s box office attendance of ~66m (which I view as very likely given my thoughts in Pt I, the upcoming film slate, and Canada’s huge population growth since), it would generate $1.2B in revenue from the theatre segment or ~$200m of EBITDAaL. Conservatively assuming no growth from Media and LBE, combined EBITDAaL after corporate costs would be~$220m, which would put CGX at ~5-6x EV/EBITDAaL, which is far too cheap, both in the absolute, and relative to historical and comparable multiples. At a more reasonable 10x EBITDAaL, the stock is worth ~$20/share for 100% upside. On a cash flow basis, after interest and mnt. capex (there are meaningful NOLs), $220m of EBITDAaL should translate to >$100m of free cash flow, or ~17% on the current equity cap. There is ample upside to these numbers from Media and LBE growth, and reduced interest expense as the company deleverages. Finding ourselves at a 20% FCF yield in a year or two does not seem out of the question, at which point the stock is worth at least $25/share.

Relative Underperformance. Cineplex has historically traded in correlation with US operator Cinemark, but while the latter’s stock seems to have woken up to the cyclical inflection in the industry, CGX has not. While the capital structure is not apples-to-apples, it is notable that CGX is down 60-70% since the pandemic, while CNK is only 25% off its highs. No doubt CNK has been crushing it on execution, but I think this is also attributable to a sleepy, more conservative Canadian investor base (CGX used to be a dividend payor) and likely some technical dynamics related to the debenture holders hedging out equity risk by shorting the commons (CGX short interest is ~8.5%).

Likely Acquisition Target. Finally, given Cineplex’s positioning as a monopoly, the attractive economics of its customer/supplier financed operating model, and the tremendous sum-of-the-parts discount that could be unlocked, I consider CGX to be a very likely acquisition target. (see e.g. here).

The Theatre Segment

To many Canadians, the word Cineplex is synonymous with movie theatres. The evolution from merely a company to a brand is an inevitable consequence of the fact that, for the last couple decades, Cineplex theatres have been in the only game in town in much of the country. As of year-end 2024, Cineplex operated 1617 screens in 156 theatres across the country and held 73% market share, with the second largest player, Landmark, coming in way below at 13%.

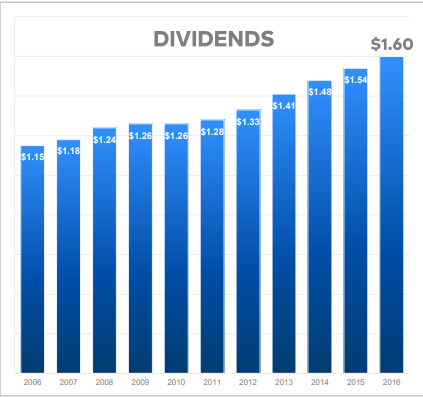

Cineplex benefits from its market dominance and scale in all the obvious ways, including reduced film and concession costs, fixed cost leverage, and pricing power. These attributes historically translated to remarkable success and made CGX a Canadian darling as it generated a 20% CAGR from 2003-2016, constantly grew its dividend, and hit a peak multiple of ~14x EBITDA:

Enthusiasm for the company began to decline in 2017 as box office attendance trended down from its peak of 77m to 66.4m by 2019. The stock responded by declining from ~$50 to the mid $20s coming into COVID. Notwithstanding the persistent declines in attendance, Cineplex flexed its pricing power all the way through to help offset volume declines, with box office per patron (BPP) increasing every year from $7.99 in 2006 to $10.63 in 2019, and concession per patron (CPP) from $3.72 up to $6.73. As remains the case today, while some of that PP pricing upside was ‘organic’, it was also driven by higher price points for premium offerings.

In late 2019, Cineplex received a buyout offer from UK listed Cineworld for $34/share, valuing the EV at $2.8B or 10x EBITDAaL. However, Cineworld backed out of the deal following the onset of pandemic.

