Disclaimer: Nothing on this blog is intended as financial or investing advice. Please do your own due diligence.

"Over the last few decades, investors' timeframes have shrunk. They've become obsessed with quarterly returns. In fact, technology now enables them to become distracted by returns on a daily basis, and even minute-by-minute. Thus one way to gain an advantage is by ignoring the ‘noise’ created by the manic swings of others and focusing on the things that matter in the long term." — Howard Marks

***

If you follow me on Twitter, you’ve likely seen me tweet ad nauseum about what is one of my favorite opportunity sets in the market today — Canadian licensed cannabis producers (LPs). I have also written fairly extensively about the theme on this platform, principally through the lens of Cronos Group (see here and here). I would defer readers to those pieces for the requisite background on what follows.

Here, I want to focus specifically on my other Canadian LP — Organigram (OGI) — and why I’ve made it my largest single position after a perplexing sell-off following the release of its Q1 numbers last week, with shares trading down ~25% to a 52 week low.

Consider this my long-overdue (and hopefully timely) OGI pitch.

When you’ve owned a stock for a significant period of time and your thesis appears to be playing out (to a tee, I’d add!) but the market continues telling you that you’re wrong, it’s obviously essential to, as objectively as possible, consider what you might be missing; after all, there is always someone on the other side of the trade.

While I am going to spend most of this piece arguing why I think the market is dead wrong here through the lens of fundamentals, I’d posit up front that you can be comfortable knowing that your counterparty trading this isn’t likely going to be Warren Buffett:

The fully diluted market cap is ~$215m USD but the actual free float is less than $100m, so all the customary reasons microcaps have a propensity to be mispriced apply here;

Institutions, and even many small hedge funds that might otherwise dabble in something like this, are generally forbidden from investing in the cannabis space altogether; indeed, I was speaking to a small fund manager just last week that said they considered owning this but were not permitted to;

Even those not operating within imposed institutional restrictions may have their own personal/moral reasons for not investing in this space;

The sector has done nothing but incinerate capital from it’s inception and whatever we might tell ourselves to the contrary, price does drive narrative; there are many investors that simply won’t give this a look until after it starts to work;

And let’s face it— cannabis investors (still dominated by retail, for the reasons above) don’t exactly have a great track record of pricing things properly. If they were so utterly wrong buying OGI at $40/share in 2019 (and most famously bidding Canopy Growth up to a decabillion market cap in what surely remains one of the most mindless manias in history!), it stands to reason they may be wrong again selling below $2 now, doesn’t it?

Sure, while it’s certainly possible my extensive product testing in diligencing this company has impaired my judgment, hopefully readers will agree with my premise that it would not be surprising to find the market isn’t particularly efficient here.

With that, let’s get into why I think the market is wrong and why OGI’s equity is severely mispriced and asymmetric.

[For reference: At Friday’s TSX-listed closing price of $1.81/share (I use the TSX listing and CAD denominations in what follows for simplicity given they report in Cad), OGI’s fully diluted market cap (165m fdso) is $300mCAD and the EV is $185m.]

Market Share and Scale

Market share and scale are crucial for carving out a moat in an emerging quasi-commoditized CPG space like cannabis.

