Enzo Biochem (ENZ)

Large sum-of-the-parts discount, improving underlying fundamentals, and a cast of aligned insiders incented to unlock value

Disclaimer: Nothing on this blog is intended as financial or investing advice. Please do your own due diligence.

Hope everyone had a great weekend.

Firstly, thanks to Twitter user Mudlark Capital for some assistance in putting this together.

This is not a particularly original idea, but with shares hovering near all time lows notwithstanding marked improvements in underlying business quality, I believe the set-up here offers very compelling risk/reward.

Enzo Biochem (ENZ, shares currently trade for $1.05) has been on the radar of special situations investors for the last year or so following the sale of its Clinical Labs segment in March 2023. The thesis at the time of that sale was premised on a large pro forma discount to net cash following the divestiture. However, due to some some tax drag on the sale proceeds and an untimely ransomware attack that led to pending lawsuits and a reduced sale price, the anticipated upside failed to materialize. Instead, shareholders were left holding a company with a cash burning remainco, an undisciplined cost structure, and a long history of corporate misgovernance. Add in some (understandably) growing impatience, and Enzo’s stock has been on a steady decline, now down ~60% over the year, and slightly below the share price immediately preceding the Clinical Labs sale announcement.

I think the set-up is now substantially more interesting and asymmetric than it was a year ago for three reasons:

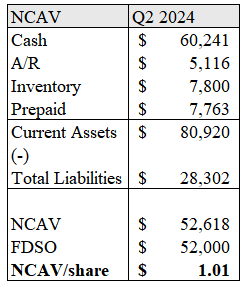

1) Given the sell-off, the equity now trades at a very large discount to the sum-of-the-parts — indeed, as I will lay out below, today’s market cap of ~$54m is approximately equal to Enzo’s net current asset value (current assets - total liabilities), meaning the market is ascribing zero value to the company’s remaining business segment, Enzo Life Sciences (“ELS”), as well as its material unencumbered real estate holdings;

2) ELS is clearly not worthless and, in fact, has undergone substantial improvement over the last 24 months, boasting a revenue run-rate of ~$35m that is growing at a mid-teens clip and experiencing its first quarter of profitability on a segment-level basis last quarter; and

3) Significantly, all signs indicate that Enzo is very unlikely to remain a standalone public entity 12-18 months from now, including a cast of new insiders that have experience in over seeing winddowns and that are incentivized to get a deal done, and several activists and large shareholders substantially down on their investments that are pushing to unlock the discount.

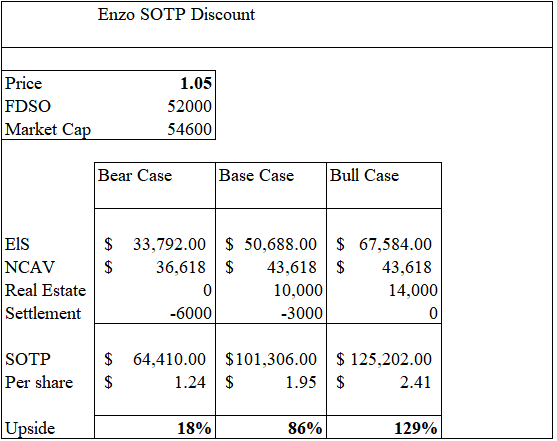

I expect Enzo will sell ELS in due course and then pursue a liquidation or otherwise sell itself outright. As I will elucidate below, Enzo is worth somewhere around $1.24/share even in my bear case (18% upside) and up to $2.40/share or more in my bull case (130% upside), depending largely on what multiple ELS can fetch. With NCAV approx. equal to the market cap, slowing cash burn, some material hidden real estate value, and a growing business that is now profitable at the segment level, I believe there’s a very substantial margin of safety at the current share price, making this an attractive R/R proposition.

The Sum-of-the-Parts Valuation

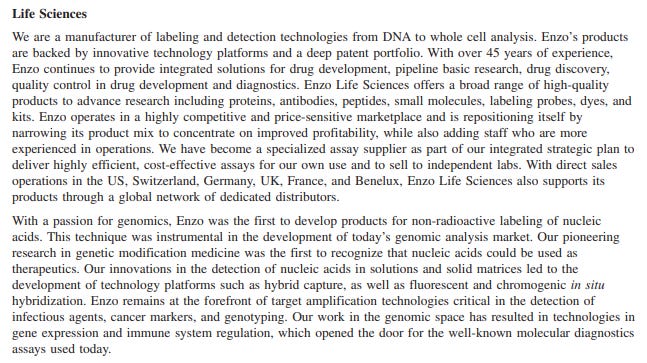

Enzo Life Sciences (ELS)

The Enzo Life Sciences business principally manufactures and sells proprietary products used in the identification of genomic information in laboratories.