The pandemic was, of course, an immense challenge for the company. Box office revenues dropped from $700m to $100 and, given the fixed costs involved, keeping the lights on required extraordinary measures. The dividend was eliminated, RIFs were implemented, rental abatements negotiated, and non-core assets, including 1/3 of the Scene program and the company’s head office building, were sold. Additionally, the company was forced to take on $300m of convertible financing. Though painful, the measures did ultimately work.

While attendance remained extremely depressed in 2021, things began trending in the right direction, with 38m of attendance in 2022 stepping up to 48m in 2023, driven largely by the ‘Barbenheimer’ window. The box office then hit a snag in 2024, which, as I discussed in Pt I, I believe is entirely attributable to a very weak slate caused by the Writer’s Strike. Through it all, Cineplex has continued to take price and BPP has CAGR’d at 4.5% since 2019, with Q4 24 setting a new record at $13.26.

Again, a big key to this success has been the mix shift towards premium format ticket sales, which were responsible for a record 42% of box office revenues in FY24. This was aided by the installation of 4 IMAX screens and upgrades of five auditoriums to all-recliner seating.

Moving to concession, the other major theatre revenue stream with higher margins, the transformation here since COVID has been even more impressive, as CPP has grown at a 7.1% CAGR since 2019, and exited 2024 at $9.41. Increases have been driven by improved menu options from Cineplex’s internal brands, third party brands, a vastly expanded liquor offering, in-theatre service, and partnerships with delivery services like Uber Eats (i.e. people ordering theatre popcorn, etc. to their home). This year, the company rolled out concession ordering on its mobile app, allowing guests to pre-order.

Current BPP and CPP sum to an overall spend per patron of $22.56 - i.e. that is the average revenue earned per attendee. Assuming that holds (and it should at the very least hold, given both CPP and BPP have essentially grown every year for two decades), we can calculate theatre segment revenue depending on our estimates of attendance. (For reference, 2019’s attendance level was 66.4m.)

As noted above, attendance in 2023 and 2024 was 48m and 43m respectively. While we already know that Q1 25 came in weak at ~81% of Q1 24, we can be pretty confident that attendance this year will be well in excess of 2024 (apparently, the first week of April exceeded 50% of the entire box in April 24). As I flagged in Pt I, CNK expects to see 90% of pre-pandemic attendance this year. Moreover, NCMI, which has insight into the big three US operators, noted on its call this week that the contribution from Minecraft in April more than offset the weak Q1 and that the rest of the year is “also shaping up to be very promising”.

Cineplex’s long communicated target is less ambitious than CNK’s guide: to return to 80% of 2019 attendance. Management will surely give some color on how likely that is for 2025 on the upcoming call (this Friday), but even a return to 75% should be great for the company (keep in mind that the broad consensus is that the box office will be even stronger in 2026). One further warranted consideration on the prospects of this ambition is that Canada’s total population has grown by 10% or so since 2019 (~4 million people), so clawing back attendance numbers will require less relative penetration.

Using a range of 75% to 80% of 2019’s 66.4m of attendees at a total spend of $22.56 per patron (assuming no growth in PP spend) results in theatre segment revenue of $1.12B - $1.2B.

Film costs vary depending depending on the strength of titles, but have historically run at ~52% of BPP. Meanwhile, concession cost has generally been ~22% of CPP. That means at 75-80% of 2019 attendance, the theatre segment should do between $680-$730m of gross profit.

On the opex line, there are a couple important things to note. First, Cineplex (and movie theatres in general) have significant operating leverage given a large part of their cost structure is fixed occupancy expense — incremental margins are high. Second, because it is difficult to convert movie theatre real estate to different uses, and because Cineplex is mostly the only game in town, Cineplex has decent leverage over landlords and cash lease expense has actually been flat to down in recent years (aided by taking underperforming locations offline). Given that, cash occupancy expenses should stay constant at ~$220m.

After deducting payroll and other expenses, which are a function of utilization to some extent and thus have a variable component, I get to ~$180-200m of EBITDAaL (~15% EBITDA margin) at the segment level (i.e. before G&A), if attendance returns to 75-80% of 2019, with high incremental margins for attendance in excess of that.