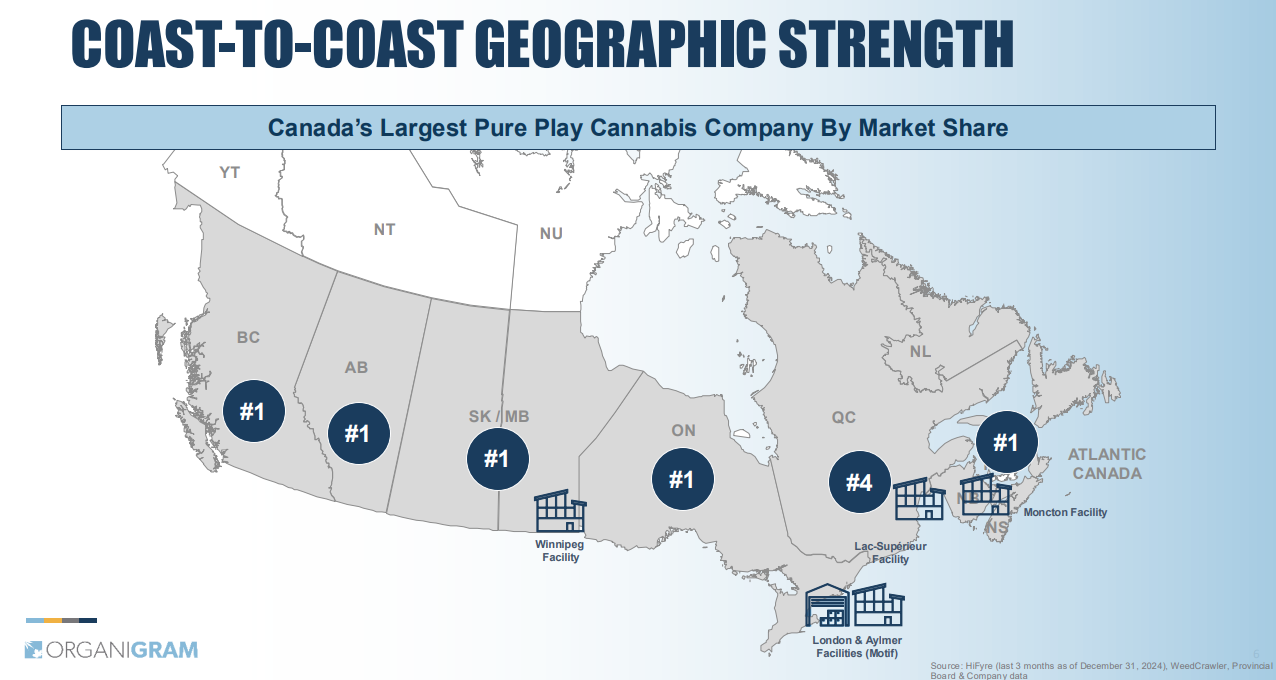

Following the acquisition of Motif Labs in December, OGI is now Canada’s largest cannabis producer, holding top three market share in every major product category, including the number 1 position in the fastest growing categories of pre-rolls and vapes.

I’d also flag that despite being #3 in edibles, OGI has just rolled out a new product, Edison Sonics FAST gummies, which is made with nanoemulsion technology. Under stringent Canadian regulations, edibles cannot contain more than 10mg of THC in the package; the result is that consumers hoping for significant psychoactive effects are generally underwhelmed by the current offering on the legal market, and often turn to the illicit one. OGI’s use of nanoemulsion has enabled them to create a gummy that manages to be much stronger while also compliant with regulations. Due to OGI funding a Health Canada study, they are permitted to advertise the product as “higher and faster”. This might not sound that important, but I have frequented many dispensaries in Canada, and the universal view communicated to me is that many consumers complain they don’t feel the psychoactive effects of the current edibles offering and that a stronger product would surely be a big draw. I suspect as retailer and consumer awareness grows, this product could help OGI take additional share in the category.

In addition to product market share, OGI’s dominance also applies coast to coast, with the #1 position in every province with the exception of Quebec (#4), and it owns five facilities strategically located across the country to entrench and further that nationwide presence.

A Fortress Balance Sheet

Pro forma the incoming and final BAT closing (below), OGI has $113m CAD in cash and no debt — i.e. net cash comprises ~40% of the market cap. Book value is ~$365m (P/BV = ~0.8). Moreover, as I’ll cover below, forward cash burn is going to be negligible (in fact, I expect OGI to be FCF positive on a normalized basis from here out). Therefore, you have a substantial margin of safety from tangible assets at this valuation and a very long runway to stave off any further prolonging of the uneconomical phase of the cycle.

