Disclaimer: Nothing on this blog is intended as financial or investing advice. Please do your own due diligence.

Elevator Pitch

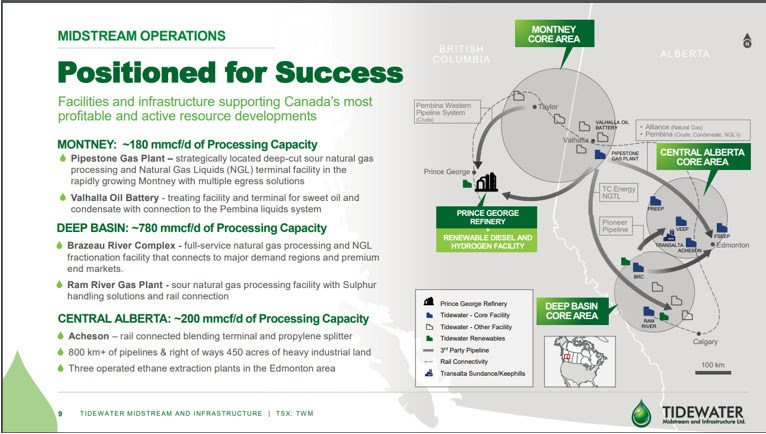

Tidewater Midstream and Infrastructure is a diversified infrastructure energy company with a collection of integrated midstream (mainly gas processing, storage, and extraction) and downstream (refining) energy assets in located Western Canada. Shares trades on the TSX as TWM and OTC as TWMIF. All numbers below are denominated in $CAD.

TSX listed shares currently trade at $0.98 for a market cap of around $417 million. Net debt at the deconsolidated level as of Q3 is $619mm, for an enterprise value of $1.036 billion.

The company, founded in 2015, was an aggressive acquirer early in its history, capitalizing on the depressed valuations brought on by the collapse of oil prices circa 2015/2016. However, the market has never fully credited TWM with the fair value of these assets. Therefore, the company trades at a substantial discount to its sum-of-the-parts.

Why the discount? Well, in addition to the ubiquitous ESG discount that comes with all things oil and gas these days (which here is exacerbated by a relatively small and illiquid stock), I believe the discount is attributable to the following:

The prior management team bit off far more than it could chew. While that team deserves credit for some good M&A, its ambitions were far too grand and sprawling for a small-cap Canadian energy company. Funding these ambitions required years of sizeable capex, leading to a leveraged balance sheet that has persistently hampered profitability.

Relatedly, the company’s aspirations have lacked direction. After acquiring a myriad of midstream infrastructure assets in various geographies, the company diversified into downstream with the purchase of the Prince George Refinery. Investors have struggled with whether to value the company as a low single digit multiple refining business or a high single digit midstream business.

Efforts to value the company are undermined by terribly ineffectual financial reporting. The company spends a lot of time touting the value of its various assets, but it provides very little clarity on financial performance at the asset or even segment level. While it does breakdown revenue and opex between the midstream and downstream segments, those numbers are extremely difficult to bridge with the numbers reported at the corporate level. After the brain damage I incurred writing this up, I am positive this turns off plenty of investors.

Adding to this complexity is the company’s build out and IPO of Canada’s first renewable diesel facility, Tidewater Renewables (TSX: LCFS). Despite being a separate public company, TWM retains 69% of the shares, therefore adding the further wrinkle of consolidated accounting to what are already difficult to comprehend financials.

With that said, I believe the pieces are now in place for the sum-of-the-parts discount to begin closing. What’s the catalyst?

In November 2022, a new CEO was appointed and a major shareholder took the helm as Chairman. Shortly thereafter, the company announced a strategic review with the aim of taking steps to drive shareholder value, including the potential sales of assets.

Concrete steps have already been taken to deliver on this promise. In August, the company announced a sale of its Pipestone gas plant, its major midstream asset, to AltaGas for $650m or around 11x EBITDA. This deal is incredibly accretive given both the far lower multiple TWM trades at today and its relative sum in relation to TWM’s present enterprise value. Yet, the stock did not budge on this news at all (if you want evidence as to how little the market case about this company, look no further). However, once this transaction closes, which the company expects to occur before year-end (i.e. very soon), I expect the proceeds to be used for rapid deleveraging, which is certain to serve as catalyst to send the stock higher.