(I am going to value Cineplex as combined entity based on FCF later on, but I do think valuing the parts here is relevant given the take-private angle.)

Given Cineplex’s market power and the capital efficiency of a scaled movie theatre business (as we will see, Cineplex is financed entirely by liabilities — funded in part by customers and vendors), as well as in reference to historical industry multiples, I view 10x EBITDA as a reasonable multiple. At that valuation, the theatre business is worth $1.8-2B (compared with $1.34B EV for the entire entity today).

While that may appear silly at first glance, one should note that is nearly $1B less than the Cineworld bid in 2019 for the whole company (Media, LBE and everything else, including some since divested segments), and well less in real terms. Further, a 15% EBITDA margin is not exactly aggressive for a theatre business during a solid box office period. I am also not underwriting any further pricing increases for BPP and CPP.

A couple more things about the theatre segment before moving on.

First, despite the positive impact that ‘premiumization’ has had, Cineplex has room for further upgrades over time, with less than 20% of its auditoriums currently equipped with recliner seating and less than 10% with PLFs. Obviously, these upgrades require capex that for many auditoriums would be uneconomic or unfeasible, but there is nevertheless some room:

Second, now is probably the right time for comment on the Scene Program, although readers should note this program has relevance to each of Cineplex’s three segments. This is your usual points program: earn points by spending money with participating businesses that can later be redeemed for rewards. As I noted in the introduction, this program is enormous with 15m Canadians (~40% of the population) as members (at least on paper — there are obviously many "dormant” members).

Cineplex founded this program around 20 years ago, but has since brought major Canadian companies Scotiabank and Empire into it within a JV structure. Again, based on the mark set by Cineplex’s 2020 sale of 17% of the program, the Scene program is worth at least $100m at-share, and likely far more, given membership has grown by 50% since the sale.

While you may not see further monetization, the real value comes not merely from generating customer loyalty, but also from all the data Cineplex has compiled on the millions of Canadians that have used the program over two decades. Among other benefits, this data aids the targeted marketing efforts I touched upon in Pt. I and is a crucial advantage for the Media business (particularly CDM, as I will elaborate on below):

Beyond the significant hidden value of the Scene Program, it results in a couple notable accounting impacts that investors should be aware of. Firstly, the issuance of new Scene points are recognized as marketing expenses on the income statement. Second, obligations for issued points are on the balance sheet as deferred revenue (because the points can be redeemed towards tickets and concession items). When you add in ~$170m of deferred revenue from gift cards (which are great from a cash flow perspective), Cineplex currently has ~$200m of deferred revenue on its balance sheet as a liability. This, in addition to low inventory levels, payment lags to suppliers (film and concession), and IFRS lease accounting rules, results in Cineplex’s balance sheet showing not only negative working capital, but negative book value. While this might appear concerning, this is one of the perks of the theatre business and one reason I view this company as a hugely attractive acquisition target — it can be funded largely, if not entirely, by liabilities, with the negative working capital and deferred revenue serving as cheap financing akin to ‘float’ — resulting in an ongoing cash flow benefit and high capital efficiency.

The final pieces I want to note on the theatre segment are:

Cineplex has a distribution partnership with Lionsgate Entertainment as well as its own distribution company, Cineplex Pictures, which provide it with valuable strategic positioning as well as an additional revenue source;

The Canadian population is extremely diverse, which creates unusual levels of demand for foreign films. Last year, 10% of Cineplex’s box office revenues came from international titles, despite those films only comprising 3.7% of the box office in North America. This diverse customer base helps Cineplex sell tickets for a much wider content slate compared to its peers, helping fill the whitespace between big domestic draws.

Cineplex is increasingly leveraging its auditoriums for unconventional uses such as airing major sporting events, rereleases of popular films and exclusive programming highlighting important films or filmmakers (e.g. the Fincher Files, in which Cineplex aired several classic films from Fincher’s filmography for a month). Given the exceptional viewing experience provided by its PLFs, coupled with concession improvements, I expect this to be a growing trend over time.

The Media Segment

Cineplex Media (CM)

You know those advertisements that play on the screen before the trailers and feature?

