Idea Update and Some Thoughts on Dealing with Market Turmoil

Lengthy Updates on CPH, RDI, OGI, and ENZ, and quick notes on some others

Disclaimer: Nothing on this blog is intended as financial or investing advice. Please do your own due diligence.

“If you invest the way people gamble at casinos you’re not going to do very well. It’s the long term investment that works best. But if you like the action of investing, sometimes winning, sometimes losing, just like the action in the casino, those people are not my people. I like the long term investors who figure out something that is going to work over the long term and buy that.” — Charlie Munger

“It’s frightening to think that you might not know something, but more frightening to think that, by and large, the world is run by people who have faith that they know exactly what’s going on.” – Amos Tversky

Around this time last year, I made the following observation on X: “Every year droves of investors flock to Omaha to hear sermons on how generational wealth is created simply through the discounted purchase and holding of quality, long-duration assets for decades; only for those same pilgrims to soon return home to obsess over quarterly EPS estimates and the fed funds rate. Retail's path to alpha is to pay little mind to such noise.”

The list of investors who purport to adhere to the ethos of Buffett’s school of value investing (e.g. long-holding periods, thinking like a business owner, avoiding macro prognostications, etc.) is endless. But of course, when the waters get choppy, as they very much are today, most investors dispense with his wisdom altogether, and instead do the very opposite. Indeed, as I’ve scrolled through my X feed these past couples weeks I’ve noticed that stock pitches and fundamental analysis on individual securities has almost entirely disappeared and been replaced with very confident (and very quickly wrong) predictions about macroeconomics and policy. And in the few instances where fundamental stock analysis has been offered, reception has largely skewed negative and even more myopic than usual, with the refrain often being something to the effect of “why not wait until it goes lower?”.

But as value investors, shouldn’t our appetite for stock pitches and fundamental analysis be inversely correlated with market prices? And isn’t it our job to identify businesses that trade at a clear and substantial discount to fair value, not instead to engage in the futile pursuit of catching the precise bottom? Unless you are beholden to redemption risk from impatient LPs, what does it really matter if an attractively discounted security continues to decline after you buy it? But like clockwork, the moment market stability dissipates, our pillars are revealed to be made of sand.

And lest I get accused of patronization, I am no under no illusions that I’m immune from any of this. The truth is that watching the numbers on your screen precipitously decline, and your net worth along with it, is a deeply visceral experience that is bound to arrest the cognitive function of all but the most unemotional machine-like humans. Sell-offs trigger all sorts of cognitive biases that make us inclined to do, in many cases, precisely the opposite of what the moment calls for.

So what to do in moments like the last couple weeks? My personal thoughts:

Firstly, (after hopefully familiarizing yourself in advance) refresh yourself with the works of behavioral psychologists/economics that have expounded on the psychological biases that compel us towards cognitive errors and faulty decision-making in moments of crisis. If have you neither the time nor interest in studying people like Kahneman, Tversky, Zeckhauser, etc. then just familiarize yourself with Munger’s lecture on “The Psychology of Human Misjudgment” which is a sharp and succinct articulation of these ideas and what I consider to probably be Munger’s most important contribution to the world.

Second, obviously make sure to not be over-levered. No amount of rational, unemotional thinking will save you if a margin call deprives you of autonomy.

Third, go through your book and figure out which names you know the best and you believe are well positioned to withstand the perils of the present moment: in this case, which businesses do you own that should be largely insulated from a trade war and any derivative macro consequences, whether inflationary or recessionary? For both technical reasons (indiscriminate selling due to e.g. margin calls) and emotional ones, all correlations go to one during moments of panic. But while the mere fact a stock has sold off heavily does not mean it has become cheap (never forget the E in P/E!), these across the board panics are certain to create dislocations in securities where the “E” is unlikely to be negatively impacted. Find the names in your book with anti-fragile earnings and look to add there first.

Fourth, relatedly, look to upgrade the quality of your portfolio if possible. You probably have some high quality businesses on your watchlist that you’ve been priced out of. This may be your opportunity.

Fifth, never exit the market and go all cash. Further, if you’re an investor, don’t suddenly become a trader and start speculating on which direction the market is going to move by e.g. shorting it. The market boasting its second best day in history last week should be a sufficient reminder why. You miss a day like that, or worse - find yourself short, and it’s awfully hard to play catch up.

Sixth, these moments are a really good opportunity to start building positions in names with uncertain outlooks, but that can be career making multi-baggers when sentiment changes (if you’re right). There’s an old saying by Shelby C. Davis that “you make most of your money in a bear market, you just don't realize it at the time”. It’s going to suck at the moment and you’re very unlikely to catch the bottom, but when I think about it, virtually every big winner I’ve ever had has been something I bought in an ugly market - e.g. in 2022 I bought at least 4 stocks that became multi-multi-baggers within the next 18-24 months off the top of my head (TDW, MREO, SPOT, OPRA). Of course, it won’t always work this way — not all bear markets are short lived and result in quick and major reversals - but you need to at least be positioned for that outcome. As we’ve seen time and time again, we often get some kind of “put” from our institutions.