I believe the Pipestone sale is just the beginning here. The Pipestone transaction shows that there is much more value for these assets in the hands of an owner with a lower cost of capital. Clearly aware of this, I expect management will continue to shop the other midstream assets at accretive multiples.

Additionally, management has already intimated they are considering options for unlocking value for its LCFS stake. Due to TWM’s majority stake, LCFS has a small float and suffers from a deep illiquidity discount. In the mid-term, I expect management take steps to fully spin-off LCFS, which should create value for each entity.

Valuation: I believe TWM should re-rate to at least $1.34/share once the Pipestone transaction closes and deleveraging begins, offering 37% upside in the near-term. In the medium-term, I expect management to take further steps to realize the sum-of-the-parts discount, and the stock should trade closer to the value of those parts which is conservatively at least $1.85/share or more than 90% from today’s price.

Further, as made clear below, downside is very limited here given the already steep discount to the fair value of the assets.

Background

TWM went public in 2015 with the initial intention of pursuing “the purchase, sale and transportation of natural gas liquids.” Proceeds from the IPO were used to purchase five railcars to transport natural gas liquids (NGL). The company’s founder and (now former) CEO, Joel MacLeod, retained 24% of the company.

The company quickly went on a rampant acquisition spree.

Broadly, the company’s early focus was on purchasing various midstream assets - gas processing facilities and accompanying infrastructure (e.g. pipelines, storage, rails) predominantly in Alberta’s Deep Basin and in the Montney formation spanning parts of northeast British Columbia and northwest Alberta. Then, in 2019, the company diversified into downstream assets with the purchase of the Prince George Refinery (“PGR”). Shortly thereafter, capitalizing on government subsidies, the company pursued renewable energy initiatives by building out a renewable diesel, renewable hydrogen and renewable natural gas complex at PGR. In July 2021, the company announced an initial public offering of the renewables business; TWM would retain 69% of the newly formed public company, Tidewater Renewables, which would trade on the TSX as LCFS. Though LCFS is a separately listed company, its facilities are co-located at PGR and the company shares its CEO with TWM.

Ultimately, there are three distinct, but strategically interdependent segments:

The Pipestone Gas Plant Sale

Before getting into the SOTP math, let’s begin what I believe is the catalyst that will begin to unlock the discount here, at least in part.

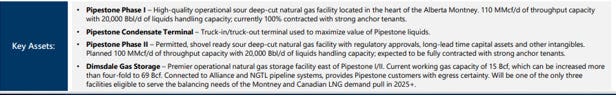

One of TWM’s key midstream assets is the Pipestone Natural Gas Plant, a 110 mmcf/d deep-cut sour natural gas processing plant with acid injection capabilities, 20,000 bbls/d of NGL processing, an extensive pipeline network, and an NGL terminal, located in the Montney formation. The project was sanctioned in November 2017, with Phase One construction estimated to be $210 million.

On August 31, 2023, the company announced that it entered into an agreement with AltaGas (TSX: ALA) to sell the Pipestone gas plant and related infrastructure assets, as well as the Dimesdale Natural Gas Storage Facility, for $650 million. TWM represents that the assets sold comprise $55-$60 million of the company’s 2023 normalized adjusted EBITDA, implying a transaction multiple of ~11x adj. EBITDA (AltaGas values the transaction at 7.2x run-rate normalized EBITDA, inclusive of synergies and an additional ~$300-$350 million required to fund Pipestone Phase II (discussed below)).

The sale proceeds will comprise of $325 million in cash and ~12.5 million shares of ALA common stock.

In addition to the customary closing conditions and regulatory approval (which has already been received), the transaction is subject to a positive final investment decision (“FID”) on the Pipestone Phase II project. FID is commonly the final precondition in determining whether to proceed in the development of an infrastructure project. Before issuing FID, the feasibility of a project’s technical and economic aspects are reviewed and the developer considers whether the project makes sense to go ahead. Further, all necessary permitting must be obtained before FID.

So, should we be worried that the Pipestone transaction fails to close based on this decision? I think the risk is low.

