Sportsman's Warehouse (SPWH) and Some Thoughts on Retail Cycles

Struggling retailer at a cyclical trough; activist involvement and new CEO; extremely cheap on mean historical margins; signs put to point imminent turnaround

Disclaimer: Nothing on this blog is intended as financial or investing advice. Please do your own due diligence.

First - Some General Thoughts on Retailers

Many, if not most, retailers - especially those of the brick and mortar variety - face inherent cyclicality. The mechanics of these cycles are generally straightforward and well-understood:

During good times, a retail business can gush a lot of cash, as strong demand speeds the cash conversion cycle and margins increase due to higher volumes and some operating leverage.

Management, looking to capitalize on the strong demand, uses the excess cash flows to increase merchandise volumes and build-out new locations.

At some point demand inevitably pulls back for whatever reason, usually due to shifting consumer preferences or macroeconomic headwinds.

Often, the cooling of demand coincides with the company having invested in record inventory levels and new store adds.

The company, which was once gushing cashflow, now has much of its cash tied up in merchandise that is no longer turning over. Moreover, cash balances might already be depleted due to heavy capex used to fund new locations.

In the face of slowing demand, the company has no choice but to markdown its inventory, compressing gross margins. On top of that, operating margins experience degradation, a problem that is magnified when the pre-opening costs and added depreciation expenses of new stores work their way through the income statement. Obviously, these troubles are compounded by operating and financial leverage, with the latter often being at newly elevated levels.

For retailers, declining sales generally result outsized decreases in EPS due to operating leverage. Further, the deterioration in performance often appears magnified to investors as the company is likely to be coming off a period of overearning and therefore faces an unfavorable comp set.

As the stock falls, often precipitously, sell-side analysts set increasingly cynical price targets, further contributing to the sell-off.

Eventually, provided the company has avoided bankruptcy and has a continued reason to exist, the cycle turns back up. After several quarters of markdowns, inventory levels normalize, providing a working capital benefit which the company can use to paydown its liabilities or ideally start repurchasing its own shares at accretive prices. Relatedly, without the need to shed excess inventory, and with growth ambitions set aside, margins begin to tick up.

Now, having suffered through several painful quarters, that company has the benefit of reporting against a favorable comp set. At same time, the company easily beats Wall Street’s overly punitive estimates.

Notably, a return to peak sales or growth rates isn’t even necessary for the stock to rebound from the lows: these companies are so bombed out when they hit their cyclical troughs that the slightest hint of improvement can cause the stock to really move.

These retail cycles, though predictable and often self-inflicted, are inevitable. If you can learn how to time these cycles, there is a lot of money to be made. Indeed, what I find very interesting about investing in retailers is that you can make multi-bagger returns on many of these companies even if the stock generates little to no positive return over the long-run. Look at the Abercrombie & Fitch (ANF) chart:

This stock has been on a huge tear recently. But if we zoom out, you will see that stock is only marginally up since its prior peak in 2008. If you would have purchased ANF in 2008 and held it the whole way, you would have massively underperformed the index. However, look at all the huge trough to peak moves since 2008 - e.g. the stock bottomed around $18 in 2008 and hit nearly $80 by 2011; even more extreme, the recent move has seen the stock go from $15 to $96; and there have been numerous smaller, but still significant runs in between. My point is that, even though the stock has gone nowhere for nearly 20 years, it has offered at least five opportunities for a multi-bagger within that period, provided timely entry and exit.

Let’s look at another very timely example - Aritzia, which is undergoing one of these trough to peak turnarounds as I write this. I like this example, because despite a lot of noise that Aritzia is high-quality compounder, this year has shown that it too is far from immune to this cyclical boom and bust.

After shares went on a massive COVID run from $10 to $60 in less than two years, Aritzia started running into some problems last year: SSS growth slowed, comping terribly to unsustainably high sales growth experienced during COVID; gross margins began to deteriorate; operating margins evaporated; and EPS for the quarter reported in August came in at -$0.05 vs. +$0.40 in Aug 22. Meanwhile, inventory levels reached $501 million, up significantly from average levels the year prior. Accordingly, the stock tanked, and stabilized around $25/share. However, ATZ reported Q2 this week and the stock finished the week up 40%. Why? The exact same story that I outlined above. The company exceeded analysts’ depressed estimates, significantly reduced inventory levels, and margins, though still below normalized levels, have started comping favorably on a sequential basis. Notably, it has taken the company a couple quarters for the turnaround to begin working.

