Pt III: A High Quality Tech Provider with an Emerging Event-Angle

Explosive growth, emerging dominance, inflecting free cash flow, buybacks, and a likely take-private at a >40% premium

Disclaimer: Nothing on this blog is intended as financial or investing advice. Please do your own due diligence.

In the preceding pieces on movie theatres I highlighted the ongoing ‘premiumization’ trend, which has both helped attract larger crowds and ensure higher per patron spend. A major piece to this transition has been the conversion of auditoriums to premium large formats (PLFs) — i.e. auditoriums that offer a superior cinematic experience, be it through high-quality audio and visual technologies, immersive seating, etc. Of the various PLF technology providers, IMAX ( IMAX 0.00%↑ ) is certainly the most prominent and well-established name in the space.

For those unfamiliar, IMAX is a proprietary system of film formats and theatres that significantly enhances the clarity and scale of movies. There are really two components to the business model:

Formatting/Remastering. IMAX uses its technology to digitally remaster films into the IMAX format for distribution. Increasingly, films are being shot directly with IMAX cameras. In the ordinary course, IMAX receives a percentage of box offices revenues from film studios (usually ~11%) in exchange for converting a film into IMAX format.

Systems. IMAX sells or leases its systems to exhibitors to enable the viewing of IMAX formatted films. IMAX auditoriums generally have massive curved screens, custom aspect ratios, enhanced acoustics, and custom seating. Systems are monetized under different arrangements. Under the Sale/Sales-Type Lease arrangement, IMAX provides its systems to the exhibitor in exchange for an upfront payment, fixed or contingent annual payments, and maintenance fees. Under the Joint Revenue Share or Hybrid models, which are increasingly common today, IMAX provides the system to exhibitors under a long-term lease, bears installation costs, and earns fees based on a percentage of box office receipts to the exhibitor (usually ~7%).

I think IMAX is a high-quality business and certainly the highest-quality business in the sector:

IMAX has a very attractive position within the industry, effectively earning a high-teens royalty (or higher) on IMAX format box office receipts through the combined take from studios and exhibitors. Given high gross margins and largely fixed operating expenses, these ‘royalties’ are highly levered to a strong box office.