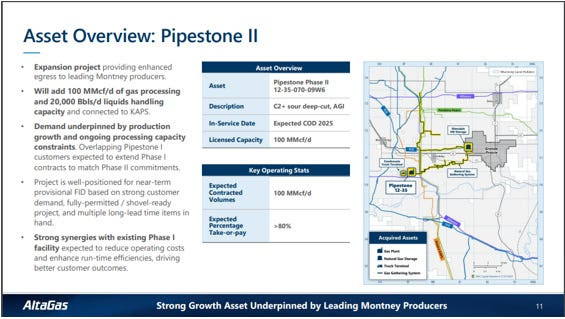

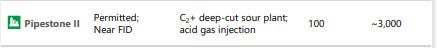

Pipestone Phase II appears to basically be a replica of Pipestone Phase I; it is an expansion project for a 100 mmcf/d gas processing plant and 20,000 bbls/d NGL processing capacity.

Note, the above slide, which is from AltaGas’s transaction presentation, explicitly notes that the “Project is well-positioned for near-term provisional FID based on strong customer demand, fully-permitted/shovel-ready project, and multiple long-lead time items in hand.” The deck repeats these claims elsewhere, including that the project is “Near FID”:

AltaGas clearly believes there is a strong demand for these assets given the premium multiple it paid and the additional $300-$350 million it expects to spend on building out Phase II. Further, given the significant similarities to Phase I, I suspect the economics and technical aspects should already be rather clear to AltaGas.

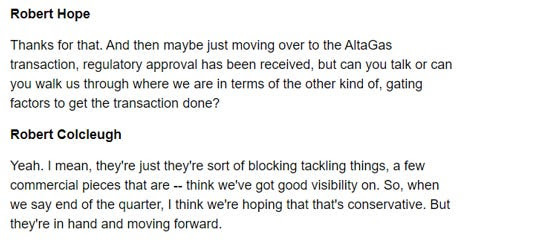

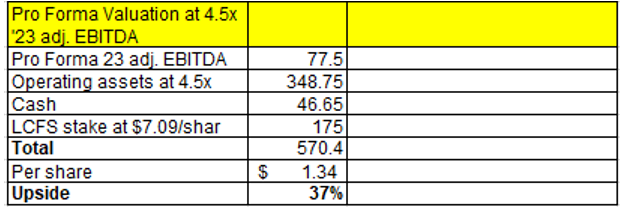

Moreover, during TWM’s Q3 conference call on November 11, the company’s new CEO, Robert Colcleugh, reiterated that he conservatively expects the transaction to close by the end of year. I suspect he would have used more cautious language here if he had material doubts about obtaining FID approval:

Obviously, I don’t know what is going on behind the scenes, and it is somewhat concerning that we have less than 2 weeks remaining in 2023 and the FID has not yet been made. However, it is also very possible this is just getting drawn out by standard administrative and legal ass covering processes. Based on the above, I think it is far more likely than not that this closes. In any event, given the share price did not react at all to the announcement, and is in fact down since, I don’t expect much downside in the event the deal does break for some reason.

Assuming the deal does close, the transaction is clearly highly accretive from every angle you look at it. Management is currently guiding to full year 2023 consolidated adj. EBITDA of $180-$200 million, with ~$55 million attributable to LCFS. With LCFS currently trading at $7.31, TWM’s stake is worth $175 million. Backing that out, TWM’s Holdco level enterprise value is $861 million, meaning TWM is currently valued at around 6.3x adj. EBITDA (861/(190-55)) excl. LCFS. So, at 11x, the Pipestone assets are fetching around a 75% premium to what they are being given credit for within the TWM structure. Another way to view the benefits of the transaction is to note that TWM will receive ~75% of its Holdco EV from the proceeds of the Pipestone sale ($650/$861), despite Pipestone comprising only 43% of deconsolidated adjusted EBITDA (57.5/136). (Note, the company has more than $500 million of tax loss carry forwards, so there should be limited taxes on the sale, which I am ignoring for simplicity). Of course, viewing things this way is not entirely fair since EBITDA from the midstream assets should be worth more than the downstream assets, but the point is that pro forma the Pipestone sale, we get the remainder of TWM for very cheap.

But not only are the deal economics highly attractive, the transaction gets rid of two large overhangs that have frustrated investors for years.