Seven, think like a business owner. Ask yourself: how many people do you know that have sold their privately held businesses or real estate in the recent weeks due to all this uncertainty? Virtually, no one says “there is a lot of uncertainty out there right now and I am very likely to get a weak price for my asset, therefore I should sell now while its depressed.” Just because the stock market offers you liquidity to exit on a dime, it doesn’t mean you should. Very few people generate alpha through constant activity; you’re not likely one of them. There’s a reason the average person makes more money in real estate than stocks despite the latter producing superior returns over the long-run.

Finally, resist the urge to stare at your portfolio all day! Seriously, is that how you want to spend your limited time on earth, watching ticker symbols moving around? Not only is it unproductive, but it’s like being a recovering alcoholic and going to an open bar event — you’re just welcoming the temptation to do something you shouldn’t. Ultimately, doing less is almost always the best course of action.

Obviously, these are just my opinions and how I approach things. Maybe I am an idiot and the market falls 80% from here. But nobody has a credible claim to knowing that, and that is the point: making emotional decisions on shaky epistemic foundations far more often than not leads to suboptimal outcomes. The past is not probative of the future, but the lessons of history strongly we will be just fine:

Alright, let’s get into the idea update, which is quite extensive this time.

Cipher Pharmaceuticals

Speaking of anti-fragile earnings streams, I am hard pressed to find something more defensive in this climate than Cipher, which after some adds this week (and OGI struggling - more below) is back to the largest position. But unlike your usual defensive stock, I think this is a multi-bagger sitting in plain sight and I am simply at a loss to comprehend the recent weakness.

Cipher released its FY24 a couple weeks ago and I must say…despite holding a position in this for a couple years, this is probably the most bullish I have ever been on the company. There are three layers to my bullishness: operations, growth opportunities, and stewardship.

First, on operations. We still haven’t had a clean quarter since the Natroba acquisition given the associated one-offs and because, well, the real world is not a spreadsheet, and integrating an acquisition that doubles the size of your company takes more than a couple months (which is apparently a shocker to some!). But it’s clear that we are fast approaching stabilization and we certainly have enough now to look through to normalized earnings.

In Q4, Cipher generated ~$12m of revenue, or $48m annualized. Gross margin was ~77% after adjusting for a non-cash inventory charge. Notably, the Natroba deal has been accretive to gross margins as the acquired products have gross margins of >80%. Applying this margin to the annualized topline figure results in gross profit of ~$37m.

As with last quarter, operating expenses were distorted by the acquisition and appear to have confused some investors. Reported figures were $5.7m of SG&A and $1.5m of D&A, which sum to more than reported gross profit, resulting in an operating loss. However, Cipher incurred ~$850K of acquisition related costs in Q4 and $900K in legal fees relating to a dispute with Sun Pharma (Notably, that legal expense does not appear to have been added back in the adjusted EBITDA bridge provided by the company). After making these adjustments, including the non-cash inventory charge, it appears EBITDA is running at ~$5-6m/Q or ~$20-$24m for the year. Again, EBITDA is a pretty strong proxy for FCF in this business given its asset light nature, limited interest expense and NOLs. At today’s share price of ~$11 cad, Cipher trades at ~9.5x ‘25 EV/EBITDA. That’s just way too cheap given the following.

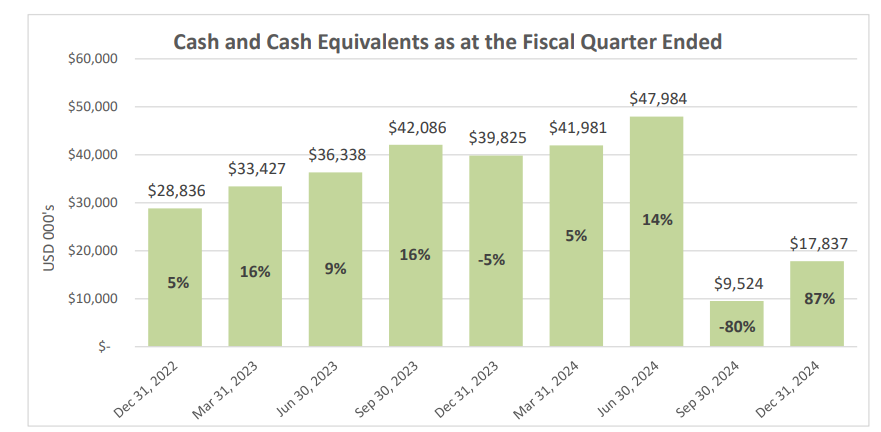

First, this business does what a good business is supposed to do — it prints cash. Indeed, despite the aforementioned income statement frictions, Cipher generated $8.3m of cash in Q4, or ~4% of its equity market cap. The thesis for this investment in one chart:

At this rate, Cipher will generate sufficient cash to pay off the $40m of debt financing applied towards the Natroba purchase in merely the first 5 quarters. Of course, at less than 2x net debt/EBITDA, Cipher is, if anything, under-levered and does not need to direct cash flows to debt reduction.

Meanwhile, legacy business crown jewel Epuris continued to grow for the sixth straight quarter, 16% YoY, and gained a further 3% market share in Canada, taking its total share to 48%. On the other hand, Absorica revenue continues to melt away, generating merely $900K in the quarter. That is not surprising, nor worth worrying about as it is no longer a meaningful revenue stream. However, investors should note the sneaky call option that Cipher could bring this product back in-house by folding it into the newly acquired US infrastructure; that could result in a major earnings uplift (I discussed this in my previous update in Feb).