Despite Cronos Group having 10x the cash of OGI in absolute terms and more relative to its market cap, I’d make the argument that OGI’s balance sheet is actually superior. CRON’s >$1B of cash is a lot of money to deploy and until that starts happening it will continue suffocating the enterprise and dragging on returns. OGI’s cash balance is large enough to offer downside protection and optionality while not overwhelming the equity.

Strong Brands

I’ve argued previously that any moat building in cannabis will turn on the development of brands. While flower, in my view, is probably too commoditized to ever be dominated by brands, I think specialty products are the perfect fit for strong brand attachment. Akin to tobacco and beer, when consumers find what they like, there is little incentive for them to try something different. That dynamic is perhaps even stronger with cannabis specialties because many consumers do not wish to take on the risk of an unfamiliar product producing unwanted psychoactive effects.

OGI has not one, but two, dominant cannabis brands in SHRED (4.2% of the market) and Motif’s BOXHOT (2.8%), which collectively did $385m of retail sales last year:

Those market share figures might seem small but that’s across the product entire space — share is much more material within specific categories, e.g., vapes (>20%).

Impressive efficiency and unit economics

Surviving a vicious capital cycle like the one LPs have been mired in necessitates becoming a lower cost producer. Though the market has largely ignored it (or lost the patience for it), OGI has been heavily investing in making its operations more efficient. We can see this through increased yield per plant over the last two years:

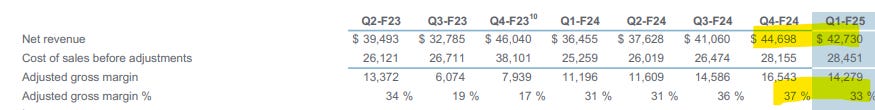

The results are borne out in OGI’s gross margins, which have trended from -30% to >30% in just three years time with revenue nearly doubling. As a reminder, these gross margins are calculated on net revenue, which is gross revenue less the excise tax, which this quarter accounted for an astonishingly punitive 36%(!) of the topline. If there were no excise tax, gross margins would have been 56%. Of course, the excise tax is a reality that we have to live with for now, but my point is simply to show that the unit economics of OGI’s operation are incredibly profitable even with soft cannabis prices. Indeed, I think the fact they are able to churn out >30% gross margins despite working for the government for the first 4.5 months of the year, and despite the average sale price of flower per gram being a laughably cheap ~$1.60, is nothing short of applause worthy.

OGI has also made huge improvements on its operating expenses. G&A as a % of net revenue has trended from 42% in FY21 to 28% in FY24. The improvement is obviously attributable, in part, to economies of scale and inherent operating leverage, which, as I’ll get into below, are apparently foreign concepts to the bears.

Cost of Capital Advantages and the British American Tobacco Partnership

This is perhaps the most significant piece to the story. Effectively the only bear case I hear on OGI is that “they don’t make money”. We are going to get into why I think this bear case is going to be confirmed dead within the next two quarters, but for now, it is true: OGI does not make money. But which of its peers do? The reality is that even with significant improvements in efficiency, the combination of the excise tax and low prices caused by a supply/demand disequilibrium have made it near impossible for LPs to earn their cost of capital.

Every quarter that goes by LPs rack up more and more losses — but unlike OGI (and CRON), the competition is quickly running out of the capital needed to continue sustaining these losses. Capital markets are shut for any financing not on utterly crushing terms. And that’s quickly turning into a problem for the competition; take, e.g. retail investor favorite Canopy Growth, which has $440m of debt against $162m of cash, has a cash from ops loss of more than $130m in the last nine months, and is diluting shareholders into oblivion. Supply and demand are beginning to find equilibrium, but we may still be a way out from market prices getting to the point where companies like CGC can sustainably make money.

Meanwhile, OGI just deployed $50m of cash as part of the consideration for the Motif deal, and still has $113 of cash with no debt. How? Because BAT has funded them $125m over the last year in exchange for equity placed at $3.22/share or a nearly 80% premium to today’s stock price through what is called the “Jupiter Strategic Investment Pool”, which is, unsurprisingly, focused on making strategic investments.

