Actionable Ideas Update - 03/17/2024

Some thoughts on Cipher's earnings; and a post-mortem on Tidewater Midstream

Disclaimer: Nothing on this blog is intended as financial or investing advice. Please do your own due diligence.

Greetings all,

Just wanted to provide an update on two of the ideas I have pitched here - Cipher Pharmaceuticals and Tidewater Midstream — with both reporting Q4/FY 2023 earnings last week. The results are truly a tale of two tapes, with the share prices (and underlying fundamentals) trending in polar opposite directions. I’ll start off with the good, Cipher, given that it has been a far more popular idea (rightfully so, in hindsight), then address TWM for anyone interested in sticking around for my misgivings and self-reflection.

Cipher Pharmaceuticals

Cipher’s Q4 results were superficially uninteresting. Epuris continues to chug along, with Q4 sales up 10% YoY and holding ~45% of the market share. Absorica unfortunately, though not unexpectedly, reverted back to around $1m in sales, indicating that the Q3 growth in the licensing category was an outlier. Cash generation continues to be robust, with the balance sheet now carrying CAD$52m of cash as of year-end 2023, up 38% YoY despite having repurchased +5% of shares (~$7.5mm worth) through the concluded SIB and ongoing NCIB.

Overall revenue was down on a sequential basis due to Absorica’s decline. Yet, as I noted in the original write-up, any growth in the legacy business is simply a bonus and tangential to the thesis here — viz. that the steady and durable cash flows from the legacy business would serve as an engine for Cipher’s growth through other avenues, one of which (MOB-015) had already largely been funded and would transform the business and its earnings power by early 2025.

Based on what was communicated during the call, I believe that this thesis has never been stronger. And the market appears to finally be catching on, with shares up 14% on Friday (and 42% since I wrote it up in late January).

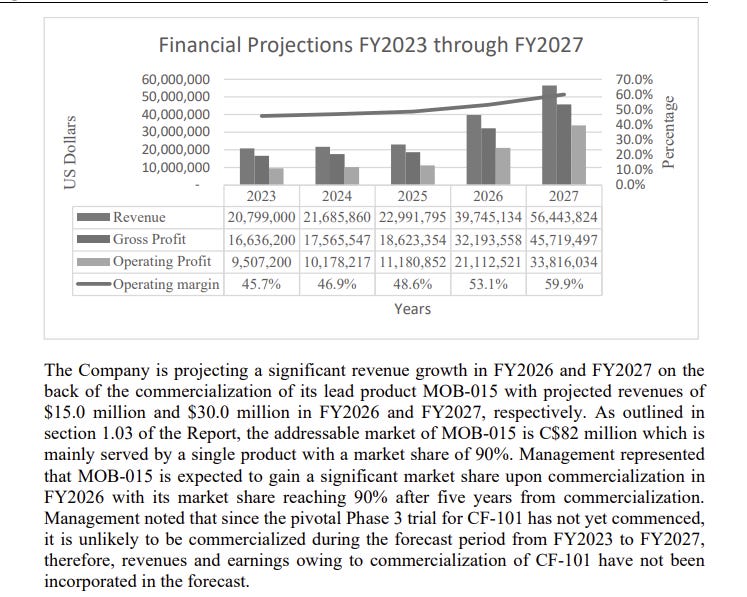

So why am I more bullish than ever? It really comes down to two points that were communicated by management. First, the company noted (per IQVIA data) that the ‘total prescription market’ for Onychomycosis is now apparently CAD$91mm, up from $82mm (+11%), with Jublia holding 95% (vs. formerly 90%) share of that market. This is obviously huge since the company’s already astonishing projections in the SIB relied on those smaller numbers. Sharing those projections again here for reference:

So, if we believe that MOB-015 is poised to capture most of Jublia’s share (I do — we already know that MOB-015 is a far superior product to Jublia based on mycological cure rates), then it appears the $33.8mm (~CAD$46mm) FY27 operating income projection is likely significantly understated. In fact, the market opportunity is likely even larger than what is being presented because the $92mm market size is based on total prescriptions, and apparently many cases of Onychomycosis go unprescribed (presumably, that should improve once a superior treatment is available).