So to sum up the operational update: the Natroba deal is looking very good, Epruis continues to be a gem of an asset, and the combined entity is a cash machine that should have much cleaner financials ahead.

But it’s the growth opportunity ahead that has me particularly excited.

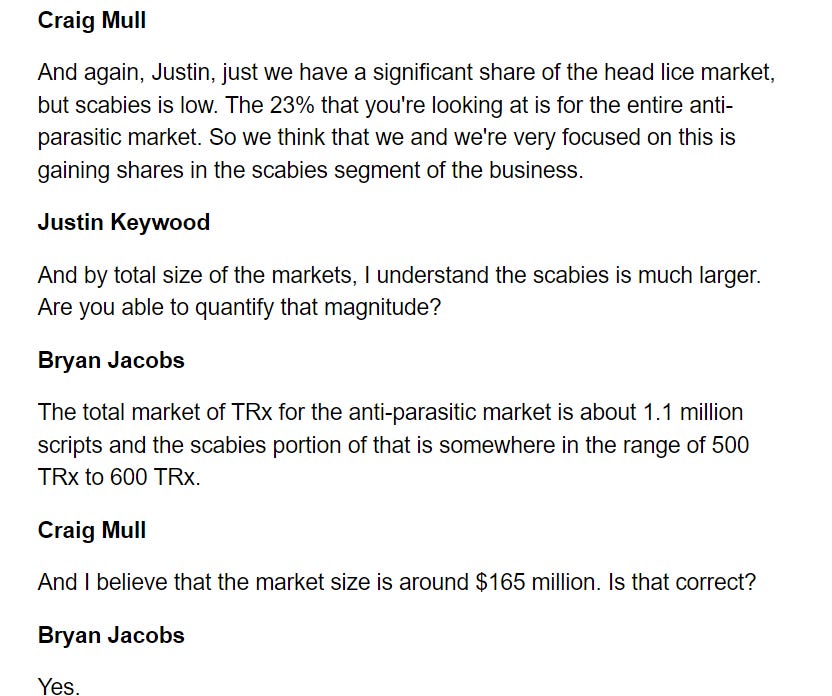

First, there is the domestic US opportunity for Natroba. As Mull noted on the earnings call, Cipher moving away from the co-promotion partner has had a temporary impact on sales and margins, but that drag is now behind us moving into 2025. Natroba’s market share remains 23%, but I suspect with commercial efforts now fully under Cipher’s control that we will start seeing material market share capture ahead. Moreover, Mull made an important disclosure to this end on the call: viz. that Natroba already has significant share in lice, which implies that its share in scabies is well below that 23% figure. As the only product with complete cure rate designation from the FDA for scabies, my sense Cipher is not going to have much issue in materially growing Natroba revenues domestically in the coming years.

Second, the international opportunity for Natroba. I think most, including myself, have probably underestimated the global licensing opportunity for this asset. On the call, management noted they have had discussions with at least eight parties in eight different countries, and that the most advanced conversations relate to potential agreements in China and the Middle East. It’s not possible to ascertain what those might be worth, but obviously those are huge markets and every million of high margin royalties Cipher generates is worth at least 5% of the current EV. Moreover, it’s just a matter of time before Cipher starts commercializing the product in Canada, offering yet another way to increase earnings organically; being lazy and simply assuming Canada could be worth 10% of the US market, that’s another <$1m of EBITDA, with international licensing deals offering significant upside beyond that.

Third, further M&A. I won’t repeat the math I already laid out in my previous update, but Cipher’s combination of cash generation, low leverage, premium multiple, and an underutilized fixed cost structure in the US gives the company a lot of room to pursue large and accretive M&A. There’s always risk with acquisitions of course, but given these attributes, a strong track record of success, and enormous management alignment, I ascribe a very low probability to value destructive M&A. These things take time, but I would be surprised to not see a deal announced this year that substantially increases the FCF/share of the business. Given what will be very high incremental margins for whatever the deal is, Cipher shares could absolutely explode upon on announcement.

And finally the third prong of my excitement — stewardship. I’ve taken the time to praise the management team at Cipher basically every time I’ve written about the company, but I simply can’t praise them enough. The longer you hold a stock, the more important capital allocation becomes and that’s especially true where, as here, the business spits out a lot of excess cash that isn’t needed to sustain operations.

