Mereo Biopharma

Two de-risked late-stage assets; an unfolding special situation w/ an imminent catalyst; an activist board; and a discount to a recent barrage of institutional buying

Disclaimer: Nothing on this blog is intended as financial or investing advice. Please do your own due diligence.

****

This is a stock I have owned for ~2 years and it has grown into a sizeable position. Despite the good run it has had over that time, I think the setup is now the most attractive it has been since I got involved.

Caveat Emptor: This is a small cap, pre-revenue biotech with a fair bit of volatility. I suspect that may well be the last sentence of this pitch many of you read. Fair enough.

But for those of you perhaps less faint-hearted or willing to keep an open mind, you may find, as I have, that this is no ordinary biotech setup.

On one hand, the alluring prospect of outsized biotech returns is certainly present here — I think shares are more likely than not to return >50-100% (and potentially more) over the next 6-8 months, with further upside down the road depending on how things play out. On the other hand, there are a constellation of factors at play here that I believe substantially mitigate (albeit, not entirely eliminate) the risks that are so often part and parcel when investing in this space.

What, then, are those factors that give me, a generalist with no science background, the conviction to size this up?

Shots on goal. The pipeline contains not one, but two, late stage assets, each of which is likely worth more than the current EV. Moreover, and significantly, clinical trial risk for both assets is now remote and virtually non-existent through the end of 2024.

A special situation with an imminent catalyst. One reason we are not exposed to clinical trial risk is that securing financing from a partner is a precondition to commencing Phase 3 trials for the company’s #2 lead asset, alvelestat. Though management has been communicating an intention to partner the asset for a year or so, recent commentary suggests that a more involved ‘non-dilutive’ financing transaction is under way. One can only speculate on what this may look like, but we know it is nearly certain to happen within the next few months given management’s continuing representation that P3 trials for the asset will start by the end of the year. Given some recent developments in the space, I think there is a very real chance that whatever deal we do end up getting results in material upside. Because we are not really paying for this asset at the current share price, and because there is no clinical trial risk for either asset through year’s end, we can essentially play this special situation as a call option for the next 5-6 months with minimal downside.

Activist involvement. David Rosen’s Rubric Capital, who are very smart value investors with a good track record in biotech, control four of the board seats after a successful activist campaign in 2022. Rubric also owns >14% of the company and have continued averaging up on its position since the proxy fight, including a ~$7m top up during the company’s June ATM issuance at $3.99/share (i.e. slightly above today’s share price). I’d argue no one understands the R/R here better than Rubric and its decision to purchase a large slug near ATHs despite already being up more than 500% since the proxy campaign is an incredibly bullish signal if you ask me.

A barrage of institutional buying. Rubric is not the only smart money that have been recently snagging shares near all time highs. The aforementioned atm issuance, which followed interim data from the primary asset (setrusumab), had hedge funds lining up out the door. In addition to Rubric and some individual board members, preexisting large shareholders and a host of new biotech focused funds participated. I normally wouldn’t read much into a stock being a hedge fund hotel; however, I do think it’s an extremely bullish sign to see all these investors subscribing to a $50m equity raise without any discount to the market price and effectively at the new highs. And again, the stock is currently slightly below those buys.

Cash runway. The company has sufficient cash through to 2027. Dilution risk is thus extremely low.

Taking all of this together, I think this is a very asymmetric bet and it is one of my highest conviction positions. NB*** Having said all of that, this is still a biotech without any commercial stage assets and despite what I think are very good odds of this working out, there is still very real risk of substantial downside and it thus needs to be sized with that in mind.

Shout out to Quilchena Park Capital for some help with this one.

Company Overview

Mereo is a UK-based biotech that trades on the London Stock Exchange as well as the Nasdaq via American Depository Shares (1 ADS represents 5 ordinary shares — when I refer to shares below, I am referencing the ADSs). There are ~153m ADS’ outstanding, which is good for a market cap of ~$600m at the current $3.96 share price. With ~$90m of net cash, the EV is ~$510m.

Mereo went public in 2015 and shortly thereafter purchased a portfolio of three products from Novartis and a fourth from AstraZeneca in 2017. Mereo achieved its US listing in 2019 through a reverse merger with OncoMed, through which it acquired the oncology asset etigilimab, which belongs to a class of drugs referred to as anti-TIGIT’s. At the time of the acquisition there was a ton of optimism for this class of drugs and etigilimab was effectively Mereo’s lead asset. Unfortunately, these candidates as a class have largely disappointed to-date and Mereo has ultimately shelved any further direct development of etigilimab.