I’m not sure it’s necessary to get too bogged down on the specifics here given the thesis and the company’s present valuation, but the annual report provides substantial information on the nature of the business for anyone interested.

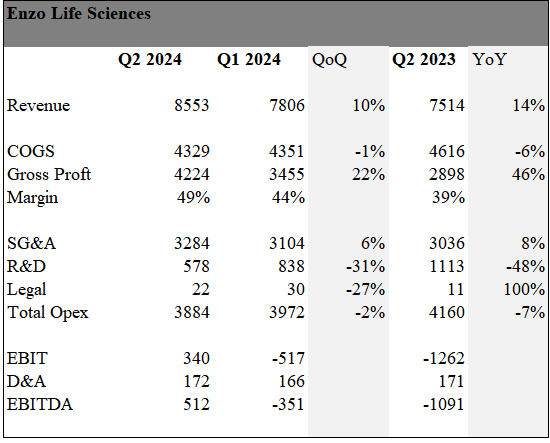

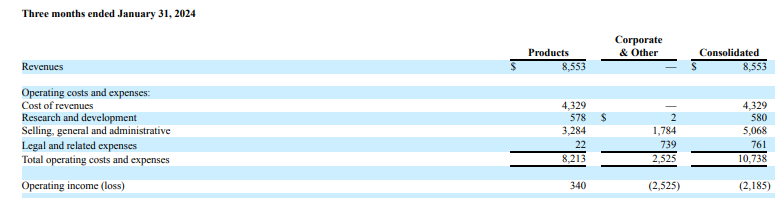

What I do want to highlight, however, is the progress the business appears to be making. During the most recent quarter, Q2 '2024 (Enzo’s fiscal year begins Aug. 1), ELS generated $8.6m of revenue, representing 14% growth YoY and 10% growth sequentially from Q1. More importantly, this growth has been concurrent with a vast improvement in margins; ELS gross margins came in at ~49% in Q2, as compared with 44% in Q1 and only 39% in Q2 23 — a whopping 1000 bps of improvement in just a year. The improvement is attributable to a shift in product mix and the normalization of input costs as inflation has cooled. There have also been significant opex improvements due to cuts in R&D spend and labor force reductions. As a result, ELS is now finally showing an operating profit:

What is this worth?

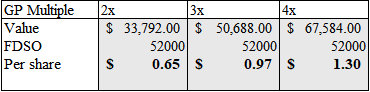

Without assuming any further growth or margin expansion, merely annualizing Q2 2024 gets us to full year revenue of $34.2m and gross profit of $16.9m. There are an abundance of small life sciences peers as well as a number of comparable transactions that have taken place, but it is difficult to pin down a scientific multiple for ELS given widely various products, technologies, and end-markets. (If anyone has more familiarity with the space, please feel free to reach out or comment below). To compensate for this uncertainty, I think it’s sufficiently conservative to assume a range of values between 2x and 4x gross profit (or ~1-2x sales given 50% margins). Applying these multiples to Q2 numbers annualized gets a value of between $0.65 and $1.30/share. Obviously, there’s plenty more upside here if you’re comfortable underwriting a higher multiple or continued growth, which perhaps isn’t crazy if the new margin profile is sustainable.

Net Current Asset Value

In addition to ELS, there is also significant net current asset value on Enzo’s balance sheet, including ~$60m of cash as of the end of Q2. Net current asset value gets us an additional ~$1.01/share.

Real Estate Value

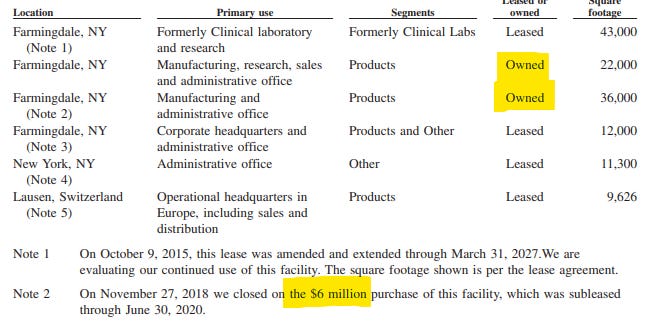

Enzo also owns outright 58,000 square feet of real estate in Farmingdale, NY, which the company uses as its manufacturing, research, sale and admin office.