Well, as it turns out, that is incredibly valuable ad space. Recently, Cineplex commissioned a study with Lumen, a tech company focused on attention measurement, to assess the attention score for, and impact of, on-screen cinema advertising. The results:

Cinema ranks #1 for all paid advertising in attention score, 2-5x higher TV;

This high attention rate results in high levels of audience recollection and a later preference towards brands they saw advertised on screen;

Significantly, attention scores are high even among younger demographics that are generally more difficult for advertisers to target.

The findings here give validation to something largely intuitive: people are more likely to actually watch ads on theatre screens than they are elsewhere because what’s happening on the screen is the occasion and distractions are minimized (less chatting, phones are put away, etc.). As a result, cinema advertising is a big business.

In the United States, the big three operators outsource the selling of their advertising space to NCMI , which is dominant in this niche with >60% market share. The theatres and NCMI share the revenues. NCMI was forced to file for bankruptcy during COVID, but it is a high quality business given its market position, asset light business model, and high FCF margins, and has historically traded at >10x EBITDA.

CM is the Canadian version of NCMI with some idiosyncratic quirks, mainly its vertical integration within Cineplex. Specifically, although CM does sell ad space for third-party cinemas, Cineplex is itself the largest ‘client’. One way to look at this is that CM, unlike NCMI, does not have to share its revenue with its major client; but because CM is wholly owned by Cineplex, the more practical viewpoint is simply that CM is part of the movie theatre business, which means that unlike its peers in the US, Cineplex’s theatres are actually able to capture the entire economics of the ad sales on its screens.

Moreover, CM is a monopoly, as it also sells ads for ~50 third party cinemas across the country, in addition to Cineplex’s 156 theatres (which alone comprise 3/4 of the market).

Finally, remember all that Scene membership data? Well, CM can leverage this to help increase the value of its services.

Although it is difficult to separate CM from the theatre segment, I would argue that these features actually make CM a superior business to NCMI.

The economics for CM are tied, among other variables, to attendance levels and the nature of the content — e.g. advertisers will spend less for ads before kids’ movies — as well as the general factors impacting advertising demand (e.g. the health of the economy).

In 2023 and 2024, CM earned $80m of revenue, although on a per patron basis (CMPP) revenue increased to $1.84 from $1.67 the prior year. For reference, this business did $115m of revenue in 2019, which translates to $1.73 CMPP (so here again we’ve seen per patron growth). While increased box attendance should benefit CM ahead, I am cognizant that a weaker macro backdrop is very likely to hurt overall ad dollars (as noted by NCMI this week). Therefore, I’ll assume CM earns the same $80m in revenue ahead; that implies CMPP dropping down to ~$1.50 assuming a return to 80% of 2019 attendance.

Cineplex Digital Media

The second arm of the Media segment, CDM, is Canada’s largest digital-out-of-home (DOOH) shopping media network and a provider digital signage solutions for shopping center retailers, restaurants, entertainment destinations, etc.

DOOH can essentially be thought of as a network of digital billboards. CDM installs digital screens in high traffic areas (e.g. malls), sells ad space on those screens to companies (leveraging CM and Scene data), who in turn pay CDM based on estimated impressions, time slots, etc. CDM’s DOOH coverage includes 9 of the 10 busiest malls in Canada, and the company is looking to expand internationally.

CDM also provides end-to-end digital signage solutions for clients (e.g. digital menu boards at fast food restaurants), which services include design, management, and maintenance.

CDM revenues are split between “Project” revenues (lumpy hardware sales and professional services like design and installation) and “Other” revenues (software sales and DOOH advertising). 2024 CDM revenue was $56m, up from $39m the prior year, largely driven by the commencement of an agreement with a large mall operator. During Q4’s earning call, management indicated that CDM is expected to grow during 2025 given a couple large contracts secured in 2024, albeit at a reduced rate. I’ll conservatively assume $60m in sales ahead.