Before Jupiter, BAT made a $221m investment in OGI under the “Product Development Collaboration”, which as the name implies, is focused on R&D (of which nanoemulsion gummies are one success).

It’s worth pausing to wonder who the patsy at the table is — a multinational Blue Chip that keeps upping its stake at a big premium…or the now bearish retail investors that loved this in the $20s.

But beyond just the free money, this partnership is invaluable for strategic reasons. Unlike Altria’s investment in Cronos, which I understand has become rather passive, I’ve been told by the company that OGI has people from BAT frequently working on site. In other words, this is a true collaboration, and BAT are motivated for their >40% economic interest in OGI (which they are down significantly on) to work out. Yes, ~$350m CAD is total peanuts for BAT — but it’s pretty clear from the contours of the relationship that BAT sees a lot of strategic value in this investment. Obviously, having access to BAT’s R&D and know how has been instrumental in the aforementioned efficiency gains, as have the strategic investments.

The Motif Acquisition

In early December, OGI closed on its acquisition of privately held Motif Labs. I think this is a phenomenal and completely transformative deal.

OGI paid $90m of up front consideration, comprised of $50m in cash and $40m of equity at $2.32/share, with a further $10m in contingent consideration payable upon OGI’s share price exceeding the same BAT Jupiter placement price of $3.22/share by December 5, 2025. Motif now owns 13% of OGI while BAT holds 36% with top-up rights to maintain their interest (discussed below).

So for $90m, what does OGI get?

An entity with $86m in TTM sales (implying a ~1x sales transaction multiple) and nearly $5m of EBITDA, which is accretive to OGI’s pro forma margins before synergies. Notably, Motif has been EBITDA positive for 15 straight Qs going into the deal.

Immediately launches OGI into #1 domestic market share, and gives it 21% of the fast growing vape category, which OGI previously had minimal presence in.

An estimated $10m of synergies to be realized over 24 months, which would make the pro forma entity substantially FCF positive even without further growth. Beyond mere economies of scale, synergies are expected to come from logistics optimization (e.g. through Motif’s London, Ontario facility, which gives OGI a strategic location to lower distribution costs), lower input costs (e.g. through THCA capabilities, which OGI used to source from Motif), and headcount reduction.

An extra 115K sqft of manufacturing facilities.

The Present Set-Up

Since November 2023, merely 15 months ago, here are the major developments at OGI:

Announced the BTI Jupiter Investment, which aside from its vast strategic importance, results in an infusion of $125m of cash struck at a 100% premium to its market cap on the announcement date;

FY 2024 metrics of: $160m net revenue, 34% gross margins, $8.4m in Adj. EBITDA, SG&A of $65.7m (41% of net revenue), CFFO of $3.9m and -$11m before working capital adjustments, and book value of $365m; compared with FY 23 of: $150m net revenue, 25% gross margins, $5.4m Adj. EBITDA, SG&A of $68m (45% of net sales), CFFO of -$39m, and -$33m before working capital adjustments, and book value of $272m. In other words, in one year, net revenue increased 6% (gross increased by more), gross margins doubled, EBITDA increased 55%, SG&A declined 400 bps as % of sales, book value grew by ~$100m, and loss from operations greatly improved.

Average Sale Price increased 13%, signaling a healthier industry;

Acquired Motif at 1x sales, propelling OGI into the #1 domestic player, adding a leading brand doing $155m of retail sales, providing huge economies of scale, and increasing its pre synergy/pre-forward growth revenue and EBITDA by ~40%.

If, in addition to all of the above, I told you that OGI was already trading at a distressed valuation in November 2023, what do you think would have happened to its share price in the ensuing 15 months? +50%? +100%? Perhaps somewhere in and around the $3.22/share BAT placement/Motif contingent payment hurdle?

Nope.