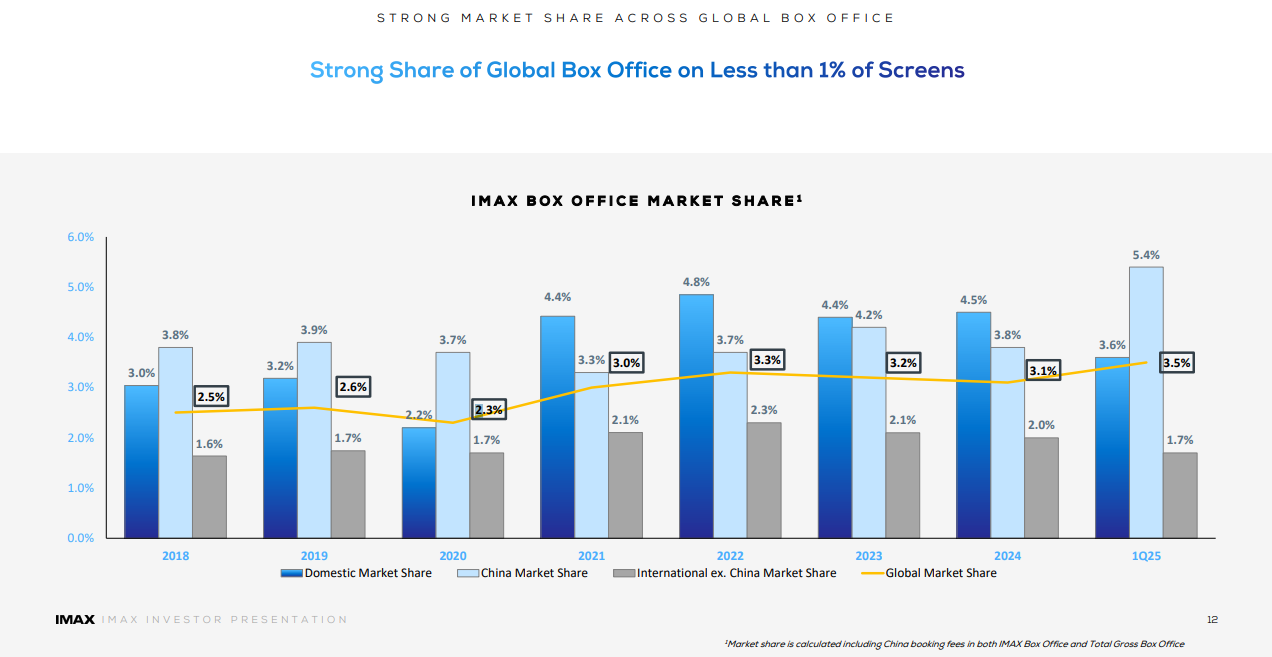

Both studios and exhibitors derive immense value from the IMAX offering as the format draws larger crowds and tickets command substantial premiums. We can see this in the disproportionate share of the box office the IMAX format earns, with that market share growing significantly since the pandemic. Indeed, despite being less than 1% of screens globally, IMAX’s market share is now running at 3.5%. IMAX’s global share has grown by >40% since 2018.

Demand for the format is clearly growing. IMAX has grown its global system count from 863 in 2012 to 1738 today (across 89 countries), and growth is accelerating with more than 350 new systems currently in the backlog. Despite this, IMAX estimates it only has roughly half of the global market penetrated.

Naturally, studios are focused on releasing ‘tentpole’ films in IMAX, and film-makers are increasingly shooting films directly with IMAX cameras (“Filmed for IMAX”), with a record number of such films set to be released this year. Given the significant benefits of shooting with IMAX cameras, IMAX is able to extract an even higher take-rate from this model. (Notably, acclaimed directors like Christopher Nolan speak highly of this technology and clearly see the value proposition). It’s also worth noting that many of the titles expected to dominate the box office this year, or that have already done so, are Filmed For IMAX, including F1, How to Train Your Dragon, and Superman.

IMAX has a robust moat supported by at least three factors. First, its proprietary technology is both superior to the competition and also offers an end-to-end solution that aligns with the incentives of other participants in the value chain. Second, switching costs are high for exhibitors given the large install base and clear trend of studios towards IMAX distribution. Finally, while there are several other PLF tech providers, IMAX has bar none the strongest brand and consumer awareness.

Altogether, I think the investment case for IMAX Corp is very compelling.

The company I want to highlight today, however, is not IMAX Corp., but rather IMAX’s publicly traded Chinese subsidiary, IMAX China, which trades in Hong Kong as 1970.hk. Shares are currently HK$8.20, for a market cap of ~USD$355m at today’s exchange rate (HKD/USD .127)

IMAX China (1970 hereafter) is a controlled subsidiary of IMAX Corp. (the parent owns ~72%) and is the exclusive licensee of the IMAX platform in Greater China. While 1970 benefits from the same desirable attributes I laid out above, there are a few items specific to this subsidiary that I believe make it a more attractive investment than the parent, and that are more than sufficient to offset the obvious concerns (viz. controlling shareholder and jurisdiction risk).

Specifically, here is why I think 1970hk is compelling:

A Strong Chinese Tailwind: China’s box office is running hot this year but there are very clear trends underway that suggest this is poised to continue, including a growing domestic/local language film industry. Moreover, on top of this market growth, IMAX screens are increasingly taking a larger share of the box office, giving IMAX a formidable position within the ecosystem.

Valuation. 1970 is substantially undervalued, both in absolute terms and relative to the premium valuation commanded by the parent. While there is no doubt that 1970 warrants a significant discount given jurisdictional/geopolitical risk, I think the discount is far too punitive today. I estimate that 1970 is trading at <7x forward EPS ex-cash. This compares with >20x EPS for the parent.