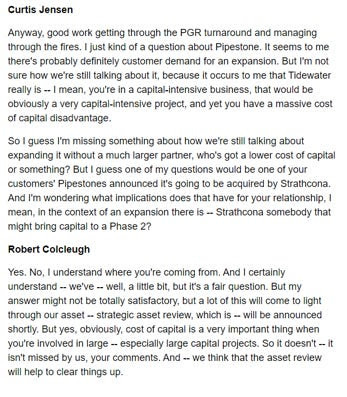

First, it eliminates the concern that the company will pursue the development of Pipestone Phase II on its own. Investors have rightly scrutinized the prudence of TWM funding a $300+ million project given the company’s size and high cost of capital. An analyst with Robotti and Co. was blunt about the madness of this during the 2023 Q2 earnings call:

So, the elimination of this overhang is obviously a positive.

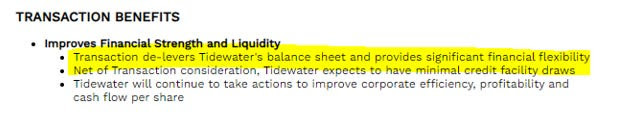

Second, management has made it clear that they intend to use the proceeds to pay down the company’s senior debt facility and outstanding converts entirely. Here is the language from the press release:

This was reiterated during the company’s Q3 conference call:

Now, recall only half of the $650 million of proceeds will be cash, yet the company is guiding to use the gross proceeds to “pay back all the debt we have outstanding.” This suggests to me that the company intends to sell off the ALA share consideration as soon as possible. ALA’s average daily volume is around 650K shares, so TWM is not going to be able to offload its 12.5 million shares overnight, but I expect they should be able to exit the position within a couple quarters. Therefore, I assume the entire sale proceeds will go towards debt paydown.

Pro Forma Valuation

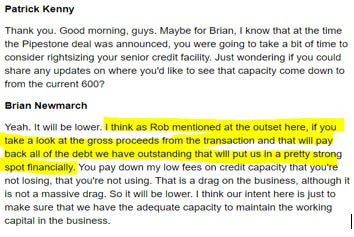

With that, here is what the pro forma capital structure and valuation looks like:

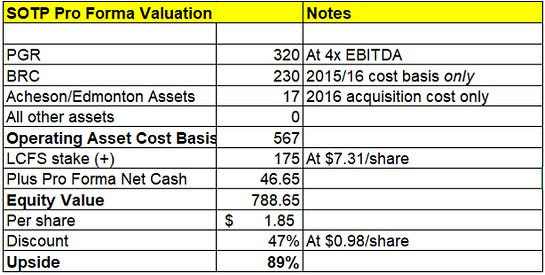

Assuming the entirety of the Pipestone proceeds are used to pay down debt, we are left with net cash of ~$46 million (for simplicity I am ignoring any impact of Q4 cash flows). At $0.98/share, this leaves us with a pro forma enterprise value of $371 million.

After backing out the LCFS stake, the enterprise value for the remining operating business (what I am referring to in the table as “Core Business”) is $196 million. Using the midpoint of management’s consolidated 2023 adj. EBITDA guide, subtracting the LCFS and Pipestone contributions leaves just under $80 million of 2023 adj. EBITDA attributable to the operating company. So, the pro forma operating company trades at a dirt cheap 2.5x adj. EBITDA.

Now, the above EBITDA numbers need to be taken with a grain of salt. As I mentioned earlier, while management does report deconsolidated vs consolidated numbers, as well as midstream vs downstream numbers, the reporting is terrible and it obfuscates the normalized earnings power of the various assets. With that said, I think this ~$80 million adj. EBITDA figure actually understates reality. This is because the company likely underearned this year due to 6 months of downtime at PGR for scheduled maintenance and 3 weeks of downtime at the Brazeau River Complex due to wildfires. I will deal more with EBITDA estimates for these remaining assets below, but just note that the pro forma Core Business is likely even cheaper than 2.5x.