OGI’s share price closed at $1.59 the trading day preceding the BAT announcement on Nov. 6, 2023, meaning shares have returned…14% since. What’s even crazier is that shares closed at $1.89 on that day, meaning that OGI’s per share equity value is now less than it was immediately after the the BAT deal was announced, and despite the transformative operational improvements, improved industry backdrop, and the Motif acquisition that have since followed.

That, at least in a vacuum, simply does not make a ‘SHRED’ of sense.

Q1 Earnings Sell-Off

While, at least to my mind, OGI’s equity has been materially undervalued over this entire period, it’s this weeks 25% drop on earnings that officially has pushed this into the absurd for me.

Here are the YoY financial headlines:

Okay, 17% topline growth, gross margin expansion, SG&A as a % of sales down, and EBITDA going from breakeven to $1.4m. But what about the net loss? Up to $23m from $15.9m. That seems really bad, right? They are actually losing even more than they used to?

I am going to come back to this in a moment, but I know for certain (because I had a stream of people message me as much) that this is where the analysis begins and ends for a lot the investors in this space. This headline GAAP loss, as I will show, is a total nothingburger and yet, I believe it is the major culprit inducing the sell-off.

Beyond the net loss, the other piece that seems to have sparked the panic is the sequential numbers:

As you can see, revenue, gross margins, EBITDA, and net income all came in significantly from the prior Q (which was a record). Let me get this straight: You’re telling me that a cannabis producer selling cannabis in one of the coldest countries in the Northern Hemisphere made more money during the summer than it did during Oct-Dec? Shocking!

Seriously, that even the analysts on the call seemed confused that there is seasonality to a business that sells cannabis in a country with dark and depressing winters shows you the dearth of actual thinking going on in this sector. I mean, maybe just try looking at the historical numbers — Q1 is always weak!

Suffice to say I am not worried about the sequential comp.

So let’s return to that -$23m net loss, which comps unfavorably YoY.

The first thing to note up front is the Motif deal closed on December 6, meaning this report only includes 3 weeks of contribution during a seasonally weak Q and during the holidays.

Of course, there were operating expenses associated with that acquisition, which are broken out for us on the income statement as $4.5m. So after adjusting for that one-off item, net loss comes down to $18.5m.

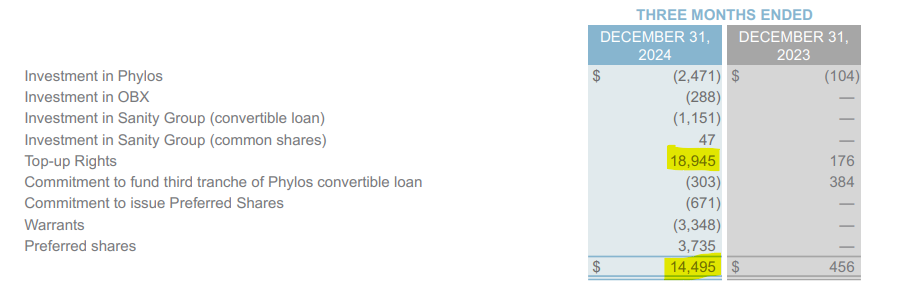

But remember those BAT top-up rights I mentioned? Due to the shares issued in the Motif deal, BAT has a right to top-up its holdings to maintain its ownership percentage. That prospective issuance, which is already included in the fully diluted market cap I use above, resulted in an $18.9m hit to the PnL. Altogether, netting this against all other fair value adjustments results in a non-cash loss of $14.5m.

Further backing this out of the PnL, the loss actually comes down to a mere $4m, which yes, is actually a huge improvement from the prior year. To be fair, OGI recognized a $2m non-operating income benefit, so I’ll add this back. That’s ~-$6m in what I’ll call adjusted operating profit, which is what investors should be interested in if they are worried about OGI’s cash profitability. I know OGI’s enormous adjusted EBITDA bridge gets a bad wrap, but if you remove the R&D, depreciation, and SBC add-backs, you’ll get a number that’s quite close to this -$6m.