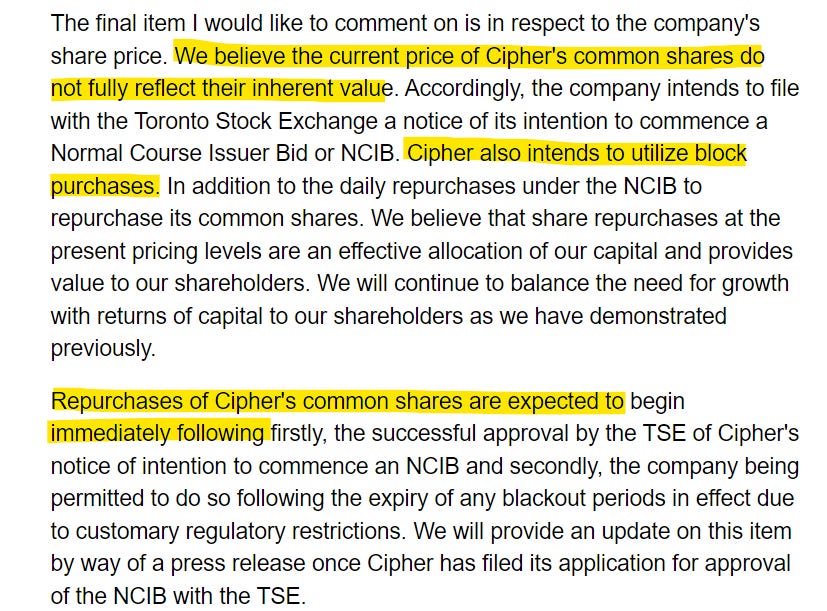

The company’s decision to announce a buyback at these prices (a >10% FCF yield on accelerating earnings growth) strikes me as very intelligent use of capital, and management’s language around the buyback displays the kind of intentionality underlying capital allocation decisions I love to see:

More times than not, management teams botch buyback programs: they deploy them pro-cyclically, they are used to simply mask SBC dilution, etc. That’s clearly not the case here. Remember, Mull’s recent history transacting with the company’s shares was a masterful case of ‘buy low, sell high’, tendering for 5% of the company in the mid $4s, only to issue a near equivalent amount of shares at 2x the price to finance the Natroba deal. In the present circumstances, Mull has no doubt looked at the opportunity set, the yield offered by their own equity, and concluded that he would happily buyout his partners at current prices. I agree. We are still awaiting the NCIB authorization (I admittedly am not sure what is taking so long) but fortunately shares have remained soft and at a very attractive level for buybacks.

I’ve heard some investors comment as if there is a binary choice here between buybacks and M&A. I think that’s clearly wrong. Between cash on hand, cash generation, very low leverage, and substantial room on the credit facility, there is a lot of liquidity here to both return to investors and use to pursue acquisitions. Further, executed well, a buyback can actually facilitate an acquisition by increasing per share equity value, which can in turn be used to finance an acquisition (as we saw last year).

This continues to be my “opportunity cost” stock and I have been a buyer again following FY24 update. I think there is a very good chance this share price starts with a 2 by the end of the year, and that >$30 is not all that far behind, which is roughly $50m of EBITDA at 10x. Through a combination of growing Natroba’s share in the US, monetizing it internationally, acquisitions, and potential Abosrica in-housing, doubling EBITDA from here does not seem remotely outlandish to me.

Reading International

A lot of people hate this idea and I get it: it’s an illiquid nanocap, highly levered equity stub with an operating business in an industry perceived to be in decline, controlled by nepo-babies that have overseen a 90% decline in equity value.

But I love it.

As you may recall, the thesis here revolves around what I referred to as two engines: 1) non-core/non-cash flowing asset sales to deleverage the balance sheet and 2) a return to profitability for the cinema business as the industry continues to recover from COVID and other headwinds.

RDI shares have declined somewhat since I published the write up (what hasn’t?) but this thesis has played out to a tee thus far and I think shares have a lot of catching up to do. Let me explain.

I’ll start first with the asset sales and shoring up the balance sheet. At the time I published the pitch in January the market cap was ~$43m, and that was against $214m of debt and $10m of cash, good for an enterprise value of ~$245m:

RDI was facing a huge maturity wall, with $71m of that debt maturing this year. The progress made here has been tremendous:

First, due to cash generation in Q4 and fx benefits (RDI holds debt in AU, but it’s accounted for in USD on the financials - this fx benefit could obviously reverse, but that would have benefits elsewhere), net debt came down to ~$190m as of the period ended Dec. 31, 24. Notably, it appears that ~$1.5m of the balance on the BoA facility (which you may recall is the most troublesome of the debt instruments given the lack of collateral) was paid down.

Second, as noted in my write-up, RDI entered into an agreement in January to sell its large asset in Wellington, New Zealand. That sale has since closed, and RDI used the proceeds to pay down the entirety of its ~$12m of NZ debt as well as a further $6.1m pay down of the expensive BoA facility in the US, with the total balance now down to $8.7m.

Third, the company announced with Q4 earnings that it expects to close on a sale of its Cannon Park property in Australia for AU$32m (~$20m USD), which is accretive to book value and all the more impressive given RDI will leaseback its cinema in the complex. Assuming this deal closes (estimated before the end of this month), and applying a hair cut for transaction fees and taxes, this should result in at least another $17m of proceeds for deleveraging. Those proceeds will eliminate the Australian bridge loan, with surplus available to apply to the AU term loan (due 2026)

I think the net result of this is wild to think through. Altogether, again assuming the Cannon Park deal closes, RDI’s net debt will have declined in USD terms by approximately the entire market cap (between $45-50m), while structurally improving the cash generation of the business (Wellington was non-productive, and given the Cannon Park leaseback, any surrendered NOI will be more than offset by reduced interest expense). And yet, the stock has actually declined. Indeed, given the pro forma cap table, RDI now trades for an EV of ~$194m:

What’s incredible, as this table illustrates, is that RDI’s decline in enterprise value has been essentially equivalent to the achieved reduction in leverage, implying that not a single dollar of debt paydown has accrued to the equity! Rather, each dollar of debt reduction has simply decreased the value of the business. Of course, if you pause and think about this for a second, that makes absolutely zero sense:

We can rightfully debate how much of a discount to asset value RDI deserves to trade at, but no one is of the view that the discount isn’t enormous; therefore, monetizing assets at a premium to that discount should be accretive, ceteris paribus, especially considering that value is largely comprised of hard assets (real estate);

Wellington was a negative NOI asset, and Cannon Park generates ~$2m in NOI, but the loss should be somewhat offset by the leaseback. On the other hand, RDI’s run-rate interest expense has, from my rough math, declined by more than $3m as a result of the deleveraging. In other words, these transactions are also net positive from an earnings power perspective.