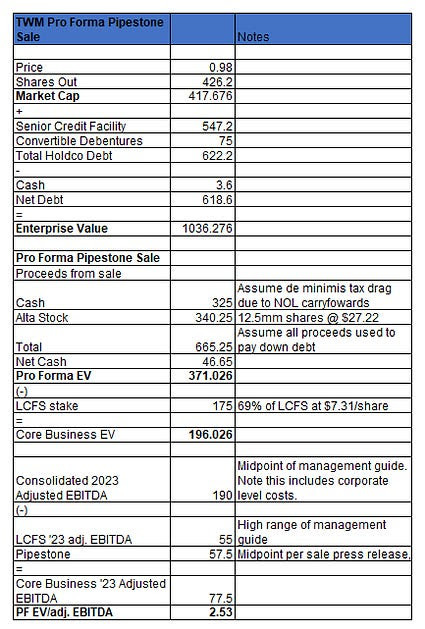

Let’s assume the pro forma Core Business re-rates to 4.5x adj. EBITDA, in line with lower range of refining assets. Then even using the likely depressed 2023 ebitda figures, shares should be worth $1.34 or 37% above today’s prices.

And 4.5x is likely too conservative given: 1) PGR is a quality asset that likely commands a premium refining multiple (discussed below); 2) there are still several midstream assets that should fetch at least 6x in a sale; and 3) the company will be completely debt free. If the company were to continue trading at 6.3x (which is currently the implied multiple excl. LCFS, upside would be closer to 65%.

This is my near-term price target based simply on the Pipestone transaction closing. However, as I explain below, I still think this is far below the sum of the remaining parts based on normalized earnings and what those assets would fetch in a sale.

SOTP Valuation

So what are the remaining assets worth?

PGR

Let’s start with PGR.

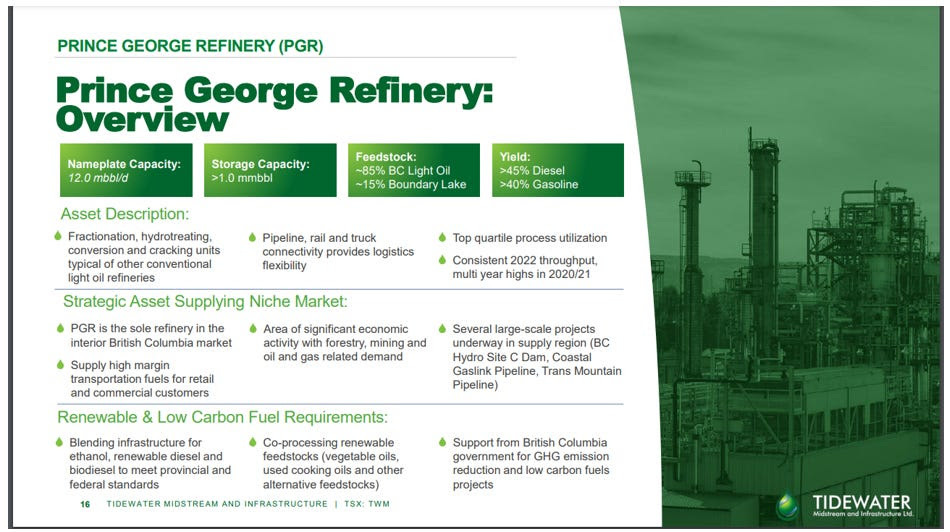

PGR is a 12,000 mbbl/d light oil refinery. It predominantly produces diesel and gasoline to supply the greater Prince George region.

TWM purchased PGR in October 2019. It paid $210 million for the refinery, for a headline multiple of 2.9x adj. EBITDA on 2020 estimates. This number is both cheap in the absolute, and relative to other refineries. The company included the following slide in its investor deck, noting the average refinery transaction around that time was 6.3x EBITDA:

Now, its true that the average here is pulled up by larger assets, which deserve a premium multiple. But I think 2.9x is far too cheap for PGR given certain structural considerations. For one, PGR is one of only two refineries in B.C. (the other, Burnaby Refinery, is larger and mostly uses heavy crude). Consequently, the province is structurally short on gasoline and diesel and consistently boasts the highest fuel prices in the Canada (see e.g. here). And given NIMBYism and the pronounced ESG policies in B.C., I think it’s safe to assume that there will never be another refinery built in B.C. (In case you don’t believe me, note the fact that there has not been a large oil refinery built in the U.S. since 1977.)