Hopefully I have made clear so far that there is a lot upside in retailers if you can time the entry and exit well. That begs the question - how do we know when it is the correct time to get involved in a retailer?

I recently re-read the famous lecture notes from Joel Greenblatt’s value investing course at Columbia (I think these are required reading for anyone interested in value investing and, in addition to Greenblatt’s book You Can Be A Stock Market Genius, have probably been the most beneficial resource I have come across - you can download them for free here). During “Class #8” (note, the notes are from a couple semesters so there are multiple Class #8s, each relevant here, though largely overlapping), Greenblatt’s sister, Linda Greenblatt, who is a retail investing specialist, provides some very valuable insight into what to look for, which I have distilled into the following list:

You want to get interested in a retail businesses when it is hated and left for dead due to deteriorating performance.

The first thing that then must be ascertained is the cause of the underperformance. Are the issues the result of potentially permanent demand issues with the product - e.g. has it become unfashionable? has it been rendered obsolete by technological advances? If so, then pass. The company needs to have a reason to exist. But, if the decline is simply due to mean reversion after a period of overearning, a weak seasonal offering, or mismanagement, then it is worth taking a further look.

The best situation is where the company suffers from transitory but rectifiable issues, like blundering a merchandise season, but is otherwise a good business. You want a high return on capital business that just hit a bump in the road.

You can get a timing edge over Wall Street by looking a few quarters ahead. This may mean buying before the bottom, or having to wait a quarter or two for the cycle to turn up.

The stock should be cheap on depressed earnings. This where you get a margin of safety and a flier on multi-bagger upside. Even if you’re a little early, if the stock is already cheap in an absolute sense, it is hard to lose money.

No insolvency risk: the company needs to have an adequate balance sheet to survive the downturn.

Once you know its cheap and is a historically decent business with a reason to exist, the key question is whether the company can get back to normalized margins:

Is the company actively doing something to address the issues? e.g. new management, inventory markdowns, activist engagement, etc.

Same store sales growth is not always necessary for the turnaround to work, provided margins normalize.

With respect to valuation, try to figure out when normalized margins will be reached and apply an earnings/fcf multiple on today’s market cap/EV.

Further timing considerations:

Favorable comps are key to when the stock price starts to turn. Wall Street is short-sighted and will continue penalizing a company for comping poorly to prior year numbers, even if the story is showing sequential improvement. Once comps start stabilizing, the market will recognize that a reversion to normalized margins is doable and that is when the stock will start to rerate.

Buy the stock if you think it is going to beat guidance/estimates.

The Aritzia situation I outlined above perfectly fits the bill here. Unfortunately, I don’t have a position in ATZ and missed out on some very easy money (though it still looks very cheap and I plan to take a closer look). However, given the precarious macro environment of the last couple years, there are a lot of bombed out names in the retail space and I think this will generally be a fertile sector to fish in this year.

One of those names is specialty outdoor goods retailer Sportman’s Warehouse (SPWH) (market cap: $157 million). In my view, as I will show below, the Sportman’s situation fits the Greenblatt criteria to a tee. After taking a beating for several quarters and falling around 60% last year, I believe the company is at a clear trough and the next upcycle is imminent. If am right, the stock is conservatively worth about 2x today’s prices before accounting for any growth or capital returns. If we do get growth and capital returns (which I think is likely), there is a path to multi-bagger upside.