Significantly, the balance sheet is now materially de-risked. Going into 2025, RDI had a whopping $71m of debt maturing this year. Pro forma the Cannon Park sale, RDI’s principal due in 2025 now sits at ~$36m, of which $28m is mortgage debt secured against solvent NYC real estate. As a result, the only outstanding 2025 maturity of any concern is the remaining $8.1m on the BoA facility, which should be serviceable with cash on hand, cash flow, and further asset sales.

When all of that is viewed in totality, one needs to conjure up some extremely punitive assumptions to explain how the EV has declined in tandem with the debt paydown. One would think monetizing unproductive assets for proceeds equivalent to the market cap and using those proceeds to paydown ~1/4 of debt outstanding, reducing interest expense and improving the maturity profile would result in a more valuable enterprise, not a less valuable one. At the very least, one would think the EV ought to remain constant, with each dollar of deleveraging accruing to the market cap. If that were the case, RDI shares would need to trade for ~$3 for the EV to return to level it was at the time of publication.

What makes this all the more interesting is that the second prong of thesis — an improving operating business — is also playing out perfectly. As previously noted, RDI’s cinema business across each of its three jurisdictions had its best November and December since the pandemic, and those strong box offices translated to the PnL, with the cinemas generating $3.8m of segment level operating profit in Q4 (vs. -$4.1m YoY), and combined corporate level EBITDA coming in at $6.8m for the Q (vs. -2.2m YoY). This is a reflection of at least three things. Firstly, a right sizing of the portfolio through shuttering of unprofitable cinemas, with two more cinemas coming offline early this year, which is expected to result in $0.6m-$1.2m of annual cost savings.

Second, continued pricing power, which is being seen across the industry, aided by improved viewing experiences and higher price point concession items like alcohol. These improvements appear to have particularly helped RDI’s subscale US business, which apparently boasted both the highest gross box office per screen and the highest concession spend per patron of any publicly traded US exhibitors. There’s still a lot of room here, particularly in AU/NZ, where only 1/2 RDI’s cinemas offer enhanced concession menus and only 1/3 have recliner seating.

Finally, a strong box office. I am likely going to do a deep dive on another movie theatre operator in the coming months, so I will refrain from going too deep here, but suffice it to say that I think being bearish on the future of movie theatres is dead wrong. The market continues to be in denial of the stream of datapoints to the contrary: 2023’s Barbenheimer phenomenon, 2024s record Thanksgiving and strong back half, the record shattering performance in China of Ne Zha 2, and the ongoing success of Minecraft, which has vastly exceeded expectations. I think the takeaway is clear as day: a lot of people still love going to the movies, they just need something good to watch. If you build it, they will come. Fortunately, despite what will be a relatively soft start to 2025, the box office is looking incredibly strong over the next two years. As studios face increasingly stiff competition for eyeballs on their productions, the incentives strongly suggest leveraging the benefits of promotional theatrical releases. All that is to say that, despite what will likely be a negative Q1 for RDI, I do not view Q4’s strong earnings as an outlier, and expect substantial EBITDA generation on a normalized basis ahead. Notably, with further deleveraging, cash conversion will greatly improve.

So what catalysts are ahead for RDI? Beyond sustaining the strong performance at the cinemas, the big pieces to keep an eye on are:

What they will do with the Reading Viaduct, as management continue dragging their feet with the city in an effort benefit from the large investments being made in the area;

What they will do with Cinemas 1,2,3, a highly valuable development asset in Manhattan, which has been a cash drag for years. Importantly, the mortgage on this asset is due in October, and having already extended the maturity several times, the clock is ticking for the company to make a move. RDI has neither the capital nor expertise to pursue this development alone (thankfully), and language in the disclosures has shifted to indicate the company is exploring alternatives for the asset. Hopefully, that means a sale, which would generate significant proceeds net of the mortgage.

A lease-up of 44 Union Square. I’m not holding my breath here, but finding a tenant for the empty space here would be huge for cash generation, both from the incremental NOI and enabling a refinancing of the very expensive loan against the asset (10.5%)

Altogether, even assuming a very punitive and deserved discount, I think there’s a very credible path to a meaningful multi-bagger here and that shares should begin to re-rate once this becomes easier easier to analyze.

Organigram

One of the best opportunities to secure a multibagger arises when a stock that is already at depressed valuations for idiosyncratic or industry-level reasons proceeds to then get massacred with everything else in a market-wide crisis. That’s what has happened with OGI, which after dumping on earnings for what I argued are unjustified reasons in my initial pitch, has proceeded to trade down to as low as $1.22/share (CAD), which amounts to a fully diluted EV of $88m. I don’t care what you think about the cannabis business, the quality of management, the state of global markets…C$88m for a company that already generates $400m of gross revenue growing >20% organically, $95m of gross profit after excise tax, what should be over $30m of EBITDA moving forward, has no financing risk, a strong competitive position, and an almost limitless runway, doesn’t make any sense! While the stock has recovered a bit to ~$1.42, that does nothing to change the equation in my view.