While CDM is certainly not core to the thesis, it is an attractive, margin accretive segment that has generated impressive growth since its launch ~15 years ago, although it remains well below its 2019 highs:

Combined Media Segment

Segment level 2024 EBITDA was $65m, representing a 49% margin, which was likely compressed due to CDM’s revenue mix (margin was 56% in 2023). Assuming CDM revenue grows to $60m and CM remains constant at $80, the Media segment should generate something around $70m of EBITDA ahead. While I recognize the practical complexity in valuing the Media segment as a standalone business given the vertical integration, for a theoretical SOTP analysis this segment could be worth ~$700m at 10x EBITDA.

The LBE Segment - Rec Room and Playdium

Cineplex’s LBE segment comprises 16 locations across Canada with two separate concepts: Rec Room and Playdium.

Rec Room is basically a modernized version of Dave & Busters focused on millennials. Each of the 12 locations currently in operation have variations in offering, but include e.g. bowling, axe throwing, arcade games, VR, shuffleboard — as well as casual dinning and drinks with large TVs for viewing sporting events. Playdium (four locations) is a similar idea but tailored to kids. Revenue are ~65/35 split between amusement (high margin) and food service, with amusement growing at a much higher clip with improved offerings like VR.

While this industry has become increasingly competitive, the LBE segment benefits from high-traffic locations and modern buildouts (avoiding the dated aesthetic and content offering that has plagued other companies in the space like D&B).

Cineplex targets attractive unit level economics with these locations: $10m build cost and 25% EBITDA margins on $10m of annual revenue, resulting in 25% returns on cost. Last year, store level margins took a hit to ~23%, impacted by increased staffing and occupancy costs. While I think there’s room to get back over 25% with high margin amusement offerings being rolled out, these boxes are perfectly attractive at 23%.

With three new locations having opened late in Q4, I think sales should comfortably increase to $145m in 2025, an estimate that underwrites SSS declines to account for macro weakness. At 23% margins, that’s store level EBITDA of ~$35m. That should be very conservative given 2023 saw $38m of EBITDA on 13 locations, and the three new locations are in high traffic areas, including Vancouver’s Granville strip. At 6x EBITDA, the LBE business is worth ~$210m today, with further upside for unit growth.

Over time, the company intends to grow this segment to at least 30 locations. As I said above, I think this is a fine use of capital, although I think it’s more likely than not CGX gets broken up or taken private before we get there. There are definitely buyers for LBE assets like this, e.g. London listed Hollywood Bowl, who has previously purchased Canadian based LBE assets.

Summing the Parts

After capitalizing annual G&A of $80m, I arrive at a SOTP valuation of ~$19.75, or ~100% upside from today’s share price. My numbers assume a return to 77.5% of 2019 attendance, no growth in the other segments, zero monetary value for Scene, and uses a fully diluted share count of 85m to adjust for the convert.

Cash Flow Analysis

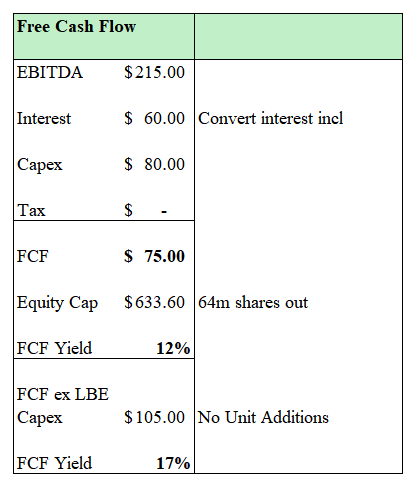

Obviously, outside of being broken up or acquired, this SOTP valuation may not be relevant, but we get to a similar valuation from a cash flow analysis. Currently cash interest expense for the debt instruments (incl. the convert but excl. lease interest which I expense out of EBITDA) runs at ~$60m. Capital expenditure are ~$80m, but a large portion of that relates to the ongoing build out of new LBE units and theatres (i.e. growth capex). Notably, I believe there are no new LBE units in the works for 2025 (as of yet), meaning capex should step down materially in 2025. Maintenance capex and auditorium upgrades run around $30m, but I’ll use $50m given there will always be some need to reinvest in “growth”. As noted, there are are sizeable NOLs and therefore cash taxes should be minimal for years.