An Event-Path: Buybacks and an Eventual Acquisition. Two years ago, IMAX offered to acquire the minority interest in 1970 for HK$10/share, but the bid was rejected. With shares currently trading well below that offer, IMAX has directed 1970 to commence an aggressive buyback program in recent months. In addition to repurchases being highly accretive at the present share price, I believe IMAX is opportunistically looking to cancel as many shares as it can below its prior HK$10/share bid price in preparation for renewed bid that will necessary need to exceed the prior offer price. I think a bid likely comes in around HK$12/share, or a ~45% premium to today’s share price.

The Chinese Landscape and 1970’s Positioning

China has long been a major jurisdiction for IMAX, but never more so than today. Indeed, of IMAX’s 1738 systems, nearly 800 (~45%) are in Greater China, with an additional 191 new systems in the backlog (55% of the total backlog).

Prior to the pandemic, 1970’s Content Solutions (i.e. remastering) was predominantly focused on Hollywood films. However, in recent years, the mix has shifted towards Chinese language films which comprised as high as 62% of China’s IMAX box office in 2023, up from merely 31% in 2019. There are at three least reasons this is important.

First, 1970 earns a higher share of box office revenues on local language films due in part to Hollywood studios only retaining ~25% of tickets sales in China.

Second, reduced dependence on Hollywood films mitigates against regulatory/geopolitical risk relating to quotas, restrictions, or censorship of foreign films. We were reminded of such risk just a few months ago when China announced it would restrict US film imports in response to US tariffs.

Third, a strong Chinese language box office helps diversify away the risk of a weak US box office slate. Here too recent history is illustrative. As I’ve discussed before, Q1 2025 was a terrible quarter for the US box office as the content simply was not there to drive attendance. Not so in China. Rather, Chinese language film Ne Zha 2, released in January, has been a phenomenon, having now grossed over US $2B on its way to becoming the fifth-highest grossing film of all time. Needless to say, Ne Zha 2 has been immensely profitable for IMAX/1970, with IMAX achieving a record first quarter and 1970’s net income exploding >170% YoY.

Thanks in large part to Ne Zha 2, China’s box office has been on fire this year at ~$4B YTD, and ~25% ahead of 2024. Importantly, there are strong reasons to believe that this strength is not an outlier and should continue ahead. China is determined to grow its domestic film industry, as evidenced by the recent launch of the ongoing “China Film Consumption Year”, in which more than $130m in subsidies and other incentives are being used to help propel visitations to movie theatres and boost consumer spending. Meanwhile, the heightened concerns around restrictions on US films that emerged surrounding “Liberation Day” have, at least to-date, been overblown, with every Hollywood film expected to be released in China heading into the year having in fact been released.

But beyond the strength at the box office, the more significant piece to this story is just how dominant IMAX’s positioning is within China:

In Q1, IMAX screens captured a record 5.4% of the box office in China despite accounting for only 1% of the total screen count. This share is higher than IMAX has ever received in any of its markets previously, underscoring the importance of 1970 to the parent. This increasing dominance is likely just the beginning: e.g. it appears that IMAX has captured over 1/3 of the box office for F1’s opening in China this weekend (shout out to Alex, whose tweets first put this idea on my radar):

As a result of underlying market growth and concurrent market share capture, IMAX’s box office numbers are up 107% YoY as of May, compared with 27% growth in the overall box office.

Local language films are increasingly being Filmed For IMAX, including three major domestic films being released this summer and between 5-7 set to be released this year. Globally, 2025 will be a record for Filmed For IMAX releases (~2x the previous high) including some Hollywood films that have and will be significant contributors in China (e.g. Mission Impossible, F1). Remember, Filmed For IMAX results in an even higher royalty for IMAX.