Sportman’s Warehouse

The Business

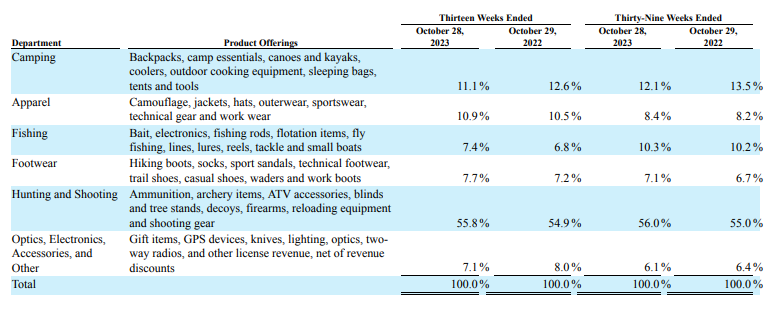

Sportman’s is a specialty retailer of outdoor sporting goods. Around 55% of sales are derived from the “Hunting and Shooting” segment (i.e. guns, ammunition, and related accessories), while the remainder are comprised of products related to camping, fishing, apparel, footwear, and outdoor accessories. Within this segment mix, consumable goods - e.g. ammo, fishing bait, propane, etc. - comprise ~42% of total sales, which helps drive recurring revenues, resulting in higher rates of customer conversion.

As at the end of Q3 (Oct. 28, 2023), the company operated 145 stores, via operating leases, in 32 states, predominantly in the west:

The company also operates an ecommerce platform and boasts of its omnichannel capabilities - i.e. a seamless shopping experience between brick and mortar and online channels.

The Hunting and Ammunition segment is the company’s key offering. In addition to comprising the majority of sales, it also provides Sportman’s with a somewhat competitively advantaged business. For one, Sportman’s claims to have the country’s largest assortment and offering of firearms available online for in-store purchase and buy-online-pickup-in-store. Further, given the anti-ESG nature of the product offering, many larger retailers have pulled back on their firearms offerings, including Walmart, Dick’s Sporting Goods, and Camping World (which purchased Gander Outdoors out of bankruptcy and appears to have deemphasized its firearms offering). Others large retailers, like Amazon, do not offer firearms at all. Really, the only national player with a similar product mix is privately owned Cabela’s/Bass Pro (both owned by Great American Outdoors Group). On the other hand, Sportman’s has a scale advantage over mom and pop retailers (which comprise 65% of market of the market for outdoor sporting goods and hold ~92% of outstanding licenses to sell firearms (FFLs)), due to its ominchannel offering and wide geographical footprint. For example, as part of the company’s e-commerce offering, individuals can purchase firearms online and have them shipped to a local, non-Sportmans, FFL holder for pick up. On top of this, Sportman’s competitive advantage is furthered by regulatory barriers to entry (though, the flip-side of course is that these regulations similarly pose a huge risk). Ultimately, Sportman’s is well-positioned in the firearms market, as it faces little competition from large retailers, and has substantial scale advantages over mom and pops.

I won’t go as far as saying that Sportman’s has a moat, but I think it is clear that it has some competitive advantages with respect to its key offering. And importantly, demand for this offering - though it may ebb and flow - is not going anywhere. In fact, the continued demand for firearms in America is as close to a sure thing as I can think of.

For obvious reasons, US gun sales hit an all time high in 2020. Those numbers have come down a fair bit since, but monthly sales in H1 2023 still averaged around 1.4 million. And I think it is more than a safe bet to assume those numbers tick up this year as we head into the election.

For Sportman’s product mix more broadly (i.e. general outdoor goods), expected CAGR seems to be around 5% annually through the rest of the decade. So I think it’s clear that there is real, durable demand for this business

Additionally, Sportman’s has historically actually been a pretty good business. Average returns on invested capital (EBIT/(net working capital + PP&E)) for the last decade are mid-teens while ROE has been around 30%. The company estimates that it costs ~$2.6 million to build out a new store plus an additional $2.1 million initial inventory, and they target four-wall adj. EBITDA margins of >10% with ROICs of greater than 20% within two years.

The Setup

So we have a decent quality retailer with a clear reason for existing. Now for the setup.

Sportman’s was a huge benefactor of the pandemic. With civilization on pause, people began spending a lot more time doing things outdoors. On top as that, there was an extraordinary amount of social unrest during the pandemic, which obviously created huge demand for firearms products (as I noted above, 2020 was record year for firearms sales). As a result, the company grew sales more than 70% over the course of the 2020 and 2021 fiscal years, margins expanded rapidly, and diluted EPS grew from $0.46 to $2.44.

The company was printing cash: it managed to essentially fully deleverage the balance sheet while still increasing its cash position from less than $2 million beginning 2020 to nearly $60 million entering 2022. Obviously, the stock exploded, climbing from a March 2020 low of below $5 to the mid-teens by summer 2020.