Okay, so that’s a lot better than -$23m, but they are still aren’t making money. And what the market is communicating following this report is that they never will.

I’m taking the other side of that in size.

The Bridge to Profitability

So let’s start with that $6m cash operating loss and consider how and when this thing might get profitable. I’ll begin with what I might go so far as to call a smoking gun that is laid out right there in the MD&A for everyone to see (i.e. the 18 people that actually took the time to read it):

What this tells you is that if the Motif acquisition had occurred on day 1 of the Q, GAAP net loss would have been effectively the same (i.e. neutral), and that gross revenue would have been nearly $100m. Again, one should pause and consider that this combined entity just did half of its EV in sales in a single, seasonally, weak quarter. Yes, I know I am trying to show a path to profitability, but a much larger topline on the exact same net loss, for reasons I don’t need to explain, makes the path to income positive a whole lot easier. In short, we are already very near break even on $100m of quarterly gross sales. And there are a number of obvious reasons profitability should improve materially over the next year.

First, simply, operating leverage. We have already seen this with the pre-merger OGI. As revenues increase, so do margins, as there is decent leverage to be had off fixed-costs. Both core OGI and Motif are growing organically and will obviously have seasonal tailwinds the remainder of the year. So Q1 should be the low point for margins absent some unforeseen compression.

Second, expected headline synergies of $10m from increased logistical efficiency, cutting out redundant labor costs, lower input costs, and simply economies of scale.

Third, increased ASPs. Sale prices already increased materially over the LTM, but as supply is increasingly exported to international markets, and marginal players continue to exit, prices should continue trending higher. Obviously, all this drops to the bottom line. I spent a lot of time going through this in the Cronos write-ups, but if you accept that there is a future for cannabis in Canada as a free market enterprise, ASP’s will have to go up eventually, given the low cost producers are still struggling, the marginal producers are running out of runway, capital markets are closed, and valuations are way below replacement cost (there are no new entrants). This is just standard capital cycle theory, but what’s different now is we are finally starting to see this bear out.

Fourth, increased export volumes. As you may know, cannabis exports have higher margins as they avoid the punitive excise tax. Q1 financials were low on exports due to timing of shipments, and the company has indicated it expects export volumes to grow throughout the year. That’s margin accretive. Moreover, OGI expects to receive its EU-GMP certification at the Moncton facility in the spring, which will both increase export volumes and improve margins. (This is a really important item that I think many glossed over).

Five, further inorganic growth. OGI still has a lot of dry powder from the Jupiter partnership ear-marked for strategic acquisitions. We don’t need this, but I’m sure it will come.

One can assume whatever contribution they think is reasonable from these various levers, but the notion that the combination of these inevitable factors won’t drive this combined entity that nearly broke even already this Q despite all the transaction frictions, zero realized synergies, seasonal weakness, etc. into substantial profitability in the quarters ahead….seems very remote, to put it bluntly.

How about another very simple exercise? Motif did ~$5m of EBITDA last year; OGI did $8.4m. Unless there are negative synergies at stabilization, that’s $13.5m of EBITDA assuming zero topline growth, and all the operating leverage that comes from it. Throw in the simple organic growth rates of these two companies (the Canadian domestic market alone grew 7% last year), some fixed cost leverage, and even a few mil of synergies and you’re looking at a market leading growth stock with zero financing risk trading at <10x NTM EBITDA.

Or perhaps another way to view it: LTM pro forma net revenue of $250m, 10% growth rate, and 33% gross margins is $90m in gross profit next year (i.e. OGI is only at 2.2x gross profit ex cash). Can this combined company achieve something materially less than $90m in cash opex? I can’t see how it wouldn’t. Ergo: profitable.

In short, anyway you cut it, this company already seems profitable to me on its current run-rate and every aspect of its PnL continues improving substantially. And with $110m of net cash, there’s not exactly existential urgency to get there.