The big update here, which the stock price has not responded to in either direction, is the company’s purchase of Collective Project, which marks OGI’s entrance into the hemp-derived THC beverage space. My feelings about this acquisition are mixed and frankly I think it’s simply too early to come to any conclusive view on it. What I like:

Beverages are certainly an interesting category and one can envision it becoming a huge overall component of the cannabis industry as consumer tastes evolve. No doubt, the long-term trend is away from combustion. Having a nice tasting drink that provides a decent buzz or a calming effect seems like something consumers otherwise averse to cannabis might be intrigued by. It’s also a product category that one can envision generating sales outside of a dispensary: convenience/liquor stores? Music festivals and events? The local pub? Indeed, in the US, hemp beverages are already available in traditional retail outlets in certain states and the US market is expected to grow from $1B in current sales to $4B by 2028, according to the PR. In other words, this is a category that looks poised to both capture market share and grow the overall market. It probably does make sense to have exposure to it.

Potential to achieve high growth with low incremental investment domestically. Collective’s footprint in Canada, as I understand it, is largely limited to Ontario, and OGI should be able to leverage its infrastructure to expand the offering across the country. Moreover, this is an asset light business that relies on outsourced manufacturing, so I don’t expect material capex will be needed to fund this new segment.

Leveraging the FAST technology. I talk a lot about OGI’s Edison branded Sonic FAST edibles and it falls on deaf ears. But I think investors are asleep on this. To put it bluntly (sorry), if your objective is to get high from consuming cannabis edibles (and unsurprisingly, that’s often the goal!), Canadian regulations make this difficult given restrictions around THC content in servings; the FAST technology enables OGI’s edibles to pack a substantial psychoactive punch whilst still complying with the regulations. The press release notes OGI’s intention to develop its own beverages using this technology, which I imagine is the most glossed over item in the document. I think it’s significant. Again, a non-alcoholic beverage that gives you a nice buzz — that sounds like it might become something.

Entry into the US. As noted above, the market for this product in certain states is more developed and rapidly growing than Canada, and I think it’s certainly worth a shot attempting to grab some of this TAM. Strategically, this is a clever way for OGI to secure its long-desired entry into the US, which is not easy to do given the legal status of cannabis in the US.

Finally, the guaranteed consideration of C$6.2m amounts to merely ~5% of OGI’s cash, with the remaining consideration tied to the performance of the acquisition. That’s a relatively small outlay for a lot of optionality — i.e. its asymmetric in the right direction.

What I am skeptical of/don’t like:

The valuation. Look, some times you need to pay up for a big opportunity and strategic value. But as a value investor, it’s always going to raise alarms when a company that is currently trading for 0.4x NTM sales goes and acquires something for 2.5x sales, particularly when a piece of that consideration involves issuing equity. The financial structure has caused some confusion here, but as I understand it, the earn-out is structured so as to guarantee a 2.5x multiple on net-revenue on the higher of 2025 or 2026 sales, with the year ending Sept 30. Collective Project currently is running at $3m. Let’s say TTM revenue exiting Sept. 2025 is $6m. The first earn-out would be 2.5 x 6m (i.e. 15m) less the $6m initial consideration less US milestones (ignore for simplicity): so OGI would be on the hook for another $9m, half of which would be paid in stock. Then let’s say the Collective’s revenue exits Sept. 2026 with $10m TTM revenue: the second earn-out would be 2.5 x 10m (25m) less the first earn-out ($9m) less the initial consideration ($6m) — i.e. $10m for the second earn-out. In this case, the total consideration is $6m + $9m +10m, or $25m, which is 2.5x 2026 revenue. So the earn-out simply guarantees a 2.5x sales multiples. Now, you might think jeez, $25m is not such a small outlay anymore and that the contingent consideration involved does turn this into what could be a dangerous and large bet. I would agree with that somewhat, however, I would also note that payout would require sales to grow at more than 200% in the next 18 months or so, a growth rate that might make the 2.5x multiple look more reasonable.

But this brings me to the next concern, which is the major one for me. And that is the incentivization to pursue of profitless growth. In a fast growing, nascent product category, generating sales is not exactly difficult — the question is: at what cost? My worry with the acquisition is that OGI shareholders stand to be on the hook for up to $31m for this deal, ~15% of the current market cap, much of that tied to the growth of a business without any reference to how accretive that growth is to per share value. Given structural issues with OGI’s comp structure, which I’ve been ranting about on Twitter (viz. that insiders own very little stock and have performance comp tied to topline growth), I consider this a material risk worth paying attention to.