Then, before the financial results above fully played out, Great American Outdoors Group (BassPro/Cabela’s) made an all cash-offer in December 2020 to purchase SPWH for $18/share. The stock hovered at a tiny spread to the offer price for much of 2021 until, in December 2021, the parties announced that they would be terminating the deal due to concerns raised by the FTC. On the news, shares fell below pre-announcement levels to around $11.

Unfortunately, and perhaps not coincidentally, the deal collapsed right as the broader market began its meltdown due to elevated inflations concerns and impending rate hikes from the Fed. The stock began a steady descent down.

Of course, late 2021 and 2022 was not a pretty time for public equities. But Sportman’s shares actually held up fairly well through 2022. However, some serious issues were beginning to show by this time. Some were brought on by broader industry issues:

COVID, which had been a tremendous tailwind for the company, was now in the rearview. People were returning to civilization, leading to an obvious decline in the demand for outdoor goods (e.g. again, gun sales peaked in 2020 and have come down substantially since).

This lack of demand was compounded by a general pullback in discretionary consumer spending caused by the onset of higher rates. This pullback was particularly acute amongst Sportman’s customer demographics (rural/suburban males earning $40-$100k annually) and its products (i.e. items with a multi-year useful life that can wait to be replaced). Taken together, revenues decreased 7% in fiscal 2022, followed by YoY declines for the first three quarters of 2023.

In addition to declining demand, the company also had its margins impacted by lower sales, inflationary cost-pressures and the normalization of ammo margins given the resolution of supply shortages (i.e. the company was able to capitalize on inelastic demand for ammo when it was in short supply during the boom).

However, these issue have been significantly compounded by some unfortunate managerial missteps. First, management, failing to anticipate waning demand, simply blew it on inventory management. While the company substantially reduced inventory spend in 2022, it was not sufficient to mitigate the otherwise reduced cash from operations. What is particularly egregious, though, is that the inventory issues actually became far more pronounced in 2023, despite 2022 offering ample warning of deteriorating economic conditions: in the first quarter of 2023, inventory levels shockingly jumped 18% sequentially.

Perhaps worse, the company made the stunning strategic decision to proceed with its ambitions to add to the store count during the downturn. The company opened 9 new stores during 2022, and more outrageously, 15 during 2023, despite experiencing larges declines in SSS and huge working capital headwinds due to the inventory problems. Obviously, this has impacted margins even further, as the company has had to incur new store opening expenses as well material depreciation expenses.

As a result of the foregoing, the bottom line consequently turned substantially negative. Further, free cash flow was hit even harder due to the capex burden associated with the new stores (somehow, Q1 2023 capex nearly doubled YoY despite the company’s troubles being patently obvious by that point).

Given the above, the share price has taken an absolute beating, hitting as low $3 after Q2 earnings (remember, this is a company that was set to be purchased for $18/share only 2 years ago!). These mishaps have been compounded by facing incredibly unfavorable comps from the period of overearning during COVID. However, with several quarters of poor performance now in the books, those comps are in the rearview.

The Turnaround

The next question is whether now is a good time to get involved. Here is why I think it is.

To begin, the stock is priced for peak cynicism.

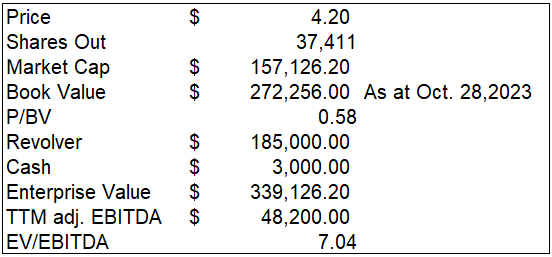

Currently, the stock trades at less than 0.6x book value. The asset side of the balance sheet is about 45% inventory, 30% operating leases, and 20% PP&E (leasehold improvements and FF&E). So a good chunk of the book is made up of inventory, which we know is being aggressively marked down. Therefore, reported book value is certainly overstated. However, even if you haircut book value by 25%, the stock still trades at less than 0.8x. Moreover, much of this inventory has a long-shelf life, so there’s no worry about the value evaporating if the company were unable to unload it anytime soon. This means you have a fair bit of liquidation value protecting the downside.