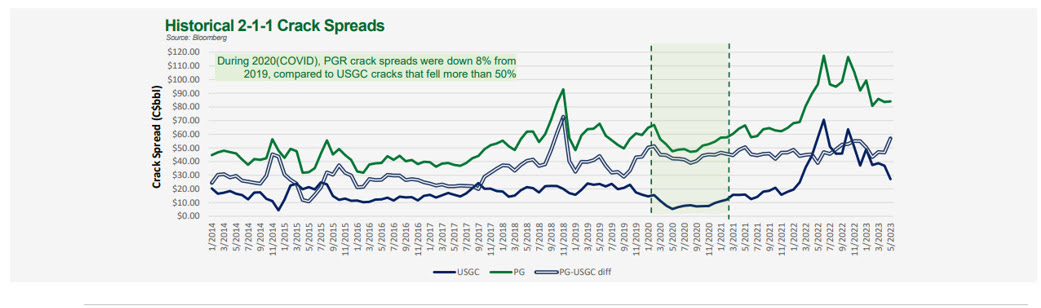

Therefore, PGR is competitively advantaged due to a permanent scarcity of refining capacity in B.C. As a result, PGR’s refining margins are significantly higher than they in the rest of North America:

And refining margins, while they have come down since going parabolic in early 2022, remain elevated. As you can see, PGR crack spreads were around $60/bbl when TWM purchased the asset in 2019. Meanwhile, during Q3 2023, crack spreads averaged $87/bbl. I am far from an expert here, but given capacity shortages and underinvestment in the sector, I would expect these margins to remain elevated in the the short/mid-term. Of course, higher margins should warrant a higher multiple.

Additionally, PGR benefits from the various midstream assets TWM has developed around it – e.g. PGR’s top two customers are also Pipestone customers. Moreover, feedstock can be delivered to PGR via pipeline, rail and truck. There are also various large-scale infrastructure projects in the region that will provide demand for PGR’s output.

As a final point, PGR just underwent a successful turnaround in Q2 2023 (i.e. the refinery went offline to undergo scheduled maintenance). Turnarounds are on a 4-year cycle, so there will be no scheduled interruptions until 2027.

Given the foregoing, I think PGR would presently go for at least 4x-5x EBITDA in a sale.

Figuring out what PGR earns requires some gymnastics. In FY 2022, the company reported consolidated adj. EBITDA of $250 million. The May 2023 deck notes that 40% of this came from downstream. Assuming the majority of this is attributable to PGR, then PGR did around $100 million of adj. EBITDA in 2022. However, the asset was clearly overearning that year due to crazy elevated crack-spreads, so the go forward number is definitely less than this.

For 2023, management is guiding to a midpoint of $190m of adj. EBITDA. However, PGR was offline for 6 weeks this year and the Brazeau River Complex was offline for 3 weeks. I’ll assume that absent that, the midpoint is $200. If PGR is responsible for 40% of that, then it is responsible for $80 million of adj. EBITDA. This is far from a perfect science, as the company does a terrible job of bridging their numbers and the number does not exclude corporate or non-segment related costs which would be ignored by a private buyer. However, this is probably in the right vicinity.

So, let’s say PGR will do $80 million in 2024. At 4-4.5x, that values the asset at $320-$360 million. To be conservative, and given the lack of visibility, I will use the low end. This values PGR at $320 million.

Recall, pro forma the Pipestone sale and excluding LCFS, the market is currently only valuing the operating business at around $200 million. So, at $0.98/share, we are buying the PGR at 60 cents on the dollar before giving any value to the remaining midstream assets.

Midstream Assets

With the sale of Pipestone, the company’s key remaining midstream assets are the Brazeau River Complex, the Acheson terminal, and the Ram River Gas Plant.

Brazeau River Complex and Fractionation Facility

The Brazeau River Complex and Fractionation Facility (“BRC”) is a 180 mmcf/d full-service natural gas processing facility with NGL pipeline connections, 10,000 bbl/d fractionation capacity, two underground storage pools, and loading facilities. It is located in the Deep Basin.