Fortunately, Mereo may have nevertheless struck gold in its earlier acquisitions from 2015 and 2017: specifically, in setrusumab from Novartis, and alvelestat from AstraZeneca.

The Activist Battle

Before getting into the pipeline and setup, I think it’s first worth touching on Rubric’s activist campaign, which provides some helpful context for what follows.

Rubric is an activist hedge fund run by Point72 alumnus David Rosen. Since inception, Rubric have launched at least 5 proxy fights, including, in addition to Mereo: Xperi, Heron Therapeutics, Chimerix, and Radius Recycling. Note that these are predominantly in the biotech space.

After filing a 13D in May 2022 disclosing ~13% ownership, Rubric sent a letter to the company on June 9 requesting the board rethink the “company’s value creation strategy”. Rubric requested four separate action items:

1) wind down the TIGIT program and cut spending on it entirely;

2) find a partner to finance alvelestat’s Phase 3 trials, because such efforts would be too risky for Mereo to bear alone;

3) reduce cash burn; and

4) focus on maximizing value for setrusumab.

At the time of the letter, shares were trading for ~$0.63 and below net cash. Notably, Rubric argued that shares were worth $4.13, or ~540% more! That insane upside was what first caught my eye and led me to start researching the company. Here is Rubric’s back of the envelope valuation from that June 2022 letter:

With respect to this model, there are two important takeaways for our purposes.

First, while shares are now essentially where Rubric pinned fair value (meaning they’ve so far been exactly right on this outlandish call and are up some 500%), Rubric have still not sold a single share, and in fact, last month they added ~$7m more at $3.99!

Second, and what surely explains Rubric’s continued bullishness — this 2022 model clearly severely undervalues the company today.

For one, it ascribes only a 65% probability of success (PoS) to setrusumab, which is probably closer to 85-90% now (e.g. even BTIG even puts PoS at 90%).

But even more: it ascribes ZERO value to alvelestat, which as I explain below, could on its own be worth >$4/share using a reasonable PoS estimate.

After several further months of back and forth, Rubric succeeded in its proxy fight and was awarded four seats on the board.

Setrusumab

For narrative clarity, let’s start with setrusumab, which is the most advanced asset.

Setrusumab is intended for the treatment of osteogenesis imperfecta (OI) aka brittle bone disease — a rare genetic bone disease whereby bones fracture with minimal or no obvious injury, in most cases due to a failure to produce the collagen necessary for strong bone formation (some of you may remember Samuel L. Jackson’s character being afflicted by this condition in this film).

There are various “types” of OI, but for our purposes the key is that setrusumab is intended for treatment of types comprising 80-90% of all cases. OI is estimated to impact 60k individuals in the US and Europe, and there are currently no FDA/EMA approved treatments.

(as an aside, note from the above slide just how awful the consequences of this condition can be).

In 2020, Mereo partnered with rare disease juggernaut Ultragenyx ($RARE) who were granted rights to the US and the rest of world, in exchange for paying Mereo tiered double digit royalties on sales in those regions as well as up to $300m in conditional milestones. Mereo, for its part, retained the European/UK rights for which it is obligated to pay RARE fixed double digit royalties.

As noted, there are currently no approved treatments for OI. Currently, the standard of care is the off-label usage of bisphosphonates. These are also used in the treatment of other bone conditions like osteoporosis, and operate by causing a reduction in bone resorption (don’t worry about what that means) which increases bone mineral density (BMD). The problem with bisphosphonates is that, despite improving BMD, studies have mostly failed to establish that their use actually leads to a reduction in annualized fracture rate (AFR). To the extent bisphosphonates do work, the benefits appears to be minimal. Moreover, there can be side effects (including bone layering, which can actually result in increased bone fragility!). Further, Mereo has found that certain physicians don’t start children on bisphosphonates, so they are left without any treatment at all.

Setrusumab is a sclerostin inhibitor. Inhibiting sclerostin activates a pathway which stimulates osteoblasts, which are responsible for bone building. At the same time, it also reduces osteoclasts, which inhibit bone resorption, thus providing a second mechanism for increasing BMD. In short, setrusumab operates with a dual mechanism: it both promotes bone building whilst inhibiting resorption (contrast this with mechanism with bisphosphonates, which only protect the bone that remains, but does not help build new bone).

That is all rather technical and I’d argue not exceptionally important to grasp. Just keep in mind as we proceed the two key variables, BMD and AFR, and what we’ve found in connection with those variables in the studies to-date.