A discount to book is far too cheap for this company if it can return to posting anything near its historical average ROE (I would note here that other publicly traded outdoor sporting goods retailers tend to trade for at least 2x book value and SPWH has traded at a premium to book for most of its history).

On a TTM adj. EBITDA basis, the company presently trades at just over 7x. This is definitely not cheap on its own, but that EBITDA number includes two quarters of negative operating profit. So unless you think this company is unlikely to return to operating profit anytime soon, the stock is clearly cheap on depressed earnings.

Having established that the stock is cheap and offers a margin of safety here, here is why is the company is ripe for a turnaround.

First, the company has two large and reputable shareholders that have gone activist. On April 27, 2023, Gamceo’s (~6% stake) principal and value investing legend Mario Gabelli sent a letter gently requesting the company add a director with financial engineering experience to the board . The other activist, Carlo Cannell, who is the largest shareholder with ~10%, has not been so gentle. In his most recent letter on Sept. 18, having previously requested the board to take a 40% and 70% reduction in cash and equity compensation, respectively, he boldly proposed that they now slash their compensation by 60% and 80% given the poor share price performance.

While all has been quiet on the activist front since, only a few days after Cannell’s letter, the company announced the appointment of Paul Stone as its new CEO as well as appointing a new Chair. Stone seems to be the right person for the CEO job, having significant retailing experience as the Chief Retail Officer of Cabela’s, as well as 28 years with Sam’s Club. Moreover, he was also a high-level executive at Hertz for several years, serving as President and COO, as well as interim CEO.

And that brings me to my next point, which is that Stone has so far done and said all the right things to suggest he knows how to lead this turnaround. In fact, I think the evidence shows that the turn is already well underway.

First of all, the company is actively attempting to normalize inventory levels through aggressive markdowns. The company has already made some progress on this front with a 2.4% sequential decline from Q2. Significantly, it looks like the company expects far more progress in inventory reduction to occur this quarter. Indeed, during the Q3 call, the company guided to inventory levels below $375 million by year-end, which implies a 16% reduction quarter over quarter.

While the company expects a 600-800 bps reduction in YoY gross margin as a result of these markdowns, the reduced inventory levels will create sizeable working capital benefit. Management intends to use that excess cash to paydown about $50 million of the $185 million outstanding on the revolver.

Significantly, management also represented that they will not be opening any new locations in 2024.

This is significant for a couple reasons. One, obviously no additions should help SG&A come down as the company no longer incurs pre-opening expenses, meaning operating margins should begin to regain lost ground. I think operating margins will surprise to the upside given management has already imposed cost-cutting measures like workforce reductions that have been hidden by new store opex. Second, no new stores means there will be a substantial reduction in capex. And, given limited levels of debt, I believe the company will use the any excess cash to buyback shares, which would be highly accretive given the sizeable discount to book.

On top of these strategic moves, the company should also benefit from general cost improvements as inflation continues to trend down.

Finally, the company will no longer have to compete with its challenging COVID comps going forward. Indeed, by Q4 2022, though better than subsequent quarters, the cracks were already well beginning to show (sales were down nearly 10% YoY, margins were compressing, and net income fell off a cliff). During Q4 ‘22, the company guided to a loss of -$0.40 to -$0.35 per share for Q1 ‘23. So the company was already signally big trouble ahead by this time last year.

Heading into Q4 ‘23, the company expects to lose only $0.25 to $0.21 per share after adjusting for an extra week this quarter. Accordingly, we are already trending in the right direction (and my suspicion is that management is also being ultra conservative with these numbers - there is simply no incentive to set unnecessarily high expectations given how bad current sentiment is, and the worst thing new management could do here is damage their credibility). Relatedly, analyst EPS and margin estimates are at the midpoint of management’s guidance. I think any beat with respect to the metrics should send the stock higher.

So that is my overview of the reasons I think the time is ripe for a turnaround here: the stock is cheap; management is actively attempting to resolve the issues and appears to be making progress to that end; and expectations are extremely low after several quarters of negative sentiment.

So far my analysis suggests that Sportman’s checks each of Greenblatt’s criteria for a good retail investment. Now the final piece - what is it worth?