There’s time arbitrage…and then there is this. I don’t know if it’s next quarter, or the one after that, but you don’t need to be Rasputin to see where this is likely going because we’re already there. With “but it’s not profitable” being the only coherent bear case that I’ve heard to justify the current valuation, it’s going to be awfully hard for this not to re-rate once everyone figures out in the next 6 months that that thesis is already dead.

Maybe I am being hyperbolic, and I could always be wrong; I would love to hear why I might be in the comments.

Valuation

OGI will likely do >$275m of net sales this year, which currently puts us at an EV/net sales of ~0.7. Does that make a any sense for a profitable, self-financing, market leading growth stock with an enormous international opportunity, faltering competition, and EBITDA margins that would already be >35% without an unsustainable tax regime? Not to me.

Taking OGI’s and Motif’s combined LTM EBITDA of $13.5m and assuming 100% of the $10m of guided synergies get realized (my sense from speaking with the company is that $10m is probably conservative longer term) brings us to $23m of EBITDA. Throw in some topline growth and margin expansion from operating leverage, improved pricing, and growth in exports (which have no excise tax - i.e. >50% GM), I think we are conservatively looking at $30m of EBITDA in 2026. Throw a 15x multiple on that and add the cash back (giving no credit to interim cash generation), and that’s $3.50/share.

And these assumptions are just the beginning of where I think this goes. As more marginal players hit the exits, cannabis prices will go a lot higher domestically as the industry rationalizes into something approximating an oligopoly; the international opportunity remains largely untapped; and eventually, the excise tax is likely to be amended — at a more sensible, though still punitive 10% flat tax, net sales next year are already >$350m and we’d be looking at well over $40m of EBITDA in 2026 (putting this at 4.5x today).

On the downside — you’re buying below book value, there’s no debt, and even if I am wrong about profitability, cash burn is already de minimis.

Deep-value with a fat right tail.

Risks

I am wrong about the PnL (e.g. Motif creates dyssynergies, competition increases, cannabis prices fall, or they just screw it up). For all the reasons discussed, I think this is unlikely, but things happen in business;

Bad capital allocation. I like the track record so far and BAT’s involvement adds some confidence, but >$100m of cash could cause serious issues if deployed destructively and I really hope they avoid any major splashes in the US for now;

Left tail regulatory risk. As I’ve said in my Cronos pieces, there is no political will to rescind cannabis’ legal status in Canada, but there’s always outside risk in these industries.

Disclosure: I am long OGI (Nasdaq) at a price of $1.54/share

Great write up!

I know Mr Market currently hates cannabis companies but I could care less what Mr Market thinks. I’ve been buying companies like OGI and CRON and plan on holding them for quite some time. I’m specifically sticking with companies with great balance sheets just because I don’t know the potential short term outcome with the cannabis industry specifically the tax.

I don’t see how in the long-term the market doesn’t keep on growing and eventually become an incredible investment.

I think the most interesting thing is to see which companies get the most brand recognition and eventually become the “Coke and Pepsi” of the cannabis industry.

I think bigger companies have a massive advantage now to grow their brand recognition while the industry is struggling (financially).

Specifically, Cronos as they already charge a premium over most other edibles and have such a high market share.

To my understanding, they’re able to charge us premium because the edibles actually taste good and don’t taste like cannabis like most edibles do. This is very enticing for most people who are trying for the first time and then they end up sticking with the brands they’ve already tried despite the more premium price.

I find it funny how many value investors like to find hated industries but will stay away from cannabis companies. Again great write up and I appreciate the coverage on an industry so hated most value investors, won’t touch it.

Nice article. Couple of questions:

- Doesn't the BAT raise price need to be adjusted somewhat for the ongoing dilution that it came attached with (the 7.5% p/a in preferred shares)?

- Why 15x EBITDA? What PE multiple does that imply?

As an aside, there seem to be a lot of adjustments in its adjusted EBITDA. Excluding R&D in particular seems a bit cheeky.