There are two ongoing studies, Phase 2/3 ORBIT (5-25 year old patients) and Phase 3 COSMIC (2-7 year olds). While there have been various phases of clinical trials run, there have been a couple notable readouts over the last 12 months which strongly support viability.

Firstly, October 2023, Phase 2 of ORBIT. The study enrolled 24 patients aged 5-25, who were randomized to receive monthly infusions of either 20mg/kg or 40mg/kg. The takeaways after 6-months:

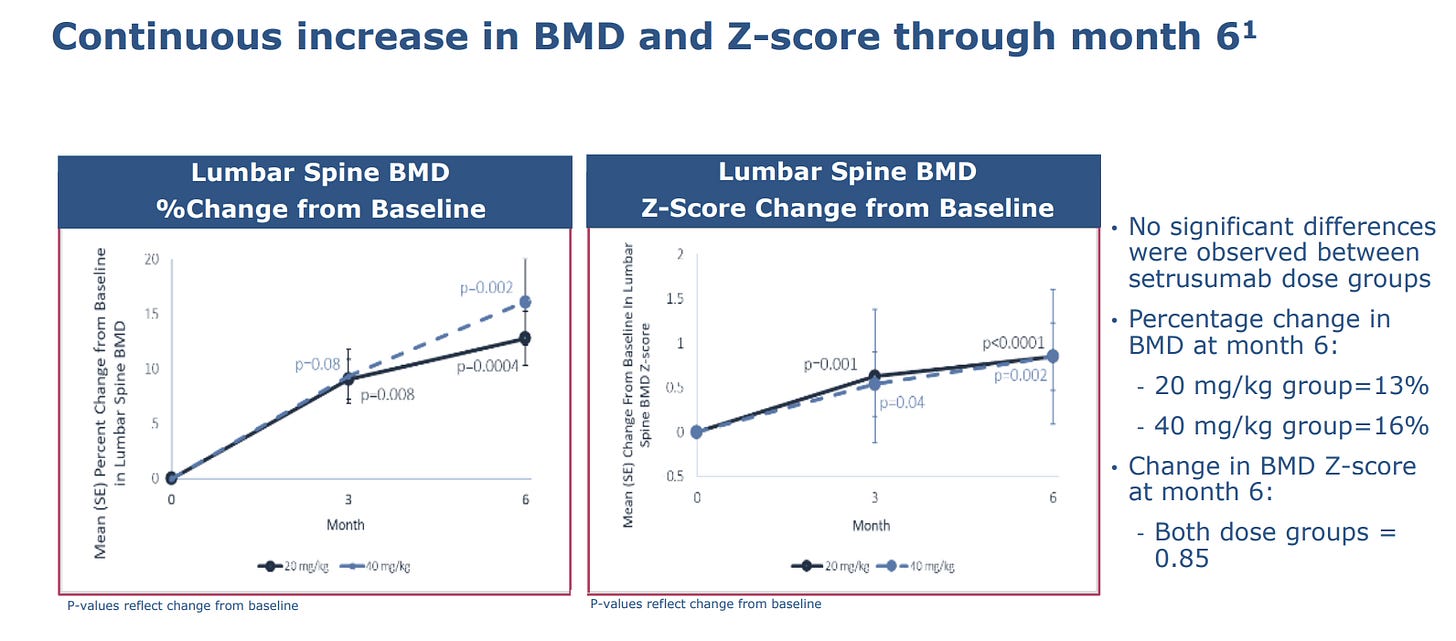

BMD increased between 13-16% from the baseline, with no significant difference between doses. Importantly, the z-score change from the baseline was 0.85.

BMD increases were greatest for patients 5-12.

But what is most significant is that the increases in BMD appear to be associated with a reduction in AFR. Indeed, despite all enrolled patients having suffered a fracture within the two years prior (0.72 AFR), 20/24 of the patients sustained no fractures during the 6-month period, resulting in a 67% reduction in AFR compared to pre-treatment. P-value was 0.042. [P-Value is the likelihood of achieving the results actually obtained if there were no relationship between the variables — the smaller number, the better].

Then we had 14 month follow up data from the same Phase 2 ORBIT in June 2024. The takeaways:

BMD continued to increase with mean improvement of 22% (vs. 14% mean at 6-months), but an even higher improvement of ~30% for patients aged 5-12. Of course, the improvement overtime is important not only because it shows that setrusumab continues to facilitate bone development over time, but also because it implies use of the medication chronically (improving its financial value). P-value improved to p<0.0001 (obviously that’s very statistically significant).