Given the consumer’s clear preference for the IMAX experience, IMAX’s offering vastly improves box office economics across the value chain. Indeed, in FY 24, the average box office per IMAX screen was $260K compared to just $70K for the average screen, in Mainland China — i.e. nearly 4x higher. As a result, exhibitors have a strong appetite to grow IMAX screen counts and we are currently seeing this play out: as of the end of Q1, the backlog for new systems in Greater China was 191, which will grow the total count by ~25%. Notably, even after installation of that backlog, IMAX estimates 30% of the market would remain unpenetrated, implying an end-state of over 1400 systems in China.

Over time, IMAX has prioritized growing its theatre network through revenue share or hybrid arrangements, rather than sales/lease arrangements. The result of shifting towards this model is that IMAX recognizes less revenue upfront in exchange for a higher share of box office receipts/royalties, giving the company huge operating leverage to a strong box office. Presently, ~80% of the systems in the backlog are under revenue share/hybrid arrangements, as are ~500 of the total 800 systems in the installed base.

Valuation/Financials

With ~340m shares outstanding, 1970’s market cap at HKD 8.20/share is ~$355m USD using today’s exchange rate of ~0.1275 HKD/USD. As at the end of 2024, the subsidiary held $80m of cash and no debt, implying an enterprise value of $275m.

1970 does not report on a quarterly basis, but there are a couple helpful data points to help us pull the numbers forward.

IMAX Corp’s Q1 results disclose that revenues in Greater China increased 88% to $40m, while net income increased ~175% to ~$20m (note the monstrous operating leverage). While one cannot simply annualize that number (Q1 was a record period given Ne Zha 2 and the box office is both seasonal and hit driven), we can immediately see how cheap this is if the box office can sustain anything close to this ahead. Ordinarily, free cash flow in this business exceeds net income, but even assuming they are equivalent, 1970’s cash balance today should exceed $100m. Assuming 1970 earns an additional $20m over the remaining three quarters of 2025 (I think that’s likely too conservative), it is trading at <7x forward EPS ex-cash (likely quite a bit less). While acknowledging that this deserves to trade at a meaningful discount to fair value, that feels way too cheap for a variety of reasons.

For one, it’s a growing, well capitalized, asset-light business with significant competitive advantages, including an adored brand, and leverage over its customers…trading just a hair above book value (which is just insane for a capital light tech company— IMAX Corp, for reference, is ~4x book).

Second, it trades at a significant discount to its historical valuation. Indeed, despite a larger install base, lower share count, more dominant positioning, and financials that should be stronger than at any point since COVID, the stock is well below where it has traded for much of its history (prior to COVID, 1970hk historically traded at >15x EPS) and at the lowest multiple it’s basically ever been.

Third, a point that will be very important below, the relative discount to the parent is simply eye-popping. Based on sell-side numbers, IMAX Corp is trading at >20x 2025 EPS — a massive premium to 1970 which, again, is conservatively at mid-single digits.

We can also see the relative discount by valuing the entities on a per screen basis. Using Greater China’s 793 theatrical screens (ignoring the backlog), 1970 trades for roughly $320K/screen (recall above the average box office per IMAX screen in China is running at $260K!). Meanwhile, backing out the value of the parent’s implied interest in 1970 and excluding the Greater China screen count, the parent is valued at ~$1.5m/screen.

Fourth, almost exactly two years ago, IMAX Corp offered to buyout the 1970 shares it did not own for HK$10/share (vs. HK$8.20/share today). Not only did that bid value 1970 ~22% higher than the market does today, but minority shareholders rejected the offer as too low. Moreover, in the two years since, IMAX China’s business has improved in basically every way.

Finally, while there is perceived jurisdictional risk, I think that risk is somewhat mitigated by the majority shareholder being a >$1B public company and because 1970 represents its business interests in its most important jurisdiction (Greater China contains IMAX’s highest screen count, backlog, and earnings contribution). That doesn’t insulate you from jurisdictional risk entirely, but it’s comforting that you are aligned with a controlling shareholder that is highly reliant on this subsidiary’s business and will be all-in on protecting its interests there.