You will note the larger of the two properties was purchased ~6 years ago for $6m, or ~$167/sqft . It appears the company purchased the smaller property in June 2006 for ~$3.6m. Enzo’s cost basis before any capex is therefore ~$10m, or ~$0.20/share. Given the amount of time that has elapsed since these purchases, I think that’s a very conservative number to use in valuing these properties (i.e. ~$172/sqft). The buildings are highlighted in yellow below:

Some digging online suggests that comps are valued at ~$250/sqft, which would value the real estate closer to $14.5m, or ~$0.28 share. As a sanity check, I note that the single (albeit larger) lot in the bottom right corner (circled in red) sold for $10.6m nearly a decade ago.

Intellectual Property

I am not giving Enzo any credit for this in my valuation, but readers should note that Enzo holds more than 450 patents, which obviously might be worth something.

Cash Burn

At first glance, it appears that Enzo’s cash burn is rather significant, with Q2 cash balance down ~$9m from Q1. However, much of that cash depletion is attributable to the aggressive paydown of liabilities. We can see this from the fact that, despite cash declining $9m, NCAV declined only ~$3m QoQ. Thus, the run-rate impact on the liquidation math is palatable. Given improving profitability from ELS, I think it is conservative to assume similar quarterly declines moving forward.

Ransomware Litigation

As noted at the outset, the company was hit with a ransomware attack last year, which exposed the clinical test information of ~2.5m patients as well as 600k social security numbers. The breach related to the Clinical Labs division and occurred just weeks after Labcorp agreed to purchase that segment (this led eventually to a reduction in transaction proceeds for Enzo). Moreover, as a result of this breach, the company is currently under regulatory investigation from several state Attorneys General, and facing class action lawsuits in Federal and state court (the state actions have been stayed pending the federal suit).

Is there reason to worry about substantial liability here? It’s possible, but I think highly unlikely. Ransomware attacks have become increasingly common, with more than 3000 incidents over the last five years, according to data from Comparitech. However, the data from class action lawsuits pursuing ransomware claims is reassuring: indeed, as of 2023, out of the 112 cases which have settled out of court, the average settlement figure is $2.2m, with the largest of those coming in between $6m-9m. As but one example, Planned Parenthood Los Angeles recently settled a data breach for $6m relating to the exfiltration of data of ~400K patients. In another instance, Scripps Health settled a class suit comprising a class of ~1.2m individuals for ~$3.5m.

Enzo is moving to dismiss the class action, but assuming that fails, I suspect the company will be eager to settle the claims rather expeditiously to eliminate the overhang. The company’s cybersecurity insurance provider has indicated that it will cover up to $3m in remediation costs. Moreover, a provision has already been made on the balance sheet for expected losses. Given these considerations and the size of precedent settlements, I am skeptical that a settlement of these claims would amount to much more than $3m in excess of the insured amount.

Putting It All Together

So what is it all worth?

In the bear case, I value ELS at 2x gross profit, give no value to the real estate, assume $6m of further liabilities to settle the ransomware litigation (remember, they are insured for $3m and have already taken a loss provision), and four quarters worth of NCAV reduction of $4m/quarter. In the base case, I assume 3x gross profit for ELS, value the real estate at cost, and assume three quarters of further NCAV burn at the current rate of $3m. Finally, in the bull case, I assume 4x gross profit, value the real estate at $250/sqft, and assume three quarters of burn at the current rate.

This is obviously a very wide-range and is not intended to be precise. Moreover, this ignores tax considerations and additional winddown costs that will be incurred if the company takes that route. However, the point is simply to illustrate how large the discount is here (18% upside even in what I think is a fairly punitive bear case) and, accordingly, how wide our margin of error is buying this at $1.05/share.

Will The Discount Be Unlocked?

I don’t believe it’s controversial that the stock is obviously very cheap. But is it a trap or will the company act to unlock this value for shareholders? The market appears to be skeptical, likely due in part to the fact the company has not communicated any intention to pursue strategic alternatives. However, I believe the company has been focused on first demonstrating the value of ELS before initiating the process to shop it; with the segment now profitable, there’s good reason to think the time is soon to come. Beyond this, I think there are a very convincing combination of factors that suggest Enzo will look to sell ELS and liquidate (or otherwise pursue an outright sale) in the near future. Why?

1. The new CEO is incentivized to sell

“Show me the incentive and I’ll show you the outcome.”