Most importantly: consistent with the 6-month read out, the median annualized fracture rate was reduced 67% to 0.00 following the mean treatment duration of 16 months. Moreover, P-value improved to p<0.0014 (implying, as with BMD, that the signal is improving with time).

The z-score improved from 0.85 after 6 months to 1.25 after 14 months, with p<0.0001. Z-score is essentially the standard deviation — an increased z-score with a low p-value indicates the data fall within the tail of the distribution, implying both a marked difference from the baseline AFR figure and a high-level of statistical significance. In other words: the data strongly suggests that the AFR data is not random, and that patients are increasingly looking like non-OI patients as they continue using setrusumab.

So that’s our data to-date. It’s good; very good. What it suggests, ultimately, is that setrusumab is leading to the formation of stronger and new bone and to significant reductions in fractures across all ages in OI patients.

For the less statistically literate of us, how about some anecdotal and visual evidence?

One of the ORBIT patients is apparently the above child who, prior to setrusumab dosing, was confined to a wheelchair. Through 17 months of dosing, the child has progressed from a wheelchair, to a walker, to now fully walking on his own! While it’s merely anecdotal, and thus should be approached with skepticism, it is incredibly hard not to be impressed by it (and to not feel great for the child benefitted by what looks like nothing less than a miracle).

I’d note this is not the only crazy anecdote MREO/RARE have shared from the studies.

(Remember, patients with OI can fracture their bones simply getting out of bed).

As a final point, I should note that setrusumab has been well-tolerated across all studies, including smaller ones prior to ORBIT.

So what’s next?

Phase 3 ORBIT. This ongoing study has 158 patients (vs. 24 for P2) aged 5-25 who have suffered either 1 fracture in the previous 12 months, or 2 in the previous 24 months. They are stratified by the number of fractures (>3 or <3) and by age. It is a double blinded study with patients randomized 2:1 to receive 20mg/kg of setrusumab or placebo by IV. The primary endpoint is AFR excluding fingers, toes, and skull.

This phase 3 ORBIT trial is the major driver for approval. There will be two potential interim read outs. The first could come as early as the end of 2024, and will require p<0.001. Per a recent Biotech TV interview (this short clip is required listening if interested in the thesis) with Mereo’s CEO, Denise Scots-Knight, it seems unlikely that the first interim endpoint will be achieved given the limited (~2%) alpha spend, which effectively requires that the results hit a much higher level of statistical significance. The second interim will require p<0.01 and should come around late Q1 2025, followed by a final analysis at 18 months of p<0.039 (for which ~78% of alpha spend is saved, and which the CSO noted at a recent fireside chat is a “pretty darn good backstop to have”). Thus, while the interim analyses set a high bar for success, they still provide several shots on goal prior to the final analysis in 2025, which appears very likely to be met.

Phase 3 COSMIC. This is study enrolled 69 patients aged 2-<7, which is an open-label (patients know which drug they are being given) study randomizing the sample 1:1 between 20mg/kg of setrusumab or bisphosphonates. The primary endpoint is AFR without exclusion of any joints, etc.

There are two important things to consider regarding phase 3 data.

First, given what we have seen from Phase 2 ORBIT, there is a really high PoS (recall BTIG pins it at 90%). Further to that end, I’d note the CEO’s comment at ~8:00 minutes into the Biotech TV interview that “for all of us, [phase 2 data] really de-risked phase 3”. I’d also note that Ultragenyx, who have a much broader pipeline line than Mereo, have expressed equal, if not greater, conviction around the program.

The second consideration is that the timeline affords investors an opportunity to play some potentially large upside without taking on real commercialization risk. This is because 1) the first interim analysis for Phase 3 ORBIT, scheduled for late 24/early 25 will not be provided unless the endpoint is met…meaning there’s a chance to play for huge upside without exposure to risk of the downside that would come from failing to meet the end point; and 2) because the alvelestat event-angle is almost certain to occur before the end of 24.

Setrusumab Valuation

One lazy, though likely directionally correct, way to value setrusumab might be to simply take Rubric’s back of envelope and adjust the probability of success to 85% (($512*.85)+($154/.65*.85)/153m shares. That get us to ~$4.15/share or ~$630m, which alone is more a good bit more than today’s EV of ~$510m (i.e. market cap-cash). That’s not a particularly robust approach, obviously, but it’s a sanity check.

There are a ton of assumptions that need to go into valuing not-yet commercialized assets, so the best we can do really is to try to get in the ballpark. I’ll play with Rubric’s model as an exercise in doing this.

