Disclaimer: Nothing on this blog is intended as financial or investing advice. Please do your own due diligence

I’m in the middle of writing up an another idea, one of my core holdings which has an intriguing and imminent event angle to it, but first I wanted to quickly highlight an interesting situation unfolding. This is not intended as a comprehensive write-up, but given I’ve previously pitched the company, I thought it might be worthwhile to put it back on your radar. Note this is an illiquid microcap with a wide bid/ask and a controlling shareholder — so please proceed with caution, etc.

Early subscribers to this blog may remember Instil Bio, a busted biotech with essentially no ongoing operations trading at an enormous discount to its NAV, which is principally comprised of a massive cash pile and its (preposterous) ownership of a new 128,000 SF life sciences building in Tarzana, California. I’ll refer you to my prior write up for further background.

My initial thesis was that given 1) what effectively amounted to the cessation of all operations after outsourcing development of its final drug candidate to a Chinese company, and 2) the listing for sale (or alternatively lease), of the Tarzana property, it seemed likely that an 8-K announcing a strategic review would soon come, at which point the company would take steps (e.g. a liquidation) to realize value.

I ended up closing the position out at break-even (~$11.70) because subsequent communication from management (who I was, and remain, skeptical of) didn’t inspire much confidence that there was any urgency to unlock the discount for shareholders. Moreover, the real estate market for life sciences properties was in the midst of a slowdown, I had skepticism regarding the company’s valuation of the property, and the listing had been up for quite some time without anything materializing. As a result, I figured there was a good chance this setup might be dead money for the foreseeable future and I exited with an eye to opportunity cost, though I’ve continued following the story since.

Well, it appears the company has finally given shareholders some positive news to work with. And although shares ended Friday up ~30%, they are only ~8% higher than they were when I closed the position out, despite what I think is now a materially improved story (although admittedly I still have some reservations regarding whether we ever see our NAV).

With all that said, I think there’s a huge margin of safety at this price, and with a decent bit of uncertainty now resolved, I think this is sufficiently asymmetric to warrant a position again. I snagged some shares yesterday at around $12.30.

***

Thursday night, Instil filed an 8-K noting that they have finally found a tenant in AstraZeneca to lease the heretofore vacant Tarzana property. The lease is for 15-years with some options to extend as well as an option to terminate after 10-years with a fee. Rent is ~$7.52m annually with a 3% annual escalator. Though we don’t yet have the specifics, AZ will also pay certain operating and tax expenses associated with the property.

This is a huge development for a few obvious reasons.

First, having an investment grade tenant locked into a long-term lease certainly makes this property a hell of a lot easier for Instil to sell. Though it’s a brand new, state of the art building, the reality is that there are not an abundance of natural tenants for a life sciences facility of this size. Having now secured one through 2039, this asset is definitely going to be a lot more enticing to prospective landlords, who will inherit attractive lease terms and a high quality tenant. I should quickly note the 8-K also provides that AZ has a right of first offer to purchase the property, so we may very well know who our buyer ends up being already.

Second, we can now have a lot more confidence in pinning down a valuation for this asset. In my initial pitch, I noted Instil had recently taken an impairment on the property, revising fair value down to $132.5m (they’ve since taken further impairments). Despite the fresh mark, I remained skeptical of the purported valuation, which amounted to a price of >$1000/SF. Here is what I wrote at the time:

I should note that I am extremely skeptical that the Tarzana Property is worth $132.5/mm. The property is 128,000 sqft, implying a price per square foot of $1035… Another way to look at this is that, assuming a 5% cap rate, which might itself be generous, a NNN lease would need to come in at $6.78/mm/year ($135.5*.05) [that’s an error, though immaterial, and should read $6.63 ($132.5*0.05)]. A quick check of Loopnet shows that industrial real estate in the area tends to lease for ~$20/sqft. The Tarzana property might go for a premium given it is brand new, but I highly doubt a lease would go for anywhere near $50/sqft.

Clearly I was far too skeptical given the AZ lease actually exceeds the figure I previously thought outlandish. Now, I am not sure whether the lease here is entirely NNN — the 8-K says AZ will cover “certain” operating and tax expenses, but the extent of Instil’s remaining obligations, if any, with respect to expenses is unclear. Regardless, even if we assume this $7.52m + “certain expenses” translates to $6.5m NOI (i.e. Instil still has to cover some of the expenses), the property is worth between ~$110-$130m applying a cap rate between 5 and 6. And a 6 cap is probably too conservative given e.g. this 2024 note from CBRE noting the ‘average’ life sciences cap rate nationally has been 5.9%, and this is clearly an above-average asset. To that end, I’d also note that this fairly similar transaction comp in California went for a 5.3% cap rate earlier this year. At 5.3%, using $6.5m for our NOI get us to $123m. Of course, if NOI is closer to the lease figure of $7.52m the value would increase to ~$140m. And again, I’d think this property deserves a premium given the quality of both the asset and the tenant, lease duration, the price escalator, etc.