Because I back out interest expense on the converts, I exclude that instrument from the market cap here. Using my estimated EBITDA above, and assuming ongoing growth capex, CGX trades at FCF yield of ~12%. However, this likely understates a ‘normalized’ FCF number in several ways. For one, Cineplex is presently not being run for cash flow with the company investing ~$30m in LBE unit expansion (which will be accretive to FCF over time), as well as building out the CDM business. Given no new units being built at the moment, ‘25 capex steps down and our yield jumps into the high teens. Second, the Notes have various prepayment options and we should see interest expense move down over time. Finally, my EBITDA number assumes no growth from Media and LBE, is which very likely to be punitive, given the long-run expectations for LBE (CGX hopes to get to 30 locations vs. the current 16) and CDM. Indeed, using the company’s own model, which I do not find unreasonable, Cineplex should be able to generate over $100m of FCF with full growth capex, and significantly more without it.

Even cutting their CFO-Mnt Capex number to $130m, we are currently trading at a 21% FCF yield on today’s share price.

Ultimately, I think even a mid-teens yield is too cheap for a monopoly business with diversified revenue streams and high capital efficiency. At an 8% FCF to equity yield on $100m of FCF, the stock is worth ~$19/share.

Management, Shareholders, and Capital Allocation

Cineplex has been run by CEO Ellis Jacob since 2003. While market perception around his abilities has soured due to the decimation of CGX’s share price, I think that view is unfair. On this point, I’d simply remind readers of the chart I shared at the outset of CGX compounding at 20% annually during his first 15 years at the helm. Over that time, in addition to helping the theatre business evolve to meet the market, Cineplex built out several business segments, including CDM and Rec Room, as well as others they were able to monetize along the way, and launched the Scene program. These measures ultimately helped the company stay alive during COVID.

Mr. Jacob and management do not own much stock, which is disappointing given their duration of tenure, but I find that is offset by a solid incentive structure, including bonuses tied to profitability, Net Promoter Scores and strategic objectives, and, importantly, significant PSUs/RSUs tied to three-year averages of TSR against comps (50%), EPS growth (25%), and ROIC (25%). After considering RSUs and other incentive comp, Mr. Jacob holds ~$5m worth of equity — nothing to sneeze at. Notably, comp has accelerated vesting under a change of control.

The TSX requires shareholder reporting for ownership exceeding 10% of shares out, and presently, there are no such shareholders.

On capital allocation, the priorities appear to be continuing to grow the CDM and LBE segments (which again, are good uses of capital given they are being financed in part by low cost liabilities), upgrading auditoriums, and getting leverage down (the debt is not low cost). There is a buyback in place and the company repurchased ~1% of shares outstanding around the present share price in 2024. Ultimately, the goal is to get leverage down to 2.5-3x, at which point the dividend likely gets turned on. That will likely serve as a catalyst for the stock given the natural investor base.

Odds and Ends

In September, Cineplex was ordered to pay a $40m penalty by the Competition Tribunal (a provision has already been taken in the financials) stemming from a finding that Cineplex’s online booking fee was misleading — essentially, the online platform apparently did not make it clear enough that there would be a fee not otherwise charged at the physical box office. CGX is appealing this to the Federal Court of Appeal; I don’t have a strong view of the outcome, but given Canadian courts afford high deference to admin bodies, I assume the appeal will fail — although success would be a material positive. Note that CGX is still entitled to earn revenue from online booking fees, and those fees are not insignificant, but I do not include them in any of the math above.

I just want to stress again the durability of the box office during economic weakness; even if Cineplex is not a beneficiary, earnings should at least be resilient:

Catalysts:

At a high-level, a change in the prevailing narrative about the health of the industry;

Strong box-office numbers;

Deleveraging;

Reinitiating the dividend;

A buyout or break up of the segments.

Risks

This time really is different and the expected box office recovery fails to materialize.

All the usual macro stuff.

Disclosure: I have an interest in shares of CGX.TO at an average price of $9.72.

Great read!