The first piece is that MREO is entitled to $254m in milestones from RARE as development progresses — that alone, undiscounted, is more than half the current EV.

Through the patient identification conducted thus far, MREO/RARE pin the global OI population at ~60,000. The OI foundation pins the U.S. number at 25,000-50,000 — the high end of that is obviously inconsistent with the companies’ estimates, so let’s assume 25,000 in the US. Types I, III and IV are ~85% of cases, which puts the addressable population at ~21,000. That’s fairly close to Rubric’s estimate of 24,000. Given how horrendous the condition is and the results we’ve seen to-date, I’d imagine peak penetration is higher than 17%. That said, it appears that setrusumab may be limited in efficacy for older cohorts as OI appears to be more effectively treated as early as possible. So after adjusting for only <26 years patients, using 5,000 as peak US penetration seems reasonable. Rubric’s estimated $150k per patient may be low, given RARE’s drug Crysvita for the treatment of another rare bone disease seemingly goes for ~$200k. Let’s assume the same here. That amounts to $1B in peak US sales for Ultragenyx. Applying Rubric’s royalty rates, that’s good for ~$128m of peak royalty revenue for Mereo alone. At a 5x multiple, which I think is sufficiently conservative for a royalty stream on a rare disease drug targeting an unmet need, that’s worth $640m…

[As another sanity check, I’d note RARE sold just 30% of the US/Canadian royalties for Crysvita to OMERS for $500m in 2022.]

Then there’s the UK/EU opportunity, which Mereo retained the rights to. The market appears to be a similar size, but given a lack of clarity with respect to reimbursement, it’s difficult to estimate the drug’s ultimate pricing and what those patients are worth. Using Rubric’s figure but readjusting the probability of success to 85%, it’s worth ~$200m.

Putting it all together we get, $200m (EU/UK) + $544m (640m*.85 for US royalties) + $160 ($254*.85 discounted at 15% for two years). In total, that’s ~$900m or ~$6/share (50% upside) from today’s share price before giving any value to alvelestat, the cash, and the hodgepodge of other minor assets.

While that alone is enticing, I think that may still understate it. For example, Baird estimates setrusumab’s peak sales globally to be ~$2B and Mereo’s portion to be ~$750m.

Throw even a modest multiple on that, and we are looking at a double digit share price simply for one asset. As a further sanity check, Needham values setrusumab at $570m using what is surely a far too conservative PoS of 60% and $450m of peak sales revenue for Mereo’s share.

Again, this is not remotely intended to be precise — it’s simply to show that we are probably not even paying for the conservative, risk-adjusted value of setrusumab at the current EV, while getting the rest of the company for free.

The June ATM and the Shareholder Register

Still not convinced of how good the June interim setrusumab data was? Don’t just take it from me.

On June 14, immediately on the heels on the data release, Mereo took the opportunity to raise ~$50m (~12m ADS) through an at-the-market equity issuance at a price of $3.99 (slightly above where shares trade today). It is, of course, not unusual for a biotech to tap the equity markets for some cash following strong data; it is, however, not particularly common for such a raise to take place at the market price, as the offering is usually priced at a discount to entice sufficient buyers.

But here, not only was the offering priced at the market and near all time highs, it had numerous funds lining queuing up to grab a piece. To begin with the insiders, directors purchased ~$150K worth of stock in the offering, while Rubric took a ~$7m slug to maintain their ownership at ~14%. Other preexisting shareholders Rock Springs and Janus Henderson also participated in the offering. Beyond that, new institutional holders participated, including Frazier Life Sciences, Deerfield Management, and Perceptive Advisors.

Do we really think all these institutions, including those with the most intimate knowledge of the company, would pile in to buy $50m of stock near ATH’s if they didn’t think this was likely worth a lot more than $4?

Bizarrely, today we have an opportunity to buy this thing below where they did. It’s simply not something I can make sense of. (Apparently it doesn’t make sense to Janus Henderson either, who appear to have taken this as an opportunity to purchase even more stock, and they now have a >5% position.)

Altogether, by my count, more than 55% of shares are now owned by long-term funds.

One final note of importance regarding the raise. Astute investors will note the offering provides that the use of proceeds will be used to fund setrusumab:

Notably, it says nothing about alvelestat, implying that this program is near certain to be monetized or funded by third party capital before it commences Phase 3 trials.

Alvelestat and the Special Situation

Alvelestat is a neutrophil elastase inhibitor being developed for the treatment of alpha-1 antitrypsin deficiency (AATD).