In short, I think we can be fairly confident the Tarzana asset would conservatively fetch ~$120m sale ($6.5m NOI at a 5.5 cap).

Third, and finally, the rental income plus AZ’s commitment to pay certain associated expenses would theoretically reduce Instil’s cash burn, which is currently running at, what seems a ridiculously high, ~$12-15m/quarter; however, because there is a rent abatement through to July 2025 and I’d bet that Instil will sell the property by then, the rental income angle here probably never comes into play.

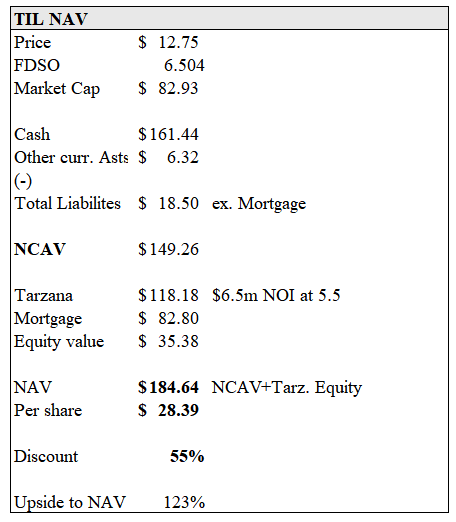

Now that we have a better sense of Tarzana’s value, here’s my updated NAV calculation:

While $28.40/share is about $5 lower than where I pinned this at when I first pitched the stock, largely due to ~$25m of cash burn over the last two quarters, we now have a far better grasp of what Tarzana’s actually worth and a clearer path to realizing it. Of course, the company will continue to burn cash for as long as this goes on, but we should also expect to see cash burn come down in the near-term, per the company’s disclosures; I’d guess its ~$10m/quarter moving forward.

So what happens next?

Well, the Tarzana property is encumbered by a mortgage note with a principal amount of $82.8m, which comes due in July 2025 (with an option to extend for two years). One would think Instil would be eager to sell the asset ahead of that maturity. Moreover, it fundamentally makes zero sense for a microcap biotech with no operating business to continue serving as the landlord for this property. The obvious retort is that it likewise made equally little sense for Instil to ever construct and own this asset, but alas here we are. But while this clearly isn’t run by the most rational, prudent allocators of capital, the CEO does own ~35% of the company and surely recognizes that the market is never going to value this asset anywhere near its fair value. Even if the CEO is adamant in hanging on to Instil and using the cash pile to purchase a new pipeline (more below), his incentives would still be to sell Tarzana, thus eliminating the maturity overhang, cleaning up the balance sheet, and freeing up even more cash to go empire building.

So, I’d say it’s more likely than not this property gets sold in the near-term. Ignoring transaction costs, this sale could add some 40% of the current market cap in cash to the balance sheet. And while the market surely isn’t going to value this cash at 100 cents on the dollar given who’s in charge, I’m sure it would still result in a material closing of the discount — and even a small closing of the discount to, for example, 40% vs. the current 55%, is worth some 35% of upside to equity.

Okay, but then what?

In the most recent press release accompanying Q1 earnings in March, the company continued to use the same language that led me to close out the position when I did — viz. “Exploring opportunities to in-license/acquire and develop novel therapeutic candidates in diseases with significant unmet medical need”. This is not the language you want to see from a busted biotech with a mountain of cash and a CEO with a subpar track record, obviously. There’s just no hint of an intention to throw in the towel and return the cash to shareholders, which would be an incredible outcome for shareholders given the liquidation math.

But, to borrow the Howard Marks adage, “it’s not what you buy, it’s what you pay” and, in my view, given the mammoth discount to NAV, further clarity on the real estate value, and all signs pointing towards a sale of Tarzana, I do think we are paying an attractive entry price here notwithstanding the uncertainty and suspect operator.

While the glass half empty assumes the cash gets incinerated, the glass half full is that this enormous cash balance offers a ton of optionality, and if management is able to find even a half decent use for it, the stock could easily double or more (just look at the chart of another net-net biotech, Nuvation Bio, previously pitched on this blog, and where the stock went after the announcement of its reverse merger at the end of March). Selling the real estate and turning this entirely into a cash shell will expand the potential for a value accretive transaction, whatever that may end up being.

One final piece I’d note is that reputable biotech investor BML Partners now owns 5.3% of the company, a position that it seemingly finished building when TIL shares were trading approximately where they are today. While biotech funds tend to run fairly diversified, based on BML’s most recent 13f filing, TIL appears to be a top 10 position for it. I wouldn’t place much weight on this, but I do think it’s notable that they would take a large position in a controlled company like this, and I doubt they’d be getting involved if they had a hint of an alignment issue with management.

Again, this isn’t intended as a full pitch, but simply to flag an unusually large asset discount that may be of interest to some of you. This is a tiny position for me as it stands, but I may look to add after thinking it through a bit more.

Have a good weekend.

Disclosure: I am long TIL shares at an average cost of $12.30.