What’s it worth?

The answer is clearly significantly more than HK$8.20/share, even under very conservative assumptions. For example, at $40m in net income, 1970 is worth ~HK$11.50/share at 10x EPS, which still represents more than a 50% discount to the parent’s valuation.

Fortunately, we do not need to be precise here because I think there is a clear event-path ongoing that should both provide a floor at the current share price and a catalyst to unlock a share price materially above HK$10/share.

The Event-Path: How Do We Get Paid?

IMAX Corp owns ~243m shares, or ~71.5%, of IMAX China.

As noted previously, in July 2023 IMAX offered to acquire the entire minority interest (at the time, 96m shares) in 1970 at a price of HK$10/share. IMAX, of course, described it as a win-win for both entities, with 1970 receiving a significant premium to the unaffected price, and the parent being able to increase its EBITDA by $5m (18%) before ~$2m of cost synergies.

Despite the large premium, however, 18% of minority shareholders voted against the offer, which was more than sufficient to kill the bid (under HK law, 75% of minorities must approve the bid and no more than 10% may vote against it). In opposition to the bid, Letko Brosseau, a 1.7% shareholder, noted that the offer “significantly undervalues the company” and represented a huge discount to the pre-pandemic share price and was made at half of the subsidiary’s historic valuation:

Following the rejection of the bid, IMAX caused the 1970 dividend to stop and the stock has basically been orphaned ever since.

So why is this interesting now, after two years of being dead money?

Because I think a renewed bid, which will certainly need to come in at a premium to the last bid of HK$10/share (i.e. > 22% above the current share price) is simply a matter of time, and that time is likely to come soon for the following reasons.

First, beginning early May, 1970hk started to meaningfully repurchase its shares. In just over a month, the company bought back ~1.5m shares. That’s ~0.44% of shares outstanding and over 1.5% of the 97m shares not already owned by IMAX. (see here and here). Obviously, without more, an aggressive buyback program in this context is welcomed given how accretive reducing the share count is at this valuation. But I think this action signals something more: namely, if you’re IMAX and anticipating making a bid for 1970, and you know that any offer is likely going to need to exceed HK$10/share, why not repurchase as many minority shares as you can in advance with the stock below 10? That’s obviously a no brainer.

This dynamic is exceptionally attractive for those 1970 minority shareholders who have no intention of selling into the buyback. On one hand, the buyback provides us with a likely floor on the share price at these levels. Unsurprisingly, given the large controlling interest and relatively small market cap, 1970hk is fairly illiquid, and often trades <100K shares daily. This means repurchase activity has a sizeable impact on the share price, and we just saw this playout, where the stock opened at 6.50/share on May 6 (day 1 of buybacks) and moved up virtually in a straight line to 8.50/share until buybacks paused on June 3.

On the other hand, IMAX is likely to continue repurchasing as many share as possible below HK$10 (again, why would they not?), and I suspect there aren’t many sellers left down here, meaning the stock is not likely to stay in the single digits for long.

Altogether, while buybacks appear to have paused for now (no activity since), I view the aggressive activity both as a signal that the entity is back in play, as well as creating a floor on the share price (since we know the company is a buyer at the current price and below, and repurchase activity should keep the bid elevated).

One concern I have heard from a few people in discussing this idea is that HK listing rules require maintaining a public float of >25% of issued shares and that continued buybacks could make the company non-compliant, and potentially open up risks to minority shareholders. I see nothing to worry about here. Beyond the fact that pulling something sketchy like that would jeopardize the parent’s reputation for little gain, the company would need to repurchase well over 10m shares to trigger the rule; given the bid increased over 30% just to buy 1.5m shares between 6.50 and 8.50, the stock would need to go much higher from here in order for the company to repurchase that many shares (ergo, we get paid if the float gets anywhere near being non-compliant). Of course, that means that ongoing efforts to take out minorities at the current price may not bear much more fruit, which could accelerate the timing of a renewed bid.