Valuation

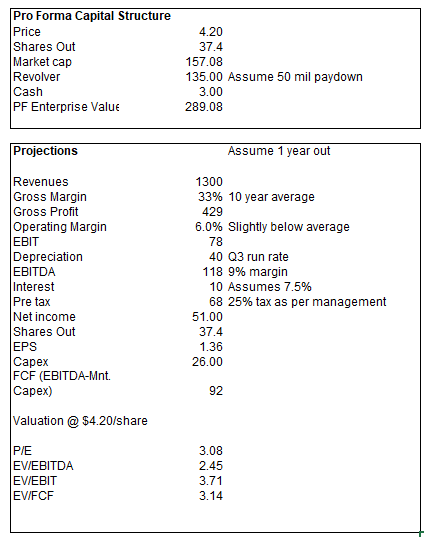

The key here is to look ahead at what the company can earn on normalized numbers and apply a fair multiple of those earnings on today’s share price. This will require some assumptions, which I think are all conservative in light of the above.

First, I assume a year from now the company can do full year sales of $1.3 billion. I arrive at this by first annualizing the midpoint management’s Q4 guide of $365-$390 mill, which comes to $1.5 billion, and then adjusting it for the fact that Q4 generally comprises ~30% of annual sales. That gives us $1.25 billion. This number is probably too low looking a year out given inflation and the fact that they already did $1.4 billion in FY ‘22 with 15 less stores. Therefore, I think $1.3 billion a year out is a sufficiently conservative assumption. (I would add that, although they will not be adding to the store count in 2024, this company has huge room for further expansion, which could grow the topline materially over time before accounting for SSS growth).

Gross margins have consistently hovered around 33% over the last decade. While the guide is for gross margins to come in slightly below 30% next quarter, I don’t see any reason the company can’t return to those averages once inventories normalize.

The difficult item here in my opinion is operating margins. Since 2018, operating expenses have been between 25% and 30% of sales (24.3% and 26.6% during the COVID boom), with the average being around 28%. Applying that number to my revenue estimate of $1.4 billion results in opex of $392 million, implying a margin of 5.6%. However, the period immediately preceding COVID was a bit of a challenging time for the industry as the larger players flooded the market attempting to liquidate their firearms’ business, which put downward pressure on prices. Prior to 2018, opex came in at closer to 25% of sales, implying operating margins of closer to 8%. The businesses was much smaller then, but it appears that much of the increase in opex as a % of sales starting 2018 has been due to annual increases to the store count. Absent new stores, perhaps margins could trend back to 8% over time, though that is probably wishful thinking in the near-term. Historical average operating margins have come in around 6.5%.

Last quarter, the company was already able to decrease SG&A by 2% due to sizeable reductions in payroll (22%) and other opex (19%). They were able to accomplish this despite incurring $9 million of pre-opening expenses and $5.4 million for depreciation and rent associated with the new stores. An additional, $1.6 went towards the CEO’s signing bonus and severance payments. The depreciation and rent expenses are here to stay, but we can knock off about $12 million in opex based on opening expenses, the signing bonus, and severance. Subtracting that from Q3’s operating expenses of ~$100 million gives $88 million, which annualized is $352 million, and implies an operating margin of 6%. Given this is slightly below the historical average, I will use this number to be conservative.

For the remaining income statement inputs, I assume depreciation of $40 million (last quarter annualized), interest expense of 10 million (which assumes 7.5% on the outstanding revolver balance), and a 25% tax rate as indicated by the company.

I calculate unlevered free cash flow as EBITDA-maintenance capex. This year, the company has spent $71 million on capex, with $45 million attributable to new stores. Subtracting that growth capex and annualizing gives maintenance capex of about $26 million.

Finally, I assume debt will be $135 million given management’s guidance for the year-end total. This again is probably too high as we are looking a couple quarters out here.

Putting it altogether, Sportman’s, on a normalized basis, trades at only slightly above 3x EPS and unlevered FCF and less than 2.5x EBITDA. A greater than 30% earnings and fcf yield is far, far too cheap for a low leverage company (<1.5x pro forma net debt/ebitda) that has historically put up high teens ROICs and has a decent competitive advantage. You can stress test the numbers above with some punitive assumptions and this still looks cheap. For example, if you reduce revenues to $1.25 billion, we are still at around 3.2x EPS. If you then take this lower sales figure and reduce operating margins by 100 bps to 5%, we are still below 4x EPS. So not only this is incredibly cheap, but there is a huge margin of safety if I am wrong in any of my assumptions.