The BRC was acquired through a series of transactions dating back to 2015:

In June 2015, the company made its first post-IPO acquisition, purchasing a 63% interest in a gas processing facility in West Pembina and related pipelines for $180 million (an implied valuation of 6.5x EBITDA);

Next, in September 2015, the company acquired an 80% interest in a pipeline asset in West Pembina for $8.4 million or 5.9x EBITDA. This transaction added to the pipeline assets purchased in June 2015;

In November 2016, the TWM acquired 50% of 150km of pipelines and three natural gas storage reservoirs for $15 million or 4.5x EBITDA;

In December 2016, the company acquired the remaining 37% of the BRC gas plant, in addition to the remaining stakes in the pipelines and gas storage reservoirs for $30 million or 6.5x EBITDA.

I am very likely missing some additional BRC acquisitions here, but the cost basis for these assets alone amounts to over $230 million. And keep in mind, 2015-2016 was a period of low oil prices, (though the M&A market for midstream assets did hold up fairly well), with WTI averaging $43 per barrel vs. an average of $78.22 so far in 2023. TWM has also invested at least $50 million of incremental capital into developing BRC.

The company provides no insight into BRC’s EBITDA contribution. The blended multiple of the above transactions is 6.4x, which implies that these assets generated around $36 million of EBITDA at the time of purchase.

I am comfortable using that number here. Given that 40% of TWM’s 2022 adj. EBITDA of $250 million was attributable to midstream assets (-i.e. $100 million) and Pipestone generates around $55-$60, that leaves $40 million is for the remaining midstream assets, of which BRC is the most important.

Due to lack of disclosures with respect to earnings, I will conservatively value BRC at its 2015-2016 cost basis of $230 million (or an implied valuation of 6.4x EBITDA) despite midstream assets selling for much higher multiples today, and ignoring any added value from incremental capex and synergies with TWM’s other infrastructure. This also ignores contribution from any of the pieces I may have missed.

Acheson/Central Alberta Assets

In January 2016, the company acquired a 100% interest in three deep cut gas processing/NGL extraction facilities (capacity of 142 Mmcf/d), as well as 250km of pipeline assets., for nominal consideration. The press release provided a $200mm replacement value of the assets (!).

In August 2016, the company announced the purchase of a 33MMcf/d deep-cut sour gas processing facility, 250km of related pipelines and 600 acres of heavy industrial land (apparently at the time worth between $15-$30mm), for a total of $11mm (headline of 2.75x EBITDA), plus an additional $6 million to build in an NGL rail facility. The all-in cost therefore appears to be $17 million.

The investor deck notes that these asset now boast ~200 mmcf/d of processing capacity, 800km + of pipelines, and three operated ethane extraction plants in Edmonton.

Unfortunately, that is the extent of the company’s recent disclosure on these assets, but clearly these assets are worth far more than the 2016 acquisition cost. However, to be conservative, I use $17 million in the valuation.

Other Assets Excl. LCFS

TWM holds several other assets, including the 600 mmcf/d Ram River Gas Plant in Deep Basin and the Valhalla Oil Battery in Montney. I am going to be very punitive and not give any credit to these assets in the valuation, despite the fact there is clearly value there.

Putting It All Together

Adding each of these pieces up, I arrived at a pro forma SOTP valuation of $1.86/share, providing an upside of around 90% from today’s prices.

Again, this is very conservative at every step of the way: a low-end multiple for PGR; BRC and the Edmonton assets valued at their 2015/2016 cost basis pre capex; and zero value for any of the other assets (which is ridiculous!).

There are other reasonable ways of looking at this that provide even more upside. For example, instead of using cost basis for the midstream assets, we can apply a median midstream multiple to go forward EBITDA. The midstream segment did around $100 million of adj. EBITDA in 2022. After backing out ~$60 million for Pipestone and haircutting the remaining $40 million by 10% due to 2022 over earning, that leaves $36 million of adj. EBITDA for midstream. Applying 8x-9x results in $288-$324 million of value for the midstream assets, which churns out a $1.97-$2.06/share value in the table above.

None of this is remotely scientific given the dearth of disclosures, but the point I am trying to drive home is that TWM is currently deeply undervalued any way you look at it, and there is further upside beyond the Pipestone transaction if management acts to unlock the value of the other assets.

Renewables (LCFS)

I will not get too into the weeds on the renewables business as it is peripheral to the main thesis, but I do think LCFS could be worth significantly more in the future subject to proper execution and the continuation of the favorable regulatory environment in Canada.