AATD is an inherited condition that results in low levels of AAT protein. This leads to overactivity of neutrophil elastase, which in turn leads to the progressive destruction of the lungs and an increased likelihood of emphysema or chronic obstructive pulmonary disorder (COPD). Smokers are at the highest risk.

It is estimated that there are 50K individuals in the US and 60K in Europe/UK that have severe deficiency, with 60-80% eventually developing lung disease. The diagnosis rate is increasing.

Currently, the only treatment is AAT augmentation therapy, which has very questionable efficacy, requires IV administration, and is not available for reimbursement in Europe due to a lack of clinical outcomes.

As this slide indicates, US augmentation therapy reached $1.4B in 2022 and AATD products could reach >$3B by 2031. Given the shortcomings of augmentation therapy and the size of the market, alvelestat obviously could be a blockbuster if it ends up succeeding.

Prior to Mereo’s acquisition, AstraZeneca ran early studies across various lung diseases such as COPD, cystic fibrosis, and bronchiectasis. Keep this in mind as it will become important momentarily.

Mereo has run two Phase 2 studies for the product: ASTRAEUS and ATALANTa. The ASTRAEUS study was European and was a 12-week study on 99 patients not on augmentation therapy with three arms: placebo, a 120mg, and 240mg dose. ATALANTa was a US based trial that studied 63 patients, including some that were on augmentation therapy with two arms: placebo and a 120mg dose.

The key parameters for these studies were: 1) FEV1, which calculates how much air a person can breathe out of their lungs in one second (the higher the better) and 2) St. George Respiratory Questionnaire score — a questionnaire designed to measure the impact of lung disease in patients, with higher scores indicating more limitations.

Here are the broad strokes of what the studies found.

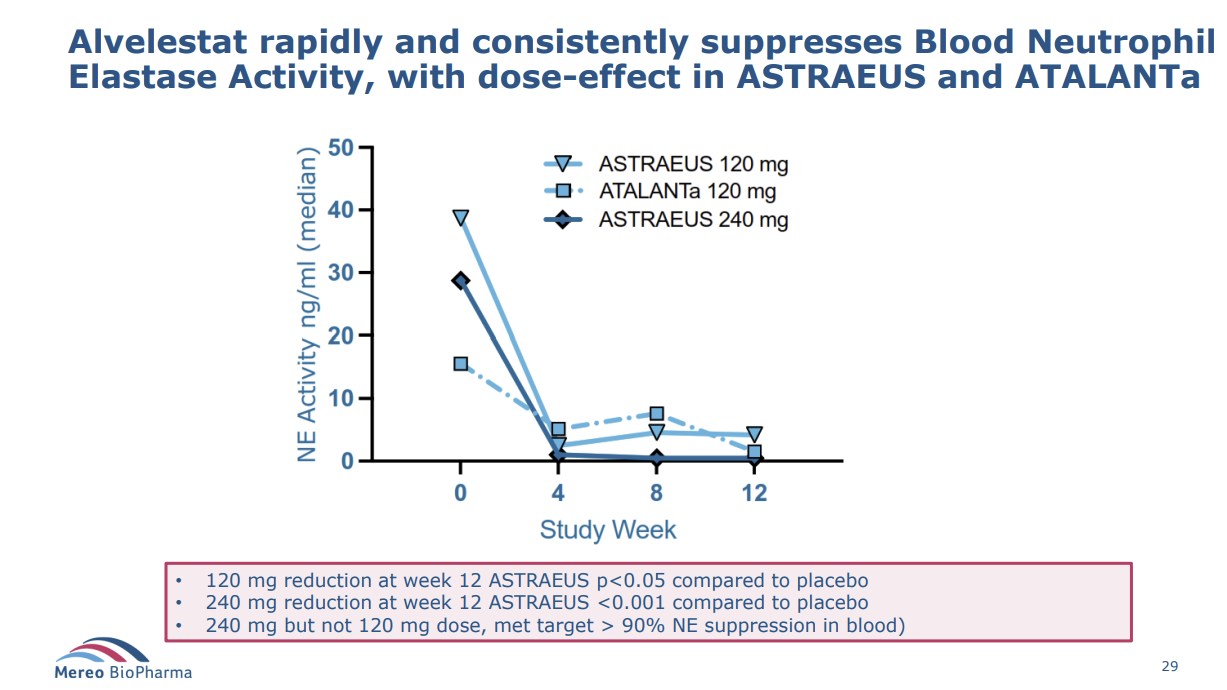

First, all patients on alvelestat showed reductions in neutrophil elastase; importantly, those with the 240mg dose showed the most significant reduction (that dose-effect is important, for obvious reasons).