I think Sportman’s is conservatively worth at least 6x EPS. This is well below where it has traded at historically, though some compression makes sense given the higher rate environment and some warranted skepticism with the business given the last two years. But even 6x is below peers: HIBB - 7.9x EPS; DKS - 12.6x EPS; ASO - 9.2x EPS; BGFV - 16x EPS. None of these are perfect comps for a number of reasons, including different product mixes, and all, except BGFV are much larger. Further ASO, DKS, and HIBB are all much more proven out businesses at this point. Nevertheless, an earnings multiple closer to 6x seems more than conservative given where these competitors trade at (for what it’s worth, I also think the comp set is too cheap).

At 6x EPS, based on my assumptions above, SPWH is worth about $8.20/share, which is just shy of a double from today’s prices. At 8x, which is certainty doable, it’s worth $10.90/share or 160% upside. It is not out of the question to get ever further returns from multiple expansion, particularly if the company returns to growth and management proves to be competent. And remember, this is on what I think are very conservative numbers.

Moreover, with some solid execution from management, the company should be able to compound earnings at a decent clip overtime given respectable industry wide ROICs. HIBB, for example, has compounded EPS at around 13.5% annually for the last decade, while DKS has done 17% over that same period of time, and ASO has compounded at an even more impressive rate since going public. Moreover, each of these companies have been able to achieve this growth whilst returning sizeable amounts of FCF to shareholders via dividends and buybacks. And of course, there is very real room for growth in this industry, and Sportman’s has huge room for expansion. If you underwrite SSS growth at GDP growth over time and add an incremental 10 new stores a year, this could turn into a homerun over the longer term with the proper execution.

What I am trying to indicate here is that beyond offering ~100% return simply through multiple expansion once margins normalize, there is a clear path for Sportman’s to become a decent compounder given the right execution.

Finally, I expect this return to be juiced over time through share repurchases. In fact, I expect management to start buying back shares as soon as the revolver is paid down and margins start to stabilize. This could be as soon as soon as mid 2024. If the stock continues to trade at a wide discount by then, those buybacks are going to be very accretive. Additionally, this is a company that can handle a bit of leverage and has generally run at about 2.5x net debt/ebitda. I’m sure management will be hesitant to lever up in the near term, but over to time I could definitely see some cash returned to shareholders through leverage. Even running at 2x my EBITDA assumption above, the company could borrow $198 million and have enough cash to return more than the entire market cap.

Additional Points

While there is not really a hard catalyst here, I would note that demand for firearms and related products tends to surge during Presidential election years, and I see no reason this one will be any different (indeed, I expect more turmoil than usual). There is a good chance this provides Sportman’s earnings with a material bump, particularly later in the year.

I would also not be surprised to see the company acquired by a competitor or taken private for a material premium. While the Great American Outdoors’ bid was shutdown by the FTC due to market concentration risk (there was overlap in 20+ markets), there are several other acquirers that make sense, including ASO which has very little store overlap. It would also do well in the hands of private equity, and in fact, was previously held by private equity before its IPO.

Risks

The key risk here is that a return to normalized margins/inventory levels proves more elusive than expected. This could be the result of failures in execution or broader industry wide issues. I think this is unlikely, and in any event, it should be hard to lose material amounts of money buying at the present share price.

There is the very real short-term risk that I am too early here and the turnaround takes longer than expected.

Firearms regulatory risk, though I don’t see any existential threats to the Second Amendment given the current SCOTUS composition.

More of a concern than a risk per se, but insiders own disappointingly few shares here, though there was a nice flurry of insider buys around these prices in Sept/Oct.

Beyond that, the general macroeconomic/market risks apply here to heightened degree given the discretionary nature of the product offering.

There has been some recent insider purchases. I own the stock and averaged down recently. I was somewhat reluctant because another value investor I am acquainted with sold his stake, but also said they are still following it. They were not happy with management but possibly some of the changes you mentioned plus the Gamco involvement addresses that. My feeling is people will be traveling abroad less, camping more and will be increasing their outdoor vacations and activities, which also will benefit the stores.