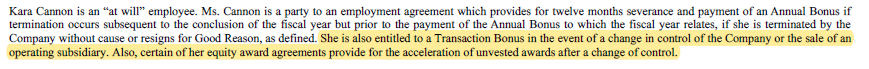

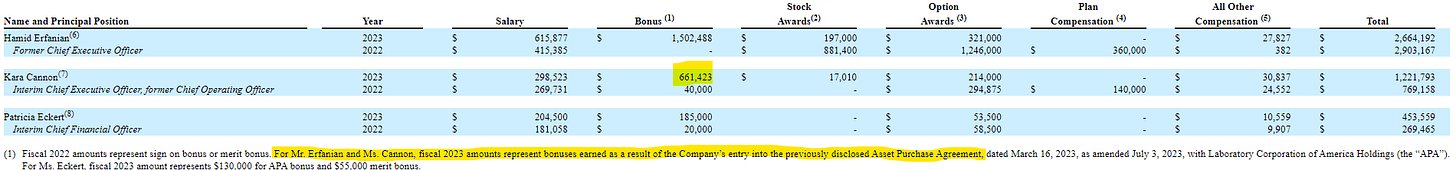

In September, the company announced that Chief Operating Officer Kara Cannon would become interim CEO, replacing the company’s former CEO Hamid Erfanian. Cannon is incentivized under the terms of her employment to sell the Life Sciences business or the company wholly, as she is entitled to a bonus and accelerated vesting of equity awards upon a change of control.

Her employment agreement provides that the bonus amounts to 0.75% of the fair market value of the gross sale proceeds, which could very likely be a material sum in relation to her present base salary, not to mention the sizeable equity awards that would accrue. Indeed, Cannon already benefitted handsomely from this provision due to the Clinical Labs sale, with more than 1/2 of her 2023 compensation attributable to the Transaction Bonus.

I’d also note that Cannon has 275,000 shares of common stock and RSUs, including a 150K block of RSUs that was granted in February 2024.

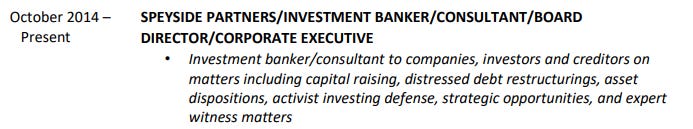

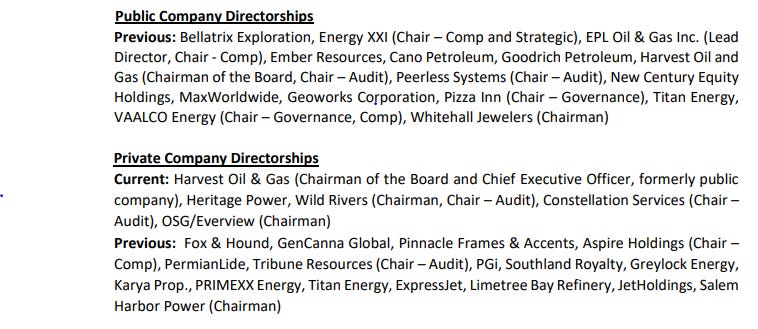

The new Chairman has vast experience over seeing strategic reviews including company winddowns.

In October, the company appointed Steven J. Pully as Chairman of the Board. I’ll start by noting that this is an incredibly credentialed guy: an attorney, CPA, CFA, former Senior Managing Director at Bear Stearns and he has served on at least 36 boards. Significantly, Pully has recently been brought in to preside over at least one previous company winddown, successfully leading Harvest Oil & Gas through a series of asset sales and a subsequent liquidation. Further, Pully’s firm, Speyside Partners, is focused on providing advisory services to companies undergoing corporate events like restructurings, asset dispositions and strategic opportunities. Here is how he describes his role in his CV which I pulled from a recent court filing:

Look at the companies he has served on the boards of:

You will note that the majority of these companies are in the energy space. This does not strike me as a guy you would bring on to chair a life sciences company unless the ultimate goal were to pursue strategic alternatives.

The register is dominated by several large shareholders, including three who have gone activist at various points and are substantially down on their investments.

Despite the points I have covered above, I would probably have passed on Enzo but-for the involvement three activist investors who each own approximately 10% of the shares outstanding, and who all have a cost basis more than 2x or even 3x the current share price.

Harbert Discovery Fund owns ~10% of the company and has/had been involved in an acrimonious proxy battle (see also here) with the company dating all the way back to 2019. Harbert’s cost basis is well over $3/share;

Bradley Radoff owns ~9% of the company and has also been on the board of directors since 2022 following a successful activist campaign. Radoff is an experienced special situations investor and activist in the small/microcap space, having already in 2024 alone secured board representation with at least three companies: LifeVantage Corp., EMCORE, and DMC Global. He also recently secured a sizeable win with Guardion Health Sciences, who sold their lone operating segment this year with some likely insistence from Radoff, who holds a 20% stake. Radoff’s cost basis is also over $3/share.