Second, the ASTRAEUS study showed a significant reduction in Aα-Val360, which is correlated with disease progression and low AAT levels, and a reduction is desmosine, likewise associated with neutrophil elastase.

Finally, the results were also promising with respect to SGRQ, which management have indicated will be the primary endpoint for the Phase 3 study in the US and which, if successful, is expected to support full US regulatory approval. The greatest SGRQ impact was on non-augmentation patients with the highest FEV1 (i.e. the least disease progression).

I recognize the foregoing is dense and scientific, but I’d personally avoid getting too caught up in the details here. It’s sufficient, for the purposes of this thesis to understand that the Phase 2 data is definitely strong enough to justify proceeding to Phase 3.

The “Partnering” Process

Recall that one of Rubric’s demands was that Mereo not pursue the development of alvelestat alone and instead find a partner for it. Since that time, management have been indicating that the partnering process is ongoing, yet nothing has come of it. Some have become skeptical and interpreted this lapse of time as a clue that perhaps there’s not sufficient interest or value in this asset to move it along.

I disagree.

Based on recent developments, I believe that a deal is not only imminent, but that the reason it has taken so long is that there has been an internal reassessment of alvelestat’s value and that management have accordingly pivoted to exploring transaction structures outside of a conventional partnership to ensure this value gets maximized. Allow me to explain.

If you read through Mereo’s filings/presentations, you’ll notice a subtle but important shift in language surrounding the partnering process.

October 2023: The data from the ATALANTa study are expected to further support the ongoing partnering process for the alvelestat Phase 3 program.

January 2024: The Company remains engaged with multiple potential partners for the development and potential commercialization of alvelestat and expects to provide further details on these efforts in 2024.

March 2024: Mereo continues to actively engage with multiple potential partners for the development and commercialization of alvelestat and aims to initiate the Phase 3 study with a partner around the end of 2024.

May 2024: Mereo continues to actively engage with multiple potential partners for the development and commercialization of alvelestat and aims to initiate the Phase 3 study with a partner around the end of 2024.

June 2024: Partnering process ongoing – range of structures (emphasis mine).

Notice the shift in June to exploring a “range of structures”. This subtle change in language became not so subtle during the Biotech TV interview. Here is what Scots-Knight had to say:

“We have two different streams [we are looking at]. The first is the more traditional partnering….looking at both global and regional deals. The second stream…is really non-dilutive financing…this is with a range of different structures. [The interviewer then asks whether this is might be a royalty deal or involve private equity, to which the CEO simply reiterates that] different structures are in play…in parallel with that, we are getting the program ready to start Phase 3 around the end of this year.”

What to make of this? Well, firstly, it sounds like whatever shape this deal takes, it is going to be imminent — if Phase 3 is going to start by the end of the year, presumably there needs to be a financing deal announced at least a couple months in advance.

Second, it strikes me as very odd that the CEO would explicitly raise this “non-dilutive” financing option now for the first time…after a year plus of speaking only of the “ongoing partnering process”…if this weren’t now the presumptive approach the company is pursuing.

This begs the question, what changed? Well, yet again, we have a some pretty clear clues.

If you pull up the YTD chart, you’ll note that Mereo shares rocketed in mid-January. The reason? In January, Sanofi announced that it was purchasing Inhibrx’s AATD candidate (in a really unique transaction that may be a sign of what’s to come for us?) for ~$2B. While different in many respects from alvelestat, the price tag of the transaction clearly opened a lot of eyes with respect to how valuable the AATD market is and led to a reappraisal of what alvelestat might be worth, even within the company. Here is Scots-Knight during a fireside chat in March:

“the other deal that’s been done in the AATD space has made us look through a slightly different lens at our partnering process, both in terms of value, but also in terms of the timing.”

But the bullish INBX sale is just the beginning…

In late May, Insmed ($INSM) announced lights-out Phase 3 data for its candidate brensocatib in patients with non-cystic fibrosis. Though a slightly different mechanism of action, brensocatib’s P3 data established that the reduction of neutrophil elastase appears to be effective in reducing lung inflammation and associated diseases.