Relatedly, my overarching apprehension is simply whether this deal is on the wrong side of the capital cycle, and in tension with my ultimate thesis for this investment — viz. that these businesses will improve profitability and develop competitive advantages as the industry consolidates and capital exits. I’ve long worried that the US, upon any opening up of its cannabis industry, will simply turn into a redux of Canada in 2018, where vicious competition and oversaturation of supply triggers a capital destructive race to the bottom. The nascent beverage market itself appears hugely susceptible to these competitive dynamics. Indeed, with no meaningful brand equity, what staying power/competitive advantage does OGI have in sustainably earning its cost of capital by selling hemp beverages in the US? I strongly suspect the answer is none. Indeed, gun to my head, my guess is that OGI will never make any meaningful profits selling Collective or other OGI branded hemp beverages in the United States. I hope to be proven wrong, but the odds are clearly not in their favor. Just think of all the failed energy drinks that have come and gone. Why would this be much different?

I realize how negative these final points come across, and they do worry me. But I am nevertheless ultimately net positive on this transaction for the moment because: I like the Canadian opportunity and OGI’s chances of being a real player there; given the size and growth of the US opportunity, I do think trying this is worth a shot provided the company can be disciplined in knowing when to pull back; gaining positioning in the US broadly has strategic value; and finally, it’s not a lot of capital at the outset.

But beyond that, zooming out, it’s important to remember that this acquisition is dwarfed by OGI’s preexisting business following the Motif deal, which the market has stubbornly refused to give them any credit for. I believe OGI will generate ~$400m of gross revenue and ~$270m of net sales this year, whereas Collective Project is currently running at like 1% of that. The Collective acquisition only seems meaningful because of how insanely depressed OGI’s share price currently is — at the business level, the foray into beverages is not going to have a significant impact on financials in the near-term. And once the market starts ascribing a more reasonable valuation to OGI, which I believe we should start to see once the market can digest a full quarter’s worth of Motif, this Collective acquisition will start to feel like a small call option without much risk.

I’ll just end by noting OGI held an investor day last week, that is definitely worth watching if you’re a shareholder.

Enzo Biochem

Enzo is another interesting case where I think a combination of overly negative sentiment on fundamentals followed by a slaughtering for technical reasons has created a really interesting opportunity. Despite this pitch being a disaster thus far, I’ve been gobbling up shares of this name again.

After that bad report in December, I thought the sell-off in ENZ, although understandable, was probably a bit overdone.

Then, as I predicted in February update, ENZ announced its intention to delist from the NYSE and move OTC. This announcement led to harsh selling pressure due to some combination of the following reasons: 1) some shareholders probably can’t own OTC stocks and were forced to sell; 2) some shareholders misunderstand the risks of OTC/aren’t familiar with reporting requirements etc; 3) some shareholders understand what an OTC listing entails, and still don’t want to own OTC stocks; 4) frustration that the March earnings press release expressed an intention to cure the listing deficiency, only for the company to turn around and voluntarily delist; 5) this all happened concurrent with the market tanking.

None of these concerns particularly bother me, and I think the 25%ish drop after the OTC announcement makes this very interesting. As it relates to the OTC listing, the intention is for ENZ to trade on the “Best Market”, and the company will still be subject to SEC reporting requirements. Given this company was already largely dark (e.g. no earnings calls) and illiquid (it’s a pico cap), I personally don’t see what the OTC listing changes other than saving the company some money. As management saying one thing and doing the opposite, I would just say, sure this company is not a beacon of good corporate governance, but to be fair, the company never said it was going to stay listed on the NYSE (that isn’t up to them), but rather that it submitted a plan to stay listed. As I noted in Feb, this seemed futile ENZ given falling well short of the book value requirements.

In any event, I hate to say this, but I kind of like this idea more than I ever have. At $0.32/share, the market cap is ~$17m. For that, you get:

$40m of cash, and net current asset value of $32m ($0.61/share) (~2x the market cap);

58K sqft of unencumbered real estate in long island, likely worth ~$15m at least, or approx. the current market cap;

~$75m of federal net operating losses, worth ~$15m undiscounted (again, worth approx. the market cap);

and the opco, ELS, which is cyclical and low quality, but bounced materially off its December trough and is running at ~$30m in sales with >50% gross margins. At 1x sales, that’s worth $0.60/share, or 2x the market cap.

Add it altogether and you have ~$1.75/share of value against a $0.31/share stock. That just seems wrong?

If you revisit my initial pitch on this you realize that the math hasn’t really changed all that much beyond the (now concluded) ransomware litigation eating more cash than expected, the bull case of 2x sales for ELS I think being clearly off the table, and $0.1/share of cash being distributed through the special. But otherwise, ELS is still the same shitco, the NOLs are there, NCAV is still high (much of the cash burn has gone towards reducing liabilities), and the real estate is likely worth more or less the same. Ultimately, while no doubt some decline makes sense here, a lot of the sell-off appears to be driven by frustration, technical dynamics, and a weak market.

Indeed, even if we value ELS at zero (valuing this has also been a black box effort), there’s still over a $1/share of value on the balance sheet, even after factoring in some burn.

To me, this feels like something should be trading for at least $0.5/share, or nearly 70% higher.