Finally, James Wolf is a 10% shareholder whose involvement dates back to 2019 and has likewise pushed for change at the company. Again, his cost basis is over $3/share.

In addition to these three 10% shareholders, 1 Main Capital, who is a disciplined and credible investor who has materially outperformed the market since his funds inception, also holds just shy of 5% of the shares outstanding, a position that was taken during Q3 of 2023.

The fact that all of these large shareholders have opted to stick around and not cut their losses is a pretty clear sign that they see significant upside; indeed, it makes me think they see the value here as being at least as high as the base case I outlined above, as I doubt they would be willing to stick around for anything much less than $2/share given how underwater they are. It is rare to see this many sophisticated and aligned shareholders involved in a ~$50m company, and this feature gives me a high level of confidence that moves will be made promptly to unlock value and protect our investment.

Enzo struggles to justify public company costs

Above I noted how much progress Enzo has made with respect to the cost structure of ELS, with that segment now finally turning an operating profit. Having said that, Enzo remains unprofitable at the company level because, in spite of material improvements, corporate SG&A annual run-rate remains higher than $7m, or more than 4x ELS’ run-rate EBIT.

Could a combination of further ELS growth and cost improvements get Enzo to profitability? It’s possible, perhaps, but it will require a great deal of time and effort, and it is not likely in anyone’s interest to see that through, certainly not the major shareholders who are surely eager to have the discount closed. On the other hand, there are clearly synergies available for any buyer that could immediately eliminate most, if not all, of the corporate costs here.

The balance sheet is already being quasi-liquidated

It is fairly customary to see balance sheets aggressively cleaned up prior to a sale or winddown so as to simplify the process. Well, we certainly have that here. Upon receipt of the Clinical Labs proceeds, the company promptly paid off the entirety of its revolver, the full $4.1 million balance on its mortgage, and $4 million (more than half) its 2024 convertible debentures. Moreover, the company has reduced its payables and accrued liabilities balances by nearly 50% over the last six months. I wouldn’t read all that much into this, but this angle certainly doesn’t hurt the thesis.

Risks

Ransomware litigation. If the liabilities are materially higher than expected, that obviously impacts the SOTP math. Having said that, even if a settlement comes in at $10m, which is the high-end of the precedent ranges, the margin of safety is wide enough here to cushion that. Another risk related to the litigation is simply that it drags on for years and impedes the prospects for a value unlocking transaction; while the litigation likely will take some time, it should not be a barrier to divesting ELS or conducting akin corporate actions.

The process is long and drawn on. While I am confident the insiders and shareholders are aligned in unlocking value here as soon as prudently possible, there’s always the risk that things take longer to unfold than expected. This would obviously inflict opportunity cost but also reduce the SOTP value given ongoing cash burn.

No strategic review. And of course, it is always possible (though I think unlikely given what I’ve highlighted above) that the company chooses to stay the course and see what they can turn ELS into. While the prospects for the business are clearly improving, Enzo is certainly not something I have any interest in holding as a fundamental long.

ELS regresses. While ELS seems a much improved business, there’s always a chance margins revert or the operations otherwise deteriorate, making it a challenged asset to market. Having said that, I think this risk is already priced in by the fairly conservative multiples I am using, albeit weakening operations could both limit the upside and extend the timeline, thus substantially impacting our IRR.

Final Comments

Those that follow this blog are aware that I’ve been a lot more focused on higher quality names I can hold for the long-term. This situation is not one of those, but given the asymmetry and clearly aligned incentives, I think this is an opportunistic bet worth taking. I’d also caution, as always, to please do your own work; I specifically note that here as I wrote this up with a bit more haste than I usually do as I am skeptical shares will be available for below $1.10 for long (I definitely could be wrong though!) and see this is an exceptionally good entry point. I’ll obviously provide any updates if I change my thinking in anyway.

As always, questions, comments and ad hominem welcome.

Disclosure: I am long shares of ENZ for an average cost of $1.05.

great idea, but you should note that a smart manager called Laughing water who have been in this idea for over a year or two sold their shares last year in frustration and 1 Main has greatly reduced their position in the 1st quarter in frustrations as well. The other investors/activist haven't been able to force the company to enhance shareholders as of yet. The board are not up and up but this could all be in the past. I agree it is worth a shot. Nice write up

thanks for the thesis. how did you come to the conclusion of 12-18 months, and why is 24-48 months not more reasonable?