INSM’s success not only increases the viability of alvelestat, but it also indicates that alvelestat may be effective in treating a wider range of neutrophil lung-related diseases than AATD. Here again is Scots-Knight in that Biotech TV interview:

“As we looked…INSM had some very compelling data in bronchiectasis. And it was a large study…and they showed very strong data. As we’ve looked at all the data we took over from AstraZeneca…we also have some bronchiectasis data. And in a small study, just shy of 50 patients but placebo controlled…with alvelestat at that 60mg lower dose, what AstraZeneca showed was a 100ml change in FEV1, which was statistically significant, a very good change of 130ml in SVC….There was also biomarker data showing reduction in inflammatory markers in cystic fibrosis, and then also some other data…in high sputum producers. With a sputum score of greater than two. So as we look across all of these diseases…and also our own ASTRAEUS data, this inhibition of neutrophil elastase has a real role to play in lung diseases [not just AATD].”

The takeaway:

INSM’s data, in addition to the aforementioned early AstraZeneca studies, indicates that neutrophil elastase inhibition clearly has a role to play not merely in AATD but in a host of other lung diseases. Therefore: INSM’s data both increases the likelihood that alvelestat works but also significantly expands its potential valuation upon success. Indeed, INSM currently sports a $12B valuation and its stock has more than tripled since the Phase 3 topline data came out. The move doesn’t seem outlandish given INSM’s projection of $5B in peak sales from brensocatib.

Now, I am not suggesting that alvelestat warrants remotely the same valuation. We still need to see Phase 3 data and until then, skepticism is warranted and a conservative probability of success ought to be assigned. But what is clear is that brensocatib’s success has clearly caused Mereo to yet again reevaluate alvelestat’s value and has surely increased the supply of parties interested capturing a piece of it.

So what happens now?

Ultimately, I think the bullish news from INBX and INSM has led to strong interest in alvelestat and that there is a Rubric inspired effort to secure the most valuable deal possible for shareholders. This explains the new communication around exploring “non-dilutive” financing rather than a conventional partnership. Again, I have no idea what that will look like (perhaps something akin to the INBX deal in that we get a separation of alvelestat and setrusmuab, or perhaps it is something as simple as a royalty agreement — all we can do is speculate).

What I do know is that some deal, whatever it may be, is likely coming soon and could create significant value for shareholders given the bullish developments in the space that took place in H1.

Two final notes on alvelestat:

The sell-side estimates for peak sales support the case I have attempted to make out. E.g. Baird has peak sales at $800m/year by the mid 2030s. Even assuming a 50% PoS and shared economics with the prospective partner, that could support today’s share price using a modest rare disease multiple.

The underlying IP is protected through the 2030s and given what we’ve seen from INSM, is likely to be used to target further conditions. Currently, there is an ongoing phase 2 for use in bronchiolitis obliterans syndrome (BOS), which is a condition that impacts many lung transplant recipients.

The Other Assets

I’m not going to spend any time here beyond nothing that Mereo also holds the global rights to navicixizumab and leflutrozole, both of which it has licensed out the development of. Mereo could earn >$350m in milestones from these programs as well as royalties. I ascribe no value to these assets, but it is worth not there are a couple other calls options here.

How to Play This?

I have a fair bit of conviction in setrusumab and thus intend on holding at least some of my position through to its Phase 3 results. However, as I’ve alluded to, I think one could play this as a very asymmetric trade over the next 6 months on both the alvelestat transaction as well as on the unlikely, but possible, chance that setrusumab meets it end point early (I suspect shares will run up heading into the first interim analysis). It’s not hard to envision 100% upside or more over this time without concurrent exposure to clinical trial downside risk.

Why this Opportunity Exists?

I’ve basically argued that this a biotech with a high probability of multi-bagger upside, remote (but real!) downside risk, and a queue of institutional capital that simply can’t get their hands on enough shares. How can this be so cheap?

For one, the stock trades terribly, due in part to >50% of s/o being tied up by institutions. The actual float here probably has a market cap closer to $200m, which creates a ton of volatility.

Second, as I alluded to in a previous post, the biotech market has been in a deep freeze this year and the market simply refuses to give companies their fair value absent a crystallizing transaction — as with small caps generally, there’s just not a lot of patient capital out there to wait for the gap to close. Indeed, after the huge run up after the INBX deal, Mereo shares declined nearly 40% in the following months on absolutely no news.

Third, there’s a lot of moving pieces here and it’s certainly not the easiest company to understand. Moreover, the combination of two significant, but highly distinct assets that target entirely different disease groups surely adds to that complexity.

Risks

It’s small cap biotech. Notwithstanding everything I’ve said about de-risking, there’s no eliminating the inherent left-tail risks entirely;

Adverse health risks could develop in enrolled patients;

Setrusumab could eventually fail (again, that is highly unlikely to occur until 2025);

The company fails to find anyone interested in alvelestat.

Disclosure: I am long shares of MREO at an average price of $0.96 and January 25 calls.