What’s even more interesting is that the March earnings release finally included what we’ve all long waited for: some commentary on strategic alternatives. While the announcement is open-ended and ambiguous, that’s not unusual for these announcements, so it strikes me as a bit odd that the stock did not respond at all to this. One concerned I’ve had expressed to me is that in precedent situations involving Couchman, the equity simply becomes dead money for years on end waiting for him to structure a deal to monetize the NOLs. But there’s a couple very real differences here in my view. First, as a director, Couchman is required to file Form 4s, and the disclosures show that he only controls a few hundred thousand shares of ENZ, less than 1% of the company. Unlike the dark NOL shells he controls like MYRX, Couchman’s involvement here is qua director more so than owner (for the time being, at least) and there are much larger shareholders like Radoff (~10% and also on the board) who obviously would prefer a swift and value maximizing outcome. Second, and more importantly, ENZ is not an NOL shell. It has a mountain of cash on the balance sheet and an operating business it can sell, or otherwise winddown. The reason it often takes NOL shells ages execute on a deal is because NOLs cannot be acquired, and thus the shell must find a way to finance an acquisition (or pursue come convoluted structure), which is not easy to do when you’re a liquidated shell. With ENZ, there is $40m of cash and what could be more if they can find a buyer for ELS. That’s a lot of liquidity to buy something of a suitable size to benefit from the NOLs, many of which do not expire.

And that’s my base case of how this plays out: ELS gets sold, and the board finds a profitable company to acquire that can benefit from the tax assets. Sure, that could take some time, but the downside at the current share price is well protected, and there could be a big right tail depending on how capital gets allocated.

The left tail risk is here that there is still ongoing litigation separate from the concluded ransomware issue. These seem like pretty silly cases, but litigation is always black boxy and this is one of the more cursed companies I’ve ever encountered, so caveat emptor.

Other Open Ideas

Zegona. This has been a savior for me this year, with the recent high being >125% from my basis. Moving forward, I am a bit cautious here and think the easy money has been made. Rumors have been circulating in the Spanish press that the process of selling the MasOrange fiberco has been slightly delayed due to legal complexities surrounding Mas’ separation of entities and how it impacts workers. My understanding is these are largely formalities and should not impact the substance of the JV. Importantly, MasOrange is said to be hungry to get something done here given pressures to reduce leverage. Beyond that, my sense is that the bull case valuation I provided for both the MasOrange and Telefonica fibercos is unlikely to play out given the economic backdrop, but those marks are not necessary for the thesis to still work well from here. This very well could still double from here, and I’ll likely do a longer update in time.

Mereo BioPharma. This one has been taken to the cleaners as part of the XBI sell off. Ultimately, nothing has really changed here and if you liked it at $4, you should love it at $1.8. This the most speculative name I’ve written up and it’s important you really consider the risks. As expected, the first interim readout for setrusumab fell short, which has contributed to some of the weakness, despite no one on the sell-side, nor even insiders at Mereo and their partner, Ultragenyx, ever expressing much confidence in that outcome. The second interim should be within the next couple months, and the expectations there are far more positive. If that hits, Mereo could very well triple from here in short order. If not, the stock will surely sell down, although the odds of success at the final readout should remain high. As it relates to alvelestat, I’ve become extremely skeptical a deal gets done in this environment, although notably Mereo’s CEO’s language at the Leerlink fireside in March on the partnering process was notably stronger than it’s ever been. While not without risk and must be sized accordingly, I think this is a ridiculously mispriced bet at these levels.

CRON. Just noting the CEO spoke recently at the Roth Conference, and I was very impressed. A worthwhile listen.

JBGS, NOL.OL, BQE.V: No updates.

Disclosure: I am long shares of every stock mentioned in this piece.

re: $ENZ selling pressure, worth noting that some investors hold shares in a Prime Brokerage account. Post NYSE delisting, their margin requirements jump from GC to 100%. That's also created technical selling.

Also think a sale of the LS business was difficult while a Class Action suit was pending. A large settlement could conceivably have claim on the asset, leading to fraudulent conveyance issues. Don't think its coincidence the strategic alternatives language in their March press release showed up AFTER the suit settlement.

🙏 for the great thoughts and write-ups.

I have a different take on OGI FWIW

I think you should reread your concerns about the acquisition and consider motif in sort of a similar light

when they bought motif, it fulfilled their “goal” of having number one market share. It seems to me their problems lie with having the wrong goals or the wrong incentives? I think this is different from a lot of other small companies in Canadian cannabis, that didn’t have a big balance sheets or cash infusions from BAT and were forced to target the customer with products that were commercially successful, and profitable

OGI hasn’t really done this

Every other company can create their own vape brand. Why did OGI have to buy one for so much money? (I imagine part of the answer has to do with the lack of a brand to leverage off. I have a notion that a great flower brand ‘earns’ the right to add other categories and that’s how a brand gets credibility in the business to be in pre-rolls, vape, edible, etc..)

I’m not sure if you’re a consumer, but I I think it’s quite helpful in understanding the industry. Every company I talk to is focused on post harvest and trim, and the look and the feel of the bud.

I’m not in Canada. I don’t fully understand the consumer perspective there, but I’d like to understand why their biggest product is *milled* flower when they supposedly have this great expensive grow facility.

They should be able to sell great high-end bud at low cost out of Moncton, but that doesn’t seem to be what’s happening there.

These are all questions worth understanding. I don’t have the answers, but the questions and my interactions with a lot of other little Canadian cannabis companies give me conviction that while OGI may be a great stock from here because I think the industry dynamics are fantastic, there are much much much better opportunities in terms of risk/reward as well as 10 bagger plus opportunities in companies with big inside ownership and people who have risked everything and paid in blood sweat and tears to get to this point where the cycle is turning