Which brings me to my next point: viz. that acquiring the minority interest would be extremely accretive for IMAX Corp. Some rough math:

Following the recent buybacks, there are ~96m minority shares outstanding. If IMAX were to bid HK$12/share to acquire those shares (a 20% premium to the prior bid, and ~46% premium to today’s price), it would cost ~$150m. Income attributable to the non-controlling interest was $5.8m in Q1 alone — sticking with my assumption of $40m in net income for this year, the income to the non-controlling interest is conservatively ~$12m (with huge growth potential over time). After adjusting for an additional ~$20m of cash that would now belong to the parent, IMAX would be acquiring the minority interest at roughly 11x earnings. Currently, the sell-side has IMAX Corp at ~22x NTM EPS, meaning that 12m of income is immediately worth ~$260m to IMAX (nearly 2x the purchase price) simply from multiple arbitrage (giving no credit to obvious synergies). IMAX’s market cap is ~$1.5B, so the acquisition is worth mid-teens upside to its equity on day one. Furthermore, to state the obvious, owning the entirety of the Chinese business, which is IMAX’s most important jurisdiction, does a lot to clean up the story for shareholders.

Next, given the major inflection occurring at the Chinese box office, the rapidly growing and dominant positioning of IMAX within the industry, and currently immense discount in 1970 shares, it would clearly create a lot of value for IMAX’s shareholders to get a deal done sooner than later. The stock is likely to be perpetually undervalued and orphaned on the HK exchange, and it’s an obvious disservice to IMAX shareholders to have a major earnings stream sitting there as dead money.

Finally, there are a few other strong signals worth noting:

The IMAX China CFO resigned in 2024 and a new one has not been appointed;

The IMAX China website has not been updated since 2023 outside of mandated filings (e.g. investor decks and press releases, which used to be published regularly, have completely ceased since the failed bid).

IMAX’s strong ongoing financial performance gives them the balance sheet to easily finance an acquisition (wishful thinking, but I would love a stock deal for my interest to get rolled into IMAX!).

IMAX’s CEO has stated numerous times that the HK listing complicates IMAX’s ability to operate as freely as it would like; one can quickly see this from a review of the annual report, which spends page after page highlighting all the complicated listing rules they must abide by.

To Sum It Up

Ultimately, this is a relatively straight-forward idea.

We are buying a high-quality, competitively advantaged business undergoing a major earnings inflection that is trading at an enormous discount to fair value — making the stock an attractive fundamental long. At the same time, we have 1) an ongoing buyback, accretive to per share value, also putting a likely floor on the share price and 2) a parent company that is very likely to renew its bid for the minority shares at what should be a significant premium to the prior bid, which itself was a 22% premium to today’s share price.

Altogether, I think there is a pretty asymmetric range of outcomes here, with your downside protected by fundamentals and the buybacks, and your upside somewhere above HK$10/share. Where a bid comes in above HK$10 is anyone’s guess, but I would think something around 12/share gets the job done, good for just shy of 50% from today’s price. The real question, in my view, is timing, but if this gets wrapped in the next 12-18 months, you’re looking at a very attractive IRR. Given the momentum in China, I think IMAX incentivized to get this done sooner than later.

Risks

China risk, obviously, although as I said, I think this being the most important jurisdiction for IMAX helps mitigate that risk to some extent;

Relatedly, tariff/trade risk surrounding US films, but the strong trend towards local language content in China helps;

Controlling shareholder risk. 1970 is wholly dependent on licensing agreements from IMAX and could be crushed by shady maneuvering. I do, however, doubt IMAX would want to cause itself reputational damage rather than simply buying an earnings stream that is immediately worth 2x from multiple arbitrage.

Disclosure: I am long 1970hk at 7.68/share

Great write-up, thank you Raging Bull

Great read, thanks!