LCFS’s key asset is HDRD, the first renewable diesel refinery in Canada. The facility is co-located at PGR, which reduces capital spending requirements and operating costs. Upfront capital costs were around $340 million and operations commenced in November 2023.

At the current share price of $7.31, LCFS has market cap of $254 million and an enterprise value of $588 million. At design capacity, the company projects between $90-$115 million of adj. EBITDA. If true, LCFS is probably significantly undervalued at today’s prices, given the high multiple renewables companies have been rewarded with. For example, in early 2022, Chevron purchased Renewable Energy Corp. (REGI) for around 9x EBITDA. Though not a perfect comp, even applying a 7.5x to the low range of the guide ($90 million), LCFS shares should trade closer to $10 (and in fact the 2023 52-week high is closer to $12).

If your interested in further details on LCFS, I would you encourage to check out their November 2023 investor deck.

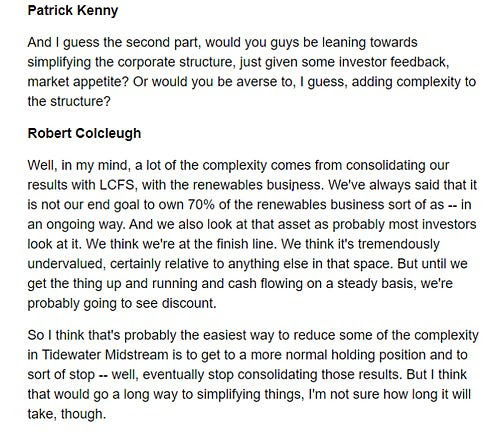

However, the key points for the TWM thesis are: 1) TWM’s stake is likely undervalued; and 2) I don’t expect TWM to continue holding a majority stake in LCFS for much longer.

Given that TWM owns 69% of the shares outstanding, LCFS has a low float and a low average daily volume (less than $600k worth of shares trade daily). This, in addition to a controlling shareholder discount, causes LCFS to trade at a depressed valuation. Additionally, because majority ownership requires TWM to consolidate its accounting, this add further complexity to what are already incomprehensible financials. New management is clearly aware of these issues. Here is what the CEO had to say during the Q2 earnings call:

And again in Q3:

Based on these comments, my best guess is that TWM will seek to spin-off its LCFS holdings once operations begin to fully ramp. Given that operations commenced last month, I could see a decision being made with respect to LCFS some time in 2024. There could be material upside from the right transaction, though I am treating this more as a free option than as a key element of the thesis.

Investor Base

Private equity company Birch Hill owns approximately 24% of the company, with the majority of these shares being purchased at $1.45, well above today’s share price. An additional 4% is held by private equity company Kicking Horse Capital. In November 2022, Kicking Horse’s principal Thomas Dea was made the company’s Chairman. This announcement was made contemporaneously with the resignation of the former CEO MacLeod, which these funds no doubt played a role in.

I would note that legendary investor Bob Robotti also appears to have recently taken a position in the company. Robotti focuses on historically cyclical business that he believes are undergoing changes that will reveal durable competitive advantages not yet understood by the market. His involvement suggests that there is some real quality to these assets and that this is not just a special situation. Here is Robotti discussing TWM at 54:10 – it is brief and worth a listen.

The presence of these shareholders gives me further confidence that management will make the right decisions to recognize the latent value here.

Risk

The most obvious risk here is that no FID is obtained and the Pipestone deal falls apart. As I have said, I think this is unlikely, but given approval is expected by years’ end and we are already at Christmas does give me some concern. However, since the stock is currently below pre-announcement levels, I think the downside is limited.

Execution and regulatory risk at LCFS. A lot goes into building out these renewables facilities and there is always some risk that something goes wrong. Moreover, the economics of these facilities are highly dependent on government subsidies, which are obviously subject to change. Again, I am not too fussed about this given LCFS is pretty secondary to the core thesis.

Poor capital allocation. Management might have a change of heart and use the Pipestone proceeds for value destructive M&A instead of deleveraging. I think this is a very remote risk given what we’ve seen so far and the large involvement of PE investors.

A collapse of energy prices. These assets are not quite as sensitive to energy prices as E&Ps, but obviously this stock will struggle to find upside if the energy markets collapse.

Feel free to reach out with any questions.