The second reason I am more bullish than ever is that management is now telegraphing transformative and imminent M&A (which likely explains why activity under the NCIB has been limited). When asked about the size and timing of a deal, here is what the team had to say:

A +$75mm deal is obviously going to fundamentally change Cipher. That is more than half of today’s market cap. And it is apparently coming within the next 8 months or so, right on the heels of the MOB-015 readout. Now, of course, there is always risk inherent in doing a large acquisition like this, but I am not particularly concerned about value destruction here. Why? Because, in addition to a strong track record on capital allocation, Cipher operates within a really niche market and there are not a lot of natural buyers for the assets/businesses they are likely to target. As such, it is a buyers market and I do not expect them to overpay. Here is how Craig Mull described what they are targeting:

A stable, legacy product in the derm or CNS space is probably not commanding a very high transaction multiple. On the other hand, I believe Cipher should be (and soon will be) worth a low teens EBIT multiple once MOB-015 launches (given the pro forma growth, size and product diversification). As such, whatever deal Cipher ends up making, I expect it to be highly accretive, adding further upside to what I already believe is a company worth +$20/share before any credit for M&A accretion. The next few years are set to be very exciting for this company.

For what it’s worth, I still think this is very attractive opportunity at these prices and I added close to the highs on Friday. This is currently my second largest position behind TDW.

Tidewater Midstream

Okay, onto TWM. There is no other way to put it — this has been an unmitigated disaster and I am closing out this idea at $.80/share for a loss of ~18% since the write-up.

What happened? The thesis was simple — a company at an enormous discount to its SOTP that was actively and explicitly seeking to unlock that value and which had already taken a large step towards doing so by selling its Pipestone assets at a very accretive multiple. At first, everything unfolded just as I wrote it up: Pipestone closed and the portion of the stock proceeds were monetized, giving the company a pro forma net-cash position. This simple deleveraging, I thought, would be enough to re-rate the stock.

But then everything blew up, with the CEO and CFO who were brought into to implement the SOTP unlock being removed with no explanation or outgoing praise. In hindsight, that should have been my cue to move on. However, I figured there must have been a good reason for their departure (given the presence of a large shareholder as Chair of the board) and that we would get clarity and comfort when the company reported full-year results. Boy, was I wrong.

The earnings press release and call made it abundantly clear that the company has made a 180 degree pivot away from the strategy that motivated my investment in the first place: talk of unlocking shareholder value has been replaced with talk of optimizing the existing asset base and growing LCFS. This pivot was bad enough on its own, but it was exacerbated by what I found to be gross opacity and misdirection from this incoming management team, who gave repeated non-answers to the rightfully probing and concerned questions of shareholders and analysts on the call (I won’t belabor this point here, but the transcript makes for some eye-opening reading for anyone with spare time).

The reason for the pivot remains utterly unclear, though I think the laughable $418mm impairment the company reported on its midstream assets (> the entire market cap!) is probably a hint. In short, my best guess is that there may not be nearly as much value to unlock as I anticipated, despite my efforts to conservatively estimate asset value by using historical cost basis (largely from a decade ago). It seems the counterparties to those deals for TWM’s collection of midstream assets got away like bandits. This is probably why the company has historically been so opaque with respect to the contribution of those assets to company wide EBITDA.

What’s the lesson? Well, for one, always be skeptical of a SOTP story in the energy space, however well reasoned - what seems so clear, often never is. Second, I should have cashed out immediately upon the change of the management; it simply was not worth sticking around for the explanation.

On the bright side, I was largely right on how huge the margin of safety here was. Indeed, despite this playing out as poorly as possible (again, a $418mm impairment, as well as Q4 EBITDA falling by 2/3s YoY, atrocious disrespect from the new management team, and somehow only improving net debt by $220mm despite a $660mm inflow of cash from Pipestone), we only lost 18% on the investment. Obviously, you never want to lose money, but given the extent of the catastrophe, I am happy the bleeding was not worse.

***

Quick housekeeping notes. I am going to activate a chat-room for this blog to have open discussions moving forward, so that I do not need to fill subscribers’ inboxes for less material developments. More generally, as always, please feel to reach out with any questions or pushback on ideas, as well as any feedback on the blog.

Hope you all enjoy the rest of the weekend.

Thanks for the great ideas. Love reading how you structure an investment thesis.

Wondering your thoughts on Jublia vs MOB-015 - I know the myco cure rate is a lot higher, but the complete cure seems to be the goal, returning the nail to normal. Which seems to be what the ongoing study is testing. They're both daily, similar cure rates, with MOB having a superior myco cure. Only a few phase 3 studies each. Doesn't seem like the total slam dunk management thinks it'll be (90% market share). What do you think.